8 pasos sobre cómo calcular la comisión de ventas con estructura de comisiones, fórmulas y ejemplos

¿Alguna vez ha presentado ingresos incorrectos en sus comisiones de ventas y ha sufrido pérdidas? ¿O ha visto cómo le ocurría a alguien y teme que a usted también le pase? Entonces echa un vistazo a esta sencilla fórmula de porcentaje de comisión por ventas y presenta siempre las cifras correctas.

En esta página

Un estudio indica que las organizaciones corren el riesgo de perder hastaun 30% desus oportunidades de venta a manos de la competencia. Destaca la importancia de evaluar el proceso de ventas y las métricas. Con las herramientas adecuadas, una organización puede aumentar en un 20% el cumplimiento de su cuota de ventas y establecer un proceso de ventas ágil y preciso.

Así lo demostró uno de los principales fabricantes de todo el mundo que cambió fácilmente la trayectoria de ventas y escaló rápidamente. Con un gran equipo repartido en más de 32 puntos de venta y servicio en todo el mundo, esta empresa se enfrentaba a retos a la hora de automatizar las comisiones.

Sus objetivos principales eran facilitar el acceso de sus representantes de ventas a los datos de sus incentivos, reducir significativamente el tiempo dedicado al cálculo de comisiones y eliminar la carga de trabajo manual de la que antes se encargaba el gestor de ventas.

