Mortgage Broker Commissions in the USA: How They Work & What to Expect

Discover how mortgage brokers earn commissions, the types of fees involved, industry regulations, and how borrowers can optimize costs when securing a home loan.

On this page

Securing a mortgage is a significant financial decision that often requires the expertise of a mortgage broker. These professionals act as intermediaries between borrowers and lenders, helping individuals find the most suitable loan options.

While mortgage brokers provide valuable services, it's crucial for borrowers to understand how these professionals are compensated. In the USA, mortgage broker commissions play a pivotal role in the home loan process.

Who are mortgage brokers?

A mortgage broker is a financial professional who acts as an intermediary between individuals or businesses seeking a mortgage loan and the lenders who provide the funds for the loan.

Mortgage brokers help borrowers navigate the complex process of securing a mortgage by connecting them with lenders that offer suitable loan products based on their financial situation and needs.

Understanding mortgage broker commissions

Mortgage broker commissions are fees paid to brokers for their services in facilitating the mortgage application and approval process. In the USA, these commissions typically come in two forms: upfront fees and ongoing fees.

1. Upfront fees

- Origination fee: This is a common upfront fee charged by mortgage brokers. It is usually a percentage of the loan amount and can range from 0.5% to 1.5%. The origination fee compensates the broker for processing the loan application, evaluating the borrower's creditworthiness, and coordinating with the lender.

- Loan discount points: Borrowers may also encounter loan discount points, which are upfront fees paid to reduce the interest rate on the mortgage. Each point typically costs 1% of the loan amount and can result in a lower interest rate, potentially saving money over the life of the loan.

2. Ongoing fees

- Yield Spread Premium (YSP): While less common today, YSP is a commission paid by lenders to brokers for securing a loan with a higher interest rate than the borrower qualifies for. This practice has been subject to scrutiny, and regulations have been implemented to ensure that brokers act in the best interests of the borrower.

- Trail commissions: In some cases, mortgage brokers may receive ongoing commissions, known as trail commissions, for the life of the loan. These commissions are based on the outstanding balance of the mortgage and incentivize brokers to maintain a long-term relationship with the borrower.

In recent years, regulatory changes have aimed to increase transparency in the mortgage industry and protect consumers. The Dodd-Frank Wall Street Reform and Consumer Protection Act, for example, requires mortgage brokers to disclose their compensation to borrowers. This includes detailing the origination fees, discount points, and any other fees associated with the loan.

How much do mortgage brokers make?

The annual earnings of a mortgage broker can vary depending on their location and the volume of business they conduct. Typically, their compensation is a percentage of the mortgage amount, making regions with high home prices more lucrative as borrowers in such areas often require larger loans.

Established and proactive mortgage brokers who engage in numerous transactions tend to earn more compared to those who are new to the field or work part-time.

Various online platforms and resources provide a range of average earnings for salaried mortgage brokers as of April 2023:

- According to Indeed, national average base salary for mortgage brokers is $98,162 per year, with some receiving additional commissions. In specific areas like the San Francisco Bay area, the average salary was notably higher at $141,240, although based on a small sample size of just three brokers.

- PayScale reports an average salary of $64,630 for mortgage brokers based on 57 reports, with commissions ranging from $12,000 to $178,000. Those with less than one year of experience had an average total compensation of $47,000, while those with over 20 years of experience averaged $69,000. These figures are derived from relatively small sample sizes.

- Glassdoor indicates an average base salary of $136,620 for mortgage brokers, with a range from $111,000 to $352,000. Additional compensation, including cash bonuses, commissions, tips, and profit-sharing, is estimated at $55,484 per year.

- Lastly, ZipRecruiter reports a national average mortgage broker salary of $129,346, with a range spanning from $11,500 to $297,500.

It is important to note that these figures are averages and can be influenced by various factors, including geographic location, experience level, and the specific circumstances of individual brokers.

How mortgage brokers profit from transactions?

