Perhitungan Insentif di Lembar Kerja Excel: 11 Masalah Umum & Cara Mengatasinya

Excel tidak dibuat untuk penghitungan insentif yang rumit-kesalahan manual, penundaan, dan kurangnya transparansi memperlambat Anda. Compass mengotomatiskan komisi, memastikan akurasi, dan meningkatkan motivasi penjualan dengan gamifikasi. Tingkatkan skala dengan mudah hari ini!

Di halaman ini

Incentive calculation in Excel has dominated the spreadsheet market since the 1990s, and it remains a powerful tool for data analysis. It is a powerful tool for handling various financial and commission calculations.

Jangan salah paham. Excel luar biasa karena:

- Serbaguna

- Memudahkan pengumpulan data

- Membantu Anda meringkas & memvisualisasikan data

- Mendukung formula

- Digunakan di seluruh dunia

However, one study found that 88% of all spreadsheets contain one or more severe errors. Don’t we all remember the JP Morgan London Whale debacle, where JP Morgan was hit with a $6 billion trading loss caused by none other than an Excel error back in 2012.

So, whether you're managing sales commissions, employee bonuses, or other incentives, Excel can simplify the process. However, like any software, it's not immune to issues.

Dalam blog ini, kami akan membahas masalah umum yang sering dihadapi orang ketika menghitung insentif di Excel dan memberikan solusi untuk memperbaikinya.

Masalah dengan penghitungan insentif di lembar Excel & bagaimana Compass membantu memperbaikinya

Spreadsheet tidak pernah dibuat untuk menghitung insentif. Spreadsheet dibuat untuk mengotomatiskan perhitungan matematika sederhana, yang lebih banyak menggunakan matematika daripada logika. Mereka tidak pernah dibuat sebagai bahasa pemrograman tugas berat yang dapat menyederhanakan 28 tingkat if bersarang.

Jadi, mari kita berhenti memaksa mereka untuk melakukan sesuatu yang tidak seharusnya mereka lakukan.

Here are the common problems with incentive calculation in Excel sheets & how Compass helps fix them.

1. Manual dan memakan waktu

Lembar Excel tidak dapat mengimpor data dari sumber yang sudah ada dan harus dikelola secara manual, yang membosankan, memakan waktu, dan menyisakan banyak ruang untuk kesalahan manual.

Data yang akan dianalisis harus disalin dan ditempelkan atau, lebih buruk lagi, dimasukkan secara manual. Hal ini dapat dilakukan untuk beberapa repetisi dengan sedikit usaha, tetapi ketika baris dan kolom dalam data bertambah, hal ini menjadi hampir tidak mungkin, sehingga menjadi sangat lambat.

