Le commissioni dei broker ipotecari negli Stati Uniti: come funzionano e cosa aspettarsi

Discover how mortgage brokers earn commissions, the types of fees involved, industry regulations, and how borrowers can optimize costs when securing a home loan.

In questa pagina

Assicurare un mutuo è una decisione finanziaria importante che spesso richiede la competenza di un broker ipotecario. Questi professionisti fungono da intermediari tra i mutuatari e gli istituti di credito, aiutando gli individui a trovare le opzioni di prestito più adatte.

Sebbene i broker ipotecari forniscano servizi preziosi, è fondamentale che i mutuatari comprendano come questi professionisti vengano remunerati. Negli Stati Uniti, le commissioni dei broker ipotecari svolgono un ruolo fondamentale nel processo di mutuo.

Chi sono i broker ipotecari?

A mortgage broker is a financial professional who acts as an intermediary between individuals or businesses seeking a mortgage loan and the lenders who provide the funds for the loan.

Mortgage brokers help borrowers navigate the complex process of securing a mortgage by connecting them with lenders that offer suitable loan products based on their financial situation and needs.

Capire le commissioni dei broker ipotecari

Le commissioni dei broker ipotecari sono compensi pagati ai broker per i loro servizi nel facilitare il processo di richiesta e approvazione del mutuo. Negli Stati Uniti, queste commissioni si presentano in genere in due forme: commissioni iniziali e commissioni correnti.

1. Spese anticipate

- Commissione di accensione: Si tratta di una commissione iniziale comunemente addebitata dai broker ipotecari. Di solito è una percentuale dell'importo del prestito e può variare dallo 0,5% all'1,5%. La commissione d'apertura compensa il broker per l'elaborazione della domanda di prestito, la valutazione dell'affidabilità creditizia del mutuatario e il coordinamento con l'istituto di credito.

- Loan discount points: Borrowers may also encounter loan discount points, which are upfront fees paid to reduce the interest rate on the mortgage. Each point typically costs 1% of the loan amount and can result in a lower interest rate, potentially saving money over the life of the loan.

2. Spese correnti

- Yield Spread Premium (YSP): While less common today, YSP is a commission paid by lenders to brokers for securing a loan with a higher interest rate than the borrower qualifies for. This practice has been subject to scrutiny, and regulations have been implemented to ensure that brokers act in the best interests of the borrower.

- Commissioni di scia: In alcuni casi, i broker ipotecari possono ricevere commissioni continue, note come commissioni di scia, per tutta la durata del mutuo. Queste commissioni si basano sul saldo residuo del mutuo e incentivano i broker a mantenere un rapporto a lungo termine con il mutuatario.

Negli ultimi anni, le modifiche normative hanno mirato ad aumentare la trasparenza nel settore dei mutui e a proteggere i consumatori. Il Dodd-Frank Wall Street Reform and Consumer Protection Act, ad esempio, impone ai broker ipotecari di comunicare ai mutuatari i loro compensi. Ciò include il dettaglio delle commissioni di accensione, dei punti di sconto e di qualsiasi altra commissione associata al prestito.

Quanto guadagnano i broker ipotecari?

The annual earnings of a mortgage broker can vary depending on their location and the volume of business they conduct. Typically, their compensation is a percentage of the mortgage amount, making regions with high home prices more lucrative as borrowers in such areas often require larger loans.

Established and proactive mortgage brokers who engage in numerous transactions tend to earn more compared to those who are new to the field or work part-time.

Diverse piattaforme e risorse online forniscono una serie di guadagni medi per i mediatori ipotecari dipendenti a partire da aprile 2023:

- According to Indeed, national average base salary for mortgage brokers is $98,162 per year, with some receiving additional commissions. In specific areas like the San Francisco Bay area, the average salary was notably higher at $141,240, although based on a small sample size of just three brokers.

- PayScale reports an average salary of $64,630 for mortgage brokers based on 57 reports, with commissions ranging from $12,000 to $178,000. Those with less than one year of experience had an average total compensation of $47,000, while those with over 20 years of experience averaged $69,000. These figures are derived from relatively small sample sizes.

- Glassdoor indicates an average base salary of $136,620 for mortgage brokers, with a range from $111,000 to $352,000. Additional compensation, including cash bonuses, commissions, tips, and profit-sharing, is estimated at $55,484 per year.

- Lastly, ZipRecruiter reports a national average mortgage broker salary of $129,346, with a range spanning from $11,500 to $297,500.

È importante notare che queste cifre sono medie e possono essere influenzate da vari fattori, tra cui la posizione geografica, il livello di esperienza e le circostanze specifiche dei singoli broker.

How mortgage brokers profit from transactions?

Mortgage brokers predominantly earn a commission based on the loan amount, usually ranging from 1% to 2%. This commission can be paid by either the borrower or the lender, and it is typically around 2% of the loan value. Larger loans result in higher commissions for brokers, creating a financial incentive for them to secure larger loan amounts for their clients.

Since a mortgage broker's income is commission-based, it is directly tied to the transaction value. For instance, a broker charging a 2% rate on a $250,000 loan would earn $5,000.