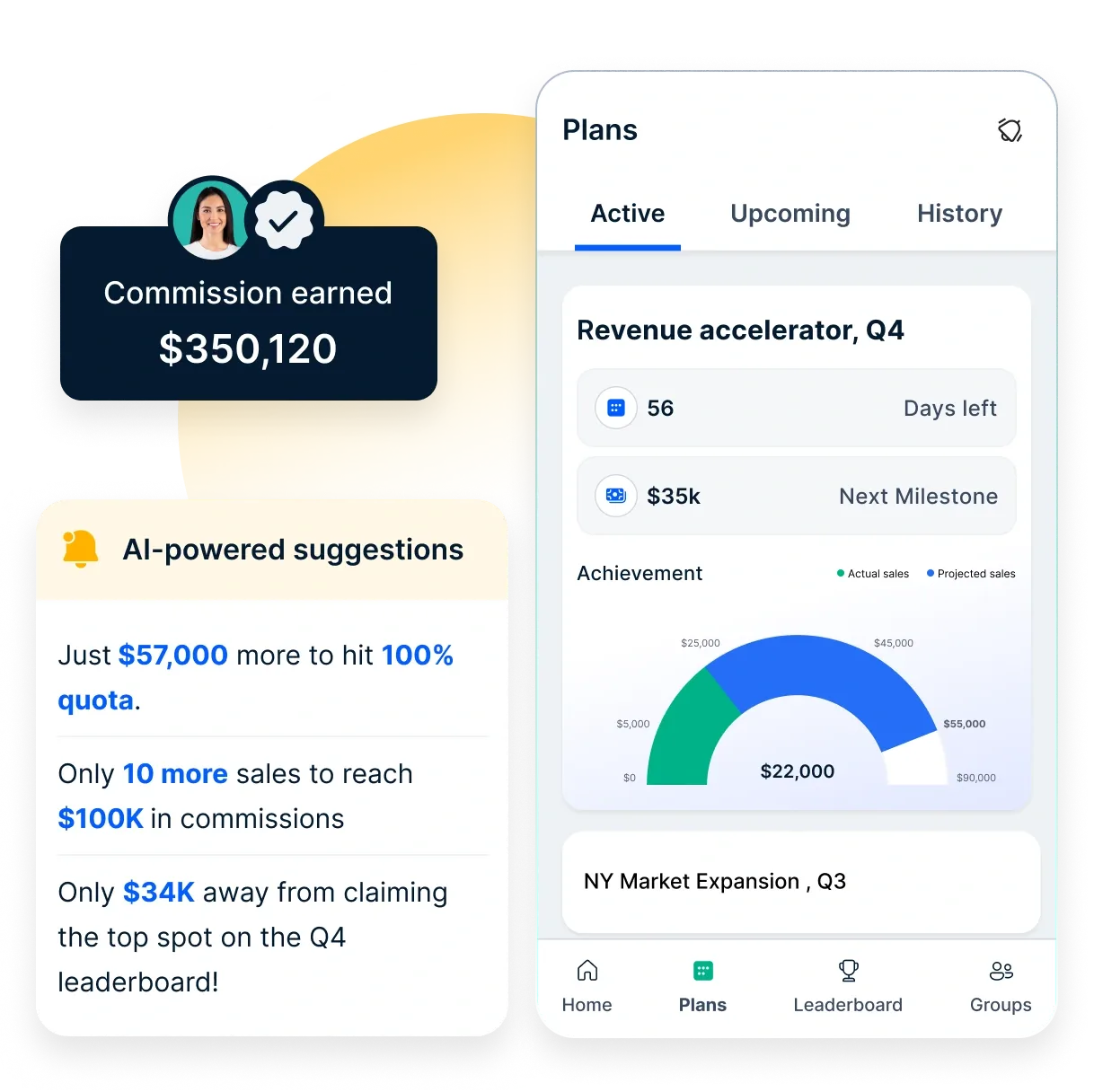

Han integradoCompassun software de gestión de comisiones de ventas. Compass ofrecía funciones como flujos de trabajo de programas, motores de reglas automatizados, procesos de aprobación, tablas de clasificación, cuadros de mando y una aplicación móvil para el seguimiento del rendimiento en tiempo real. La organización obtuvo visibilidad en tiempo real del cálculo de incentivos.

También garantizaba la precisión de los pagos, eliminaba la dependencia del equipo de gestión de ventas para gestionar manualmente el proceso de comisiones y se basaba en el cálculo de las ventas por comisiones para automatizar el procedimiento de principio a fin.

Como resultado, el cumplimiento de las cuotas aumentó un 20% en menos de 90 días, la participación en el programa creció un 22% y la adopción de la plataforma alcanzó el 73%.

Dado que una compensación justa es crucial para motivar a los vendedores, una calculadora de comisiones de ventas se convierte en una herramienta importante. Por lo tanto, este blog explorará aspectos importantes de las calculadoras de comisiones de ventas para ayudarle a comprender su utilidad.

¿Qué es una calculadora de comisiones de ventas?

Una calculadora de comisiones de ventas es una herramienta que ayuda a calcular la cantidad de dinero que gana un vendedor en función de sus resultados de ventas. Suele consistir en introducir el importe de las ventas y la tasa de comisión, y la calculadora proporciona la comisión ganada. Una calculadora de comisiones de ventas puede ayudar a una organización a mantener:

- Precisión. Una calculadora de comisiones SaaS garantiza el cálculo correcto de las comisiones para evitar errores manuales.

- Eficacia, ya que ahorra tiempo al automatizar los cálculos. Como resultado, permite a los vendedores centrarse en vender.

- Transparencia, porque una herramienta de este tipo proporciona información clara e inmediata sobre las ganancias potenciales.

Analicemos un estudio estadístico de la tecnología de ventas para comprender cómo una herramienta de este tipo añadida a la pila tecnológica puede influir en el resultado empresarial.

- Según unestudio de McKinseyel 80% de los jefes de ventas opinan que contar con una pila de tecnología de ventas eficaz es crucial para alcanzar los objetivos de ingresos.

- El mismo estudio reveló que el 80% de los líderes de ventas creen que las habilidades analíticas y cuantitativas se encuentran entre las principales.

- Otro estudio de McKinsey reveló que las empresas B2B que emplean equipos de ventas omnicanal, tecnología de ventas avanzada, automatización y análisis de datos registran un10%de cuota de mercado.

- El mismo estudio sugiere que más del 30% de las tareas y procesos del ciclo de ventas pueden automatizarse hasta cierto punto. Esto incluye actividades que van desde el cálculo de comisiones de ventas, la planificación y la gestión de clientes potenciales hasta la generación de presupuestos.

- También revela que la automatización aumenta los ingresos y permite reducir los costes de servicio hasta un 20% en cada caso, al tiempo que fomenta la satisfacción de clientes y empleados.

Aunque muchas tareas de ventas pueden automatizarse, no todos los esfuerzos tienen el mismo éxito. Las empresas líderes se centran en automatizar áreas específicas como la gestión de clientes potenciales, la redacción de contratos, la generación de incentivos mediante una calculadora de comisiones de ventas y la planificación de comisiones de ventas.

La tecnología avanzada puede automatizar muchas tareas de ventas que consumen mucho tiempo para liberar a los vendedores y que puedan centrarse en actividades más valiosas. Esto puede suponer un aumento de los ingresos, una reducción de los costes y una mayor satisfacción tanto para los clientes como para los empleados.

