Comisiones de ventas medias por sector: Un desglose detallado

Sales commission rates vary widely across industries, depending on deal size, sales cycles, and compensation structures. In this guide, we break down average sales commission rates by industry, explore different commission models, and highlight best practices for optimizing sales compensation.

En esta página

Sales commission rates motivate salespeople to perform at their best and drive business revenue growth. However, determining the appropriate commission rate can be challenging for employers, especially given the variations across different industries.

The standard structure for US sales organizations is set at 60:40. However, this commission structure varies dramatically based on the company and its industry, substantiated by Harvard Business Review.

However, a source has revealed that on-target earnings or total target compensation for any average sales representative is $115,000. Understanding the commission rates prevalent in your industry can give you an edge in attracting and retaining top sales talent.

A continuación, ofrecemos una visión general de las estructuras de comisiones en los sectores minorista, manufacturero y tecnológico. El artículo analiza los factores que influyen en las comisiones, como el tamaño de la empresa, el volumen de ventas y la ubicación geográfica.

With this information, businesses can evaluate their commission plans and make adjustments to ensure they are competitive and incentivize their salespeople effectively. Companies can enhance their sales performance by identifying industry-specific commission rates and ultimately driving their bottom line.

¿Qué son las comisiones de venta?

Las comisiones de ventas son una forma de compensación que se paga a los vendedores en función de las ventas que generan. Suelen calcularse como un porcentaje de la venta total y pueden variar en función del sector, la empresa y la función de venta concreta.

Businesses can use several commission structures to determine commission rates, such as straight commission, salary plus commission, and variable commission. The commission rate for each sales role will depend on several factors, including the complexity of the sales process, the average sale value, and the market competition level.

En algunos sectores, como el inmobiliario o los servicios financieros, las comisiones pueden estar reguladas por ley.

¿Por qué es importante decidir el porcentaje de comisión de ventas?

Sales commission rates are essential for incentivizing salespeople to achieve sales targets and drive revenue growth for the business. More specifically, these rates are crucial for the following:

1. Motivar el rendimiento de las ventas

Las comisiones de ventas pueden motivar a los vendedores a alcanzar sus objetivos e impulsar el crecimiento de los ingresos. Unas comisiones más altas animan a los vendedores a trabajar más y a vender más, lo que puede beneficiar a la empresa al aumentar las ventas y los ingresos.

2. Atraer y retener a los mejores vendedores

Sales commission rates can help businesses attract and retain top sales talent by offering a competitive compensation package. Commission-based compensation allows salespeople to earn more based on their performance, which can be an attractive incentive for talented sales professionals.

3. Alinear las metas de ventas y los objetivos empresariales

Los porcentajes de comisión pueden alinear las metas de ventas y los objetivos empresariales. Por ejemplo, una empresa centrada en la fidelización de clientes puede ofrecer un porcentaje de comisión más alto por ventas repetidas o por ventas adicionales a clientes existentes.

4. Compensación rentable

Commission-based compensation can be a cost-effective way to compensate salespeople, as businesses only pay commissions when a sale is made. This can help companies to control labor costs and manage their budget.

5. Normas industriales y competitividad

Deciding sales commission rates is essential to stay competitive and attract top sales talent. Salespeople may be motivated to seek employment elsewhere if commission rates are too low. Similarly, if commission rates are too high, businesses may need help to remain profitable.

Comisiones de venta medias por sector

Multiple factors are at play, leading to different industry commission rates. So, here are the average commission rates for 11 industries. It's important to note that these are just general ranges, and actual commission rates can vary depending on various factors specific to each business in each industry.

Thus, It's recommended that companies conduct their research and analysis to determine the appropriate commission rates for their sales teams.

Below is a breakdown of average sales commission rates across major industries.

1. Software sales (SaaS & technology)

- Commission Rate: 8%: 12%

- Base Salary + Commission: Common (60:40 or 50:50 split)

- Quota Attainment: Typically annualized, with accelerators for exceeding targets.

- Sales Cycle Length: 30: 120 days for mid-market; 6: 12 months for enterprise deals.

- Why? SaaS sales involve long sales cycles and recurring revenue models, making residual commissions or tiered accelerators standard.

2. Real estate

- Commission Rate: 3%: 6% (split between buyer & seller agents)

- Base Salary + Commission: Mostly 100% commission-based

- Quota Attainment: Based on annual property sales.

- Sales Cycle Length: 3: 6 months per transaction.

