Pengiraan insentif dalam helaian Excel: 11 Masalah Biasa & Cara Membaikinya

Excel tidak dibina untuk pengiraan insentif yang rumit—ralat manual, kelewatan dan kekurangan ketelusan melambatkan anda. Compass mengautomasikan komisen, memastikan ketepatan dan meningkatkan motivasi jualan dengan gamifikasi. Skala dengan mudah hari ini!

Pada halaman ini

Pengiraan insentif dalam Excel telah menguasai pasaran hamparan sejak tahun 1990-an, dan ia kekal sebagai alat yang berkuasa untuk analisis data. Ia adalah alat yang berkuasa untuk mengendalikan pelbagai pengiraan kewangan dan komisen .

Jangan salah faham. Excel menakjubkan kerana:

- Ia serba boleh

- Menjadikan pengumpulan data mudah

- Mari kita ringkaskan & gambarkan data

- Menyokong formula

- Digunakan di seluruh dunia

Walau bagaimanapun, satu kajian mendapati bahawa 88% daripada semua hamparan mengandungi satu atau lebih ralat yang teruk. Tidakkah kita semua ingat bencana JP Morgan London Whale, di mana JP Morgan telah dilanda kerugian dagangan sebanyak $6 bilion disebabkan oleh kesilapan Excel pada tahun 2012.

Jadi, sama ada anda menguruskan komisen jualan , bonus pekerja atau insentif lain, Excel boleh memudahkan proses tersebut. Walau bagaimanapun, seperti mana-mana perisian, ia tidak terlepas daripada masalah.

Dalam blog ini, kami akan meneroka masalah biasa yang dihadapi oleh orang ramai apabila mengira insentif dalam Excel dan menyediakan penyelesaian untuk membaikinya.

Masalah dengan pengiraan insentif dalam helaian Excel & bagaimana Compass membantu memperbaikinya

Hamparan tidak pernah dibina untuk mengira insentif. Mereka dibina untuk mengautomasikan pengiraan matematik mudah, yang mempunyai lebih banyak matematik daripada logik. Mereka tidak pernah dibina sebagai bahasa pengaturcaraan tugas berat yang dapat memudahkan 28 tahap ifs bersarang.

Oleh itu, mari kita berhenti memaksa mereka untuk melakukan sesuatu yang mereka tidak dimaksudkan untuk lakukan.

Berikut ialah masalah biasa dengan pengiraan insentif dalam helaian Excel & cara Compass membantu menyelesaikannya.

1. Manual dan memakan masa

Helaian Excel tidak boleh mengimport data daripada sumber sedia ada dan mesti ditadbir secara manual, yang membosankan, memakan masa dan meninggalkan banyak ruang untuk ralat manual.

Data yang hendak dianalisis perlu disalin dan ditampal atau, lebih teruk lagi, dimasukkan secara manual. Ia boleh dilakukan untuk segelintir wakil dengan sedikit usaha, tetapi apabila baris dan lajur dalam peningkatan data, ia menjadi hampir mustahil, menjadikannya sangat perlahan.

Dengan Compass , anda boleh menangkap data langsung dengan mudah dan membiarkannya Compass untuk pengiraan automatik dalam masa nyata.

2. Terdedah kepada kesilapan manusia

Selain sangat memakan masa, helaian Excel terdedah kepada kesilapan manual. Ia bukan terutamanya bahasa pengekodan dan hanya boleh mengendalikan pengiraan matematik yang kompleks tetapi bukan logik yang kompleks.

Pengiraan insentif adalah sebaliknya. Ia lebih logik dan kurang matematik. Di sinilah campur tangan manusia diperlukan. Di sinilah penganalisis perniagaan membina pertanyaan dengan 50 indeks dan 25 jika bersarang untuk mengira insentif.

Allah melarang jika salah seorang daripada mereka tersilap. Sangat mudah untuk ralat pengguna memasuki proses dan memesongkan keputusan, berpotensi membayar lebih atau kurang membayar wakil jualan anda.

