Life Insurance Agent Commission – Breaking Down Rates, Structures, and Payout Models

Explore life insurance agent commissions and gain a deep understanding of how they get paid. Discover the intricacies of commission structures in this guide.

On this page

For life insurance agents, commissions aren’t just a paycheck—they drive motivation, influence sales strategies, and determine long-term earning potential. Unlike standard sales commissions, life insurance payouts follow a structured model that extends beyond the first policy sale.

Agents earn in multiple ways, including first-year commissions, renewals, and bonuses based on policy type, premium value, and persistency rates. However, the complexity of these structures often leads to confusion, payment delays, and disputes.

Insurance companies face their own challenges in managing agent commissions. Balancing competitive payouts with profitability, handling clawbacks for lapsed policies, and ensuring transparency in commission calculations are critical to keeping agents engaged while maintaining business efficiency. Without a well-defined system, inaccuracies and inconsistencies can weaken agent trust and impact sales performance.

This blog unpacks the life insurance agent commission system—how rates are determined, the key components of commission structures, and how insurers can streamline payouts for better agent retention and business growth. Whether you’re an agent seeking clarity on earnings potential or a sales leader optimizing commission strategies, this guide provides the insights you need.

The role of life insurance agents

While purchasing life insurance online is convenient, working with a life insurance agent offers personalized guidance and several key advantages. Agents help clients navigate the complexities of life insurance, ensuring they select the right plan based on their unique financial needs and goals.

Life insurance agents play a crucial role in helping clients secure financial protection, and their services extend beyond just selling policies. With life insurance companies paying out over $200 billion in benefits and annuities by 2021, having expert advice can make all the difference in choosing the most beneficial policy. So, why work with a life insurance agent? Because, you get:

- Expert guidance: Agents help clients understand policy options, tax benefits, and premium structures.

- Maximizing benefits: They assist in selecting plans that offer financial security and tax deductions on life insurance premiums.

- Personalized service: Agents simplify the buying process, helping clients compare plans and make informed decisions.

How life insurance commissions work: Structure & payouts

Life insurance commissions vary based on the policy type and the insurance provider. However, most agents earn 60% to 80% of the first-year premium as their commission. In subsequent years, commissions are lower, typically ranging from 5% to 10% of the premium over the policy's lifetime.

In 2023, life insurance companies paid out $55 billion in commissions, making up 6% of total operating expenses, according to the 2024 ACLI Fact Book.

However, if a policyholder lets their policy lapse within the first few years, the insurance company may require the agent to return a portion of their commission, a process known as commission chargeback.

Understanding how commissions work can help aspiring agents gauge their earning potential and the financial risks involved in selling life insurance.

Why agent commissions matter in life insurance

Agent commissions play a crucial role in the life insurance industry, as they are typically a percentage of the policy’s premium. This structure incentivizes agents to promote policies with higher premiums—such as permanent life insurance—which offers lifelong coverage and a cash value component that grows over time.

Compared to term life insurance, permanent policies can have premiums that are six to ten times higher, leading some agents to recommend them even when commission percentages remain the same.

In many cases, life insurance companies offer higher commission rates on permanent policies, making them even more appealing to agents. This is because cash value life insurance requires more ongoing management, including investment monitoring and policy servicing, which increases the insurer’s administrative costs.

However, it's important to note that commissions can impact cash value accumulation, particularly in the early years of a permanent policy. Since these policies are long-term financial commitments, policyholders should consider a 20- or 30-year projection to assess the actual impact of agent commissions on their overall returns.

How much do life insurance agents make?

A career in life insurance sales can be highly rewarding, but how much do agents actually earn? Life insurance agent salaries vary based on experience, commission structures, and location. Below is a breakdown of salary estimates for life insurance agents at different percentiles and experience levels.

Life insurance agent salary by percentile

Life insurance agent salary by experience level

Life insurance agents also have uncapped earning potential, as commissions can significantly boost their income. For a broader look at earnings, including the highest- and lowest-paying states for insurance agents, check out our complete guide on how much insurance agents make.

Ways to minimize commission costs

How life insurance agents get paid?

Wondering how life insurance agents earn their income? The primary way agents make money is through commissions, and the amount they earn can vary based on the policy sold. Typically, agents receive front-loaded commissions ranging from 40% to 115% of the first-year premium, but renewal commissions drop significantly to around 1% to 2%. After the third year, some agents no longer earn commissions on certain policies.

