In questa pagina

As the battle to attract and retain top talent intensifies, pay mix is a differentiator when candidates choose between equal value offers.

Pay mix is not just about numbers; it's about crafting the perfect package of base pay, perks, and rewards that inspire employees to deliver results that move the needle.

But how does one crack the code to calculate the ideal pay mix?

In this article, we will discuss pay mix, how to calculate it, the importance of the right pay mix in driving employee motivation, industry benchmarks, role-specific nuances, and more.

What is Pay Mix?

Pay mix is the ratio between an employee’s fixed salary (base pay) and variable pay (which includes incentives, commissions, or bonuses). It signifies how much of an employee’s total compensation is guaranteed versus performance based. The pay mix is generally created using role complexity, sales cycle length, and company maturity.

For instance, commission-based salary is a major component of salespeople's salaries.

Let’s understand this with an example. Assume that a sales professional has a pay mix ratio of 70:30, meaning 70% of an employee’s compensation is fixed salary, while 30% is variable pay based on the deals they close.

How To Calculate Pay Mix?

Pay mix is typically expressed as base salary %/ variable pay % as a percentage of an employee’s total on-target earnings (OTE).

Further breakdown of the pay mix formula:

- Base salary % = (base Salary ÷ OTE) × 100

- Variable pay % = (on-target Commission ÷ OTE) × 100

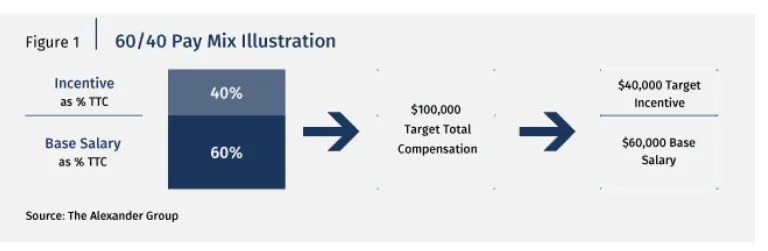

For example, if a sales rep has a base salary of $60,000 and an OTE of $100,000, the pay mix calculation would be:

- Fixed pay: (60,000 / 100,000) * 100 = 60%

- Variable pay: (40,000 / 100,000) * 100 = 40%

- Pay mix = 60: 40

Establishing the Right Pay Mix

As the fight to hire and retain top talent gets fiercer, having the right pay mix becomes crucial in crafting a competitive compensation strategy.

The right pay mix is a thoughtful combination of base salary, benefits, incentives, and bonuses that motivates the right behaviors and helps organizations achieve their goals.

Here are some key considerations to keep in mind when determining the optimal pay mix for your organization:

1. Industry standards

Understand the prevailing pay practices within your industry to ensure your pay mix remains competitive and attractive to potential candidates. Conduct regular benchmarking exercises to stay informed about current trends.

This data will help you understand the base-to-variable compensation ratios within your industry and region, providing a strong foundation for establishing a competitive pay-mix.

Be mindful of any regulations that might be prevalent in your industry. Some industries have specific rules around commission structures, like ensuring pay is not tied to quotas in a way that encourages unethical behavior.

2. Role-specific considerations

Different roles require different pay structures to drive employees to achieve their goals effectively.

Let’s understand this with an example of the pay-mix for a typical sales organization. Here are some key roles you have in a sales team along with the suggested pay-mix:

- Hunters (New Business Sales Reps) → Typically have a higher commission mix to encourage aggressive pipeline generation.

- Farmers (Account Managers, Customer Success Managers) → Lean toward higher base salaries with performance incentives tied to renewals and expansions.

- Sales Engineers & Technical Experts → Often have 80/20 or 90/10 structures, reflecting their role in supporting deals rather than directly closing them.

3. Sales cycle and product complexity

Organizations must also consider the length of their deal cycles and the complexity of their products or services when deciding their pay mix.