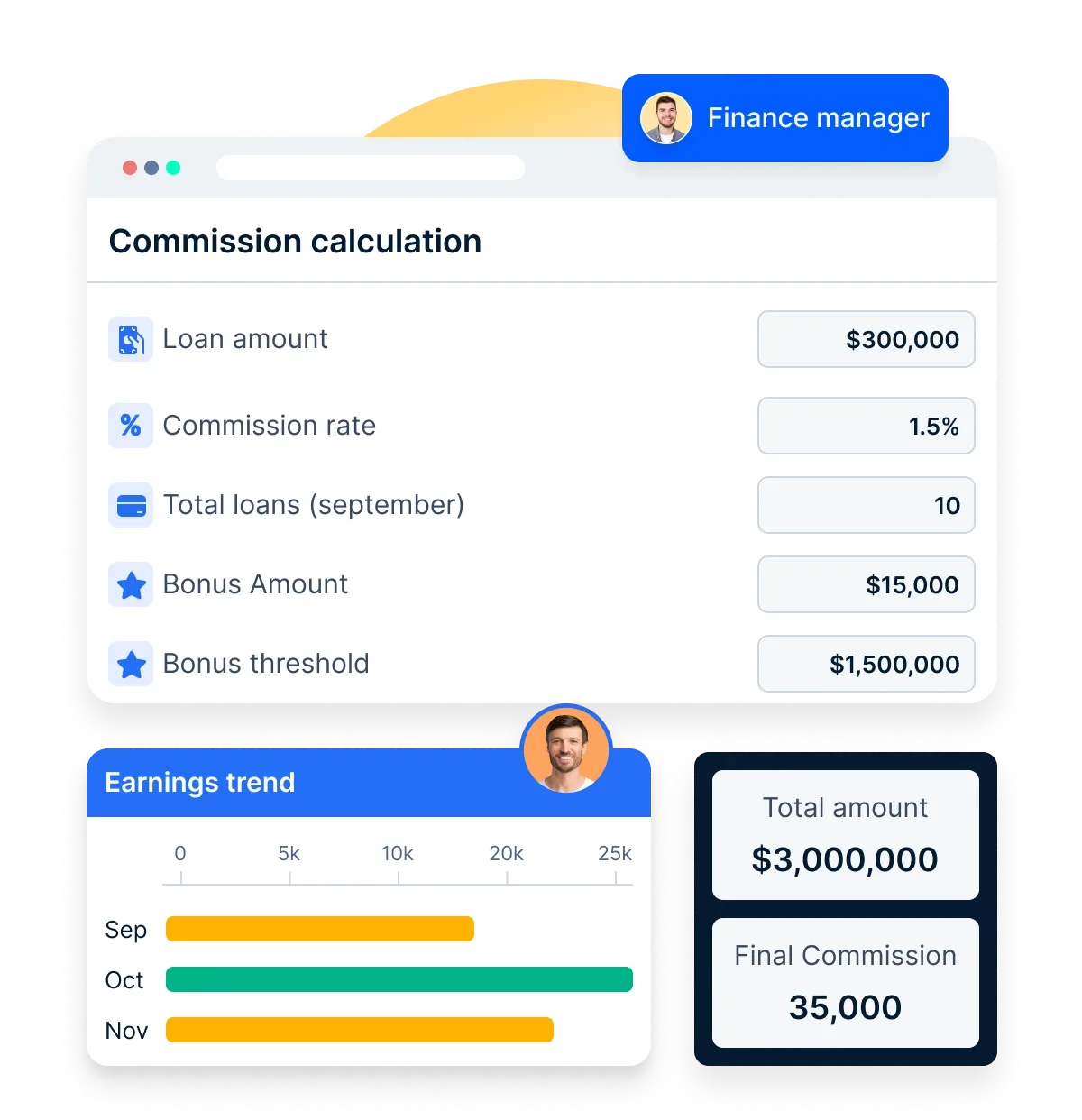

Dengan Compass , anda boleh membina program insentif yang kompleks dengan mudah dengan kebiasaan Excel dalam beberapa klik.

3. Tidak mempunyai keterlihatan dan ketelusan masa nyata

Pada helaian Excel atau versi dalam taliannya, melainkan seseorang mengemas kininya secara manual setiap minit, data dengan cepat menjadi ketinggalan zaman. Helaian Excel tidak disambungkan ke CRM dan ERP langsung dan, oleh itu, tidak boleh dikemas kini masa nyata. Akibatnya, tidak ada ketelusan atau keterlihatan data.