However, commission rates differ depending on the type of life insurance policy sold. Here's a breakdown of what agents can expect based on the policy type:

Whole life insurance commission rates

Whole life insurance policies tend to offer the highest commissions, often over 100% of the total premium in the first year. The exact percentage may depend on the policyholder's age.

Universal life insurance commission rates

For universal life insurance, agents typically earn commissions equal to at least 100% of the first-year premiums up to the target premium amount. Commissions decrease for premiums paid beyond the target level.

Term life insurance commission rates

Term life insurance policies offer the lowest commissions, typically between 30% to 80% of the annual premium.

Life insurance policies are essential in providing financial security for families after the loss of a loved one. The right coverage can help beneficiaries pay off debts, cover loans, and manage ongoing living expenses. To dive deeper into how life insurance works, be sure to check out our comprehensive guide to life insurance.

How agent commissions are calculated

The calculation of life insurance agent commissions depends on multiple factors, including policy type, premium amount, and agent agreements with insurance carriers. Here’s how commissions are typically structured:

- First-year commission: The agent earns a percentage of the first-year premium, usually between 40% to 115%, depending on the type of policy.

- Renewal commissions: After the first year, commissions decrease, usually ranging from 1% to 10% of the premium.

- Chargebacks: If the policy lapses within the first few years, agents may have to repay a portion of their commission.

- Override commissions: In some cases, agency managers or brokers earn a percentage of the commissions from the agents they oversee.

- Bonuses & incentives: Insurance companies often provide performance-based incentives for top-selling agents, which can significantly boost earnings.

By understanding these commission structures, insurance agencies can create fair and motivating compensation plans for their agents.