- Why? High-ticket sales with longer closing cycles and no recurring revenue, meaning commissions must be high enough to sustain agents.

3. Financial services & banking

- Commission Rate: 5%: 10% on investments, 1%: 3% on loans

- Base Salary + Commission: Common in banking; 100% commission for independent advisors.

- Quota Attainment: Based on client portfolio growth and revenue generated.

- Sales Cycle Length: Varies (weeks for loans, years for wealth management).

- Why? Commissions are often residual, incentivizing advisors to maintain long-term client relationships.

4. Medical & pharmaceutical sales

- Commission Rate: 5%: 15%

- Base Salary + Commission: Common (70:30 or 60:40 split)

- Quota Attainment: Annual, often tied to specific drug or equipment sales.

- Sales Cycle Length: 3: 9 months.

- Why? Sales require deep industry knowledge, long relationships with healthcare professionals, and high compliance regulations.

5. Manufacturing & industrial sales

- Commission Rate: 2%: 10%

- Base Salary + Commission: Varies (some profit-based)

- Quota Attainment: Based on bulk orders or high-value contracts.

- Sales Cycle Length: 6: 12 months for large contracts.

- Why? Margins vary significantly, so profit-based commissions ensure sales reps focus on selling high-margin products.

6. Retail & e-commerce sales

- Commission Rate: 1%: 5%

- Base Salary + Commission: Common in luxury retail, auto sales

- Quota Attainment: Monthly or quarterly, based on volume and revenue.

- Sales Cycle Length: Immediate to weeks (depending on product type).

- Why? Retail sales have lower deal values but higher sales velocity, so commissions are lower per transaction.

7. Marketing & advertising sales

- Commission Rate: 10%: 20%

- Base Salary + Commission: Varies (50:50 or higher commission for agencies)

- Quota Attainment: Based on ad spend or contracts closed.

- Sales Cycle Length: 1: 6 months.

- Why? High commission rates help compensate for competitive pricing and client churn risks.

How to optimize sales commission plans for your industry

A well-designed commission plan balances company profitability and sales rep motivation. Here are best practices for optimizing commission structures:

- Align commission with business goals: Ensure incentives drive the right sales behaviors.

- Incorporate tiered accelerators: Reward top performers by increasing commission rates beyond quota.

- Introduce residual commissions: Encourage retention in subscription-based industries.