Dengan Compass , wakil jualan, pengurus, pentadbir, pasukan HR, pasukan kewangan dan pengurusan mempunyai akses masa nyata kepada penyata insentif. Mempunyai data ini sedia ada mendorong wakil jualan untuk melihat apa yang mereka perolehi dan cara mereka boleh memperoleh lebih banyak.

Selain daripada memotivasikan pasukan jualan anda, Compass memberikan ketelusan lengkap ke dalam pengiraan sebenar di sebalik nombor dan pasukan anda boleh mempercayai nombor yang mereka lihat kerana mereka mempunyai keterlihatan tentang cara ia dikira.

4. Tidak dibina untuk skala

Pakar menerangkan Excel sebagai bahasa pengaturcaraan berfungsi. Walaupun Excel menggabungkan analisis data, penggambaran dan pengaturcaraan bersama-sama, ia hanya berfungsi dengan baik apabila data kecil dan terhad kepada beratus-ratus rekod, boleh dimasukkan secara manual atau boleh disalin dan ditampal, dan logiknya lebih matematik daripada kompleks.

Organisasi menghadapi cabaran besar apabila mereka cuba membina perisian insentif dalam Excel yang memerlukan logik yang kompleks, menjadikannya mustahil untuk mengira insentif secara berskala.

Dengan Compass , anda mendapat yang terbaik daripada Excel, seperti antara muka intuitif bersama pembolehubah dan pilihan pembayaran, dan ia boleh berskala untuk perusahaan kecil dan gergasi serta syarikat permulaan.

5. Mahal

Apabila anda menggunakan Excel untuk mengira insentif jualan, anda memasukkan sumber, teknologi, sumber manusia dan masa yang besar dan sumber ini mempunyai kos yang berkaitan dengannya.

Memandangkan 88% hamparan mengandungi ralat, setiap kali anda menemui ralat, anda menanggung kos semua sumber ini sekali lagi, menjadikannya tidak ekonomik di semua peringkat, sehingga menghancurkan baki.

Dengan Compass , anda boleh mengautomasikan proses dan semua perubahan boleh dikendalikan dengan hanya beberapa klik. Ia juga menjimatkan banyak masa dan menghapuskan ketidaktepatan dan membolehkan pasukan anda meluangkan masa di kawasan kritikal perniagaan yang lain.

6. Tidak boleh diaudit

Pernahkah anda kembali ke helaian Excel anda hanya untuk mengetahui bahawa ia bukan cara anda meninggalkannya? Atau adakah anda pernah menimpa formula anda hanya untuk mencari #ERROR! merentas sel? Jika ini memberi anda rasa Deja Vu, biar saya beritahu anda, anda tidak bersendirian.

Excel tidak menawarkan sejarah bagi setiap perubahan yang dibuat pada setiap sel dan anda tidak dapat melihat individu yang membuat perubahan atau jika mereka mempunyai kelulusan untuk berbuat demikian. Anda juga tidak dapat menyediakan rangkaian sokongan. Walaupun Helaian Google memperkenalkan ciri untuk mengatasi masalah ini, menyemak sejarah perubahan untuk sel individu adalah mustahil.

Dengan Compass , anda boleh menjejak sejarah dengan mudah dan memudahkan kebolehauditan dengan menunjukkan kepada pengguna yang mengubah perkara dan bila. Ia juga memudahkan automasi dan membolehkan anda menambah hierarki kelulusan dengan mudah.

7. Tidak boleh dirayu

Excel mudah dikongsi, bukan? Hanya letakkan sebagai lampiran dalam e-mel.

Mungkin begitu. Tetapi tidak apabila anda mempunyai pasukan besar yang terdiri daripada ratusan dan ribuan pekerja yang ingin mengakses fail yang sama. Di sinilah Excel runtuh. Anda boleh membuat hamparan insentif dalam Excel untuk syarikat anda, tetapi bagaimana jika anda mahu berkongsinya dengan 50000 wakil?

Sekarang, bayangkan wakil tersebut dikumpulkan dalam 15 pelan insentif yang berbeza. Sekarang tambahkan kerumitan ketua pasukan yang dapat melihat insentif ahli pasukan mereka tetapi tiada ahli pasukan lain.

Anda boleh membina hamparan Excel anda, tetapi anda tidak boleh membahagikan dan berkongsinya dengan cara yang membolehkan pengguna hanya melihat maklumat yang perlu mereka lihat. Inilah yang menjadikannya tidak boleh dikongsi dan mencabar.