How Compass helps you automate agent commission calculations

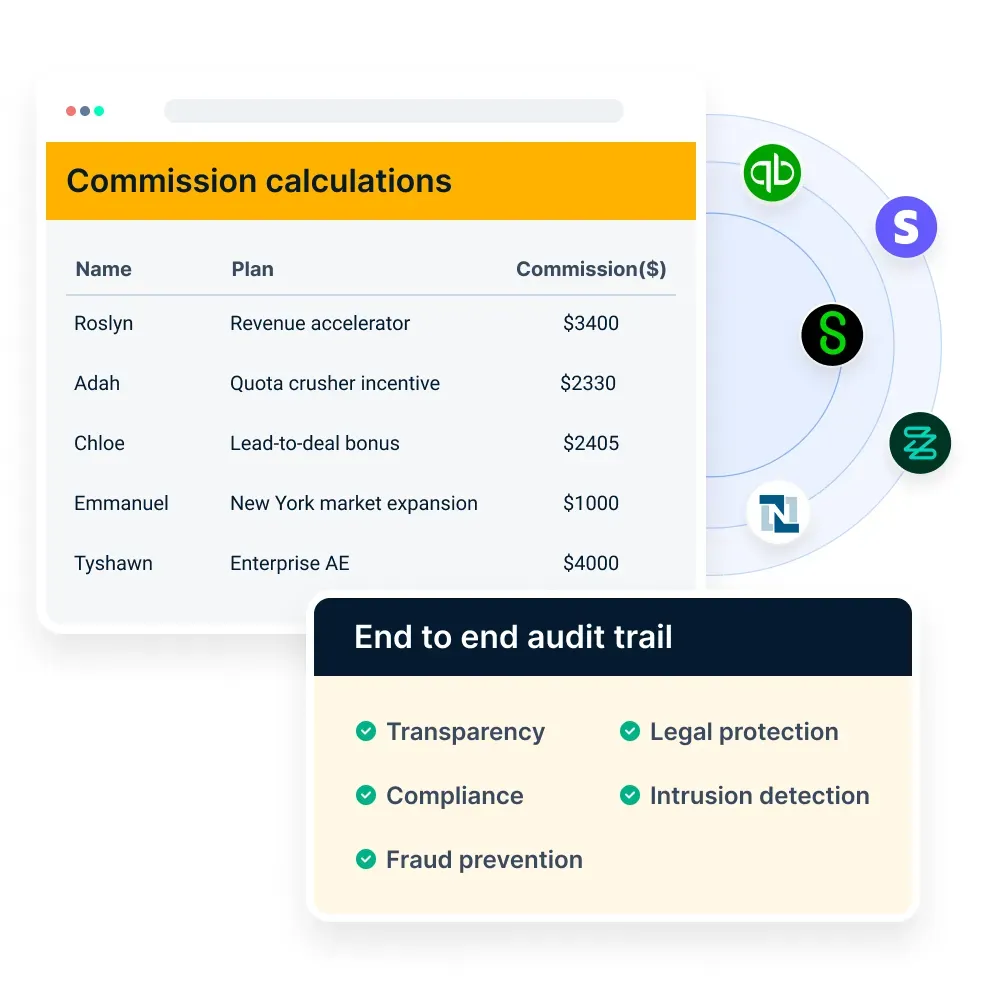

Managing insurance agent commissions manually can lead to errors, delays, and disputes. In the life insurance industry, where commissions are often structured around policy premiums, renewal cycles, and performance-based incentives, ensuring accurate calculations is crucial.

With multiple commission tiers, chargebacks for policy cancellations, and varying payout schedules, sales heads often struggle to maintain accuracy and transparency.

Compass automates commission management, eliminating inefficiencies and providing agents with real-time insights into their earnings.

Here’s how it transforms commission calculations for life insurance companies:

1. Centralized commission tracking for accurate payouts

Life insurance commissions can involve multiple layers—initial commissions, renewal commissions, and performance-based bonuses. Tracking these manually across agents, brokers, and agencies leads to errors and delays.

Compass centralizes all commission-related data in a single dashboard, ensuring that every payout is calculated accurately based on predefined rules. Whether it’s a first-year commission on a whole life policy or a renewal payout for a term policy, Compass automates the process, reducing the risk of miscalculations and discrepancies.

