Clawback dalam Jualan & Komisen: Maksud, Contoh, Penanda Aras

Clawback dalam jualan membantu perniagaan menuntut semula komisen atas tawaran yang gagal, mengurangkan risiko kewangan dan menggalakkan amalan jualan beretika. Ketahui cara ia berfungsi dan sebab ia penting untuk pertumbuhan jualan yang mampan.

Pada halaman ini

What started as a way to prevent reckless corporate behavior and protect shareholders' interests due to Wells Fargo's cross-selling scandal, clawback soon became a practice adopted by multiple companies across the globe. Moreover, it put the need to ground the Dodd-Frank Act into the policy.

Insiden itu berlaku pada 2016, mendorong Wells Fargo untuk menyemak semula rangka kerja pengurusan, risiko dan kawalannya. Fargo juga mengubah budaya dan dasar cakarnya untuk membina semula kepercayaan dan menangani isu yang membawa kepada skandal itu. Walau bagaimanapun, ia membuka peluang kepada syarikat merentas industri yang berbeza di seluruh dunia untuk menyemak semula dasar clawback mereka.

The clawback policy is seen as a tool in organizations to discourage excessive and inappropriate risk-taking by the representatives. In 2016, Wells Fargo employees, 5,300 to be exact, opened 2 million unauthorized accounts, leading to the bank clawing back 185 million dollars in executive compensation. This reinstates the purpose of the clawback policy.

Tujuannya adalah untuk membolehkan syarikat mendapatkan pampasan berasaskan insentif yang dibayar kepada eksekutif jika kemudiannya ternyata penyata kewangan yang mengandungi metrik tersebut adalah cacat atau bersumberkan tidak beretika. Mengekalkan Wells Fargo sebagai contoh kontemporari 'clawing back', seseorang boleh mengatakan bahawa akibat melanggar dasar clawback boleh menjadi ketara.

Apa itu clawback?

Clawback, according to NASDAQ, refers to "an arrangement whereby the equity owners commit to using dividends they have received in the past to finance the cash needs of the project or corporation in the future."

Secara mudah, clawback ialah peruntukan kontrak yang membenarkan syarikat mengambil pampasan atau faedah yang dikeluarkan sebelum ini, biasanya dikaitkan dengan gaji berasaskan prestasi seperti bonus.

Its purpose is to uphold accountability among employees. It allows the organization to recover compensation if an employee engages in misconduct or if there is a significant correction of financial records.

Now that we have understood the meaning of clawback, let us scrutinize how the mechanism of clawback provision works.

What is clawback provision & how does it work?

Peruntukan clawback merujuk kepada klausa kontrak yang memerlukan pemulangan wang atau pampasan lain di bawah keadaan atau peristiwa tertentu. Ia sering digunakan dalam perjanjian pekerjaan kewangan untuk mengawal selia pembayaran bonus dan melindungi daripada kerugian kewangan, penipuan atau salah laku. Clawbacks direka bentuk dalam cara untuk turut mempromosikan amalan kewangan yang lebih baik, menghalang aktiviti penipuan dan menggalakkan tingkah laku jualan yang mampan.

Dalam sektor kewangan, clawback biasanya digunakan pada kontrak pekerjaan untuk mengawal pampasan eksekutif dan mencegah penipuan. Ia boleh dicetuskan oleh variasi jangka panjang instrumen kewangan, salah laku atau pelaporan kewangan yang salah. Akta Dodd-Frank bertujuan untuk mengembangkan clawback lebih jauh, tetapi peraturan yang dicadangkan belum diluluskan.

For sales organizations, clawback clauses allow a business to reclaim commission or other performance-based compensation paid to a salesperson when a customer churns or cancels their purchase within a specified period.

Ini membantu melindungi perniagaan daripada kerugian kewangan akibat pergelutan pelanggan dan menggalakkan wakil jualan untuk mengejar tawaran berkualiti tinggi dan meningkatkan pengalaman pelanggan.

- Between 2005 and 2010, the number of big companies in the Fortune 500 using clawbacks went up a lot. At first, less than 3% used them, but then it jumped to 82%.

- According to ISS Corporate Solutions, over 90% of S&P 500 companies have rules for clawing back money and stocks. But for the Russell 3000, which doesn't include the S&P 500, only a bit more than half have similar policies.

- A Harvard-based research has shown a 94% adoption rate among S&P 500 healthcare companies. However, only about 31% of healthcare companies outside of the S&P 500 have such policies in place.