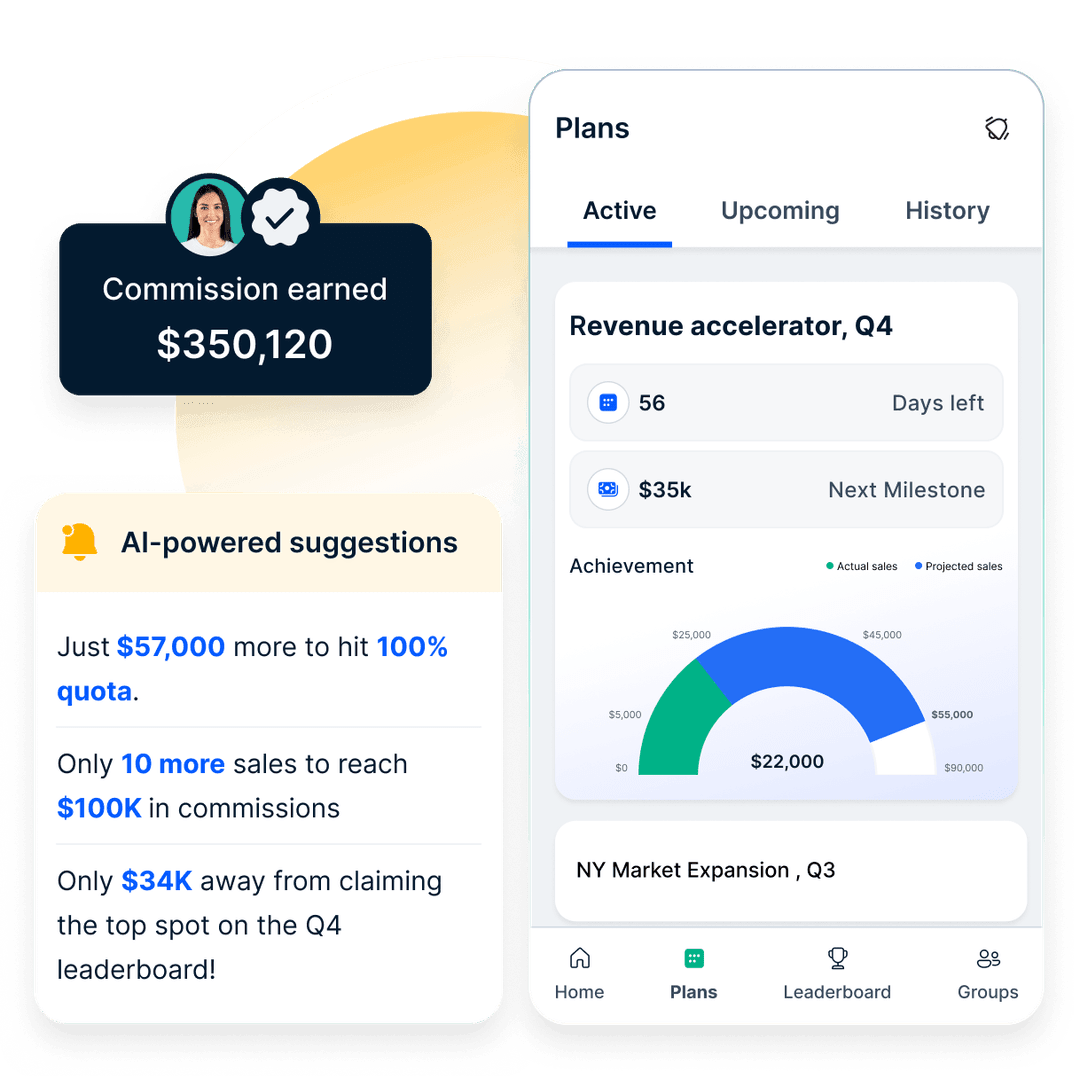

- Use AI-powered tools: Platforms like Compass automate commission tracking, ensuring accuracy and fairness.

- Benchmark against industry standards: Compare your commission rates to competitors to stay competitive.

Optimize sales commission management with Compass

Managing sales commissions across different industries requires accuracy, transparency, and real-time tracking. Compass simplifies commission management by automating calculations, ensuring fair payouts, and providing actionable insights to optimize compensation structures.

How Compass enhances sales commission management

- Automated commission calculations: Eliminate errors and ensure accurate, on-time payments based on real-time sales data.

- Customizable commission structures: Adapt to different industries with flexible plans, including tiered, residual, and profit-based commissions.

- Real-time performance tracking: Give sales reps visibility into their earnings, motivating them to hit and exceed quotas.

- Quota and incentive management: Set up accelerators, bonuses, and performance-based rewards seamlessly.

- Seamless CRM and sales tool integration: Connect with existing systems to streamline sales compensation workflows.

With Compass, businesses can ensure that sales commission rates align with industry standards while keeping sales teams motivated and focused on closing more deals.

🚀 Ready to streamline your sales commission process? Try Compass today!

Conclusión

Commissions are one-way salespeople maintain their income, which motivates them to sell more to earn more. However, it is also essential for businesses to ensure that they follow the industry standards when providing them with their due commission pay to retain them for a long time.

With this guide on the different sales commission rates by industry and the steps to calculate commissions, it is much easier to ensure that you are paying your salespeople competitive industry pricing. This will help your reps perform better, bring in more income for your business, and help retain your talented reps for a long time, so they help increase sales for you.

Preguntas frecuentes

Q. ¿Cuál es el porcentaje típico de comisión por ventas?

A. El porcentaje típico de comisión de ventas varía mucho según el sector, pero oscila entre el 2% y el 10% de los ingresos totales por ventas.

Q. ¿Las comisiones por ventas deben basarse en los ingresos o en los beneficios?

A. Aunque las comisiones basadas en los ingresos son más comunes en la mayoría de los sectores, las comisiones de ventas pueden basarse en los ingresos o en los beneficios, en función de los objetivos y la estrategia de la empresa.

Q. ¿Con qué frecuencia deben revisarse y ajustarse las comisiones de venta?

A. Las tarifas de las comisiones de ventas deben revisarse y ajustarse con regularidad, normalmente una vez al año, para garantizar que se ajustan a los objetivos empresariales y a las condiciones del mercado.

Q. ¿Cómo puedo asegurarme de que las comisiones motivan a mi equipo de ventas?

A. Para asegurarse de que las comisiones motivan a su equipo de ventas, es esencial establecer objetivos de ventas claros y alcanzables, proporcionar feedback y asesoramiento periódicos y ofrecer incentivos adicionales como primas o premios.