Mortgage brokers predominantly earn a commission based on the loan amount, usually ranging from 1% to 2%. This commission can be paid by either the borrower or the lender, and it is typically around 2% of the loan value. Larger loans result in higher commissions for brokers, creating a financial incentive for them to secure larger loan amounts for their clients.

Since a mortgage broker's income is commission-based, it is directly tied to the transaction value. For instance, a broker charging a 2% rate on a $250,000 loan would earn $5,000.

However, factors such as the local real estate market and the broker's experience level can significantly impact their annual earnings. According to ZipRecruiter, the average annual salary for a mortgage broker in different states varies, with factors like demand and experience playing a crucial role.

While mortgage brokers provide valuable services in simplifying the loan process, borrowers should be aware of potential fees. One way to mitigate costs is by obtaining multiple mortgage quotes from different lenders.

According to a 2018 Freddie Mac report, borrowers can save an average of $3,000 over the life of the loan by securing at least five quotes. If a broker's commission exceeds this potential savings, borrowers may consider exploring alternatives with different fee structures.

How are mortgage brokers paid?

The payment to mortgage brokers can take various forms, including cash or an addition to the loan balance. If the borrower is responsible for the fee, it is paid at the loan closing.

However, if the lender covers the cost, it may be rolled into the overall loan amount, meaning the borrower still bears the financial burden. As fee structures vary among brokers, borrowers are advised to thoroughly understand the terms before committing to a specific broker.

What affects a mortgage broker's pay?

Mortgage brokers typically earn a base salary along with a commission that varies based on several factors, including loan terms, client agreements, and market conditions.

1. The terms of the loan

On average, mortgage brokers charge a commission of 2% to 2.5% per loan. However, federal regulations prohibit brokers from charging more than 3% of the total loan amount. For example, if a mortgage broker charges 2.25% on a $500,000 loan, they would earn $11,250 in commission.

2. The agreement with the client

Mortgage brokers can work for either borrowers or lenders, and their fees depend on these agreements. Lenders generally pay higher commissions than borrowers. When lenders compensate brokers, they typically pay between 0.5% and 2.75% of the total loan amount. If borrowers pay, brokers charge an origination fee, which is usually less than 3% of the loan amount.

3. The housing market

The local housing market also influences mortgage broker commissions. In highly competitive markets, brokers may lower their commission rates to attract more clients. In contrast, in less competitive markets with fewer options, brokers might charge higher fees.

Mortgage brokers' commissions calculation

Let's break down an example of how a mortgage broker's commission might be calculated.

1. Loan amount: $300,000

2. Interest rate: 4%

3. Loan term: 30 years

Where,

- Loan amount: This is the total amount of money borrowed by the borrower.

- Interest rate: The interest rate is the percentage of the loan amount that the borrower pays as interest to the lender over the life of the loan.

- Loan term: The loan term is the number of years over which the loan will be repaid.

Commission structure

Broker's commission rate: 1% of the loan amount

Calculation:

1. Loan amount: $300,000

2. Commission rate: 1%

3. Commission amount: Commission Rate * Loan Amount

Commission amount = 0.01 * $300,000

Commission amount = $3,000

So, in this example, the mortgage broker would earn a commission of $3,000 for facilitating the mortgage loan of $300,000 at a 1% commission rate.

It's important to note that commission structures can vary, and some brokers may also receive additional bonuses or incentives based on factors like loan volume or client satisfaction.

Additionally, brokers may receive commissions from both the borrower and the lender, or they may charge fees to the borrower in addition to or instead of a commission. Always refer to the specific terms of the agreement between the broker and the lender for accurate calculations.