Dengan Compass , anda mendapat kawalan pengguna. Anda boleh mengawal siapa yang melihat data dan data itu sentiasa dikongsi antara pihak berkepentingan.

8. Tidak bersepadu dengan sistem semasa anda seperti ERP, CRM, dll.

Excel, walaupun versi dalam taliannya, tidak disambungkan. Pengiraan insentif yang kompleks memerlukan data masa nyata untuk semua sumber seperti CRM, ERP dan senarai gaji. Hampir mustahil untuk mengekstrak data daripada sumber ini, mengusahakannya dan memastikannya dikemas kini dalam masa nyata. Proses ini lambat, manual, mudah ralat, dan bukan masa nyata.

Dengan Compass , anda boleh dengan mudah menarik data ini daripada sistem sedia ada anda. Anda boleh menyepadukan Compass melalui webhooks, API atau SDK. Pautkan dan tambah penapis get sekiranya terdapat berbilang sumber data.

9. Tidak dibina untuk pelaporan kewangan & pematuhan undang-undang

Excel ialah alat perniagaan yang dibina untuk pengiraan matematik dengan mekanisme input, proses dan output yang mudah. Ia tidak membenarkan anda mengkonfigurasi implikasi cukai, apatah lagi berdasarkan papak atau geografi, dan menjadikan pelaporan kewangan dan pematuhan undang-undang bebas daripada pengiraan dan pembayaran insentif.

Dengan Compass , selain daripada membolehkan pengiraan insentif yang adil, bebas ralat dan telus, menjaga pengesahan pengguna dan semua langkah keselamatan seperti GDPR atau ISO serta mengendalikan implikasi dan pematuhan cukai geografi.

10. Tidak dapat mengautomasikan pembayaran

Excel ialah alat pengiraan yang boleh membantu anda dengan pengiraan insentif akhir. Ia tidak boleh melampaui satu langkah pun. Ia mengekalkan pengiraan insentif bebas daripada pembayaran insentif .

Untuk memproses pembayaran, anda perlu mengeluarkan pembayaran secara manual melalui bank atau melalui kad hadiah, yang meninggalkan banyak peluang untuk kesilapan manual. Excel tidak membenarkan anda menyambungkannya ke mana-mana API atau percutian pembayaran untuk memproses pembayaran.

Dengan Compass , anda boleh mengendalikan implikasi cukai geografi dan pematuhan sebelum pembayaran insentif. Anda boleh mempertimbangkan mana-mana atau semua jenis pembayaran insentif seperti pindahan bank, katalog ganjaran lebih daripada 20000 kad hadiah digital, kad prabayar, pengalaman dan dompet merentasi 80+ negara, nota kredit atau pindahan bank lama yang baik. Pembayaran boleh diuruskan merentas pelbagai geografi & mata wang dengan lancar.

11. Tidak dibina untuk insentif

Excel ialah kanvas kosong dengan dua dimensi. Ia tidak boleh mengendalikan pengiraan yang rumit ditambah dengan lapisan logik. Anda perlu menggunakan 10s dan 20s ifs dan indeks bersarang untuk mencapai nilai akhir. Allah melarang jika anda salah dengan salah satu daripada 20 orang itu.

Dengan Compass , anda boleh membina logik dengan cepat dengan n bilangan pembolehubah di mana satu-satunya input anda adalah mentakrifkan pembolehubah, dan Compass akan mengurus selebihnya. Selain daripada pengiraan insentif yang mudah, Compass membantu anda memotivasikan wakil jualan anda dengan peraduan jualan gamified dengan perpustakaan templat untuk dipilih. Compass juga dicipta untuk mengendalikan implikasi cukai yang kompleks merentas geografi dan kurungan cukai untuk membolehkan pembayaran yang lancar.

5 faedah utama melaksanakan sistem pengiraan insentif

Berikut ialah jadual perbandingan yang mempamerkan faedah memasang sistem pengiraan insentif untuk persona yang berbeza.