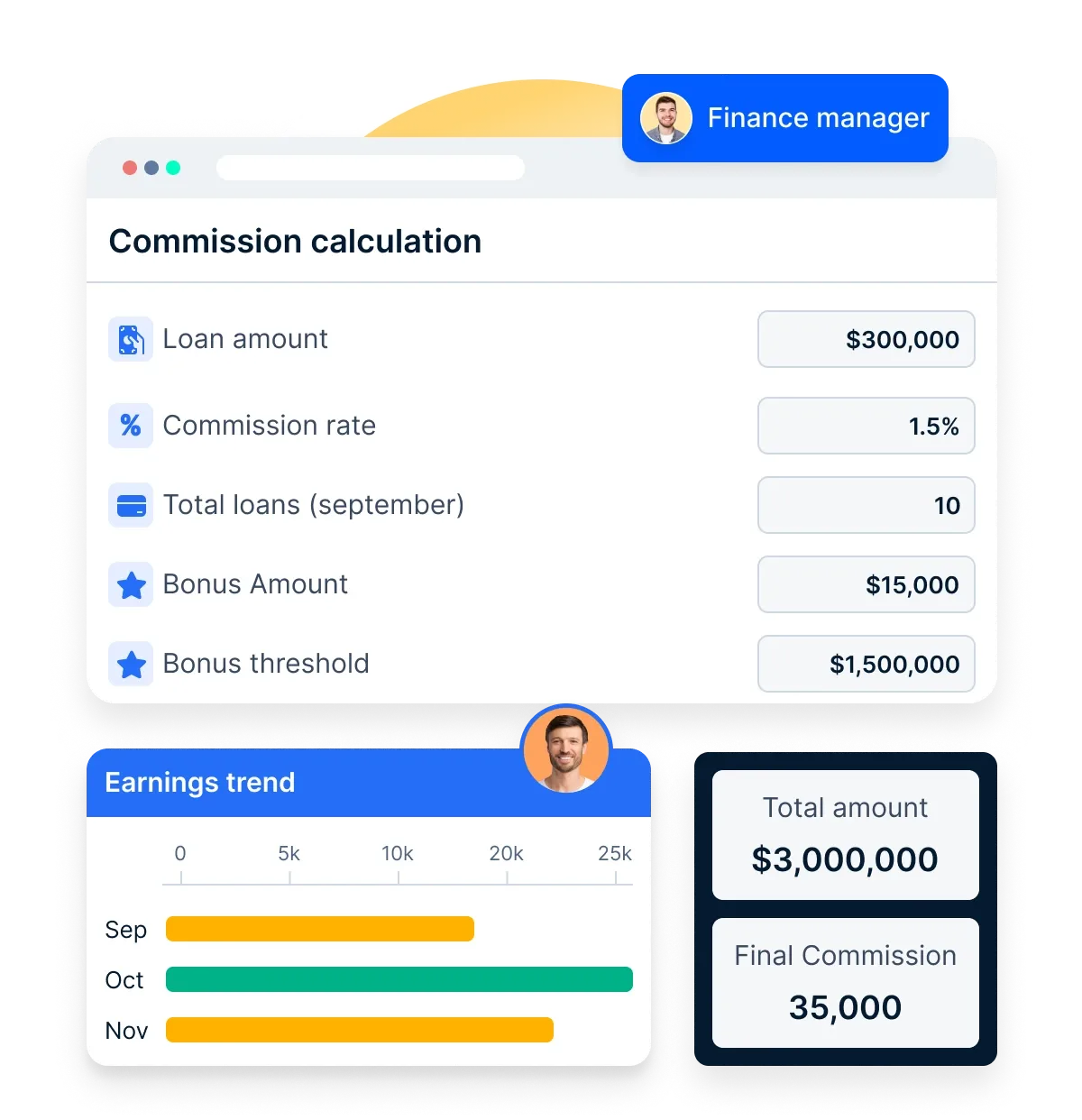

Dengan Compass, Anda dapat dengan mudah menangkap data langsung dan menyerahkannya kepada Compass untuk menghitung secara otomatis dalam waktu nyata.

2. Prone to human error

Selain sangat memakan waktu, lembar kerja Excel juga rentan terhadap kesalahan manual. Excel bukanlah bahasa pengkodean dan hanya dapat menangani perhitungan matematika yang rumit, bukan logika yang kompleks.

Incentive calculation is the exact opposite. It is more logic and less math. This is exactly where human intervention is required. This is where a business analyst builds a query with 50 indexes and 25 nested ifs to calculate incentive.

God forbid if one of them goes wrong. It's fatally easy for user error to creep into the process and skew the results, potentially overpaying or underpaying your sales reps.

Dengan Compass, Anda dapat dengan mudah membuat program insentif yang kompleks dengan keakraban Excel dalam beberapa klik.

3. Lacks real-time visibility and transparency

Pada lembar Excel atau bahkan versi online-nya, kecuali jika seseorang memperbaruinya secara manual setiap menit, data dengan cepat menjadi usang. Lembar Excel tidak terhubung ke CRM dan ERP langsung dan, karenanya, tidak dapat diperbarui secara real-time. Akibatnya, tidak ada transparansi atau visibilitas data.

