Komisi Broker KPR di AS: Cara Kerja & Apa yang Diharapkan

Discover how mortgage brokers earn commissions, the types of fees involved, industry regulations, and how borrowers can optimize costs when securing a home loan.

Di halaman ini

Mengamankan hipotek adalah keputusan keuangan yang signifikan yang sering kali membutuhkan keahlian broker hipotek. Para profesional ini bertindak sebagai perantara antara peminjam dan pemberi pinjaman, membantu individu menemukan opsi pinjaman yang paling sesuai.

Meskipun broker hipotek menyediakan layanan yang berharga, sangat penting bagi peminjam untuk memahami bagaimana para profesional ini diberi kompensasi. Di Amerika Serikat, komisi broker hipotek memainkan peran penting dalam proses pinjaman rumah.

Siapa yang dimaksud dengan pialang hipotek?

A mortgage broker is a financial professional who acts as an intermediary between individuals or businesses seeking a mortgage loan and the lenders who provide the funds for the loan.

Mortgage brokers help borrowers navigate the complex process of securing a mortgage by connecting them with lenders that offer suitable loan products based on their financial situation and needs.

Memahami komisi broker hipotek

Komisi broker KPR adalah biaya yang dibayarkan kepada broker untuk layanan mereka dalam memfasilitasi proses pengajuan dan persetujuan KPR. Di Amerika Serikat, komisi ini biasanya datang dalam dua bentuk: biaya di muka dan biaya berkelanjutan.

1. Biaya di muka

- Biaya awal: Ini adalah biaya di muka yang umum dibebankan oleh broker hipotek. Biasanya berupa persentase dari jumlah pinjaman dan dapat berkisar dari 0,5% hingga 1,5%. Biaya awal merupakan kompensasi bagi broker untuk memproses aplikasi pinjaman, mengevaluasi kelayakan kredit peminjam, dan berkoordinasi dengan pemberi pinjaman.

- Loan discount points: Borrowers may also encounter loan discount points, which are upfront fees paid to reduce the interest rate on the mortgage. Each point typically costs 1% of the loan amount and can result in a lower interest rate, potentially saving money over the life of the loan.

2. Biaya yang sedang berjalan

- Yield Spread Premium (YSP): While less common today, YSP is a commission paid by lenders to brokers for securing a loan with a higher interest rate than the borrower qualifies for. This practice has been subject to scrutiny, and regulations have been implemented to ensure that brokers act in the best interests of the borrower.

- Komisi jejak: Dalam beberapa kasus, broker KPR dapat menerima komisi berkelanjutan, yang dikenal sebagai komisi jejak, selama masa pinjaman. Komisi ini didasarkan pada saldo hipotek yang belum dilunasi dan memberi insentif kepada broker untuk mempertahankan hubungan jangka panjang dengan peminjam.

Dalam beberapa tahun terakhir, perubahan peraturan bertujuan untuk meningkatkan transparansi dalam industri hipotek dan melindungi konsumen. Undang-Undang Reformasi dan Perlindungan Konsumen Dodd-Frank Wall Street, misalnya, mengharuskan broker hipotek untuk mengungkapkan kompensasi mereka kepada peminjam. Hal ini termasuk merinci biaya awal, poin diskon, dan biaya lainnya yang terkait dengan pinjaman.

Berapa penghasilan broker hipotek?

The annual earnings of a mortgage broker can vary depending on their location and the volume of business they conduct. Typically, their compensation is a percentage of the mortgage amount, making regions with high home prices more lucrative as borrowers in such areas often require larger loans.

Established and proactive mortgage brokers who engage in numerous transactions tend to earn more compared to those who are new to the field or work part-time.

Berbagai platform dan sumber daya online memberikan kisaran penghasilan rata-rata untuk broker hipotek yang digaji per April 2023:

- According to Indeed, national average base salary for mortgage brokers is $98,162 per year, with some receiving additional commissions. In specific areas like the San Francisco Bay area, the average salary was notably higher at $141,240, although based on a small sample size of just three brokers.

- PayScale reports an average salary of $64,630 for mortgage brokers based on 57 reports, with commissions ranging from $12,000 to $178,000. Those with less than one year of experience had an average total compensation of $47,000, while those with over 20 years of experience averaged $69,000. These figures are derived from relatively small sample sizes.

- Glassdoor indicates an average base salary of $136,620 for mortgage brokers, with a range from $111,000 to $352,000. Additional compensation, including cash bonuses, commissions, tips, and profit-sharing, is estimated at $55,484 per year.