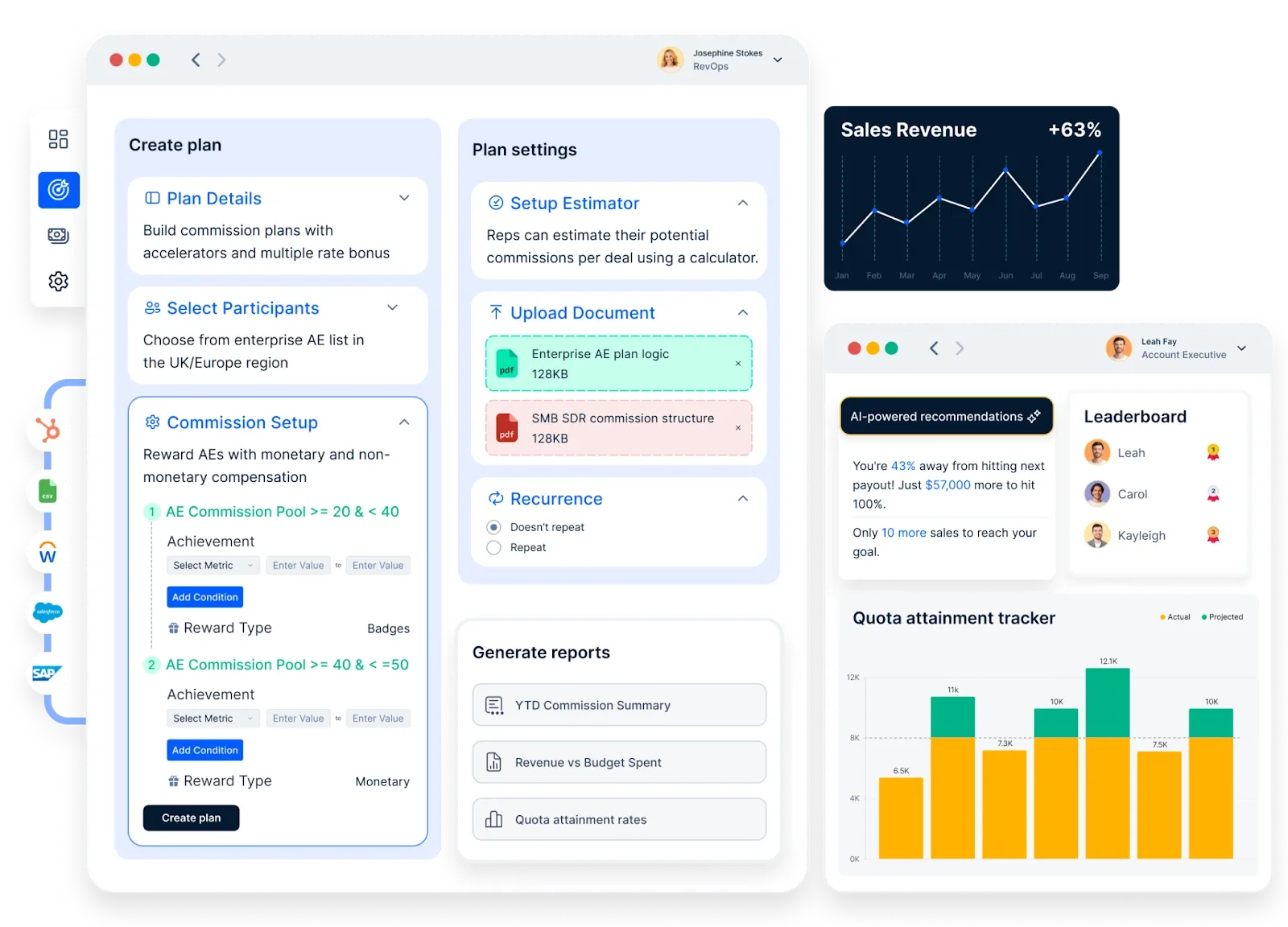

How can Compass simplify Mortgage Broker commission calculation?

Here is how Compass, mortgage commission automation software, that might simplify mortgage broker commission calculations:

- Integration with mortgage systems: Compass could integrate with various mortgage-related systems, such as loan origination software and customer relationship management (CRM) tools, to access relevant data for commission calculations.

