Clawback dalam Penjualan & Komisi: Arti, Contoh, Tolok Ukur

Clawback dalam penjualan membantu bisnis mendapatkan kembali komisi dari transaksi yang gagal, mengurangi risiko keuangan, dan mendorong praktik penjualan yang etis. Pelajari cara kerjanya dan mengapa hal ini penting untuk pertumbuhan penjualan yang berkelanjutan.

Di halaman ini

Apa yang dimulai sebagai cara untuk mencegah perilaku perusahaan yang sembrono dan melindungi kepentingan pemegang saham karenaSkandal penjualan silang Wells Fargoclawback segera menjadi praktik yang diadopsi oleh banyak perusahaan di seluruh dunia. Selain itu, hal ini membuat kebutuhan untuk membumikanUndang-Undang Dodd-Frankke dalam kebijakan tersebut.

Insiden ini terjadi pada tahun 2016, mendorong Wells Fargo untuk merevisi kerangka kerja manajemen, risiko, dan kontrolnya. Fargo juga mengubah budaya dan kebijakan clawback untuk membangun kembali kepercayaan dan mengatasi masalah yang menyebabkan skandal tersebut. Namun, hal ini membuka peluang bagi perusahaan di berbagai industri di seluruh dunia untuk merevisi kebijakan clawback mereka.

Kebijakan clawback dipandang sebagai alat dalam organisasi untuk mencegah pengambilan risiko yang berlebihan dan tidak tepat oleh para perwakilan. Pada tahun 2016,Karyawan Wells Fargotepatnya 5.300 orang, membuka 2 juta rekening tidak sah, yang menyebabkan bank mengembalikan 185 juta dolar dalam bentuk kompensasi eksekutif. Hal ini menegaskan kembali tujuan dari kebijakan clawback.

Tujuannya adalah agar perusahaan dapat memperoleh kembali kompensasi berbasis insentif yang dibayarkan kepada eksekutif jika ternyata laporan keuangan yang berisi metrik tersebut cacat atau bersumber secara tidak etis. Dengan menggunakan Wells Fargo sebagai contoh kontemporer dari 'clawing back', kita dapat mengatakan bahwa konsekuensi dari pelanggaran kebijakan clawback dapat menjadi signifikan.

Apa yang dimaksud dengan clawback?

Cakar balik, menurutNASDAQmengacu pada "pengaturan di mana pemilik ekuitas berkomitmen untuk menggunakan dividen yang telah mereka terima di masa lalu untuk membiayai kebutuhan uang tunai proyek atau perusahaan di masa depan."

Sederhananya, clawback adalah ketentuan kontrak yang memungkinkan perusahaan untuk mengambil kompensasi atau tunjangan yang telah dicairkan sebelumnya, biasanya terkait dengan pembayaran berbasis kinerja seperti bonus.

Tujuannya adalah untuk menegakkan akuntabilitas di antara para karyawan. Hal ini memungkinkan organisasi untuk mendapatkan kembali kompensasi jika seorang karyawan terlibat dalam pelanggaran atau jika ada koreksi catatan keuangan yang signifikan.

Sekarang setelah kita memahami arti clawback, mari kita lihat bagaimana mekanisme pemberian clawback bekerja.

Apa itu ketentuan clawback & bagaimana cara kerjanya?

Ketentuan clawback mengacu pada klausul kontrak yang mengharuskan pengembalian uang atau kompensasi lain dalam keadaan atau peristiwa tertentu. Ketentuan ini sering digunakan dalam perjanjian kerja finansial untuk mengatur pembayaran bonus dan melindungi dari kerugian finansial, penipuan, atau pelanggaran. Clawback dirancang sedemikian rupa untuk mempromosikan praktik keuangan yang lebih baik, mencegah aktivitas penipuan, dan mendorong perilaku penjualan yang berkelanjutan.