Factores esenciales para el cálculo de las comisiones de venta

Calcular las comisiones de ventases esencial para muchas empresas, especialmente las que dependen de un equipo de ventas para generar ingresos. Teniendo en cuenta la importancia del proceso, es necesario entender que hay que considerar varios factores esenciales a la hora de determinar cuánta comisión pagar a un vendedor.

Por lo tanto, antes de que le digamoscómo calcular la comisión de ventas, es mejor que se familiarice con los factores esenciales que influyen en el cálculo de su comisión de ventas.

1. Comisión base

La base de comisiones son los ingresos o beneficios en los que se basa la comisión de un vendedor. Puede tratarse de los ingresos totales por ventas, el margen de beneficio sobre las ventas o cualquier otro parámetro que refleje la contribución del vendedor a la cuenta de resultados de la empresa.

2. Comisión

La tasa de comisión es el porcentaje de la base de comisión que un vendedor recibirá como comisión. Por ejemplo, si la comisión base es de 100.000 $ y el porcentaje de comisión es del 10%, el vendedor recibirá una comisión de 10.000 $.

3. Período de comisión

El periodo de comisión es el tiempo sobre el que se calcula la comisión. Puede ser una semana, un mes, un trimestre o cualquier otro periodo adecuado para la empresa y el ciclo de ventas.

4. Nivel de comisión

Un nivel de comisión es una estructura que establece diferentes porcentajes de comisión en función de los distintos niveles de rendimiento. Por ejemplo, un representante de ventas puede recibir una comisión del 10% por los primeros 50.000 $ de ventas, del 12% por los siguientes 50.000 $ y del 15% por las ventas superiores a 100.000 $.

En este caso, aplicar el nivel de comisión adecuado es esencial para garantizar que el representante de ventas reciba una cierta compensación en función de sus resultados.

5. Anular

Un complemento es una comisión adicional que se paga a un vendedor que gestiona un equipo de otros vendedores. La comisión adicional se calcula como un porcentaje de la comisión ganada por los vendedores del equipo.

6. Dividir

El split se utiliza cuando dos o más vendedores trabajan juntos en una venta. En este caso, la comisión se divide entre los vendedores en función de una fórmula acordada. Por ejemplo, la comisión puede dividirse al 50% entre dos vendedores que hayan trabajado juntos en una venta.

Es importante tener en cuenta estos factores a la hora de calcular las comisiones de ventas, ya que pueden influir significativamente en la comisión que recibe un vendedor. Al tener en cuenta estos factores y crear una estructura de comisiones justa y transparente, las empresas pueden motivar a su equipo de ventas para que alcance sus objetivos e impulse el crecimiento de los ingresos.

¿Cómo calcular las comisiones de ventas en 8 sencillos pasos?

El cálculo de las comisiones de ventas implica varios pasos para garantizar que los representantes de ventas reciban una compensación justa por su trabajo. Aunque en 2023 existen tecnologías que permitenautomatizar el cálculode comisiones, es posible que desee hacerlo todo manualmente.

Por lo tanto, a continuación se explican detalladamente los pasos necesarios para calcular las comisiones de ventas si desea realizar el cálculo de forma manual:

Paso 1: Determinar el periodo de comisión

El primer paso es determinar el periodo de comisión, el periodo sobre el que se calculará la comisión. Puede ser semanal, mensual, trimestral o anual. Por lo tanto, elija el período para el que busca comisiones y, a continuación, redondee las ventas que realizó en este período.

Paso 2: Identificar la base de comisiones

Identifique y tenga a mano la comisión base para cada transacción de venta por la que solicita comisión. Dado que el importe base puede ser diferente para cada venta que consigas generar, es esencial que lleves un seguimiento estricto para facilitar el cálculo más adelante.

Paso 3: Multiplicar la tasa de comisión por la base de comisión

Ahora que ya tienes la comisión base, multiplícala por la tasa de comisión para obtener la cantidad base de comisión que te corresponde.

Pero recuerde que este no es el valor final, ya que puede haber adiciones o incluso deducciones sobre este valor base de la comisión en función de las condiciones de su contrato.

Paso 4: Estudiar distintas comisiones

Cambie el valor de sus tarifas de comisiones en el caso de que su tarifa sea diferente de su tarifa habitual.

Por ejemplo, si su tasa de comisión para un negocio o transacción es del 10% pero del 12% para otro negocio/transacción, multiplique la base de comisión para ese negocio/transacción en particular por la tasa de comisión respectiva para un cálculo preciso.