With Compass, the sales reps, managers, admins, HR teams, finance team, and the management have real-time access to incentive statements. Having this data readily available motivates sales reps to see what they’ve earned and how they can earn more.

Apart from motivating your sales team, Compass provides complete transparency into the actual calculations behind the numbers, and your team can trust the numbers they see because they have visibility into how they’re calculated.

4. Tidak dibuat untuk skala

Para ahli menggambarkan Excel sebagai bahasa pemrograman fungsional. Meskipun Excel menggabungkan analisis data, visualisasi, dan pemrograman secara bersamaan, Excel hanya berfungsi dengan baik jika datanya kecil dan terbatas pada ratusan catatan, dapat dimasukkan secara manual atau dapat disalin dan ditempelkan, dan logikanya lebih bersifat matematis daripada kompleks.

Organisasi menghadapi tantangan yang signifikan ketika mereka mencoba membangun perangkat lunak insentif di dalam Excel yang membutuhkan logika yang rumit, sehingga tidak memungkinkan untuk menghitung insentif dalam skala besar.

Dengan Compass, Anda mendapatkan yang terbaik dari Excel, seperti antarmuka yang intuitif bersama dengan variabel dan opsi pembayaran, dan dapat diskalakan untuk perusahaan kecil dan raksasa serta perusahaan rintisan.

5. Mahal

Ketika Anda menggunakan Excel untuk menghitung insentif penjualan, Anda menggunakan sumber daya, teknologi, sumber daya manusia, dan waktu yang signifikan, dan sumber daya ini memiliki biaya yang terkait dengannya.

Mengingat 88% dari spreadsheet berisi kesalahan, setiap kali Anda menemukan kesalahan, Anda akan mengeluarkan biaya untuk semua sumber daya ini lagi, sehingga membuatnya tidak ekonomis di semua tingkatan, dan dengan demikian merusak keseimbangan.

With Compass, you can automate the process, and all changes can be handled with just a few clicks. It also saves a lot of time and eliminates inaccuracies and allows your team to spend time on other critical areas of the business.

6. Tidak dapat diaudit

Have you ever returned to your Excel sheet only to discover that it is not how you left it? Or have you ever overwritten your formula only to find #ERROR! across cells? If this gives you a sense of Deja Vu, let me tell you, you are not alone.

Excel tidak menawarkan riwayat setiap perubahan yang dibuat pada setiap sel, dan Anda tidak dapat melihat siapa yang membuat perubahan atau apakah mereka memiliki persetujuan untuk melakukannya. Anda juga tidak dapat mengatur rantai dukungan. Meskipun Google Spreadsheet memperkenalkan fitur untuk mengatasi masalah ini, memeriksa riwayat perubahan untuk setiap sel tidak mungkin dilakukan.

Dengan Compass, Anda dapat dengan mudah melacak riwayat dan memudahkan audit dengan menunjukkan kepada pengguna siapa yang mengubah apa dan kapan. Compass juga memfasilitasi otomatisasi dan memungkinkan Anda dengan mudah menambahkan hierarki persetujuan.

7. Tidak dapat dibagikan

Excel mudah dibagikan, bukan? Cukup letakkan sebagai lampiran dalam email.

Perhaps it is. But not when you have a massive team of hundreds and thousands of employees who want to access the same file. This is where Excel collapses. You can create an incentive spreadsheet in Excel for your company, but what if you want to share it with 50000 reps?

Now, imagine those reps are grouped across 15 different incentive plans. Now add in the complexity of team leaders being able to see the incentives of their team members but no other team members.

You can build your Excel spreadsheet, but you can’t divide and share it in a way where the users can only see the information that they need to see. This is precisely what makes it non-sharable and challenging.

Dengan Compass, Anda mendapatkan kontrol pengguna. Anda dapat mengontrol siapa yang melihat data apa dan data tersebut selalu dibagikan di antara para pemangku kepentingan.