- Lastly, ZipRecruiter reports a national average mortgage broker salary of $129,346, with a range spanning from $11,500 to $297,500.

Penting untuk dicatat bahwa angka-angka ini adalah rata-rata dan dapat dipengaruhi oleh berbagai faktor, termasuk lokasi geografis, tingkat pengalaman, dan keadaan spesifik masing-masing broker.

How mortgage brokers profit from transactions?

Mortgage brokers predominantly earn a commission based on the loan amount, usually ranging from 1% to 2%. This commission can be paid by either the borrower or the lender, and it is typically around 2% of the loan value. Larger loans result in higher commissions for brokers, creating a financial incentive for them to secure larger loan amounts for their clients.

Since a mortgage broker's income is commission-based, it is directly tied to the transaction value. For instance, a broker charging a 2% rate on a $250,000 loan would earn $5,000.

However, factors such as the local real estate market and the broker's experience level can significantly impact their annual earnings. According to ZipRecruiter, the average annual salary for a mortgage broker in different states varies, with factors like demand and experience playing a crucial role.

While mortgage brokers provide valuable services in simplifying the loan process, borrowers should be aware of potential fees. One way to mitigate costs is by obtaining multiple mortgage quotes from different lenders.

According to a 2018 Freddie Mac report, borrowers can save an average of $3,000 over the life of the loan by securing at least five quotes. If a broker's commission exceeds this potential savings, borrowers may consider exploring alternatives with different fee structures.

Bagaimana cara broker hipotek dibayar?

The payment to mortgage brokers can take various forms, including cash or an addition to the loan balance. If the borrower is responsible for the fee, it is paid at the loan closing.

However, if the lender covers the cost, it may be rolled into the overall loan amount, meaning the borrower still bears the financial burden. As fee structures vary among brokers, borrowers are advised to thoroughly understand the terms before committing to a specific broker.

What affects a mortgage broker's pay?

Mortgage brokers typically earn a base salary along with a commission that varies based on several factors, including loan terms, client agreements, and market conditions.

1. The terms of the loan

On average, mortgage brokers charge a commission of 2% to 2.5% per loan. However, federal regulations prohibit brokers from charging more than 3% of the total loan amount. For example, if a mortgage broker charges 2.25% on a $500,000 loan, they would earn $11,250 in commission.

2. The agreement with the client

Mortgage brokers can work for either borrowers or lenders, and their fees depend on these agreements. Lenders generally pay higher commissions than borrowers. When lenders compensate brokers, they typically pay between 0.5% and 2.75% of the total loan amount. If borrowers pay, brokers charge an origination fee, which is usually less than 3% of the loan amount.

3. The housing market

The local housing market also influences mortgage broker commissions. In highly competitive markets, brokers may lower their commission rates to attract more clients. In contrast, in less competitive markets with fewer options, brokers might charge higher fees.

Perhitungan komisi pialang hipotek

Mari kita lihat contoh bagaimana komisi broker hipotek dapat dihitung.

1. Loan amount: $300,000

2. Interest rate: 4%

3. Loan term: 30 years

Where,

- Loan amount: This is the total amount of money borrowed by the borrower.

- Interest rate: The interest rate is the percentage of the loan amount that the borrower pays as interest to the lender over the life of the loan.

- Loan term: The loan term is the number of years over which the loan will be repaid.

Commission structure

Broker's commission rate: 1% of the loan amount

Calculation:

1. Loan amount: $300,000

2. Commission rate: 1%

3. Commission amount: Commission Rate * Loan Amount

Commission amount = 0.01 * $300,000

Commission amount = $3,000

Jadi, dalam contoh ini, broker hipotek akan mendapatkan komisi $3.000 untuk memfasilitasi pinjaman hipotek sebesar $300.000 dengan tingkat komisi 1%.

It's important to note that commission structures can vary, and some brokers may also receive additional bonuses or incentives based on factors like loan volume or client satisfaction.

Additionally, brokers may receive commissions from both the borrower and the lender, or they may charge fees to the borrower in addition to or instead of a commission. Always refer to the specific terms of the agreement between the broker and the lender for accurate calculations.