Paso 5: Aplicar el nivel de comisión (si procede)

Además de las diferentes tasas de comisión que debe tener en cuenta, también debe realizar un seguimiento de las empresas/transacciones con tasas escalonadas. Dado que la mayoría de las transacciones de venta no están escalonadas, es fácil pasar por alto una, en cuyo caso, se le compensará mucho menos de lo que le corresponde.

Por lo tanto, lo mejor es mantener una lista separada de las empresas que ofrecen comisiones escalonadas junto con los niveles para un cálculo conveniente al final del período de comisiones.

Paso 6: Calcular la comisión de anulación

Reclame la comisión que le corresponde por las ventas cerradas con éxito por los representantes que gestiona. Multiplique la tasa de comisión por la comisión totalque los miembros de su equipoy añada el valor resultante al cálculo de su comisión.

Paso 7: Deducir las devoluciones

Anote el valor de la comisión que recibió hasta el último paso y deduzca las ganancias de las ventas que el cliente canceló o devolvió.

Aunque usted haya cerrado el trato inicialmente, este tipo de operaciones se consideran nulas si su empresa tiene que devolver finalmente el dinero o no lo recibió en primer lugar porque el cliente canceló la venta.

Paso 8: Repartir la comisión (si procede)

Del valor de la comisión que has obtenido, deduce la parte de tus compañeros representantes si has participado en el cierre de alguna de las ventas con ellos.

Siguiendo estos pasos, el cálculo de la comisión final de todas sus ventas puede determinarse de la siguiente manera

A =Base de comisión para el periodo de comisión determinado x Tasas de comisión respectivas para las distintas transacciones

B =A + Valor de la comisión según los diferentes niveles

C =B + Parte de la comisión ganada por los miembros del equipo

D =C - Valor de la comisión de ventas por transacciones de ventas devueltas o llamadas

E =D - Parte de las ventas de los compañeros en caso de comisiones divididas

Para seguir calculando la fórmula del porcentaje de comisión de ventas, tome el valor de "E" de la fórmula anterior y divídalo por "100".

8 Estructuras de comisiones de ventas y cómo calcularlas con fórmula

Los planes de comisiones de ventas no son universales. La estructura ideal depende de los objetivos, el ciclo de ventas y el modelo de ingresos de tu empresa.

Un plan bien diseñado puede impulsar la motivación y el rendimiento, al tiempo que garantiza una retribución justa. A continuación se presentan ocho estructuras de comisiones habituales, junto con fórmulas de comisiones para calcular los ingresos.

1. Sueldo base + comisión

Este modelo combina un salario fijo con una comisión basada en el rendimiento de las ventas, ofreciendo estabilidad financiera con incentivos para el crecimiento. A continuación se expone su fórmula de comisiones:

Ejemplo: Un representante de ventas gana un salario base de 45.000 $ más una comisión del 12%. Si genera 120.000 $ en ventas, sus ingresos totales serían de 45.000 $ + (120.000 $ x 0,12) = 59.400 $.

Lo mejor para: Empresas con ciclos de ventas impredecibles

Ventajas: Fomenta el rendimiento constante al tiempo que reduce el riesgo financiero para los representantes.

Contras: costes fijos más elevados para los empresarios; puede reducir la urgencia por maximizar las ventas.

2. Comisión por cuotas

Este plan recompensa a los representantes con comisiones sólo cuando superan una cuota de ventas establecida, lo que lo convierte en una estrategia eficaz para impulsar el alto rendimiento.

Ejemplo: Un representante tiene un salario base de 3.500 $ y gana una comisión del 18% sobre las ventas que superen una cuota de 12.000 $. Si genera 15.000 $ en ventas, sus ganancias serían de 3.500 $ + (3.000 $ x 0,18) = 4.040 $.

Lo mejor para: Equipos de ventas experimentados con objetivos agresivos

Ventajas: Motiva a los representantes para que superen sus objetivos y aumenten sus ingresos.

Contras: Puede desanimar a los representantes si las cuotas les parecen inalcanzables.

3. Comisión directa

Los representantes ganan un porcentaje de las ventas totales sin un salario base. El porcentaje de comisión determina la totalidad de sus ingresos. A continuación se muestra su fórmula de comisión:

Ejemplo: Un representante vende 8.000 $ en productos con una tasa de comisión del 15%. Sus ganancias serían de 8.000 $ x 0,15 = 1.200 $.

