A Complete Guide to Manufacturer Sales Rep Commission Rate

Discover the latest manufacturer's sales rep commission rates in the USA. Learn how commissions work, industry standards, and factors influencing rates.

On this page

Manufacturer’s sales rep commission rates are pivotal in establishing an effective deal between manufacturers and sales representatives.

Substandard commission rates can lead to demotivation, dissatisfaction, and even attrition among sales reps, potentially impacting the manufacturer's bottom line.

As per Forbes, a mere 5 percent increase in the average sales rep attrition rate can escalate selling costs by 4 to 6 percent while reducing total revenue by 2 to 3 percent.

In the manufacturing industry the sales rep commission rate is between 7 to 15 percent.

The average yearly income of sales reps is around $62,720, and the average hourly wage is $30.16.

These numbers highlight the significance of retaining sales reps.

Commission dynamics in the sales ecosystem is a major factor in retaining sales representatives, which calls for an in-depth study and evaluation of the manufacturer's sales rep commission rates.

And we are here to provide you with all the needed information.

In this piece, we look at the details of manufacturer rep commission, revealing the factors that affect them, their types, step-up procedures, standard rates and a few case studies for reference.

What is a manufacturing sales commission plan?

A manufacturing sales commission plan is a structured compensation model that determines how much a sales representative earns based on their performance. This commission structure typically includes a percentage-based payout influenced by factors such as deal type, value, and size. Additionally, it considers the rep’s experience and seniority within the organization.

A well-designed manufacturing sales commission plan not only incentivizes sales teams but also aligns their efforts with the company’s revenue goals. When implemented effectively, it offers several benefits, including:

Higher sales rep retention

A competitive commission plan encourages sales representatives to stay with the company. When reps feel adequately rewarded for their efforts, turnover rates decrease, and retention improves.

Increased sales productivity

A well-structured commission plan motivates sales reps to improve their performance, meet targets, and drive higher revenue. Clear incentives push them to close more deals efficiently.

Enhanced sales performance

When a commission structure aligns with business goals and offers lucrative incentives, sales teams are more likely to exceed targets and bring in consistent revenue.

Beyond these core benefits, a well-planned sales commission structure fosters a healthy competitive environment, boosts overall revenue, and keeps sales teams continuously motivated to perform better.

Now, the question arises, is sales commissions manufacturing overhead cost?

Yes, it comes under the variable manufacturing overhead costs as the amount changes each time and is dependable on the number of units sold.

However, there are various structures and factors that influence the decision on fixing the commission rates, let's move to it.

Factors influencing manufacturing sales rep’s commission rates

Manufacturers' sales rep commission rates can greatly vary as they are influenced by various factors in the USA. As the commission structure should be such that it supports the manufacturer's objectives, market dynamics, and sales strategy.

The two main factors that influence the commission rates are:

1. Industry-specific considerations

- Product type - The type of product and its complexity in being sold affects the commission rates. For example, High-tech or highly specialized products can entitle higher commissions due to the skill and effort required to market them.

- Sales cycle length - From lead generation to contract completion, the length of the sales cycle is a crucial aspect in deciding the rates. Higher commission rates might be necessary for longer sales cycles to maintain sales reps' motivation.

- Profit margins - Profit margins associated with the product can impact commission rates. Products with higher profit margins can have greater commissions than others.

- Competitors commission - Manufacturers are always at risk of losing their best sales reps. The best way to avoid this is to know what commission rates competitors offer to their reps. This will help to set commission rates accordingly.

2. Company-specific factors

- Sales strategy - Commission rates depend on the manufacturer's sales strategy, whether it's market penetration, customer retention, or new product launches. Aligning commission structures with sales objectives will make sure your sales reps are motivated.

- Budget - The financial objectives of the manufacturer directly influence commission rates. Companies set commission rates based on their revenue goals, budgetary constraints, and overall financial strategy.

- Historical performance and data analysis - To assess what commission rates have been successful in achieving desired goals, manufacturers usually analyze historical data, sales metrics and decide the rates.

Which is an ideal manufacturing sales commission plan to adopt?

Here are four ideal manufacturing sales commission plans that align with revenue goals:

1. Base salary plus commission

This structure includes a base salary plus a performance-based commission. The base salary ensures financial stability, while commissions motivate reps to improve performance. It helps balance fixed and variable costs, ensuring sustainable business operations.