Faedah | HR | Ops Jualan | CFO | CRO |

Meningkatkan kecekapan dan mengurangkan kos | Mengautomasikan pengiraan, membebaskan HR untuk fokus pada tugas strategik. | Menjimatkan masa pada pengiraan manual, membolehkan lebih fokus pada strategi jualan. | Mengurangkan kos operasi dengan mengurangkan ralat dan memperkemas proses. | Meningkatkan penjejakan jualan, meningkatkan kecekapan keseluruhan. |

Ketepatan dan ketelusan yang dipertingkatkan | Mengurangkan kesilapan manusia, memastikan ganjaran pekerja yang adil. | Menyediakan metrik yang jelas untuk prestasi jualan, memupuk kepercayaan. | Memastikan pelaporan kewangan yang tepat dan pematuhan kepada peraturan. | Meningkatkan keterlihatan ke dalam prestasi jualan, menyelaraskan strategi. |

Meningkatkan motivasi dan penglibatan pekerja | Memotivasikan HR untuk mencipta program pengurusan bakat yang lebih baik. | Memastikan pasukan jualan terlibat dengan penjejakan ganjaran masa nyata. | Meningkatkan produktiviti keseluruhan dengan menghubungkan ganjaran kepada prestasi. | Memacu budaya berprestasi tinggi melalui struktur insentif yang jelas. |

Pentadbiran program diperkemas | Memudahkan pengurusan pelbagai program insentif. | Mengautomasikan pendaftaran dan penjejakan, mengurangkan beban pentadbiran. | Memudahkan pengurusan belanjawan yang lebih mudah untuk pembayaran insentif. | Membolehkan pelarasan pantas pada program berdasarkan data prestasi. |

Cerapan berpandukan data | Menyediakan data berharga untuk menambah baik strategi dan program HR. | Menawarkan cerapan tentang arah aliran jualan dan metrik prestasi pasukan. | Membantu dalam menganalisis ROI pada insentif, mengoptimumkan strategi kewangan. | Membolehkan membuat keputusan termaklum untuk meningkatkan taktik dan matlamat jualan. |

Bagaimana untuk beralih daripada excel kepada sistem insentif automatik?

Beralih daripada Excel kepada sistem insentif automatik boleh meningkatkan kecekapan dan ketepatan dalam mengurus ganjaran. Berikut ialah panduan ringkas tentang cara membuat peralihan ini.

1. Fahami keperluan untuk automasi

Pertama, kenali sebab automasi bermanfaat. Sistem automatik membantu mengurus dan menjejaki insentif dengan lebih berkesan daripada Excel. Mereka mengurangkan ralat dan menjimatkan masa dengan mengautomasikan tugas seperti pengedaran ganjaran dan penjejakan prestasi.

2. Pilih platform yang betul

Pilih platform automasi insentif yang sesuai dengan keperluan anda. Cari ciri seperti analisis masa nyata, atur cara yang boleh disesuaikan dan penyepaduan mudah dengan sistem sedia ada seperti perisian CRM atau HR. Ini akan memastikan bahawa platform boleh mengendalikan keperluan khusus anda.

3. Tetapkan peraturan dan kriteria yang jelas

Tentukan peraturan untuk program insentif anda. Ini termasuk menetapkan metrik prestasi dan kriteria kelayakan untuk ganjaran. Garis panduan yang jelas akan membantu sistem mengira insentif dengan tepat.

4. Mengintegrasikan sumber data

Sambungkan sistem automasi kepada sumber data anda. Ini boleh termasuk data jualan, metrik prestasi pekerja atau interaksi pelanggan. Penyepaduan membolehkan sistem mengakses data masa nyata yang diperlukan untuk mengira ganjaran.

5. Automatikkan pengiraan dan pemberitahuan

Setelah disediakan, sistem harus mengira ganjaran secara automatik berdasarkan kriteria yang ditetapkan. Ia juga harus menghantar pemberitahuan kepada pekerja atau rakan kongsi apabila mereka mencapai pencapaian atau memperoleh insentif.

6. Pantau prestasi dan laraskan mengikut keperluan

Gunakan alat analitik yang disediakan oleh platform untuk menjejak prestasi program. Semak kadar penyertaan dan keberkesanan ganjaran secara kerap. Maklumat ini akan membantu anda membuat pelarasan untuk mengoptimumkan strategi insentif anda.

7. Latih pasukan anda

Pastikan pasukan anda memahami cara menggunakan sistem baharu. Menyediakan latihan tentang cara mengakses metrik prestasi mereka dan memahami struktur insentif. Ini akan menggalakkan penglibatan dan akauntabiliti di kalangan peserta.