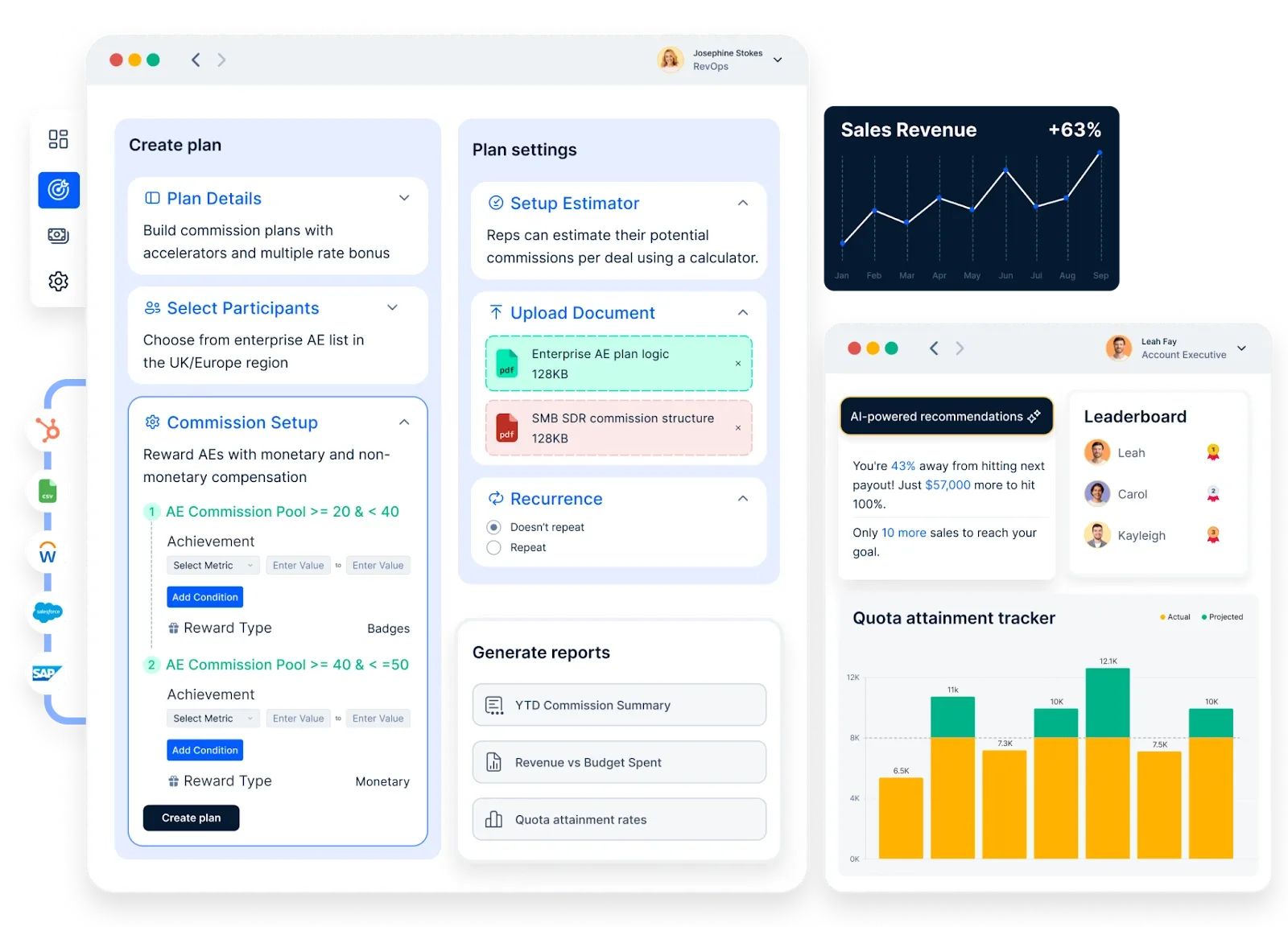

How can Compass simplify Mortgage Broker commission calculation?

Here is how Compass, mortgage commission automation software, that might simplify mortgage broker commission calculations:

- Integrasi dengan sistem hipotek: Compass dapat berintegrasi dengan berbagai sistem yang berhubungan dengan hipotek, seperti perangkat lunak originasi pinjaman dan alat manajemen hubungan pelanggan (CRM), untuk mengakses data yang relevan untuk perhitungan komisi.

- Struktur komisi yang dapat disesuaikan: Platform ini memungkinkan pialang hipotek untuk mengatur dan menyesuaikan struktur komisi berdasarkan perjanjian dengan pemberi pinjaman yang berbeda. Fleksibilitas ini memastikan bahwa perhitungan sesuai dengan ketentuan spesifik dari setiap hubungan pinjaman.