This structure is ideal for

- Companies looking to balance the fixed and variable sales commissions manufacturing overhead.

- Companies where sales volumes can vary throughout the year.

- Companies that want to encourage proactive sales efforts.

When to use: Ideal for small and mid-sized manufacturing businesses looking to attract and retain top sales talent by offering both financial stability and performance-based incentives.

2. Straight commission plan

This structure compensates sales reps solely based on commissions, eliminating base salary costs. It motivates reps to close more deals while allowing management to control variable expenses. However, unpredictable income may lead to high turnover if commissions are not competitive.

This structure is ideal for

- Companies or startups that might not have consistent means of raising capital paying their sales reps.

- Companies with short sales cycles or those where their sales reps can earn a big commission on only one sale.

When to use: Best suited for businesses with aggressive sales targets or those operating with limited capital, such as startups.

3. Gross margin commission structure

This model rewards sales reps based on gross margin rather than total sales, encouraging them to focus on selling high-margin products.

This structure is ideal for

- Companies that are already large and have well-established sales teams.

- Companies wanting to improve their sales rep enthusiasm and increase sales as the reps may be more motivated to outperform in order to advance to the next tier.

Gross Margin x Commission Percentage = Total Commission

When to use: Ideal for manufacturing companies looking to maintain profitability while ensuring that sales reps focus on high-margin products.

4. Territory volume commission

This structure distributes commission revenue among all sales reps operating in a specific region, fostering teamwork and collaboration. However, it may create conflicts if multiple reps are assigned the same territory.

When to use: Best for manufacturers expanding into new markets or operating at national and international levels.

5. Tiered Commission

In the tiered commission model the commission rises if a sales rep meets a set goal, such as selling a predetermined number of goods or hitting a certain revenue target. To encourage sales reps to attain the next goal, many businesses decide to set up multiple sales commission tiers.

Sales reps do not receive a lump sum amount after reaching the set goal. They generally receive a certain percentage on all sales until they reach the next tier. The percentage of the commission increase will be by each tier. This can be better understood by the below example.

This structure is ideal for

- Companies that are already large and have well-established sales teams.

- Companies wanting to improve their sales rep enthusiasm and increase sales as the reps may be more motivated to outperform in order to advance to the next tier.

Case study

- The giant beverage company Coca-Cola follow a tiered commission structure.

- They pay their sales agents a higher commission if they close more deals and exceed their quotas and tiers designed.

- Reportedly, on an average they pay sales reps a base salary of $48,000 with a $10,000 bonus annually.

4. Draw against commission

A sales representative earns their commission in advance with a recoverable draw against commission plan. It typically appears as a fixed lump payment at the start of a pay cycle or sales cycle.

This lump sum or draw is deducted from the representative's overall earned commissions at the close of that sales cycle. In the non recoverable model, if the sales rep commission is under the lump sum, the draw commission can not be recovered.

This structure is ideal for

- Companies that are new to sales, this arrangement works well. The increased pressure makes sure that the sales rep reaches the draw amount.

- Companies with unpredictable sales cycles and off-season products.

If the earned commission is less than the draw, the salesperson owes the difference.

Non-recoverable draw (Guaranteed minimum pay)

Final Pay = Max 0 (Draw Amount, Earned Commission)

The salesperson keeps the draw even if the commission earned is lower.

How to set up fair commission rates?

It is vital that the manufacturer's sales rep commission rates are fair enough, competitive, and attractive to sales reps, in order to achieve sales goals and contribute to the growth of business.

Here are a few considerations for setting up fair commission rates:

1. Market research and benchmarking

- To start, perform in-depth market research to learn about industry norms and going commission rates for similar products.

- Benchmarking against rivals will give you useful information about what the market perceives as fair.

2. Create a tailored commission structure

- Design a commission structure that is aligned with the objectives, type of product, and market dynamics of your organization.

- Sales commissions manufacturing overhead, profit margins, sales goals, and the complexities of the goods or services should all be taken into account.

- Make sure the structure is feasible for the firm while also motivating sales representatives.

3. Start offering a commission to the sales rep

- By establishing all of the terms and conditions in a written agreement or contract, implement the commission structure.