8. Tidak terintegrasi dengan sistem Anda saat ini seperti ERP, CRM, dll.

Excel, despite its online versions, is not connected. Complex incentive calculations need real-time data for all sources like CRM, ERP, and payroll. It is almost impossible to extract data from these sources, work on them, and keep them updated real time. This process is slow, manual, error-prone, and not real-time.

Dengan Compass, Anda dapat dengan mudah menarik data ini dari sistem yang sudah ada. Anda dapat mengintegrasikan Compass melalui webhook, API, atau SDK. Tautkan dan tambahkan filter gerbang jika ada beberapa sumber data.

9. Tidak dibangun untuk pelaporan keuangan & kepatuhan hukum

Excel adalah alat bantu bisnis yang dibuat untuk perhitungan matematis dengan mekanisme input, proses, dan output yang sederhana. Excel tidak memungkinkan Anda untuk mengonfigurasi implikasi pajak, apalagi berdasarkan lempengan atau geografis, dan membuat pelaporan keuangan dan kepatuhan hukum tidak tergantung pada perhitungan dan pembayaran insentif.

Dengan Compass, selain memungkinkan penghitungan insentif yang adil, bebas dari kesalahan, dan transparan, Compass juga menangani otentikasi pengguna dan semua langkah keamanan seperti GDPR atau ISO serta menangani implikasi dan kepatuhan pajak secara geografis.

10. Tidak dapat mengotomatiskan pembayaran

Excel is a calculation tool that can help you with the final incentive calculation. It cannot go even a step beyond that. It keeps incentive calculation independent of incentive payouts.

Untuk memproses pembayaran, Anda harus mengeluarkan pembayaran secara manual melalui bank atau melalui kartu hadiah, yang menyisakan banyak peluang untuk kesalahan manual. Excel tidak mengizinkan Anda untuk menghubungkannya ke API atau tempat pembayaran apa pun untuk memproses pembayaran.

Dengan Compass, Anda dapat menangani implikasi dan kepatuhan pajak geografis sebelum pembayaran insentif. Anda dapat mempertimbangkan salah satu atau semua jenis pembayaran insentif seperti transfer bank, katalog hadiah lebih dari 20.000 kartu hadiah digital, kartu prabayar, pengalaman, dan dompet di lebih dari 80 negara, nota kredit, atau transfer bank lama. Pembayaran dapat dikelola di berbagai wilayah & mata uang dengan lancar.

11. Tidak dibangun untuk insentif

Excel is a blank canvas with two dimensions. It cannot handle complex calculations coupled with layers of logic. You will have to resort to using 10s and 20s of nested ifs and indexes to arrive at the final value. God forbid if you go wrong with one of those 20.

With Compass, you can quickly build a logic with n number of variables where your only input is defining the variable, and Compass will take care of the rest. Apart from easy incentive calculation, Compass helps you motivate your sales reps with gamified sales contests with a library of templates to choose from. Compass is also created to handle complex tax implications across geographies and tax brackets to enable seamless payouts.

5 manfaat utama dari penerapan sistem penghitungan insentif

Here is a comparative table that showcases the benefits of installing an incentive calculation system for different personas.

Benefit | HRs | Sales Ops | CFO | CRO |

Increased efficiency and reduced costs | Automates calculations, freeing HR to focus on strategic tasks. | Saves time on manual calculations, allowing more focus on sales strategy. | Lowers operational costs by reducing errors and streamlining processes. | Improves sales tracking, enhancing overall efficiency. |

Improved accuracy and transparency | Reduces human error, ensuring fair employee rewards. | Provides clear metrics for sales performance, fostering trust. | Ensures accurate financial reporting and compliance with regulations. | Enhances visibility into sales performance, aligning strategies. |

Enhanced employee motivation and engagement | Motivates HR to create better talent management programs. | Keeps sales teams engaged with real-time reward tracking. | Increases overall productivity by linking rewards to performance. | Drives a high-performance culture through clear incentive structures. |

