11 Program Kompensasi Insentif dengan Contoh untuk Tahun 2025

Temukan bagaimana perusahaan-perusahaan top meningkatkan motivasi dan kinerja karyawan serta mengetahui alasan di balik program kompensasi insentif yang sukses.

Di halaman ini

Rencana kompensasi insentif yang efektif adalah salah satu alat yang paling ampuh untuk mendorong motivasi karyawan, meningkatkan kinerja, dan menyelaraskan upaya individu dengan tujuan bisnis. Perusahaan yang menerapkan rencana kompensasi yang terstruktur dengan baik tidak hanya meningkatkan penjualan, tetapi juga meningkatkan kepuasan dan retensi karyawan. Namun, merancang rencana yang tepat membutuhkan pertimbangan yang cermat atas berbagai struktur insentif yang memenuhi tujuan jangka pendek dan jangka panjang.

Blog ini membahas 11 contoh rencana kompensasi insentif terbaik untuk tahun 2025, yang mencakup beragam strategi seperti bagi hasil, komisi, bonus retensi, dan insentif non-moneter. Baik Anda ingin memberi insentif kepada tim penjualan, memberi penghargaan kepada karyawan yang berkinerja tinggi, atau menciptakan budaya akuntabilitas, contoh-contoh ini akan membantu Anda merancang rencana yang memaksimalkan produktivitas dan keterlibatan.

Apa yang dimaksud dengan kompensasi insentif?

Kompensasi insentif adalah bentuk pembayaran yang diberikan kepada karyawan berdasarkan kinerja atau pencapaian mereka. Kompensasi ini dirancang untuk memotivasi karyawan agar memenuhi tujuan tertentu atau melampaui harapan, sering kali dalam bentuk bonus, komisi, atau imbalan finansial lainnya. Bagian ini dapat dimasukkan dalam

- Total gaji untuk karyawan.

- Atau jumlah tambahan yang diperoleh ketika karyawan memenuhi target kinerja tertentu.

Jadi bagaimana cara kerjanya? Manfaat dari kompensasi insentif meliputi:

- Meningkatkan motivasi karyawan,

- Kinerja yang lebih baik,

- Produktivitas yang lebih tinggi.

Umumnya, kompetisi insentif untuk tenaga penjualan menyelaraskan tujuan individu dengan tujuan organisasi, mendorong karyawan untuk mencapai target tertentu, dan menumbuhkan budaya akuntabilitas.