Di sektor keuangan, clawback biasanya diterapkan pada kontrak kerja untuk mengendalikan kompensasi eksekutif dan mencegah penipuan. Hal ini dapat dipicu oleh variasi jangka panjang dari instrumen keuangan, pelanggaran, atau pelaporan keuangan yang salah. Undang-Undang Dodd-Frank bertujuan untuk memperluas clawback lebih jauh lagi, tetapi aturan yang diusulkan belum disetujui.

Untuk organisasi penjualan,klausul clawbackmemungkinkan bisnis untuk mendapatkan kembali komisi atau kompensasi berbasis kinerja lainnya yang dibayarkan kepada tenaga penjualan ketika pelanggan melakukan perputaran atau membatalkan pembelian mereka dalam jangka waktu tertentu.

Hal ini membantu melindungi bisnis dari kerugian finansial akibat perputaran pelanggan dan mendorong perwakilan penjualan untuk mengejar penawaran berkualitas tinggi dan meningkatkan pengalaman pelanggan.

- Antara tahun 2005 dan 2010, jumlah perusahaan besar di Fortune 500 yang menggunakan clawback meningkat pesat. Awalnya, kurang dari 3% yang menggunakannya, namun kemudian melonjak menjadi82%.

- Menurut ISS Corporate Solutions, lebih dari90%perusahaan S&P 500 memiliki aturan untuk mencakar kembali uang dan saham. Namun untuk Russell 3000, yang tidak termasuk dalam S&P 500, hanya lebih dari setengahnya yang memiliki kebijakan serupa.

- Sebuahpenelitian yang berbasis di Harvardmenunjukkan tingkat adopsi 94% di antara perusahaan-perusahaan perawatan kesehatan S&P 500. Namun, hanya sekitar 31% perusahaan perawatan kesehatan di luar S&P 500 yang memiliki kebijakan seperti itu.

Studi yang dikuantifikasi tentang clawback ini menunjukkan pentingnya menempatkan kebijakan clawback dalam perjanjian. Namun, ada lebih banyak alasan untuk memasukkan kebijakan clawback dalam rencana komisi penjualan.

Namun, untuk memasukkan kebijakan clawback ke dalam ketentuan Anda, Anda harus mengetahui jenis-jenis clawback yang ada.

Jenis-jenis klausul clawback

Berikut adalah jenis-jenis klausul clawback dengan penjelasan singkat dan contohnya:

1. Kredit kuota negatif

Jenis clawback ini mengurangi komisi atau bonus karyawan jika mereka gagal memenuhi target penjualan tertentu. Katakanlah seorang tenaga penjualan mendapatkan bonus $5.000 karena melampaui kuota mereka sebesar 10%.

Namun, jika klausul tersebut menyertakan kredit kuota negatif, dan tenaga penjual tidak memenuhi kuota mereka sebesar 5%, sebagian dari gaji pokok atau komisi mereka sebelumnya dapat dikurangi dengan jumlah yang sebanding dengan kuota yang tidak terpenuhi.

2. Kredit kuota negatif yang berlaku surut

Serupa dengan kredit kuota negatif, ketentuan ini memungkinkan pemberi kerja untuk menarik kembali komisi atau bonus yang telah dibayarkan kepada karyawan jika mereka gagal memenuhi kuota mereka dalam jangka waktu yang ditentukan, yang dapat diperpanjang melebihi periode penjualan saat ini.

3. Pengembalian dana hanya untuk komisi

Clawback ini hanya berlaku untuk komisi yang diperoleh karyawan. Jika karyawan gagal memenuhi metrik kinerja tertentu atau melanggar kontrak mereka, perusahaan dapat menahan atau mengembalikan semua atau sebagian komisi yang dibayarkan.

Contoh ketentuan clawback dalam komisi penjualan

Clawback dalam penjualan sangat penting untuk mempertahankan struktur komisi yang adil sekaligus melindungi perusahaan dari risiko keuangan. Di bawah ini, kami membahas tiga metode umum untuk menangani skenario clawback penjualan.