- Make sure sales reps are aware of how commissions will be determined, paid, and any requirements they have to fulfill in order to get commissions.

4. Incorporate feedback loops

- Direct channels of communication should be established with the sales team, and feedback on the commission system should be gathered.

- Engage with salespeople on a regular basis to hear about their thoughts and experiences with regard to the fairness of the commission rates. For example, conduct a survey or arrange group discussions.

- Utilize this input to modify and enhance the commission structure if needed to keep it fair and motivating.

How to calculate manufacturing sales commission in 5 simple steps?

Determining a fair commission rate is crucial for manufacturers to motivate their sales teams and drive revenue. Here are five simple steps to help you calculate manufacturing sales commission accurately:

Step 1: Decide on your ideal commission structure

Start by selecting the right commission structure for your sales team. Consider different commission models—such as fixed, tiered, or profit-based—along with their benefits and drawbacks. Define the commission percentage, influencing factors like deal size and type, and any additional incentives like quotas and bonuses. A well-planned structure ensures fair compensation and boosts sales performance.

Step 2: Gather sales data for a defined period

Accurate sales data is essential for fair commission payouts. Collect and organize sales data for a specific period—monthly, quarterly, or annually. Use Compass to gain deeper insights into sales performance.

Keep in mind that commission payouts may vary based on company policies. Some companies delay commissions until they receive full payment from customers, which can result in a delay of several weeks. While this policy may seem unfair to sales reps, it helps businesses manage cash flow, especially when dealing with high-value transactions.

Step 3: Calculate gross sales

Once the sales data is collected, calculate the total gross sales for the given period. Categorize sales by product or service type, and factor in any adjustments, such as returns or refunds, to ensure accuracy. Understanding these figures helps in determining the correct commission payout.

Step 4: Determine the base commission rate while considering additional factors

Multiply the total sales figure by the designated commission rate to determine the base commission. If using a tiered commission structure, adjust payouts based on performance thresholds. Consider factors like quota-based incentives, performance bonuses, and deductions (such as chargebacks) to ensure a fair and balanced commission plan.

Step 5: Calculate the final commission payout

In the final step, sum up all adjustments, bonuses, and deductions to determine the exact commission payout. Ensure transparency by clearly communicating the commission breakdown with sales reps and addressing any concerns they may have.