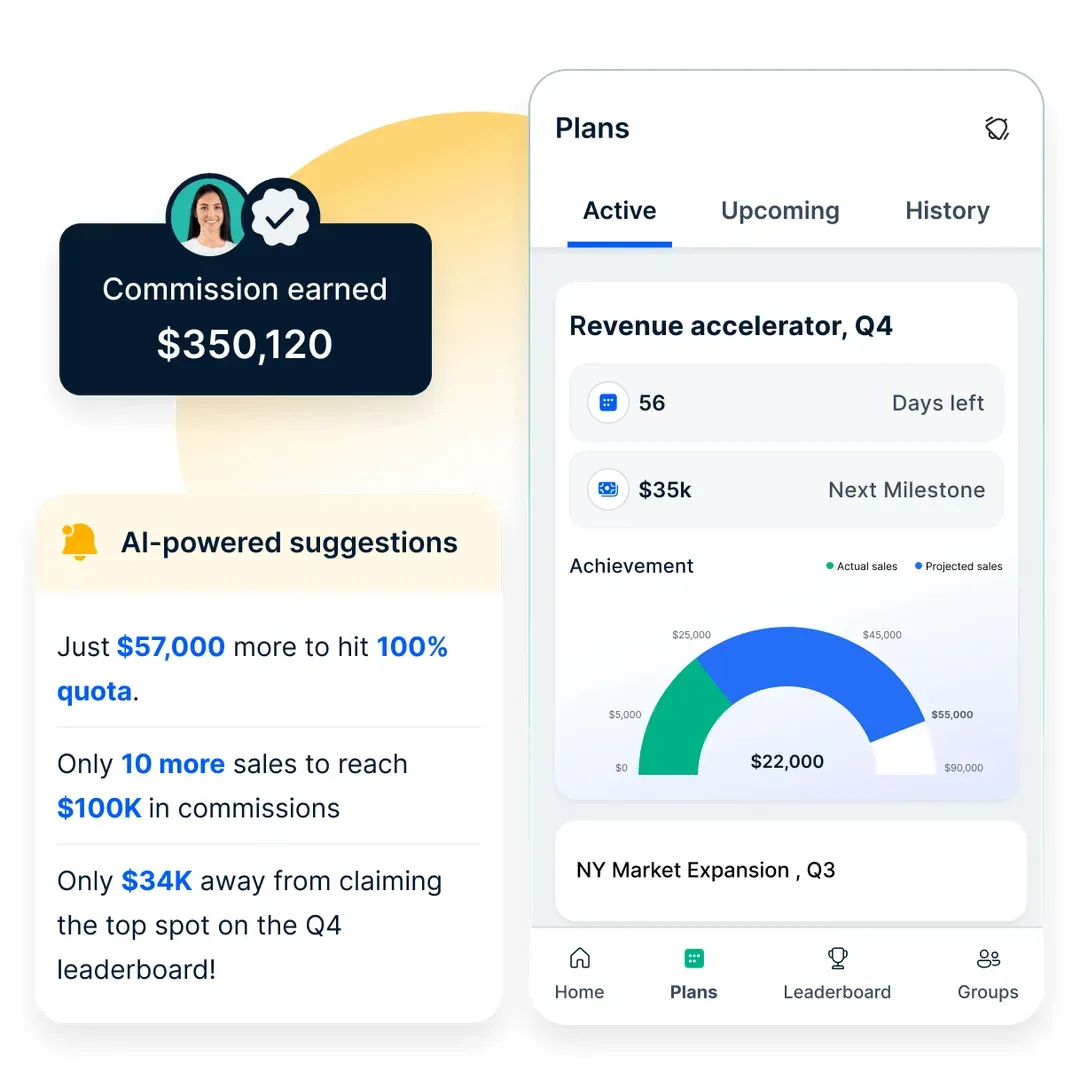

Dengan memanfaatkan platform intuitif Compass, perusahaan ini menyederhanakan proses kompensasinya. Compass memungkinkan tim penjualannya untuk dengan mudah memahami metrik pendapatan dan kinerjanya. Hasilnya, perusahaan mengalami peningkatan yang signifikan dalam kepuasan tim penjualan, dengan 95% dari tim penjualan melaporkan bahwaCompassmembantu mereka memahami kompensasi mereka dengan lebih baik.

Sebelum kita membahas contoh rencana insentif, mari kita bahas perbedaan antara insentif jangka panjang dan jangka pendek.

Apa yang dimaksud dengan insentif jangka panjang vs insentif jangka pendek?

Kompensasi insentif biasanya dibagi menjadi dua jenis utama: insentif jangka panjang dan insentif jangka pendek.

Program ekuitas dimaksudkan untuk menarik, mempertahankan, dan menginspirasi karyawan sekaligus menyelaraskan mereka dengan tujuan jangka panjang perusahaan.

Perusahaan juga berupaya menyediakan jalan lain untuk pengembangan kekayaan, seperti Program Investasi Khusus Karyawan, yang menyediakan akses ke aset Goldman Sachs bagi karyawan yang memenuhi syarat.

8 Rencana kompensasi insentif yang efektif dengan contoh

Kompensasi insentif membantu menarik dan mempertahankan talenta terbaik sekaligus meningkatkan kepuasan dan loyalitas kerja secara keseluruhan. Berikut ini adalah contoh kompensasi insentif yang dapat Anda sertakan.

1. Bagi Hasil

Bagi hasil adalah program yang memberikan penghargaan kepada karyawan untuk meningkatkan produktivitas. Perusahaan menggunakan insentif finansial untuk mendorong karyawan mencapai tujuan bisnis tertentu. Sasaran-sasaran ini dapat mencakup:

- Penjualan yang lebih tinggi.

- Layanan pelanggan yang lebih baik.

- Mengurangi pergantian karyawan.

- Waktu produksi yang lebih cepat.

Program bagi hasil sangat hemat biaya karena bonus hanya diberikan kepada mereka yang menunjukkan peningkatan yang terukur. Biasanya, bonus ini dibayarkan setiap bulan, sehingga manajer dapat melacak kemajuan dan menyesuaikan program sesuai kebutuhan.