Dengan mengikuti langkah ini, anda boleh beralih dengan lancar daripada menggunakan Excel kepada sistem insentif automatik, meningkatkan kecekapan dan keberkesanan program anda. Ambil Mahindra Finance sebagai contoh. Mereka beralih kepada sistem pengiraan insentif dan mendapati 98% kurang ralat dalam pengiraan.

Mahindra Finance , penyedia perkhidmatan kewangan terkemuka di India, menghadapi cabaran dalam menguruskan program insentif jualan kompleks mereka. Pengiraan manual terdedah kepada ralat, masa pemprosesan adalah panjang, dan kekurangan ketelusan melemahkan semangat wakil jualan.

Mahindra Finance bekerjasama dengan Compass , pembekal penyelesaian automasi komisen jualan, untuk melaksanakan Xoxoday platform. Plum mengautomasikan keseluruhan proses pengurusan insentif, termasuk:

- Wakil jualan boleh melihat pendapatan mereka terakru berdasarkan peraturan dan skim yang telah ditetapkan, memastikan pembayaran tepat pada masanya dan tepat.

- Pengurusan skim yang boleh disesuaikan: Mahindra memperoleh fleksibiliti untuk mengemas kini dan mengurus pelbagai program insentif dengan mudah di seluruh wilayah dan barisan produk yang berbeza.

- Ketelusan dipertingkat: Sistem yang telus membenarkan wakil jualan menjejak prestasi dan pengiraan insentif mereka dalam masa nyata.

- Algoritma dibangunkan untuk mengendalikan pengecualian dan outlier, mengurangkan keperluan untuk pelarasan manual dan meningkatkan ketepatan.

Automasi proses komisen jualan membawa kepada peningkatan yang ketara:

- Peningkatan kelayakan insentif: Lebih 25% lagi wakil menerima insentif mereka, memupuk budaya pengiktirafan.

- Pengurangan ralat: Ralat pengiraan dikurangkan lebih 98%, meningkatkan ketepatan dan kebolehpercayaan.

- Kelajuan pemprosesan: Masa pemprosesan insentif telah dikurangkan sebanyak 99%, dengan pembayaran diselesaikan dalam beberapa jam dan bukannya hari.

- Kepuasan pekerja: Semangat dan produktiviti meningkat sebanyak 30%, membawa kepada peningkatan langsung dalam prestasi jualan.

- Kecekapan operasi: Operasi yang diperkemas menghasilkan pengurangan 40% dalam masa yang dibelanjakan untuk pengurusan insentif.

- Pematuhan penuh terhadap keperluan audit telah dicapai, meminimumkan risiko isu kawal selia dan denda.

Dengan mengautomasikan proses komisen jualan mereka, Mahindra Finance mengubah sistem pengurusan insentif mereka. Penyepaduan pengendalian data lanjutan, pemprosesan masa nyata dan ketelusan bukan sahaja meningkatkan kecekapan operasi tetapi juga meningkatkan kepuasan pekerja dan prestasi jualan.

Compass sebagai sistem pengiraan insentif yang boleh dipercayai

Compass berfungsi sebagai sistem pengiraan insentif yang berkesan untuk kedua-dua jabatan Ketua Pegawai Hasil (CRO) dan Sumber Manusia (HR). Begini cara ia memberi manfaat kepada setiap peranan:

Untuk CFO

- Penyepaduan dengan sistem gaji: Compass boleh disepadukan dengan lancar dengan pelbagai sistem gaji, seperti QuickBooks, Oracle Netsuite dan Stripe. Ini membolehkan CFO menjadualkan dan menghantar pembayaran komisen kepada wakil jualan dengan cekap.

- Pembayaran pukal diperkemas: Sistem ini membolehkan pemprosesan berbilang transaksi sekaligus. Ciri ini mengurangkan usaha manual dan menjimatkan masa yang berharga, menjadikan proses pembayaran lebih cekap.

- Sokongan berbilang mata wang: Compass menyokong urus niaga dalam pelbagai mata wang, yang bermanfaat untuk perniagaan yang beroperasi pada skala antarabangsa.