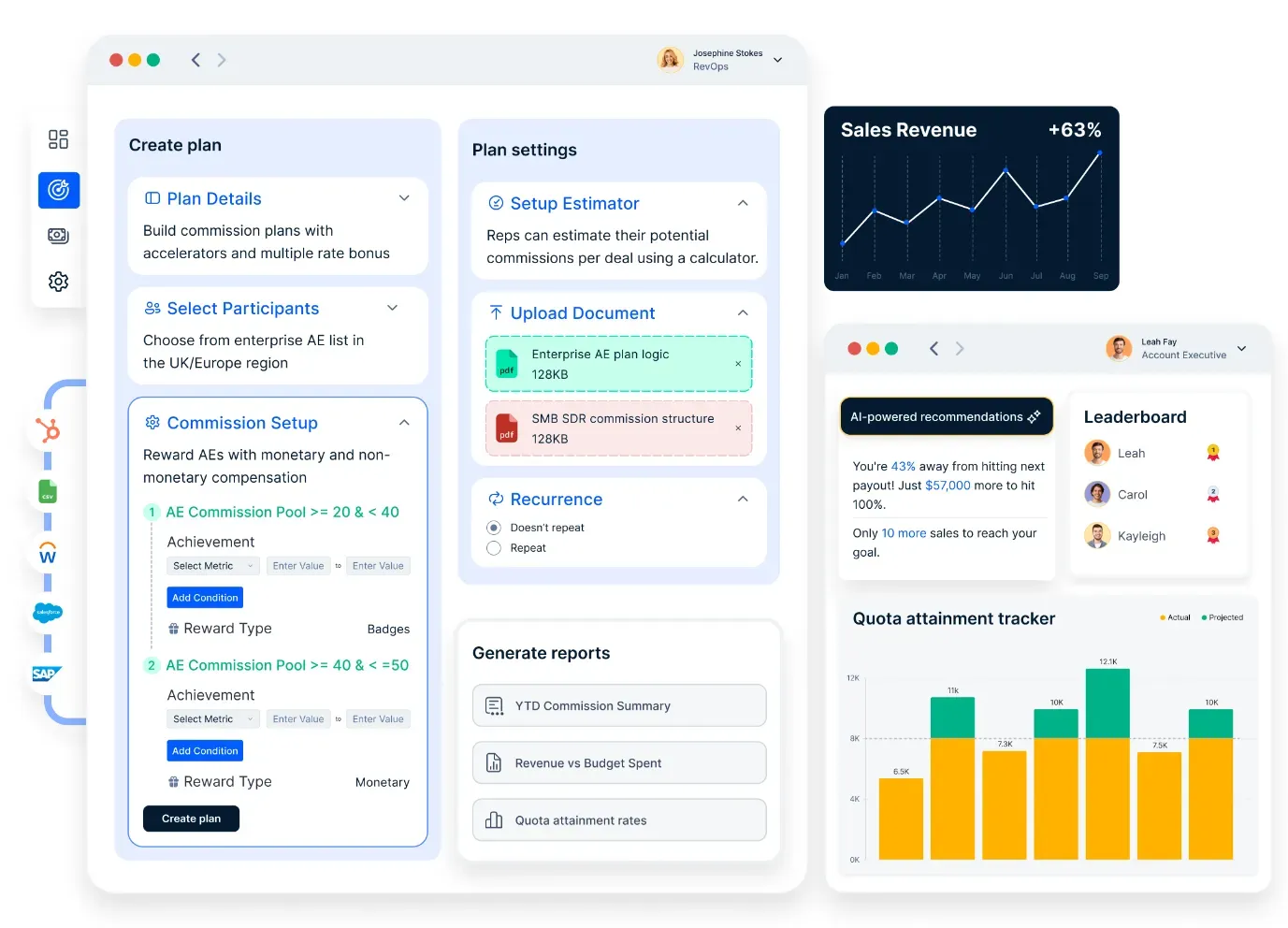

Why use Compass for manufacturing sales commission management?

If you are a manufacturer looking to:

- streamline commission management,

- save time and resources

- while motivating your sales force,

Then Compass is the right partner. It can enable:

- Automated commission tracking & payouts – No manual calculations or spreadsheets.

- Real-time integration with CRMs and ERPs – Seamlessly pulls sales data from existing tools.

- Customizable commission structures – Supports fixed, tiered, quota-based, and profit-sharing models.

- Transparent earnings dashboard – Reps can track their commissions in real time.

- Error-free calculations – Eliminates disputes and ensures timely, fair payouts.

Consider Compass. Book a demo today! To know how Compass, a sales commission automation platform, can revolutionize your sales commission process.

Conclusion

Commission dynamics are pivotal in optimizing the manufacturer sales rep relationship and driving sales performance. The above guide will help you set up an appropriate manufacturer's sales rep commission rates and succeed. In this blog, we learned:

- A well-defined manufacturing sales commission plan improves sales performance and retention.

- Gathering and organizing sales data is crucial for fair commission calculations.

- Using Compass automates sales commission tracking, reducing errors and disputes.

- Considering quotas, bonuses, and chargebacks ensures a balanced compensation system.

- Clearly communicating commission structures and automating payouts boosts sales rep motivation and trust.

FAQs

What is the commission for manufacturing sales?

Manufacturing sales commissions typically range from 2% to 10%, depending on factors like industry, product complexity, and sales volume.

How much commission does a car salesman make on a $50,000 car?

Car sales commissions vary but generally range from 2% to 5%. On a $50,000 car, this would be $1,000 to $2,500, though some dealerships offer flat fees or bonuses instead.

How does a manufacturing company classify sales commissions?

Sales commissions in manufacturing are classified as a selling expense under operating expenses, since they are directly related to revenue generation rather than production.

Is sales commission a manufacturing overhead cost?

No, sales commission is not a manufacturing overhead cost. It is a selling expense, as it is not directly tied to production but rather to selling efforts.

How would a 5% sales commission paid to sales personnel be classified in a manufacturing company?

A 5% sales commission would be classified as a selling expense under the company's income statement, impacting the operating expenses rather than the cost of goods manufactured.