Penjualan bulanan awal: $50.000

Setelah upaya tim: Penjualan meningkat menjadi $55.000

Pendapatan ekstra: $5.000

Pembagian bagi hasil (20% untuk karyawan):

Bagian perusahaan: $4.000

Bagian karyawan: $1.000

Jika ada 10 karyawan, masing-masing mendapat bonus $100 sebagai hadiah untuk meningkatkan penjualan!

2. Bagi hasil

Bagi hasil, contoh program insentif kinerja lainnya, melibatkan pembagian sebagian keuntungan perusahaan dengan karyawan melalui bonus. Tidak seperti bagi hasil, program ini berfokus pada kinerja perusahaan secara keseluruhan. Bonus bagi hasil biasanya dibagikan setahun sekali. Semakin menguntungkan perusahaan, semakin besar bonusnya.

3. Bonus retensi

Bonus retensi adalah pembayaran satu kali yang ditawarkan kepada karyawan kunci yang mungkin mempertimbangkan untuk meninggalkan perusahaan. Insentif ini mendorong mereka untuk tetap tinggal selama masa-masa kritis, seperti merger atau perubahan signifikan lainnya. Jumlahnya bisa berkisar antara 10% hingga 25% dari gaji karyawan, tergantung kesepakatan.

Karyawan menandatangani perjanjian 2 tahun untuk bertahan.

Perusahaan menawarkan bonus retensi sebesar $10.000 jika karyawan tersebut menyelesaikan 2 tahun.

Jika karyawan keluar lebih awal, mereka tidak mendapatkan bonus.

Hal ini memotivasi karyawan untuk bertahan lebih lama dan mengurangi perputaran karyawan!

4. Penghargaan tempat

Penghargaan spot, atau bonus spot, adalah penghargaan langsung yang diberikan untuk kinerja luar biasa dalam tugas-tugas tertentu. Penghargaan ini mengakui pencapaian yang mungkin tidak sesuai dengan kriteria evaluasi standar. Nilai penghargaan spot dapat berkisar antara $50 hingga $5.000, biasanya mewakili 0,25% hingga 1% dari total gaji.

Makan malam di restoran yang bagus.

Piala untuk kinerja yang luar biasa.

Kartu hadiah.

Bonus uang tunai.

Liburan akhir pekan di sebuah resor.

Ini adalah contoh program insentif kinerja yang baik.

5. Bonus tahunan

Bonus tahunan, contoh program insentif kinerja, adalah pembayaran sekaligus yang diberikan kepada karyawan sebagai tambahan dari gaji reguler mereka. Bonus ini dapat berupa uang tunai atau opsi saham dan biasanya dihitung pada akhir tahun fiskal. Jumlahnya dapat bergantung pada kinerja perusahaan secara keseluruhan, kinerja individu, atau keduanya.

Sebuah toko ritel menawarkan bonus $1.000 untuk setiap perwakilan penjualan setelah satu tahun yang sukses.

Sebuah perusahaan teknologi memberikan bonus tahunan mulai dari 5% hingga 11% berdasarkan kinerja individu.

Sebuah bisnis manufaktur memberikan bonus tahunan tetap kepada tim produksinya sebesar 10% dari gaji pokok.

6. Komisi

Komisi adalah bagian dari struktur gaji karyawan yang dirancang untuk menghargai kinerja. Karyawan mendapatkan komisi berdasarkan penjualan atau target yang dicapai. Tingkat komisi dapat dibatasi atau tidak dibatasi.

Anda mendapatkan komisi 5% dari pendapatan penjualan Anda.

Anda menerima komisi $2 untuk setiap produk yang terjual.

Anda mendapatkan $1 untuk setiap penjualan hingga 50 unit dan kemudian $1,50 untuk setiap penjualan setelah itu.

Menggunakan perangkat lunak kompensasi insentif dapat membantu mengotomatiskan perhitungan ini untuk tim Anda.