However, factors such as the local real estate market and the broker's experience level can significantly impact their annual earnings. According to ZipRecruiter, the average annual salary for a mortgage broker in different states varies, with factors like demand and experience playing a crucial role.

While mortgage brokers provide valuable services in simplifying the loan process, borrowers should be aware of potential fees. One way to mitigate costs is by obtaining multiple mortgage quotes from different lenders.

According to a 2018 Freddie Mac report, borrowers can save an average of $3,000 over the life of the loan by securing at least five quotes. If a broker's commission exceeds this potential savings, borrowers may consider exploring alternatives with different fee structures.

Come vengono pagati i broker ipotecari?

The payment to mortgage brokers can take various forms, including cash or an addition to the loan balance. If the borrower is responsible for the fee, it is paid at the loan closing.

However, if the lender covers the cost, it may be rolled into the overall loan amount, meaning the borrower still bears the financial burden. As fee structures vary among brokers, borrowers are advised to thoroughly understand the terms before committing to a specific broker.

What affects a mortgage broker's pay?

Mortgage brokers typically earn a base salary along with a commission that varies based on several factors, including loan terms, client agreements, and market conditions.

1. The terms of the loan

On average, mortgage brokers charge a commission of 2% to 2.5% per loan. However, federal regulations prohibit brokers from charging more than 3% of the total loan amount. For example, if a mortgage broker charges 2.25% on a $500,000 loan, they would earn $11,250 in commission.

2. The agreement with the client

Mortgage brokers can work for either borrowers or lenders, and their fees depend on these agreements. Lenders generally pay higher commissions than borrowers. When lenders compensate brokers, they typically pay between 0.5% and 2.75% of the total loan amount. If borrowers pay, brokers charge an origination fee, which is usually less than 3% of the loan amount.

3. The housing market

The local housing market also influences mortgage broker commissions. In highly competitive markets, brokers may lower their commission rates to attract more clients. In contrast, in less competitive markets with fewer options, brokers might charge higher fees.

Calcolo delle commissioni dei broker ipotecari

Vediamo un esempio di come potrebbe essere calcolata la commissione di un broker ipotecario.

1. Loan amount: $300,000

2. Interest rate: 4%

3. Loan term: 30 years

Where,

- Loan amount: This is the total amount of money borrowed by the borrower.

- Interest rate: The interest rate is the percentage of the loan amount that the borrower pays as interest to the lender over the life of the loan.

- Loan term: The loan term is the number of years over which the loan will be repaid.

Commission structure

Broker's commission rate: 1% of the loan amount

Calculation:

1. Loan amount: $300,000

2. Commission rate: 1%

3. Commission amount: Commission Rate * Loan Amount

Commission amount = 0.01 * $300,000

Commission amount = $3,000

Quindi, in questo esempio, il broker ipotecario guadagnerebbe una commissione di 3.000 dollari per aver facilitato il prestito ipotecario di 300.000 dollari con un tasso di commissione dell'1%.

It's important to note that commission structures can vary, and some brokers may also receive additional bonuses or incentives based on factors like loan volume or client satisfaction.

Additionally, brokers may receive commissions from both the borrower and the lender, or they may charge fees to the borrower in addition to or instead of a commission. Always refer to the specific terms of the agreement between the broker and the lender for accurate calculations.