The quantified study of the clawback seeds in the significance of placing the clawback policy in the agreement. However, there are more reasons to include clawback policy in the sales commission plans.

Walau bagaimanapun, untuk memasukkan dasar clawback dalam peruntukan anda, anda mesti mengetahui jenis clawback yang ada.

Jenis klausa clawback

Berikut ialah jenis klausa clawback dengan penjelasan dan contoh ringkas:

1. Kredit kuota negatif

Jenis clawback ini mengurangkan komisen atau bonus pekerja jika mereka gagal memenuhi sasaran jualan tertentu. Katakan jurujual memperoleh bonus $5,000 kerana melebihi kuota mereka sebanyak 10%.

Tetapi, jika klausa tersebut termasuk kredit kuota negatif, dan jurujual kekurangan kuota mereka sebanyak 5%, sebahagian daripada gaji pokok atau komisen terdahulu mereka mungkin dikurangkan dengan jumlah yang berkadar dengan kuota yang terlepas.

2. Kredit kuota negatif retroaktif

Sama seperti kredit kuota negatif, peruntukan ini membenarkan majikan menarik balik komisen atau bonus yang telah dibayar kepada pekerja jika mereka gagal memenuhi kuota mereka dalam tempoh masa yang ditetapkan, yang boleh melangkaui tempoh jualan semasa.

3. Komisyen sahaja clawback

Clawback ini hanya terpakai kepada komisen yang diperoleh oleh pekerja. Jika pekerja gagal memenuhi metrik prestasi tertentu atau melanggar kontrak mereka, syarikat boleh menahan atau mendapatkan balik semua atau sebahagian daripada komisen yang dibayar.

Clawback provisions examples in sales commissions

Clawbacks in sales are essential to maintaining a fair commission structure while protecting companies from financial risk. Below, we explore three common methods of handling sales clawback scenarios.

Quotas and commission structure

Let’s say Emma earns a commission based on the annual recurring revenue (ARR) of closed-won deals within a quota period. In Periods 1 and 2, the quotas are $150,000 and $300,000, respectively. Emma receives a 10% commission on deal ARR until she reaches her quota (Tier 1) and 20% for any amount exceeding the quota (Tier 2).

Commission and clawback rules

Commissions are paid on bookings but are subject to a clawback provision in case of customer non-payment. Below are the closed deals for Periods 1 and 2. At the end of Period 2, the company determines that Deal A will not pay, triggering a sales clawback.

Clawback method #1: exact payout amount

This is the most common method due to its operational simplicity and intuitive nature for sales teams.

Since Emma earned a $5,000 commission for Deal A, which was not fulfilled, she must return $5,000.

This method ties clawback amounts to when a deal was closed within the quota period. For example, since Deal A was closed within Tier 1, the clawback amount is 10% of ARR. However, if Deal C had been clawed back, the amount would have been $15,000 (20% of ARR).

Why we like Method #1

- Most intuitive and easy to understand.

- Simple for both employers and sales reps.

- Ensures fairness in clawbacks in sales commissions.

Clawback method #2: negative quota credit to current period

This method reduces Period 2’s quota credit by treating the clawback as a negative sale amount, effectively reducing current-period attainment.

By adding Deal A’s clawback as a negative sale, this method is easy to automate in spreadsheets and CRMs. However, it could incentivize sales reps to defer deals to future periods to avoid negative quota impacts.

Why we like Method #2

- Operationally simple and easy to automate.

- Clear commission statements.

- Eliminates the need for historical payout reference.

Clawback method #3: negative quota credit to past period

This method retroactively adjusts the previous period’s quota attainment to reflect the clawback. Unlike Method #2, this prevents negative incentives in the current period.

This method is more complex as it requires recalculating past commissions and adjusting payouts accordingly. Companies using ASC 606 for cost capitalization need to ensure proper compliance when implementing this method.

Why we like Method #3

- Balances fairness between employer and salesperson.

- Prevents negative incentives to defer sales.

- Avoids impacting current-period commissions negatively.

Pemikiran akhir

Clawback provisions in sales ensure financial security for companies while maintaining a fair commission structure.

Apakah beberapa tanda aras biasa yang digunakan untuk menentukan clawback dalam jualan?

Penanda aras yang paling biasa digunakan untuk menentukan clawback dalam jualan ialah:

1. Pencapaian kuota

Ini adalah penanda aras yang paling asas. Peruntukan clawback selalunya bermula jika jurujual jatuh di bawah peratusan yang telah ditetapkan daripada kuota jualan yang diberikan mereka untuk tempoh tertentu.