Kuota dan struktur komisi

Katakanlah Emma mendapatkan komisi berdasarkan pendapatan berulang tahunan (ARR) dari transaksi yang dimenangkan dalam periode kuota. Pada Periode 1 dan 2, kuotanya masing-masing adalah $150.000 dan $300.000. Emma menerima komisi 10% dari ARR transaksi hingga ia mencapai kuotanya (Tingkat 1) dan 20% untuk jumlah yang melebihi kuota (Tingkat 2).

Aturan komisi dan clawback

Komisi dibayarkan pada saat pemesanan, namun tunduk pada ketentuan pengembalian dana jika pelanggan tidak membayar. Di bawah ini adalah transaksi yang ditutup untuk Periode 1 dan 2. Pada akhir Periode 2, perusahaan menentukan bahwa Transaksi A tidak akan membayar, sehingga memicu clawback penjualan.

Metode clawback #1: jumlah pembayaran yang tepat

Ini adalah metode yang paling umum karena kesederhanaan operasional dan sifatnya yang intuitif bagi tim penjualan.

Karena Emma mendapatkan komisi $5.000 untuk Deal A, yang tidak terpenuhi, dia harus mengembalikan $5.000.

Metode ini mengaitkan jumlah clawback dengan saat transaksi ditutup dalam periode kuota. Sebagai contoh, karena Deal A ditutup dalam Tier 1, jumlah clawback adalah 10% dari ARR. Namun, jika Deal C telah di-clawback, jumlahnya akan menjadi $15.000 (20% dari ARR).

Mengapa kami menyukai Metode #1

- Paling intuitif dan mudah dipahami.

- Sederhana untuk perusahaan dan perwakilan penjualan.

- Memastikan keadilan dalam komisi penjualan.

Metode clawback #2: kredit kuota negatif ke periode berjalan

Metode ini mengurangi kredit kuota Periode 2 dengan memperlakukan clawback sebagai jumlah penjualan negatif, yang secara efektif mengurangi pencapaian periode berjalan.

Dengan menambahkan clawback Deal A sebagai penjualan negatif, metode ini mudah diotomatisasi dalam spreadsheet dan CRM. Namun, metode ini dapat memberikan insentif kepada tenaga penjualan untuk menunda transaksi ke periode mendatang untuk menghindari dampak kuota negatif.

Mengapa kami menyukai Metode #2

- Secara operasional sederhana dan mudah diotomatisasi.

- Pernyataan komisi yang jelas.

- Menghilangkan kebutuhan akan referensi pembayaran historis.

Metode clawback #3: kredit kuota negatif ke periode sebelumnya

Metode ini secara retroaktif menyesuaikan pencapaian kuota periode sebelumnya untuk mencerminkan clawback. Tidak seperti Metode #2, metode ini mencegah insentif negatif pada periode saat ini.

Metode ini lebih kompleks karena memerlukan penghitungan ulang komisi di masa lalu dan penyesuaian pembayaran yang sesuai. Perusahaan yang menggunakan ASC 606 untuk kapitalisasi biaya perlu memastikan kepatuhan yang tepat saat menerapkan metode ini.

Mengapa kami menyukai Metode #3

- Menyeimbangkan keadilan antara pemberi kerja dan penjual.

- Mencegah insentif negatif untuk menunda penjualan.

- Menghindari dampak negatif pada komisi periode berjalan.

Pikiran terakhir

Ketentuan clawback dalam penjualan memastikan keamanan finansial bagi perusahaan dengan tetap mempertahankan struktur komisi yang adil.

Apa saja tolok ukur umum yang digunakan untuk menentukan clawback dalam penjualan?