Streamlined program administration | Simplifies the management of various incentive programs. | Automates enrolment and tracking, reducing administrative burden. | Facilitates easier budget management for incentive payouts. | Allows for quick adjustments to programs based on performance data. |

Wawasan berbasis data | Provides valuable data for improving HR strategies and programs. | Offers insights into sales trends and team performance metrics. | Helps in analysing ROI on incentives, optimizing financial strategies. | Enables informed decision-making to enhance sales tactics and goals. |

How to transition from excel to an automated incentive system?

Moving from Excel to an automated incentive system can improve efficiency and accuracy in managing rewards. Here’s a simple guide on how to make this transition.

1. Understand the need for automation

First, recognize why automation is beneficial. Automated systems help manage and track incentives more effectively than Excel. They reduce errors and save time by automating tasks like reward distribution and performance tracking.

2. Choose the right platform

Select an incentive automation platform that fits your needs. Look for features such as real-time analytics, customizable programs, and easy integration with existing systems like CRM or HR software. This will ensure that the platform can handle your specific requirements.

3. Set clear rules and criteria

Define the rules for your incentive programs. This includes setting performance metrics and eligibility criteria for rewards. Clear guidelines will help the system calculate incentives accurately.

4. Integrate data sources

Connect the automation system to your data sources. This could include sales data, employee performance metrics, or customer interactions. Integration allows the system to access real-time data needed for calculating rewards.

5. Automate calculations and notifications

Once set up, the system should automatically calculate rewards based on the defined criteria. It should also send notifications to employees or partners when they achieve milestones or earn incentives.

6. Monitor performance and adjust as needed

Use the analytics tools provided by the platform to track program performance. Regularly review participation rates and reward effectiveness. This information will help you make adjustments to optimize your incentive strategies.

7. Train your team

Ensure that your team understands how to use the new system. Provide training on how to access their performance metrics and understand the incentive structure. This will encourage engagement and accountability among participants.

By following these steps, you can smoothly transition from using Excel to an automated incentive system, enhancing your program's efficiency and effectiveness. Take Mahindra Finance as an example. They transitioned to an incentive calculation system and noticed 98% less errors in calculations.

Mahindra Finance, a leading financial services provider in India, faced challenges in managing their complex sales incentive programs. Manual calculations were prone to errors, processing times were lengthy, and a lack of transparency demotivated sales representatives.

Mahindra Finance partnered with Compass, a provider of sales commission automation solutions, to implement the Xoxoday platform. Plum automated the entire incentive management process, including:

- Sales reps could see their earnings accrue based on pre-defined rules and schemes, ensuring timely and accurate payouts.

- Customizable scheme management: Mahindra gained the flexibility to easily update and manage various incentive programs across different regions and product lines.

- Enhanced transparency: A transparent system allowed sales reps to track their performance and incentive calculations in real-time.

- Algorithms were developed to handle exceptions and outliers, reducing the need for manual adjustments and improving accuracy.

The automation of the sales commission process led to significant improvements:

- Increased incentive qualifiers: Over 25% more representatives received their incentives, fostering a culture of recognition.

- Error reduction: Calculation errors were slashed by over 98%, boosting accuracy and reliability.

- Processing speed: Incentive processing times were reduced by a staggering 99%, with payouts completed within hours instead of days.

- Employee satisfaction: Morale and productivity increased by 30%, leading to a direct boost in sales performance.

- Operational efficiency: Streamlined operations resulted in a 40% reduction in time spent on incentive management.

- Full compliance with audit requirements was achieved, minimizing the risk of regulatory issues and fines.

By automating their sales commission process, Mahindra Finance transformed their incentive management system. Integration of advanced data handling, real-time processing, and transparency not only improved operational efficiency but also boosted employee satisfaction and sales performance.