2. Pemecut jualan

Ini adalah bonus atau insentif yang ditawarkan kepada jurujual untuk melebihi sasaran tertentu. Clawback boleh digunakan pada pemecut ini jika jurujual tidak mencapai kuota asas asas atau metrik prestasi lain.

Walau bagaimanapun, syarikat harus berkomunikasi dengan jelas dengan wakil jualan tentang menyepadukan klausa clawback dan implikasinya. Ini boleh membantu mengelakkan salah faham dan memastikan wakil jualan memahami kemungkinan akibat daripada tindakan mereka. Untuk aspek sedemikian, mengekalkan amalan terbaik dalam navigasi clawback akan membantu.

Mengapa anda perlu memasukkan klausa clawback dalam rancangan komisen jualan anda?

Klausa Clawback adalah penting untuk dimasukkan dalam rancangan komisen jualan untuk melindungi syarikat daripada kerugian kewangan akibat aktiviti penipuan, jualan haram atau ketidakpatuhan dasar syarikat. Pertimbangkan untuk memasukkan klausa clawback dalam rancangan komisen jualan anda atas beberapa sebab utama:

1. Mengurangkan risiko kewangan

Clawbacks boleh membantu mengurangkan risiko kewangan dengan mendapatkan semula komisen atas jualan yang tidak diterjemahkan kepada manfaat jangka panjang untuk syarikat. Ini mungkin disebabkan oleh pergolakan pelanggan, pemulangan produk atau aktiviti penipuan.

The policy applies if Airbnb's publicly disclosed financial statements must be restated due to fraudulent or willful misconduct by the employees or executives.

It provides the Leadership Development, Belonging, and Compensation Committee or the board of directors with the discretion to recover cash incentives, equity awards, or other compensation of at-fault employees.

2. Enhanced legal protection

Clawbacks menyediakan lapisan perlindungan undang-undang dalam kes penipuan atau salah laku oleh jurujual. Jika komisen diperoleh melalui cara yang menyalahi undang-undang atau tidak beretika, klausa clawback membenarkan syarikat mendapatkan semula dana tersebut.

3. Penjajaran dengan matlamat perniagaan

Klausa clawback boleh memberi insentif kepada tingkah laku jualan yang menyumbang kepada pertumbuhan jangka panjang syarikat. Dengan berkemungkinan mendapatkan semula komisen atas keuntungan jangka pendek yang tidak diterjemahkan kepada pengekalan atau kepuasan pelanggan, clawback menggalakkan jurujual untuk menumpukan pada membina nilai yang mampan.

This rule applies to incentive pay received after October 2, 2023. A committee appointed by the board will oversee this and follow Nasdaq Rule 5608.

4. Incentivize sales behaviors

Clawbacks in sales play a crucial role in enhancing the overall customer experience. Instead of collecting their commission and moving on, sales reps have a vested interest in ensuring customer satisfaction throughout the onboarding process.

This is particularly valuable for SaaS providers and other subscription-based businesses, where long-term retention outweighs the impact of a single sale. By implementing a clawback sales commission structure, companies give their reps extra motivation to align with this long-term success mindset.

How Compass simplifies clawback management

Compass streamlines the clawback process, ensuring accuracy, transparency, and efficiency.

Here’s how it works:

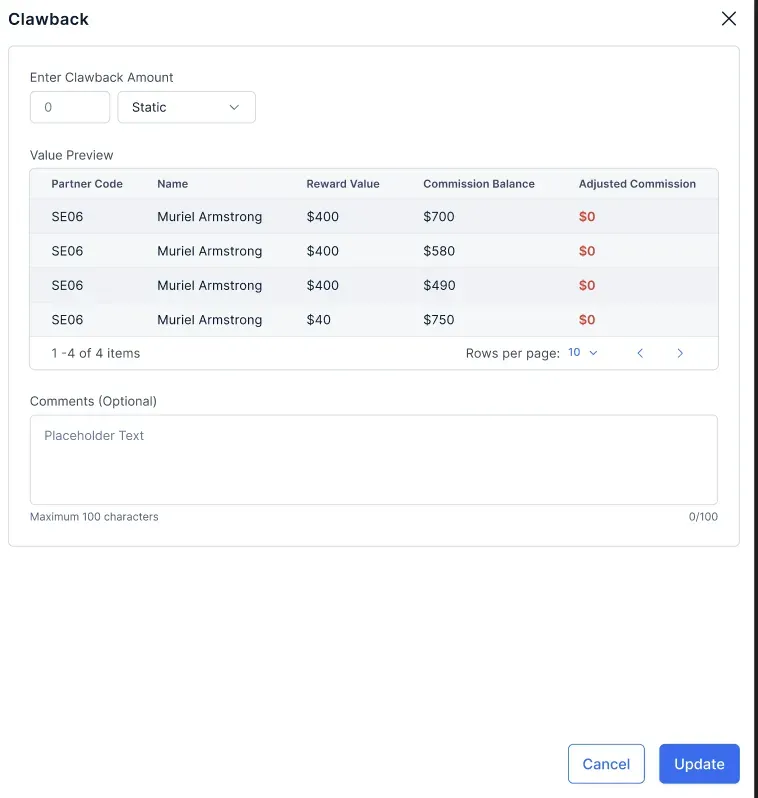

- Identifying deals and participants – Compass helps pinpoint past deals requiring clawback and identifies the participants involved.

- Determining commission adjustments – It calculates the amount paid to participants and determines the clawback amount based on pre-set logic, such as a percentage of the paid commission.

- Seamless deduction process – The clawed-back amount is adjusted from either the current month's commission or future payouts, ensuring minimal disruption.

- Validation and approval – Data validation and pre-defined approval workflows ensure accuracy before any clawback is processed.

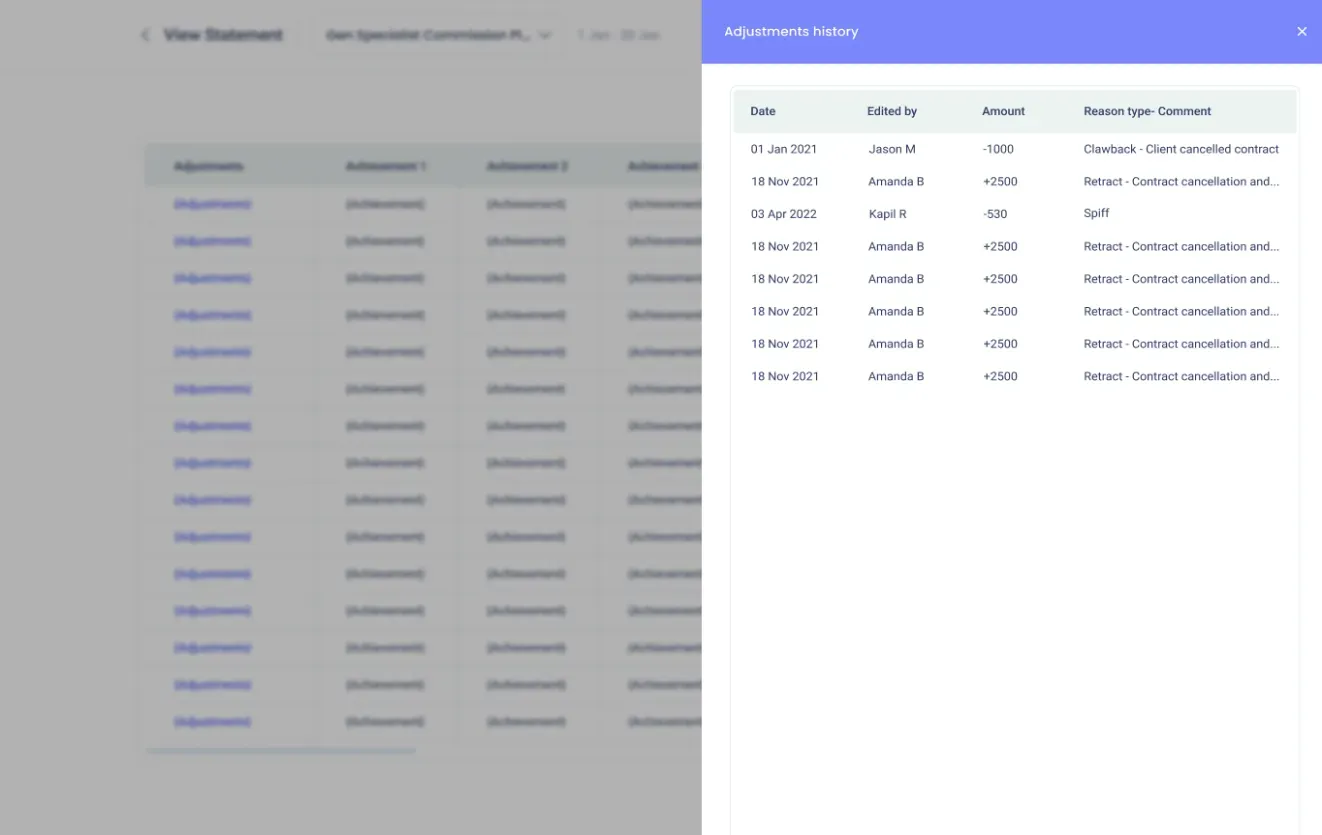

- Complete transparency – End users gain full visibility into their clawbacks, including details on deals, deducted amounts, and any relevant comments from approvers.