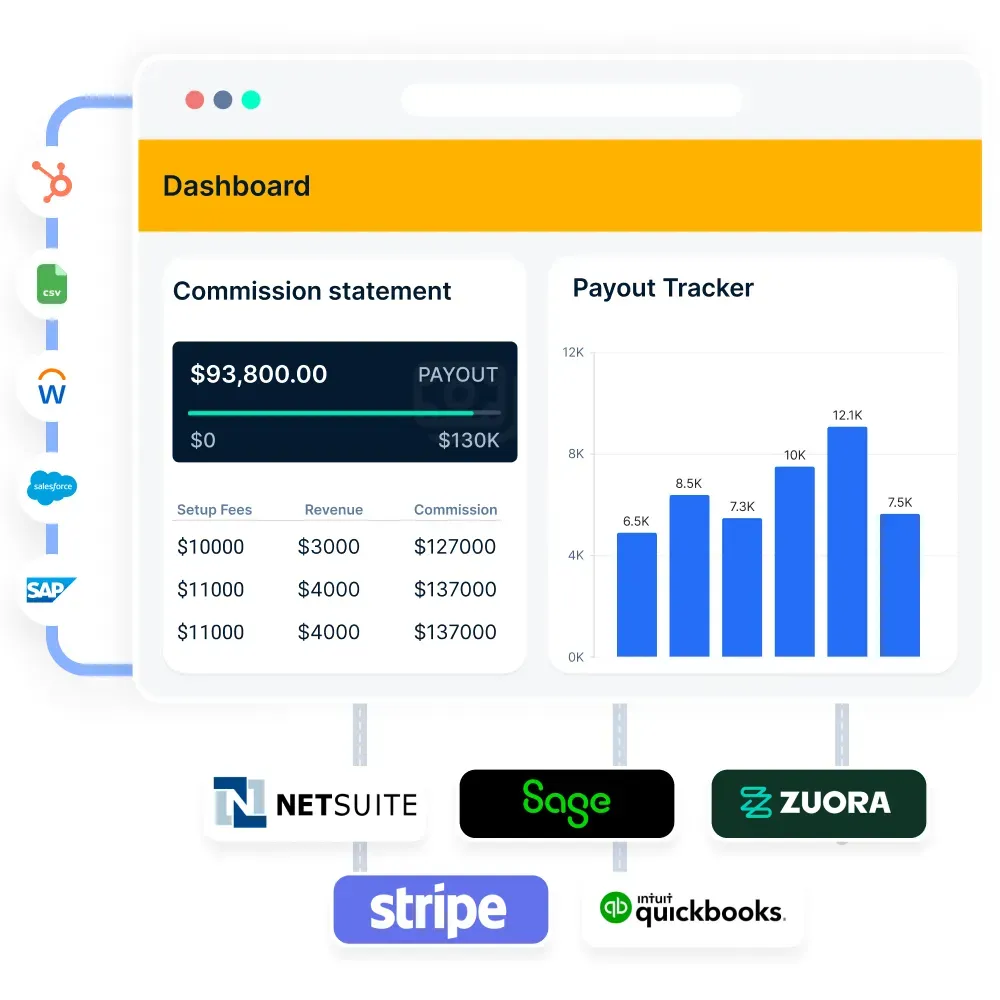

Komisi otomatis dengan Compass

Compass menawarkan solusi komprehensif untuk manajemen komisi penjualan, yang memungkinkan organisasi merampingkan proses kompensasi insentif mereka secara efektif.

Jadwalkan panggilan sekarang!

7. Dana Insentif Kinerja Penjualan (SPIF)

Sales Performance Incentive Fund (SPIF) adalah program penghargaan jangka pendek yang bertujuan untuk mencapai target penjualan tertentu dengan cepat. Meskipun SPIF terutama difokuskan pada tim penjualan, program ini juga dapat diterapkan di departemen lain.

8. Bonus MBO

Bonus Manajemen Berdasarkan Sasaran (MBO) menghubungkan penghargaan karyawan dengan sasaran spesifik yang ditetapkan dalam rencana MBO mereka. Manajer dan karyawan bekerja sama untuk menetapkan tujuan-tujuan ini.

9. Komisi penjualan

Sebagai kompensasi insentif andalan, komisi penjualan sangat relevan untuk posisi yang secara langsung melibatkan penghasilan. Insentif keuangan yang dikenal sebagai komisi penjualan sebagian besar ditentukan oleh persentase pendapatan penjualan karyawan.

10. Pembagian keuntungan

Karyawan menerima persentase dari keuntungan perusahaan melalui pembagian keuntungan, yang ditentukan oleh standar yang telah ditetapkan seperti total profitabilitas atau kontribusi individu. Hal ini membuat karyawan merasa lebih terlibat dalam kesuksesan perusahaan secara keseluruhan.