- Pelaporan berwawasan: Platform menjana laporan terperinci yang memberikan cerapan tentang pulangan pelaburan (ROI) pelan komisen. Ini memberi kuasa kepada pasukan kewangan untuk membuat keputusan termaklum mengenai peruntukan belanjawan masa hadapan.

- Pematuhan cukai dan keselamatan data: Compass secara automatik mengira dan menahan cukai berdasarkan peraturan tempatan. Ia juga memastikan penyulitan data untuk melindungi maklumat pembayaran yang sensitif, mengekalkan pematuhan piawaian seperti ASC 606.

Untuk HR

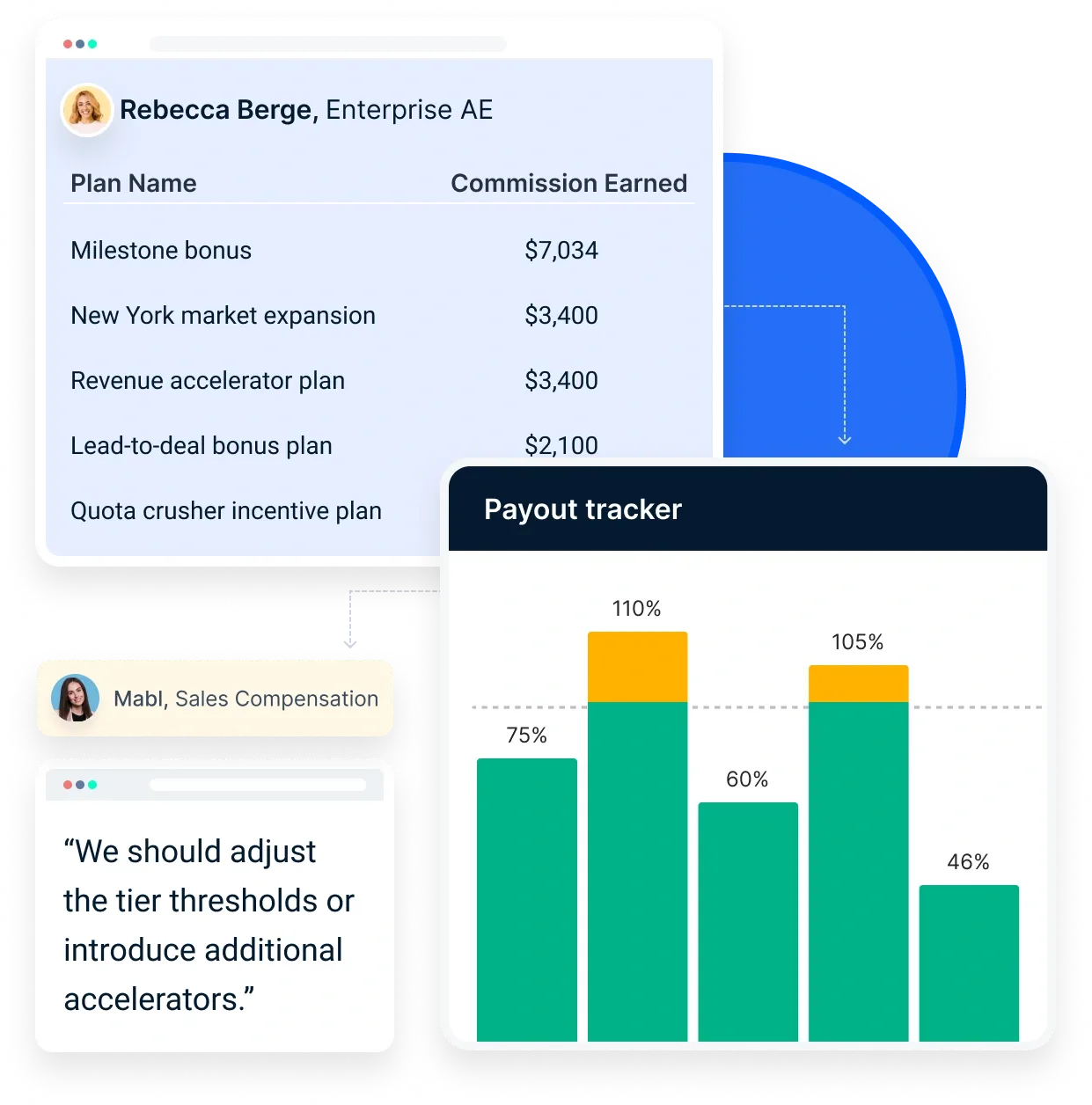

- Pengurusan prestasi jualan yang komprehensif: Compass menawarkan penyelesaian lengkap untuk mengurus prestasi jualan, memupuk budaya berdaya saing dan kolaboratif di kalangan pasukan jualan.