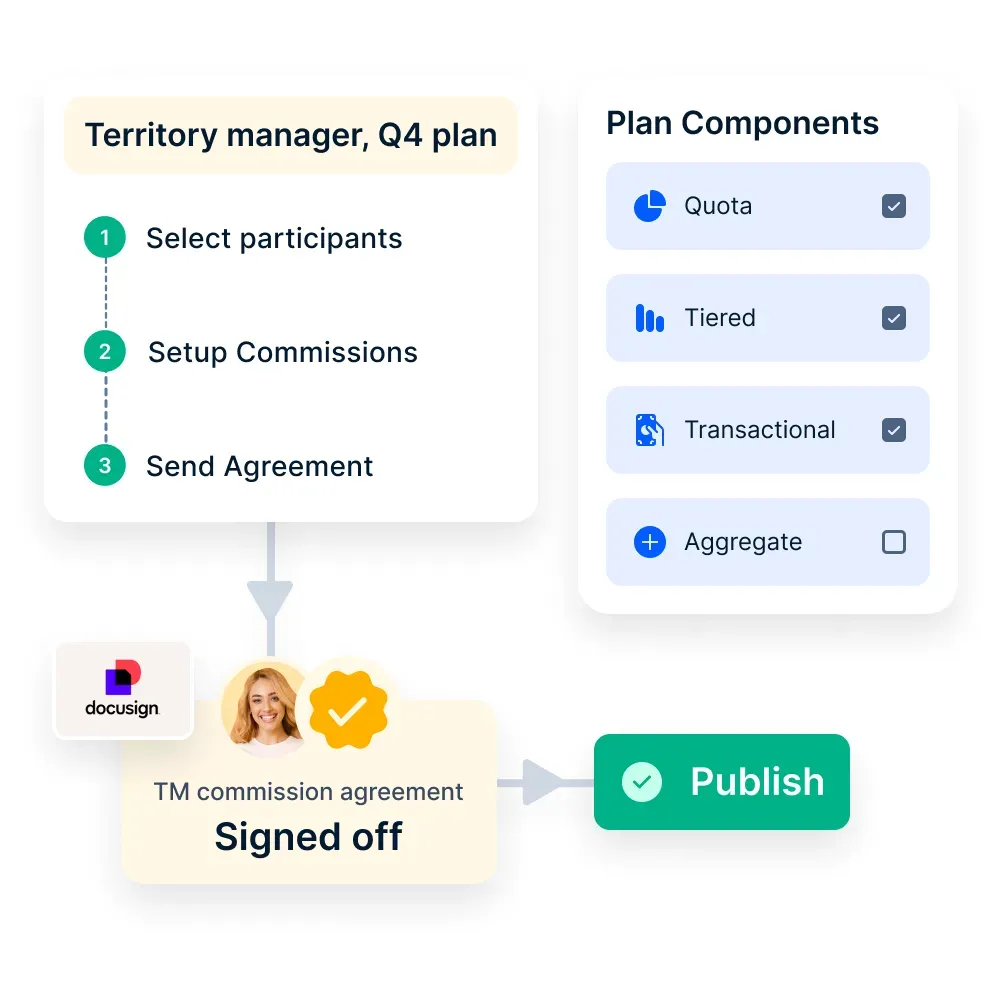

2. Automated commission rules and real-time adjustments

Life insurance companies often have complex commission structures that include different payout rates based on policy type, premium amount, and policyholder tenure. Additionally, chargebacks due to policy cancellations or non-payment can create further complications.

Compass automates these calculations by applying predefined commission rules, ensuring that agents are compensated correctly while adjusting for clawbacks, bonuses, and deductions in real time. This eliminates the need for manual interventions and ensures that commission adjustments are applied fairly and transparently.

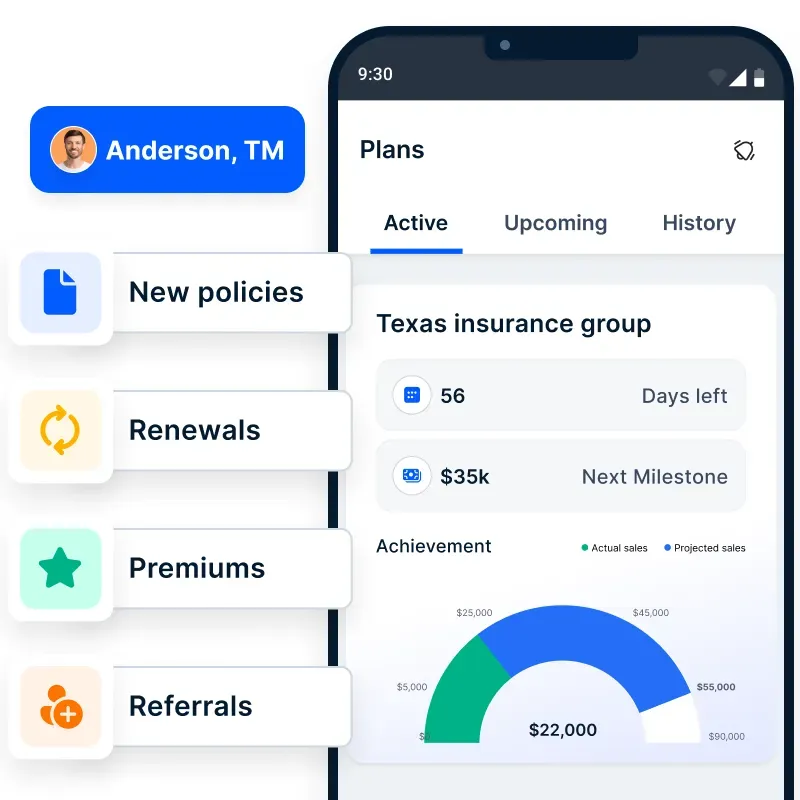

3. Real-time earnings visibility for agents to boost motivation

Lack of transparency in commission payouts can lead to frustration and disengagement among agents. Compass provides agents with a mobile-friendly dashboard where they can access detailed breakdowns of their earnings, upcoming payouts, and any deductions due to cancellations or policy lapses.

This level of visibility allows agents to track their performance, plan their sales strategies, and stay motivated to sell high-value policies. Instead of waiting for commission statements at the end of the month, agents get instant access to their earnings, reducing disputes and increasing trust in the system.