Lo mejor para: Profesionales de ventas independientes o empresas con ciclos de ventas cortos

Ventajas: Alto potencial de ingresos y correlación directa entre esfuerzo e ingresos.

Contras: la variabilidad de los ingresos puede crear inestabilidad financiera

4. Comisión residual

Este modelo recompensa a los representantes de ventas con comisiones recurrentes de clientes a largo plazo.

Ejemplo: Un cliente se suscribe a un servicio de 1.500 $/mes. El representante gana una comisión del 6%, recibiendo 90 $ al mes mientras el cliente siga suscrito.

Lo mejor para: SaaS y empresas basadas en suscripciones

Ventajas: Fomenta la retención de clientes a largo plazo

Contras: Puede llevar tiempo generar ingresos sustanciales.

5. Comisión de volumen territorial

Un modelo basado en equipos en el que la comisión se reparte entre los representantes en función de su contribución a las ventas totales del territorio. Su fórmula de comisiones es la siguiente:

Ejemplo: El territorio de un representante genera 70.000 $ en ventas, y las ventas totales del equipo alcanzan los 700.000 $ con una tasa de comisión del 9%. Las ganancias del representante serían (70.000 $ / 700.000 $) x 0,09 x 700.000 $ = 6.300 $.

Lo mejor para: Grandes equipos de ventas que cubren territorios geográficos

Ventajas: Fomenta el trabajo en equipo y el desarrollo del mercado regional

Contras: Puede crear disputas si las contribuciones no se reconocen por igual.

6. Comisión escalonada

Los representantes obtienen comisiones más elevadas a medida que alcanzan umbrales de ventas más altos, lo que les incentiva a ir más allá de sus objetivos iniciales.

Ejemplo: Un plan ofrece una comisión del 5% sobre los primeros 10.000 $ en ventas, del 10% sobre las ventas entre 10.000 $ y 20.000 $, y del 15% sobre las ventas superiores a 20.000 $. Un representante que venda 25.000 $ ganaría: (10.000 $ x 0,05) + (10.000 $ x 0,10) + (5.000 $ x 0,15) = 2.250 $.

Lo mejor para: Equipos de alto rendimiento con potencial de ventas escalable.

Ventajas: Recompensa a los mejores vendedores e impulsa la motivación continua.

Inconvenientes: puede desanimar a los trabajadores con menor rendimiento si los niveles superiores parecen inalcanzables.

7. Comisión de margen bruto

Este plan calcula la comisión en función de los márgenes de beneficio y no de los ingresos, alineando los incentivos con la rentabilidad.

Ejemplo: Un producto con un margen bruto de 300 $ y una tasa de comisión del 12% hace ganar a un representante 300 $ x 15 x 0,12 = 540 $.

Lo mejor para: Empresas que priorizan los beneficios sobre el volumen de ingresos

Ventajas: Fomenta la venta de productos con márgenes elevados

Contras: Más complejo de calcular que la comisión estándar basada en los ingresos.

8. Empate contra comisión

Este modelo ofrece a los representantes de ventas un anticipo que debe devolverse mediante futuras comisiones.

Ejemplo: Un representante recibe un sorteo de 2.500 $. Si más tarde gana 4.000 $ en comisiones, su pago final será de 4.000 $ - 2.500 $ = 1.500 $.

Lo mejor para: Nuevos empleados de ventas o puestos con ingresos fluctuantes

Ventajas: Proporciona seguridad financiera a los representantes durante los periodos de ventas bajas.

Contras: Puede provocar tensiones financieras si las ventas no cumplen las expectativas.

¿Cómo puede ayudar Compass a calcular las comisiones de ventas?

Compass puede agilizar considerablemente la automatización del cálculo de ventas eliminando los procesos manuales y garantizando un seguimiento preciso y en tiempo real de las comisiones. Descubra cómo puede ayudarle Compass :

1. Cálculo automático de comisiones

- Compass automatiza cálculos de comisiones de ventas utilizando fórmulas predefinidas para la calculadora de cuotas de ventas y reglas personalizables, reduciendo los errores humanos y garantizando la transparencia.

- Admite múltiples estructuras de comisiones, incluidas comisiones escalonadas, incentivos basados en cuotas y comisiones residuales.

- También funciona como una calculadora de cumplimiento de cuotas, ya que muestra los hitos y envía avisos en función del objetivo alcanzado.

2. Seguimiento en tiempo real del cumplimiento de las cuotas

- Los equipos de ventas pueden realizar un seguimiento de la consecución de sus cuotas y del progreso hacia los incentivos mediante paneles en tiempo real.