11. Insentif non-moneter

Tujuan utama dari insentif non-moneter adalah untuk menumbuhkan suasana kerja yang positif, peluang untuk pengembangan pribadi, dan pengakuan. Menurut sebuahLinkedInLearning, 94% pekerja mengatakan bahwa mereka akan bertahan lebih lama di sebuah perusahaan jika perusahaan tersebut mendukung pertumbuhan profesional mereka. Pertimbangkan:

- Program pengakuan:Program ini mendorong perilaku yang diinginkan dengan mengakui pencapaian karyawan dengan hadiah, penghargaan, atau pengakuan publik.

- Peluang Pengembangan Karier:investasi dalam kemungkinan pertumbuhan dan kemajuan pekerjaan, seperti pelatihan, pendampingan, atau promosi karier.

Bagaimana cara merancang rencana kompensasi insentif yang efektif?

Untuk membuat rencana kompensasi insentif yang efektif, Anda memerlukan pendekatan yang jelas dan terorganisir. Hal ini berlaku untuk semua departemen. Berikut ini beberapa langkah utama untuk membantu Anda membangun rencana ini:

Langkah 1: Perencanaan dan desain

Apa tujuan Anda? Apakah Anda ingin meningkatkan pendapatan, meningkatkan retensi pelanggan, atau meningkatkan kesadaran merek?

Mulailah dengan menentukan apa yang ingin Anda capai dan bagaimana hal tersebut selaras dengan tujuan perusahaan secara keseluruhan.

Selanjutnya, pilihlah jenis rencana kompensasi insentif yang paling sesuai dengan tujuan-tujuan ini.

Terakhir, buatlah kerangka kerja terperinci untuk rencana Anda.

Langkah 2: Dukungan dari pemangku kepentingan utama

Setelah kerangka kerja Anda siap, sekarang saatnya untuk membagikannya kepada para pemangku kepentingan untuk mendapatkan masukan dari mereka.

Grup ini biasanya terdiri dari manajemen tingkat atas, manajer senior, pemimpin tim, dan beberapa anggota tim senior.

Setelah mendiskusikan dan merevisi rencana bersama, dapatkan persetujuan mereka dengan meminta mereka menandatanganinya.

Langkah 3: Komunikasi dan implementasi

Sekarang saatnya mengomunikasikan rencana tersebut ke seluruh perusahaan!

Komunikasi yang efektif sangat penting pada tahap ini. Akan sangat disayangkan jika Anda memiliki rencana yang bagus namun tidak memastikan bahwa karyawan memahaminya sepenuhnya.

Gunakan pesan yang jelas dan sederhana, dan bagikan informasi secara teratur untuk memastikan penerapannya berjalan lancar.

Langkah 4: Tinjau ulang dan optimalisasi

Langkah ini sedang berlangsung. Anda harus secara teratur meninjau rencana tersebut dengan melihat kinerja individu dan tim.

Apakah rencana tersebut memberikan hasil yang Anda harapkan? Atau apakah ada hal-hal yang berubah?

Adalah hal yang wajar jika rencana memerlukan penyesuaian dari waktu ke waktu. Kuncinya adalah mengidentifikasi masalah apa pun sejak dini dan membuat perubahan yang diperlukan saat Anda melangkah maju.

Praktik-praktik terbaik untuk menerapkan rencana kompensasi insentif

Berikut ini adalah praktik-praktik terbaik yang harus Anda perhatikan untuk menerapkan kompensasi insentif.

- Berkomunikasi dengan jelas:Untuk mendorong pemahaman dan dukungan, sampaikan dengan jelas kepada karyawan mengenai program spesifik, persyaratan kelayakan, dan standar kinerja.

- Seimbangkan insentif jangka pendek dan jangka panjang:Untukmendorong kesuksesan yang konsisten, kombinasikan manfaat jangka pendek dengan manfaat jangka panjang seperti opsi saham atau pertumbuhan profesional.

- Sering melakukan evaluasi dan modifikasi:Mengawasi keberhasilan program, mencari masukan, dan membuat modifikasi yang diperlukan untuk memaksimalkan dampak dan relevansinya.

- Integrasi dengan manajemen kinerja:Untuk menyelaraskan tujuan individu dengan tujuan organisasi yang lebih umum, integrasikan kompensasi insentif dengan sistem manajemen kinerja.

- Kesadaran hukum dan kepatuhan:Ikuti terus persyaratan hukum dan peraturan terbaru untuk memastikan bahwa program Anda mematuhi aturan tentang ketenagakerjaan, pajak, dan standar industri.