For short sales cycles & high transaction volume (e.g., SaaS, retail, inside sales), the pay mix should gear towards a higher commission-heavy structure (e.g., 50/50 or 60/40) so that employees drive more volume.

On the other hand, for longer sales cycles and complex enterprise deals, higher base salaries (e.g., 70/30 or 80/20) are preferred to sustain reps through extended closing periods and avoid job dissatisfaction.

4. Company health and long-term sustainability

Your business objectives should dictate your pay mix strategy. For example, a high-growth company looking to expand its market share may offer higher commission structures to encourage aggressive selling.

Established organizations with complex sales cycles may lean toward higher base salaries to support consultative selling and long-term relationship building.

Higher commissions might be manageable if you’re in a growth phase with lots of capital to reinvest in sales. A more balanced or base-heavy mix might make more sense if money is tight.

Striking a balance between short-term rewards and benefits that promote employee well-being and development can help create a robust and enduring compensation structure.

A pro tip is to leverage sales performance management software, which can help you increase your sales revenue by offering automated incentive compensation, advanced commission budgeting, and other features.

5. Employee preferences

Every individual has unique preferences when it comes to compensation. A poorly structured pay mix can lead to burnout, disengagement, or high turnover.

Take into account your workforce's diverse needs and priorities, and tailor the pay mix to balance financial rewards and non-monetary benefits. Offering flexible tools to automate commission plans will help boost sales rep motivation.

6. Communication and transparency

Transparent communication about the pay mix and how it aligns with organizational goals can help build employee trust and engagement. Clearly articulate the rationale behind the compensation decisions and provide opportunities for feedback to foster a culture of openness and fairness.

By carefully considering these key factors, you can design a compelling compensation package that attracts top talent, motivates employees, and drives organizational success.

Common pay mix models

Understanding Pay Mix Benchmarks

Pay mix ratio varies significantly across industries and countries. It depends on market maturity, attitude toward risk, and economic stability.

Let’s look at pay mix benchmarks as per countries. The Alexander Group has established global benchmarks to categorize countries by risk tolerance levels and align pay mix structures accordingly.

Countries are segmented into three risk tolerance groups:

- High-risk tolerance: Countries where variable compensation comprises a larger portion of total earnings, reflecting a strong emphasis on pay-for-performance.

- Moderate-risk tolerance: Countries with a balanced approach, offering a near-equal split between base salary and incentives.

- Low-risk tolerance: Countries that prioritize stability, with a higher base salary and a lower proportion of variable compensation.

Some common sales roles in different countries are analyzed to define industry benchmarks. According to the Sales Compensation Trends Survey, the United States falls into the high-risk tolerance group, and account managers typically have a pay mix between 40/60 and 50/50 whereas China, on the other hand, has a low risk tolerance with an average pay mix of 63/37.

Setting Pay Mix for Each Job and Country Group

Aligning pay mix structures across industries requires balancing market competitiveness with cultural expectations around compensation.

To establish a structured pay mix approach, classify sales roles into three broad job persuasion groups, based on individual influence on final output and market practices:

- Job Group 1: High-influence, revenue-driving roles such as Named Account Managers

- Job Group 2: Moderate-influence, relationship-based roles (Global Account Managers)

- Job Group 3: Low-influence, transactional roles (e.g., Inside Sales Representatives)

By cross-referencing job persuasion groups with country risk tolerance groups, you can derive a pay mix matrix that aligns sales compensation across global markets.

Table: Pay Mix Matrix

Leveraging The Right Sales Commission Management Tool

Designing the right pay mix is not just a compensation strategy—it’s a tool for attracting top talent, driving performance, and ensuring long-term business success. Factors such as industry benchmarks, role-specific nuances, company maturity, and market risk tolerance play a role.

Any organization can make this process easy by using the right tool, such as Compass.AI. This tool provides AI-driven insights to help businesses analyze compensation, has multiple payroll integrations, builds and automates workflows, and makes the process more rewarding and enjoyable for sales reps.

Book a demo today!