- Otomatisasi proses perhitungan: Compass dapat mengotomatiskan penghitungan komisi, mengurangi kebutuhan input manual dan meminimalkan risiko kesalahan. Otomatisasi memastikan bahwa penghitungan dilakukan secara konsisten dan efisien.

- Pembaruan data secara real-time: Dengan mengakses data real-time, Compass dapat memberikan perhitungan komisi yang akurat dan terkini. Hal ini sangat penting dalam pasar KPR yang dinamis di mana suku bunga dan persyaratan dapat berubah sewaktu-waktu.

- Manajemen kepatuhan: Platform ini dapat menggabungkan fitur kepatuhan untuk memastikan bahwa perhitungan komisi mematuhi peraturan dan standar industri. Hal ini membantu broker hipotek tetap mematuhi persyaratan hukum.

- Pelaporan yang transparan: Compass mungkin menawarkan alat pelaporan yang memberikan wawasan terperinci tentang pendapatan komisi. Laporan yang jelas dan transparan membantu broker hipotek memahami bagaimana komisi dihitung dan memberikan dasar untuk komunikasi dengan klien dan pemberi pinjaman.

- Pengurangan kesalahan: Melalui otomatisasi dan mekanisme validasi, Compass dapat membantu mengurangi kemungkinan kesalahan dalam penghitungan komisi, meminimalkan risiko ketidaksesuaian dan perselisihan keuangan.

- Optimalisasi alur kerja: Compass dapat merampingkan alur kerja komisi secara keseluruhan, mulai dari entri data hingga distribusi pembayaran. Optimalisasi ini dapat menghemat waktu bagi broker KPR, sehingga mereka dapat fokus membangun hubungan dengan klien dan mengembangkan bisnis mereka.

- Integrasi dengan sistem akuntansi: Platform ini dapat berintegrasi dengan sistem akuntansi dengan lancar, memfasilitasi transfer data komisi yang lancar untuk manajemen dan pelaporan keuangan.

Kesimpulan

Menavigasi dunia komisi broker hipotek di Amerika Serikat membutuhkan pemahaman yang jelas tentang berbagai biaya dan bagaimana dampaknya terhadap keseluruhan biaya hipotek. Seiring dengan peraturan yang terus berkembang, peminjam dapat mengharapkan peningkatan transparansi dan perlindungan. Saat bekerja sama dengan broker hipotek, komunikasi terbuka tentang biaya dan kompensasi adalah kunci untuk memastikan kemitraan yang sukses dan saling menguntungkan.

Pertanyaan Umum

1. Do mortgage brokers earn more than loan officers?

Mortgage brokers and loan officers both play pivotal roles in facilitating home loans, but their compensation structures differ. Mortgage brokers typically earn commissions by connecting borrowers with suitable lenders, while loan officers, employed by specific financial institutions, may receive a combination of salary and performance-based bonuses.

According to data from April 2023, mortgage brokers have an average base salary of $58,304, whereas mortgage loan officers have an average base salary of $49,369. However, total earnings for both can vary based on factors like experience, location, and transaction volume.

2. Do mortgage brokers need a license?

Yes, mortgage brokers are required to be licensed to operate legally. In the United States, the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) mandates that mortgage brokers complete pre-licensing education, pass a national exam, and fulfill annual continuing education requirements. Licensing ensures that brokers adhere to industry standards and regulations.

3. How can I ensure a mortgage broker is legitimate?

To verify the legitimacy of a mortgage broker:

- Check licensing: Use the Nationwide Multistate Licensing System (NMLS) Consumer Access portal to confirm the broker's licensing status and review any disciplinary actions.

- Review credentials: Ensure the broker has relevant experience and professional affiliations.

- Seek recommendations: Consult friends, family, or real estate professionals for referrals to reputable brokers.

- Assess transparency: A trustworthy broker will clearly explain fees, loan options, and the lending process.

- Read reviews: Look up online reviews and ratings to gauge the broker's reputation and client satisfaction.

4. How much do mortgage brokers make in commission?

Mortgage brokers typically earn commissions ranging from 0.5% to 2.75% of the total loan amount. For instance, on a $300,000 mortgage, a broker might earn between $1,500 and $8,250. The exact percentage can vary based on the broker's agreement with the lender, the complexity of the loan, and regional market conditions.

5. How much do brokers charge for commission?

The commission charged by mortgage brokers generally falls between 0.5% and 2.75% of the loan amount. This fee is often paid by the lender, the borrower, or a combination of both, depending on the agreement. It's essential for borrowers to discuss and understand the fee structure upfront to avoid any surprises at closing.