Compass as a reliable incentive calculation system

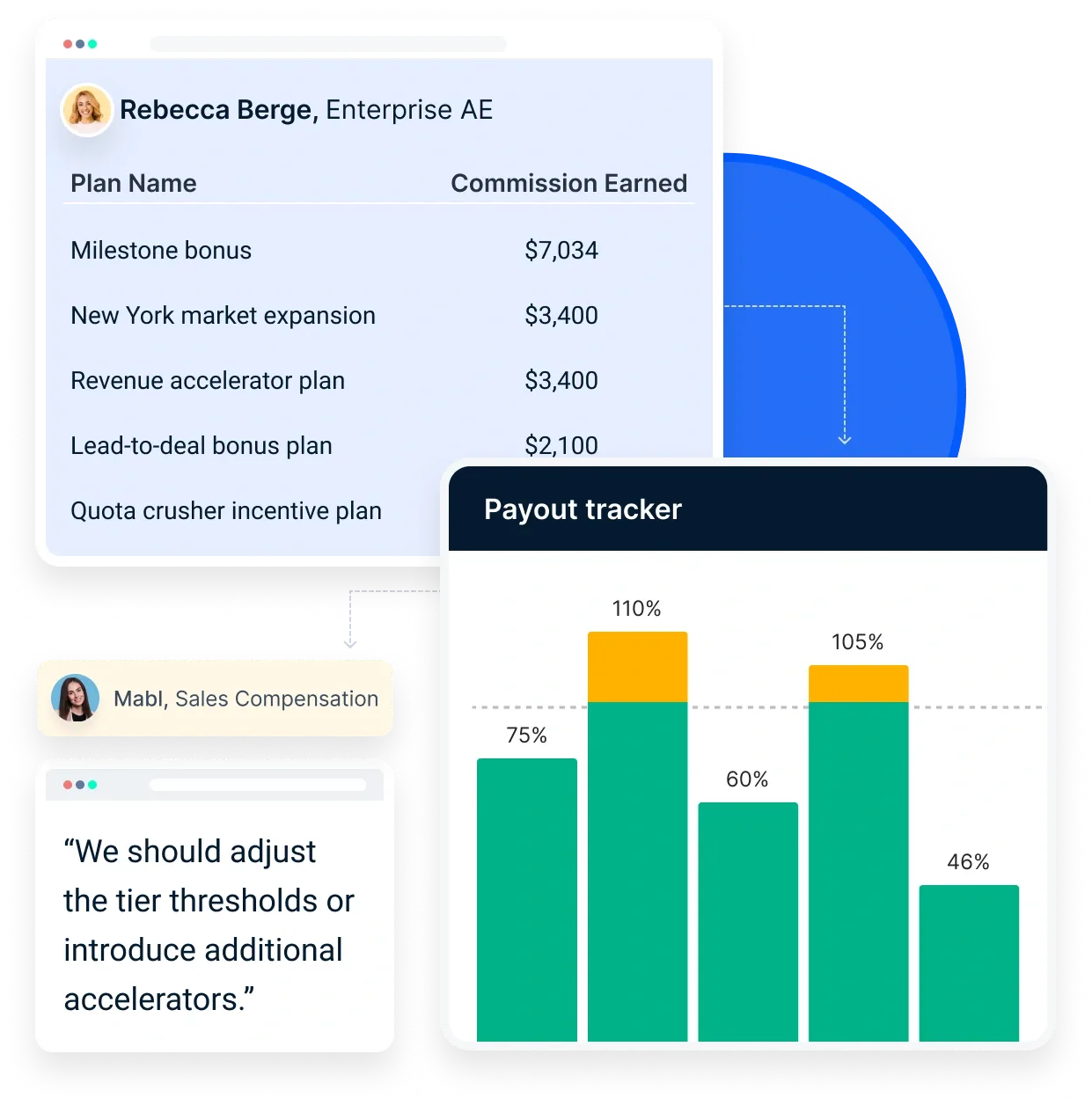

Compass serves as an effective incentive calculation system for both Chief Revenue Officers (CRO) and Human Resources (HR) departments. Here’s how it benefits each role:

For CFOs

- Integration with payroll systems: Compass can integrate seamlessly with various payroll systems, such as QuickBooks, Oracle Netsuite, and Stripe. This allows CFOs to schedule and send commission payouts to sales representatives efficiently.