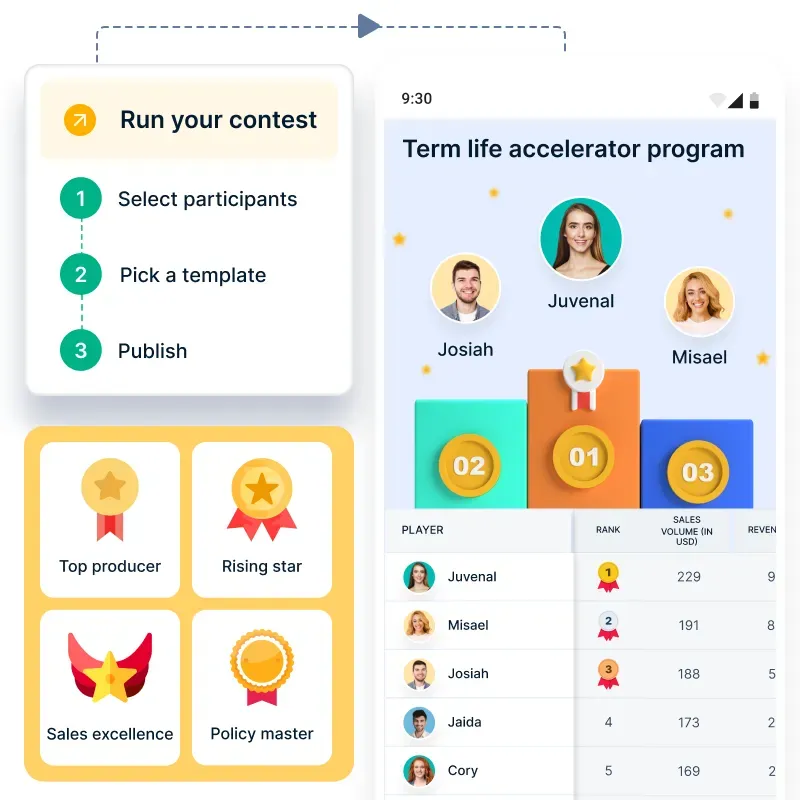

4. AI-powered insights for optimizing sales and incentives

Sales heads in life insurance companies need more than just commission tracking—they need data-driven insights to optimize incentive structures and improve agent performance.

Compass provides AI-powered analytics that offer real-time insights into sales trends, commission payouts, and agent productivity. By identifying top-performing agents and assessing the effectiveness of different commission models, sales teams can make data-backed decisions to refine incentives and drive higher policy sales.

These insights also help in adjusting commission rates based on policy profitability, ensuring that the company maximizes revenue while keeping agents engaged.

A smarter way to manage life insurance commissions

By automating commission calculations, Compass helps life insurance companies streamline payouts, reduce errors, and enhance agent satisfaction. With a centralized system, real-time transparency, and AI-driven insights, sales heads can focus on driving revenue growth rather than dealing with commission disputes.

Curious about how Compass can transform your payouts? Talk to our experts today!

What affects life insurance agent’s earnings?

Several factors influence how much a life insurance agent can earn:

- Type of Agent: Captive agents simplifies work exclusively for one insurance carrier and generally earn lower commissions. Independent agents, who represent multiple insurance companies, often earn higher commissions but are responsible for business expenses like office rent and marketing.

- Type of Policy: Whole life and universal life policies typically provide higher commission rates than term life policies. However, if policyholders stop paying premiums within the first few years, agents may need to repay a portion of their commissions.

- Location: Commissions and opportunities can vary by location. States have different regulations that impact agent earnings, and larger cities generally provide more opportunities to sell life insurance policies than smaller towns.

Wrapping up with key takeaways

The insurance sector employs a whooping 338,000 people as of 2021 and an additional 48,300 openings are expected to come along each year.

There is a projected growth of 8 percent in the insurance industry job sector and with the ever-so-high demand for life insurance products, agents can bag up a good salary and commission structure if they grab the opportunity now.

As a new hire in an insurance carrier, you will need to build your personal and communication skills along with market knowledge to tap into the right clientele. But once agents get into the process of selling more and more policies, referrals and recommendations can help gain more popularity and build sales.

Having an honest and transparent relationship with clients is of foremost importance as it improves your image in the market and helps you sell more policies and earn more commission eventually.

FAQs

Are life insurance agents salaried employees?

In addition to commission-based agents, some life insurance agents are salaried employees at insurance agencies. These agents receive a fixed salary and benefits but may also need to meet monthly sales quotas to earn bonuses or additional compensation.