- Customizable commission structures: The platform might allow mortgage brokers to set up and customize commission structures based on agreements with different lenders. This flexibility ensures that calculations align with the specific terms of each lending relationship.

- Automation of calculation processes: Compass could automate the calculation of commissions, reducing the need for manual input and minimizing the risk of errors. Automation ensures that calculations are performed consistently and efficiently.

- Real-time data updates: By accessing real-time data, Compass can provide accurate and up-to-date commission calculations. This is crucial in a dynamic mortgage market where rates and terms can change frequently.

- Compliance management: The platform may incorporate compliance features to ensure that commission calculations adhere to industry regulations and standards. This helps mortgage brokers stay compliant with legal requirements.

- Transparent reporting: Compass might offer reporting tools that provide detailed insights into commission earnings. Clear and transparent reports help mortgage brokers understand how commissions are calculated and provide a basis for communication with clients and lenders.

- Error reduction: Through automation and validation mechanisms, Compass could help reduce the likelihood of errors in commission calculations, minimizing the risk of financial discrepancies and disputes.

- Workflow optimization: Compass may streamline the overall commission workflow, from data entry to payment distribution. This optimization can save time for mortgage brokers, allowing them to focus on building client relationships and growing their business.

- Integration with accounting systems: The platform could seamlessly integrate with accounting systems, facilitating the smooth transfer of commission data for financial management and reporting.

Conclusion

Navigating the world of mortgage broker commissions in the USA requires a clear understanding of the various fees and how they impact the overall cost of a mortgage. As regulations continue to evolve, borrowers can expect increased transparency and protection. When working with a mortgage broker, open communication about fees and compensation is key to ensuring a successful and mutually beneficial partnership.

FAQs

1. Do mortgage brokers earn more than loan officers?

Mortgage brokers and loan officers both play pivotal roles in facilitating home loans, but their compensation structures differ. Mortgage brokers typically earn commissions by connecting borrowers with suitable lenders, while loan officers, employed by specific financial institutions, may receive a combination of salary and performance-based bonuses.

According to data from April 2023, mortgage brokers have an average base salary of $58,304, whereas mortgage loan officers have an average base salary of $49,369. However, total earnings for both can vary based on factors like experience, location, and transaction volume.

2. Do mortgage brokers need a license?

Yes, mortgage brokers are required to be licensed to operate legally. In the United States, the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) mandates that mortgage brokers complete pre-licensing education, pass a national exam, and fulfill annual continuing education requirements. Licensing ensures that brokers adhere to industry standards and regulations.

3. How can I ensure a mortgage broker is legitimate?

To verify the legitimacy of a mortgage broker:

- Check licensing: Use the Nationwide Multistate Licensing System (NMLS) Consumer Access portal to confirm the broker's licensing status and review any disciplinary actions.

- Review credentials: Ensure the broker has relevant experience and professional affiliations.

- Seek recommendations: Consult friends, family, or real estate professionals for referrals to reputable brokers.

- Assess transparency: A trustworthy broker will clearly explain fees, loan options, and the lending process.

- Read reviews: Look up online reviews and ratings to gauge the broker's reputation and client satisfaction.

4. How much do mortgage brokers make in commission?

Mortgage brokers typically earn commissions ranging from 0.5% to 2.75% of the total loan amount. For instance, on a $300,000 mortgage, a broker might earn between $1,500 and $8,250. The exact percentage can vary based on the broker's agreement with the lender, the complexity of the loan, and regional market conditions.

5. How much do brokers charge for commission?

The commission charged by mortgage brokers generally falls between 0.5% and 2.75% of the loan amount. This fee is often paid by the lender, the borrower, or a combination of both, depending on the agreement. It's essential for borrowers to discuss and understand the fee structure upfront to avoid any surprises at closing.