Tolok ukur yang paling umum digunakan untuk menentukan clawback dalam penjualan adalah:

1. Pencapaian kuota

Ini adalah tolok ukur yang paling mendasar. Ketentuan clawback sering kali berlaku jika seorang tenaga penjual berada di bawah persentase yang telah ditentukan sebelumnya dari kuota penjualan yang ditugaskan untuk periode tertentu.

2. Akselerator penjualan

Ini adalah bonus atau insentif yang ditawarkan kepada tenaga penjualan untuk melampaui target tertentu. Clawback dapat diterapkan pada akselerator ini jika tenaga penjual tidak mencapai kuota dasar atau metrik kinerja lainnya.

Namun, perusahaan harus berkomunikasi secara jelas dengan tenaga penjualan tentang pengintegrasian klausul clawback dan implikasinya. Hal ini dapat membantu mencegah kesalahpahaman dan memastikan bahwa perwakilan penjualan memahami potensi konsekuensi dari tindakan mereka. Untuk aspek seperti ini, mempertahankan praktik terbaik dalam navigasi clawback akan sangat membantu.

Mengapa Anda harus menyertakan klausul clawback dalam rencana komisi penjualan Anda?

Klausul clawback sangat penting untuk disertakan dalam rencana komisi penjualan untuk melindungi perusahaan dari kerugian finansial akibat aktivitas penipuan, penjualan ilegal, atau ketidakpatuhan terhadap kebijakan perusahaan. Pertimbangkan untuk menyertakan klausul clawback dalam rencana komisi penjualan Anda karena beberapa alasan utama:

1. Mengurangi risiko keuangan

Clawback dapat membantu mengurangi risiko keuangan dengan mengembalikan komisi atas penjualan yang tidak menghasilkan keuntungan jangka panjang bagi perusahaan. Hal ini dapat disebabkan oleh perputaran pelanggan, pengembalian produk, atau aktivitas penipuan.

Kebijakan ini berlaku jika laporan keuangan Airbnb yang diungkapkan kepada publik harus disajikan kembali karena adanya kecurangan atau kesalahan yang disengaja oleh karyawan atau pejabat eksekutif.

Kebijakan ini memberikan kebijaksanaan kepada Komite Pengembangan Kepemimpinan, Kepemilikan, dan Kompensasi atau dewan direksi untuk mengembalikan insentif tunai, penghargaan ekuitas, atau kompensasi lainnya kepada karyawan yang melakukan kesalahan.

2.Perlindungan hukum yang ditingkatkan

Clawback memberikan lapisan perlindungan hukum jika terjadi penipuan atau pelanggaran oleh tenaga penjualan. Jika komisi diperoleh dengan cara ilegal atau tidak etis, klausul clawback memungkinkan perusahaan untuk mendapatkan kembali dana tersebut.

3. Keselarasan dengan tujuan bisnis

Klausul clawback dapat memberikan insentif bagi perilaku penjualan yang berkontribusi pada pertumbuhan jangka panjang perusahaan. Dengan potensi mendapatkan kembali komisi dari keuntungan jangka pendek yang tidak diterjemahkan ke dalam retensi atau kepuasan pelanggan, clawback mendorong tenaga penjualan untuk fokus membangun nilai yang berkelanjutan.

Aturan ini berlaku untuk pembayaran insentif yang diterima setelah tanggal 2 Oktober 2023. Sebuah komite yang ditunjuk oleh dewan akan mengawasi hal ini dan mengikuti Aturan Nasdaq 5608.

4. Memberi insentif pada perilaku penjualan

Clawback dalam penjualan memainkan peran penting dalam meningkatkan pengalaman pelanggan secara keseluruhan. Alih-alih mengumpulkan komisi mereka dan melanjutkan, staf penjualan memiliki kepentingan untuk memastikan kepuasan pelanggan selama proses penerimaan.

Hal ini sangat berharga bagi penyedia SaaS dan bisnis berbasis langganan lainnya, di mana retensi jangka panjang lebih besar daripada dampak dari satu penjualan. Dengan menerapkan struktur komisi penjualan clawback, perusahaan memberikan motivasi ekstra kepada perwakilan mereka untuk menyelaraskan pola pikir kesuksesan jangka panjang.