- Los directivos obtienen información sobre las tendencias del rendimiento de las ventas y pueden ajustar las estrategias de compensación en consecuencia.

3. Fórmulas de comisiones personalizables

- Compass permite a las empresas establecer diferentes fórmulas de comisiones en función de las funciones, los objetivos de ingresos y los niveles de rendimiento.

- Funciona bien para modelos de comisión SaaS, ventas de productos de alto margen y estructuras basadas en el territorio.

4. Perfecta integración con las herramientas de ventas y finanzas

- Se integra con plataformas CRM (Salesforce, HubSpot), sistemas ERP y software de nóminas, garantizando un flujo de datos fluido.

- Reduce los esfuerzos de conciliación manual extrayendo datos de ventas en tiempo real para el procesamiento automatizado de los pagos.

Tanto si se trata de una nueva empresa como de una compañía, Compass se adapta a su equipo, lo que facilita el ajuste de las estructuras de comisiones a medida que evoluciona el negocio. Gestione modelos de compensación multirregión, multidivisa y multinivel sin esfuerzo con Compass. Programe una llamada ahora

Conclusión

Convertir clientes potenciales en ventas requiere un esfuerzo considerable, y debe asegurarse de que se le compensa adecuadamente. Esto empieza por presentar los cálculos correctos teniendo en cuenta todo lo que hay que sumar o restar.

Con esta sencilla guía sobre el cálculo de las comisiones de ventas, ahora puedes asegurarte de que se reconozcan todos tus esfuerzos y de que recibas hasta el último céntimo de la comisión que te mereces. Así que, redondea todas tus transacciones de ventas y calcula tu comisión con esta fórmula de porcentaje de comisión de ventas que es tan fácil como"ABCD!"

Preguntas frecuentes

1. ¿Con qué frecuencia se revisan y actualizan las comisiones?

Depende de la política de la empresa. Algunas empresas revisan las comisiones anualmente, mientras que otras pueden hacerlo con mayor o menor frecuencia.

2. ¿La comisión se paga sobre el precio de venta o sobre el margen de beneficios?

Depende de la política de la empresa. Algunas empresas pagan una comisión sobre el precio de venta, mientras que otras pagan una comisión sobre el margen de beneficios.

3. ¿Las comisiones están sujetas a impuestos?

Sí, las comisiones se consideran ingresos y están sujetas a impuestos. Los impuestos dependerán del tramo impositivo de cada persona y de otros factores.

4. ¿Cómo se calcula la comisión de ventas?

La fórmula básica de cálculo es comisión = (ventas totales x porcentaje de comisión). Sin embargo, calcular las comisiones puede ser complicado porque depende de la estructura de comisiones, el sector y las condiciones específicas del acuerdo.

Algunos pasos básicos para calcular las comisiones incluyen determinar el periodo de comisión, calcular la base de comisión total realizada durante ese periodo y multiplicar la tasa de comisión por la base de comisión.

Además, es esencial tener en cuenta las comisiones variables y escalonadas y realizar los cálculos y ajustes adicionales aplicables, como anulaciones, deducciones por devoluciones y reparto de comisiones por territorios compartidos.

5. ¿Qué es una comisión del 3% sobre 100 $?

Para calcular una comisión del 3% sobre 100 $, multiplique 100 $ por 3%3. El cálculo es el siguiente $100 x 0.03 = $33.

6. ¿Cuál es la fórmula de la comisión de beneficios?

La fórmula para la comisión de beneficio bruto es ingresos ($) - costes ($) = margen de beneficio bruto ($) x tasa de comisión (%) = comisión total ($)1. Para calcular la comisión de beneficio bruto en una hoja de cálculo, puede utilizar la fórmula =(SUMA(A1:A10)-SUMA(B1:B10))*C1, donde A1:A10 es el rango de celdas que contiene los importes de las ventas, B1:B10 es el rango de celdas que contiene el coste de los bienes vendidos y C1 es el porcentaje de comisión.

7. ¿Cuál es la estructura media de comisiones por ventas?

La estructura media de comisiones para ventas suele implicar un salario base combinado con un porcentaje de los ingresos generados por las ventas. Las comisiones pueden oscilar entre el 5% y el 20%, dependiendo del sector, el producto y el rendimiento individual, y las comisiones más altas suelen estar vinculadas a la consecución de objetivos de ventas específicos. Parte inferior del formulario