- Penciptaan pelan pampasan pantas: HR boleh mencipta pelan pampasan kompetitif dengan pantas menggunakan templat pra-bina. Ini membolehkan pelarasan sebagai tindak balas kepada perubahan keadaan ekonomi tanpa penangguhan yang panjang.

- Ketelusan dalam pelan pampasan: Sistem ini menyediakan keterlihatan ke dalam keseluruhan pelan insentif, yang membantu menghapuskan pertikaian mengenai pengiraan dan potensi pendapatan. Ketelusan ini meningkatkan semangat pekerja.

- Pembayaran tepat pada masanya: Compass memastikan pembayaran insentif dibuat tepat pada masanya, menggantikan hamparan yang menyusahkan dan membolehkan pelan komisen bebas ralat pada skala.

- Analisis keberkesanan: HR boleh menganalisis prestasi pelan insentif dalam masa nyata, menggunakan papan pemuka dan laporan perbandingan untuk mengukur keberkesanannya dan membuat pelarasan yang diperlukan.

Compass meningkatkan kecekapan pengiraan insentif untuk kedua-dua CRO dan profesional HR dengan mengautomasikan proses, memberikan pandangan yang berharga dan memastikan pematuhan kepada peraturan kewangan.

Membungkus

Excel, semasa alat serba boleh, menghadapi batasan apabila ia berkaitan dengan pengiraan insentif yang kompleks. Potensi untuk kesilapan manual, kekurangan data masa nyata, dan kesukaran dalam skalabiliti boleh menimbulkan cabaran yang ketara.

Melaksanakan sistem pengiraan insentif menawarkan banyak faedah untuk perniagaan dari semua saiz. Dengan mengautomasikan tugas manual, memastikan ketepatan dan menyediakan data berharga untuk pengoptimuman program, sistem ini boleh meningkatkan pengurusan program insentif anda dengan ketara.

Compass menawarkan penyelesaian yang menyelaraskan proses pengiraan insentif, mengautomasikan pembayaran dan meningkatkan ketelusan dan ketepatan. Memanfaatkan Compass , perniagaan boleh melebihkan pasukan jualan mereka, mengurangkan masa pemprosesan, meningkatkan produktiviti dan menghapuskan kelegapan komunikasi, semuanya sambil memastikan ketepatan pengiraan insentif mereka.

Soalan lazim

1. Apakah formula pengiraan insentif?

Formula untuk mengira insentif ialah:

Amaun insentif = (Prestasi Sebenar −Ambang) × Kadar Insentif

Ini bermakna anda mengambil prestasi yang dicapai, menolak ambang minimum dan darab dengan kadar insentif.

2. Apakah formula sistem gaji insentif?

Sistem gaji insentif boleh diwakili sebagai:

Bayaran insentif = Gaji Asas + (Pencapaian Jualan × Kadar Komisen)

Ini menunjukkan bahawa gaji insentif termasuk gaji pokok ditambah pendapatan tambahan berdasarkan prestasi jualan.

3. Apakah sistem gaji insentif?

Sistem gaji insentif ialah struktur pampasan yang memberi ganjaran kepada pekerja berdasarkan prestasi mereka. Ia bertujuan untuk memotivasikan pekerja untuk mencapai matlamat atau sasaran tertentu, selalunya melalui bonus atau komisen.

4. Bagaimanakah gaji insentif biasanya dikira?

Bayaran insentif biasanya dikira dengan menentukan gaji pokok pekerja, kemudian menggunakan peratusan insentif atau jumlah tetap berdasarkan prestasi mereka. Pengiraan selalunya melibatkan penggandaan gaji pokok dengan peratusan insentif.

5. Apakah peratusan insentif yang baik?

Peratusan insentif yang baik boleh berbeza-beza tetapi selalunya sekitar 10% hingga 20% daripada gaji pokok pekerja. Julat ini boleh memotivasikan pekerja dengan berkesan sambil kekal mampan dari segi kewangan untuk syarikat.