Bagaimana Compass menyederhanakan manajemen clawback

Compass merampingkan proses clawback, memastikan akurasi, transparansi, dan efisiensi.

Begini cara kerjanya:

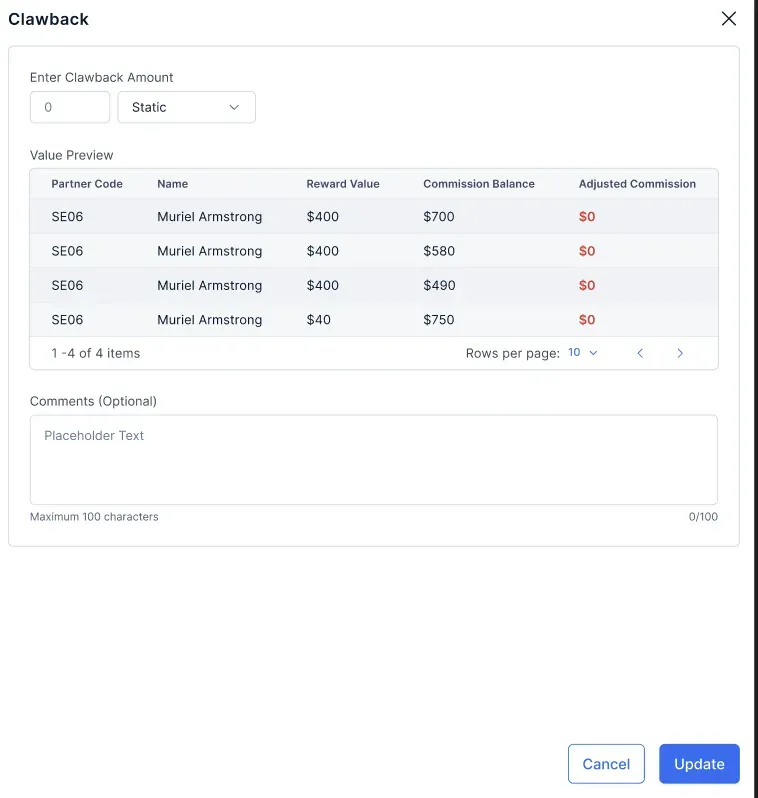

- Mengidentifikasi transaksi dan partisipan - Compass membantu menentukan transaksi masa lalu yang membutuhkan clawback dan mengidentifikasi partisipan yang terlibat.

- Menentukan penyesuaian komisi - Sistem ini menghitung jumlah yang dibayarkan kepada peserta dan menentukan jumlah clawback berdasarkan logika yang telah ditentukan sebelumnya, seperti persentase dari komisi yang dibayarkan.

- Proses pemotongan yang mulus - Jumlah yang dipotong disesuaikan dengan komisi bulan berjalan atau pembayaran di masa mendatang, sehingga memastikan gangguan minimal.

- Validasi dan persetujuan - Validasi data dan alur kerja persetujuan yang telah ditentukan sebelumnya memastikan akurasi sebelum clawback diproses.