Mengotomatiskan komisi dengan Compass

Berikut ini adalah cara Compass dapat membantu mengelola komisi penjualan:

Desain Tanpa Kode: Compass memungkinkan pengguna untuk membuat dan meluncurkan rencana komisi penjualan yang kompleks dengan cepat, memanfaatkan perancang rencana komisi tanpa kode yang dapat membuat rencana 10X lebih cepat daripada metode tradisional.

Fleksibilitas dalam Struktur: Pengguna dapat menerapkan berbagai struktur insentif, termasuk spiff, akselerator, bonus, pengganda, landai, dan clawback, yang disesuaikan dengan peran penjualan yang berbeda.

Perhitungan otomatis: Platform ini mengotomatiskan penghitungan komisi, secara signifikan mengurangi kesalahan manual dan membebaskan tim keuangan dari penghitungan yang membosankan. Hal ini memastikan pembayaran yang akurat secara otomatis.

Integrasi data real-time: Compass terintegrasi secara mulus dengan sistem CRM untuk secara otomatis mengambil data penjualan, memastikan bahwa semua perhitungan komisi didasarkan pada informasi terkini.

Pengumpulan tanda tangan: Sebelum meluncurkan rencana komisi baru, Compass memfasilitasi pengumpulan tanda tangan dari perwakilan penjualan untuk memastikan dukungan dan transparansi.

Jejak audit: Sistem ini menyimpan catatan audit yang melacak penyesuaian dan penggantian yang dilakukan pada rencana komisi apa pun, sehingga meningkatkan akuntabilitas dan kepatuhan terhadap pedoman keuangan.

Visibilitas untuk tim penjualan: Perwakilan penjualan dapat melihat perhitungan komisi mereka terlebih dahulu dan memantau metrik kinerja utama. Transparansi ini membantu menyelaraskan upaya mereka dengan tujuan organisasi.

Kolaborasi di seluruh tim: Compass mendorong kolaborasi antara pemimpin penjualan, tim operasi, dan keuangan dengan memberikan visibilitas ke dalam proses komisi dan menyelesaikan perselisihan secara efisien.

Kesimpulan

Contoh-contoh kompensasi insentif dalam blog ini menunjukkan bagaimana imbalan dapat diselaraskan secara strategis dengan tujuan organisasi untuk meningkatkan keterlibatan dan kinerja karyawan. Organisasi dapat membina tenaga kerja yang termotivasi yang siap untuk sukses jangka panjang dan mendapatkan keuntungan di pasar dengan menerapkan program insentif yang seimbang dan transparan.

Dengan menerapkan program insentif yang seimbang dan transparan, organisasi dapat membina tenaga kerja yang termotivasi yang siap untuk kesuksesan jangka panjang dan mendapatkan keunggulan kompetitif di pasar. Jelajahi bagaimanaCompassdapat membantu organisasi Anda merancang program kompensasi insentif yang efektif yang mendorong kesuksesan.Jadwalkan panggilansekarang!

Pertanyaan Umum

Apa saja strategi untuk rencana kompensasi insentif?

Strategi untuk rencana kompensasi insentif yang efektif meliputi:

- Menyelaraskan insentif dengan tujuan perusahaan

- Memanfaatkan imbalan moneter dan non-moneter

- Menggabungkan insentif jangka pendek dan jangka panjang

- Meninjau dan mengoptimalkan rencana secara teratur berdasarkan data kinerja

- Memastikan komunikasi yang jelas tentang tujuan dan harapan kepada karyawan.

Apakah gaji insentif itu baik atau buruk?

Pembayaran insentif dapat bermanfaat karena memotivasi karyawan untuk mencapai tujuan tertentu, namun efektivitasnya bergantung pada seberapa baik pembayaran insentif tersebut selaras dengan motivasi karyawan dan tujuan organisasi.

Apakah kompensasi insentif merupakan bonus?

Ya, kompensasi insentif dapat mencakup bonus dan pembayaran tambahan yang dibuat untuk memenuhi metrik kinerja di luar tugas pekerjaan reguler.

Apa yang dimaksud dengan contoh insentif?

Contoh insentif adalah bonus berbasis kinerja, yang memberikan penghargaan kepada karyawan karena mencapai tujuan atau target tertentu yang terkait dengan peran mereka.

Apa bentuk kompensasi insentif yang paling mendasar?

Bentuk kompensasi insentif yang paling dasar adalah rencana komisi penjualan, yang memberikan jumlah tetap berdasarkan kinerja penjualan individu.