- Ad-hoc clawbacks – Admins have the flexibility to initiate clawbacks for specific payouts from any commission plan, with a dedicated audit trail for both admins and users.

Through Compass, admins can efficiently set up and manage clawback provisions, while end users can conveniently track their clawbacks via the mobile app.

Additionally, users can view, email, or download their relevant transactions, ensuring complete control and transparency over their commission adjustments. Schedule a call now!

Amalan terbaik untuk menavigasi klausa clawback

Untuk menavigasi klausa clawback dengan berkesan, adalah penting untuk mengikuti beberapa amalan terbaik. Amalan ini termasuk:

1. Mendapatkan nasihat undang-undang

Adalah penting untuk berunding dengan pakar undang-undang apabila membuat klausa clawback untuk memastikan ia sah dan boleh dikuatkuasakan di sisi undang-undang. Ini boleh mengelakkan potensi pertikaian dan prosiding undang-undang.

2. Mewujudkan keadaan clawback yang jelas dan adil

Klausa clawback hendaklah mudah dan adil, dengan syarat telus menggariskan bila komisen boleh dituntut semula. Ini membantu mengelakkan salah faham dan memastikan wakil jualan menyedari kemungkinan akibat daripada tindakan mereka.

3. Sentiasa menyemak dan mengemas kini klausa clawback

Syarikat harus menyemak dan menyemaknya secara berkala untuk mengekalkan keberkesanan dan kaitannya. Proses ini mungkin melibatkan menganalisis kejadian lepas di mana klausa itu digunakan untuk menilai kesannya terhadap prestasi kewangan perniagaan dan hasil jualan.

Undang-undang terkini mengenai klausa clawback

- The new rules, implemented in October 2022, are part of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

- Listed companies must follow new SEC Clawback Rules.

- Peraturan ini memerlukan syarikat mendapatkan semula pampasan berasaskan insentif yang diberikan berdasarkan kesilapan dalam penyata kewangan. Ini terpakai kepada kebanyakan syarikat di bursa saham utama, tanpa mengira pengetahuan atau salah laku pegawai.

- According to recent laws, companies cannot protect officers from these clawbacks, and both major and minor accounting errors can trigger them.

- Peraturan pendedahan baharu memerlukan syarikat melaporkan butiran tentang clawbacks. Peraturan juga mungkin mempengaruhi cara syarikat menjalankan penyiasatan dalaman.

Kesimpulan

Peruntukan Clawback memainkan peranan penting dalam rangka kerja dengan mengembalikan keyakinan pelabur dan memupuk kepercayaan di kalangan orang ramai. Kemasukan mereka meningkatkan akauntabiliti individu dan mengubah suai sistem insentif untuk mengurangkan pergantungan pada keputusan pembayaran jangka pendek.

Orang boleh mengatakan bahawa cakar balik dilaksanakan merentas sektor seperti ekuiti persendirian, insurans, dividen, dan kontrak perniagaan untuk memastikan tanggungjawab yang lebih besar di kalangan pihak yang terlibat.

However, to ensure a fair application of clawback policies among the sales reps, an incentive automation channel can be established for them to meet the expectations set out in the contract. Compass is a sales incentive management software that helps businesses manage and automate their sales incentive programs fairly. The platform simplifies the management of complex incentive plans by:

- Melancarkan pelan insentif

- Mengira dan mengagihkan insentif, dengan keterlihatan masa nyata ke dalam prestasi

- Hasilkan maklumat komisen dan pembayaran tepat pada masanya.

- Penyepaduan dengan CRM melalui webhooks, API atau SDK, menggabungkan pautan dan penapis get untuk mengurus berbilang sumber data.

Jadi memudahkan automasi program insentif, memudahkan proses mewujudkan matlamat prestasi jualan, dan memantau kemajuan pekerja dalam mengatasinya sambil mengekalkan kesopanan dan keadilan di semua peringkat dengan Compass .