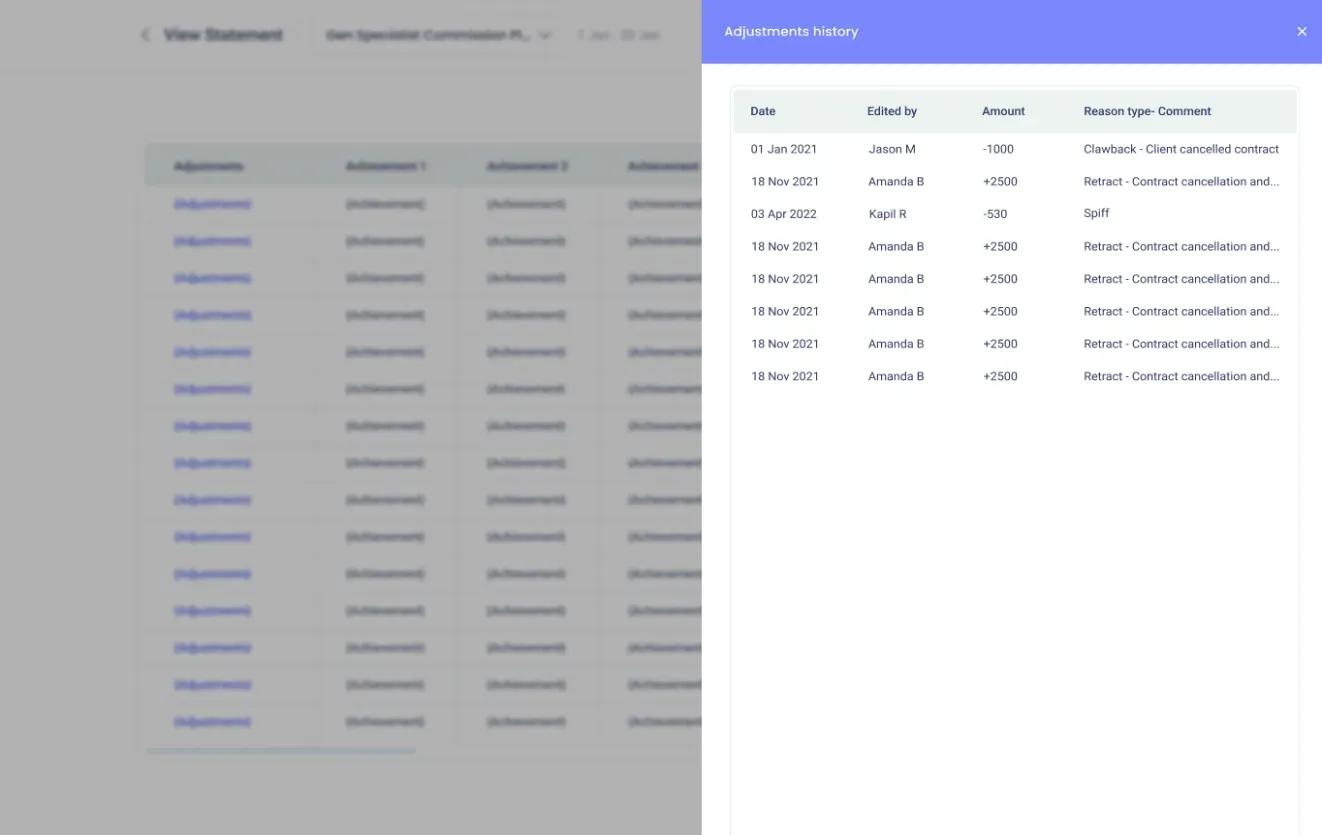

- Transparansi penuh - Pengguna akhir mendapatkan visibilitas penuh ke dalam clawback mereka, termasuk detail transaksi, jumlah yang dipotong, dan komentar yang relevan dari pemberi persetujuan.

- Clawback ad-hoc - Admin memiliki fleksibilitas untuk memulai clawback untuk pembayaran tertentu dari paket komisi apa pun, dengan jejak audit khusus untuk admin dan pengguna.

Melalui Compass, admin dapat mengatur dan mengelola ketentuan clawback secara efisien, sementara pengguna akhir dapat dengan mudah melacak clawback mereka melalui aplikasi seluler.

Selain itu, pengguna dapat melihat, mengirim email, atau mengunduh transaksi yang relevan, memastikan kontrol penuh dan transparansi atas penyesuaian komisi mereka. Jadwalkan panggilan sekarang!