- Streamlined bulk payments: The system enables the processing of multiple transactions at once. This feature reduces manual effort and saves valuable time, making the payment process more efficient.

- Multi-currency support: Compass supports transactions in multiple currencies, which is beneficial for businesses operating on an international scale.

- Insightful reporting: The platform generates detailed reports that provide insights into the return on investment (ROI) of commission plans. This empowers finance teams to make informed decisions regarding future budget allocations.

- Tax compliance and data security: Compass automatically calculates and withholds taxes based on local regulations. It also ensures data encryption to protect sensitive payment information, maintaining compliance with standards like ASC 606.

For HR

- Comprehensive sales performance management: Compass offers a complete solution for managing sales performance, fostering a competitive and collaborative culture among sales teams.

- Quick compensation plan creation: HR can create competitive compensation plans rapidly using pre-built templates. This allows for adjustments in response to changing economic conditions without lengthy delays.

- Transparency in compensation plans: The system provides visibility into the entire incentive plan, which helps eliminate disputes over calculations and potential earnings. This transparency boosts employee morale.

- Timely payouts: Compass ensures that incentive payouts are made on time, replacing cumbersome spreadsheets and enabling error-free commission plans at scale.

- Effectiveness analysis: HR can analyze the performance of incentive plans in real-time, using dashboards and comparison reports to measure their effectiveness and make necessary adjustments.

Compass enhances the efficiency of incentive calculations for both CROs and HR professionals by automating processes, providing valuable insights, and ensuring compliance with financial regulations.

Penutup

Excel, meskipun merupakan alat yang serbaguna, memiliki keterbatasan dalam hal penghitungan insentif yang kompleks. Potensi kesalahan manual, kurangnya data waktu nyata, dan kesulitan dalam skalabilitas dapat menjadi tantangan yang signifikan.

Menerapkan sistem penghitungan insentif menawarkan banyak sekali manfaat untuk bisnis dari semua ukuran. Dengan mengotomatiskan tugas-tugas manual, memastikan akurasi, dan menyediakan data yang berharga untuk pengoptimalan program, sistem ini dapat secara signifikan meningkatkan manajemen program insentif Anda.

Compass offers a solution that streamlines incentive calculation processes, automates payments, and enhances transparency and accuracy. Leveraging Compass, businesses can supercharge their sales teams, reduce processing time, increase productivity, and eliminate communication opacity, all while ensuring the precision of their incentive calculations.

Pertanyaan Umum

1. What is the formula for calculating incentives?

The formula for calculating incentives is:

Incentive amount = (Actual Performance −Threshold) × Incentive Rate

This means you take the performance achieved, subtract a minimum threshold, and multiply by the incentive rate.

2. What is the formula of the incentive wage system?

The incentive wage system can be represented as:

Incentive pay = Base Pay + (Sales Achievement × Commission Rate)

This shows that incentive pay includes a base salary plus additional earnings based on sales performance.

3. What is the incentive pay system?

The incentive pay system is a compensation structure that rewards employees based on their performance. It aims to motivate employees to achieve specific goals or targets, often through bonuses or commissions.

4. How is incentive pay typically calculated?

Incentive pay is typically calculated by determining an employee's base salary, then applying an incentive percentage or fixed amount based on their performance. The calculation often involves multiplying the base salary by the incentive percentage.

5. What is a good incentive percentage?

A good incentive percentage can vary but is often around 10% to 20% of an employee's base salary. This range can effectively motivate employees while remaining financially sustainable for the company.