Praktik terbaik untuk menavigasi klausul clawback

Untuk menavigasi klausul clawback secara efektif, penting untuk mengikuti beberapa praktik terbaik. Praktik-praktik ini meliputi:

1. 1. Mencari nasihat hukum

Sangat penting untuk berkonsultasi dengan ahli hukum saat membuat klausul clawback untuk memastikan klausul tersebut sah secara hukum dan dapat ditegakkan. Hal ini dapat mencegah potensi perselisihan dan proses hukum.

2. Menetapkan ketentuan clawback yang jelas dan adil

Klausul clawback harus lugas dan adil, dengan kondisi transparan yang menguraikan kapan komisi dapat diperoleh kembali. Hal ini membantu mencegah kesalahpahaman dan memastikan bahwa perwakilan penjualan menyadari potensi konsekuensi dari tindakan mereka.

3. Meninjau dan memperbarui klausul clawback secara teratur

Perusahaan harus meninjau dan merevisinya secara berkala untuk menjaga efektivitas dan relevansinya. Proses ini dapat melibatkan analisis contoh-contoh sebelumnya di mana klausul tersebut digunakan untuk menilai dampaknya terhadap kinerja keuangan dan hasil penjualan bisnis.

Undang-undang terbaru mengenai klausul clawback

- Theaturan baruyang diimplementasikan pada Oktober 2022, merupakan bagian dari Dodd-Frank Wall Street Reform and Consumer Protection Act tahun 2010.

- Perusahaan yang terdaftar harus mengikutiAturan Clawback SEC yang baru.

- Peraturan ini mengharuskan perusahaan untuk mendapatkan kembali kompensasi berbasis insentif yang diberikan berdasarkan kesalahan dalam laporan keuangan. Hal ini berlaku untuk sebagian besar perusahaan di bursa saham utama, terlepas dari pengetahuan atau kesalahan yang dilakukan oleh karyawan.

- Menurutundang-undang terbaruperusahaan tidak dapat melindungi para pejabatnya dari clawback ini, dan kesalahan akuntansi besar maupun kecil dapat memicunya.

- Aturan pengungkapan yang baru mengharuskan perusahaan untuk melaporkan rincian tentang clawback. Peraturan ini juga dapat memengaruhi cara perusahaan melakukan investigasi internal.

Kesimpulan

Ketentuan clawback memainkan peran penting dalam kerangka kerja dengan mengembalikan kepercayaan investor dan menumbuhkan kepercayaan di antara masyarakat. Pencantuman ketentuan ini meningkatkan akuntabilitas individu dan memodifikasi sistem insentif untuk mengurangi ketergantungan pada hasil pembayaran jangka pendek.

Dapat dikatakan bahwa clawback diterapkan di berbagai sektor seperti ekuitas swasta, asuransi, dividen, dan kontrak bisnis untuk memastikan tanggung jawab yang lebih besar di antara para pihak yang terlibat.

Namun, untuk memastikan penerapan kebijakan clawback yang adil di antara para perwakilan penjualan, saluran otomatisasi insentif dapat dibuat agar mereka dapat memenuhi ekspektasi yang ditetapkan dalam kontrak.Compassadalah perangkat lunak manajemen insentif penjualan yang membantu bisnis mengelola dan mengotomatiskan program insentif penjualan mereka secara adil. Platform ini menyederhanakan pengelolaan rencana insentif yang kompleks dengan:

- Meluncurkan rencana insentif

- Menghitung dan mencairkan insentif, dengan visibilitas kinerja secara real-time

- Hasilkan informasi komisi dan pembayaran tepat waktu.

- Integrasi dengan CRM melalui webhooks, API, atau SDK, yang menggabungkan filter tautan dan gerbang untuk mengelola berbagai sumber data.

Jadi, fasilitasi otomatisasi program insentif, sederhanakan proses penetapan target kinerja penjualan, dan pantau kemajuan karyawan dalam melampauinya dengan tetap menjaga kesopanan dan keadilan di semua tingkatan dengan Compass.