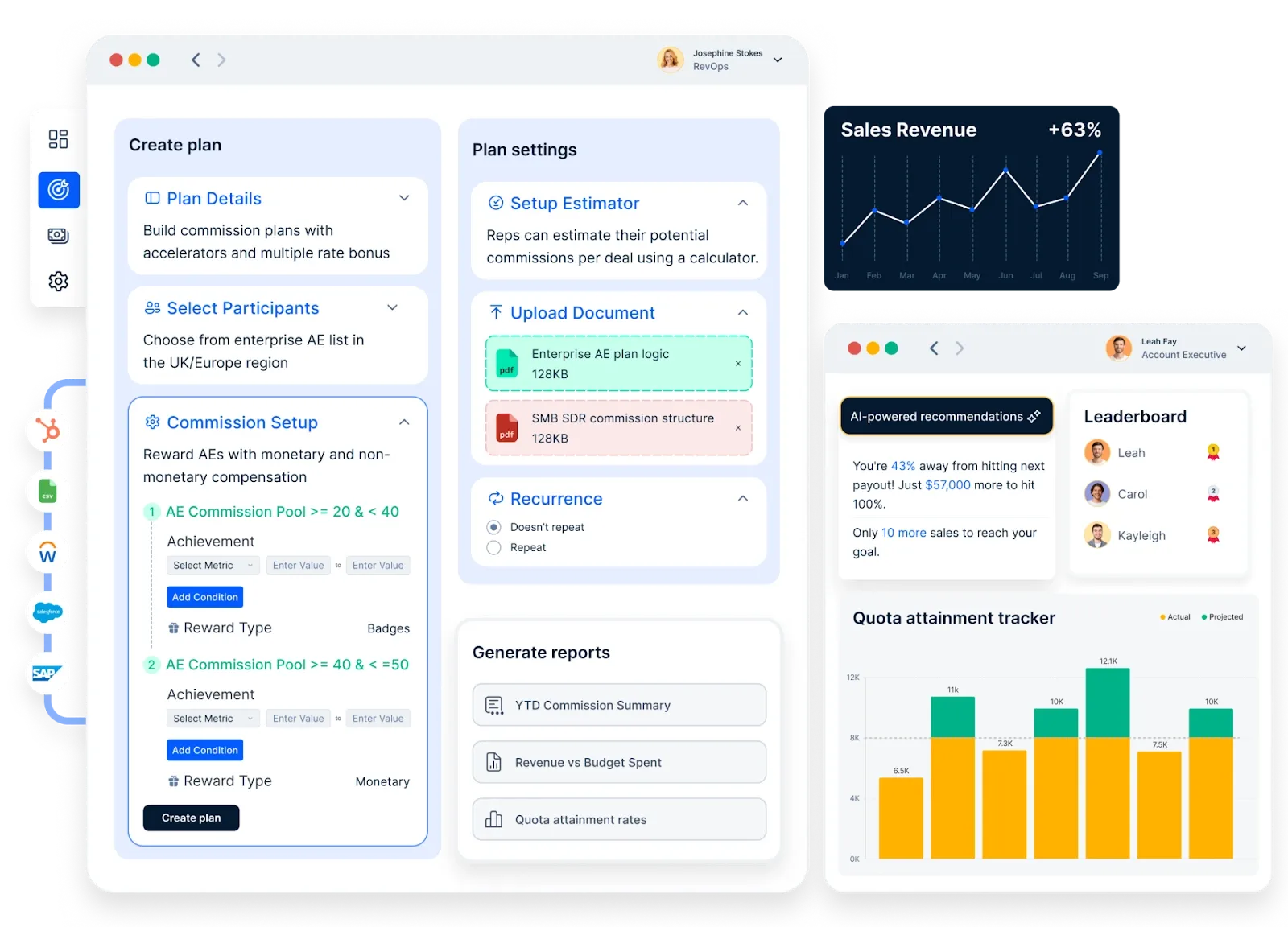

How can Compass simplify Mortgage Broker commission calculation?

Here is how Compass, mortgage commission automation software, that might simplify mortgage broker commission calculations:

- Integrazione con i sistemi ipotecari: Compass potrebbe integrarsi con vari sistemi legati ai mutui, come il software di creazione dei prestiti e gli strumenti di gestione delle relazioni con i clienti (CRM), per accedere ai dati rilevanti per il calcolo delle commissioni.

- Strutture di commissione personalizzabili: La piattaforma potrebbe consentire ai broker ipotecari di impostare e personalizzare le strutture delle commissioni in base agli accordi con i diversi istituti di credito. Questa flessibilità garantisce che i calcoli siano in linea con i termini specifici di ciascun rapporto di prestito.

- Automazione dei processi di calcolo: Compass può automatizzare il calcolo delle commissioni, riducendo la necessità di inserimento manuale e minimizzando il rischio di errori. L'automazione garantisce che i calcoli vengano eseguiti in modo coerente ed efficiente.

- Aggiornamenti dei dati in tempo reale: Accedendo ai dati in tempo reale, Compass può fornire calcoli delle commissioni accurati e aggiornati. Questo è fondamentale in un mercato ipotecario dinamico in cui i tassi e le condizioni possono cambiare frequentemente.

- Gestione della conformità: La piattaforma può incorporare funzioni di conformità per garantire che i calcoli delle commissioni siano conformi alle normative e agli standard del settore. Questo aiuta i broker ipotecari a rispettare i requisiti di legge.

- Rendicontazione trasparente: Compass potrebbe offrire strumenti di rendicontazione che forniscono informazioni dettagliate sui guadagni delle commissioni. Rapporti chiari e trasparenti aiutano i broker ipotecari a capire come vengono calcolate le commissioni e forniscono una base per la comunicazione con i clienti e i finanziatori.

- Riduzione degli errori: Grazie all'automazione e ai meccanismi di convalida, Compass potrebbe contribuire a ridurre la probabilità di errori nel calcolo delle commissioni, minimizzando il rischio di discrepanze finanziarie e controversie.

- Ottimizzazione del flusso di lavoro: Compass può snellire il flusso di lavoro complessivo delle commissioni, dall'inserimento dei dati alla distribuzione dei pagamenti. Questa ottimizzazione può far risparmiare tempo ai broker ipotecari, consentendo loro di concentrarsi sulla creazione di relazioni con i clienti e sulla crescita della loro attività.

- Integrazione con i sistemi contabili: La piattaforma potrebbe integrarsi perfettamente con i sistemi contabili, facilitando il trasferimento dei dati sulle commissioni per la gestione finanziaria e la rendicontazione.

Conclusione

Per orientarsi nel mondo delle commissioni dei broker ipotecari negli Stati Uniti è necessario comprendere chiaramente le varie commissioni e il loro impatto sul costo complessivo di un mutuo. Con la continua evoluzione delle normative, i mutuatari possono aspettarsi una maggiore trasparenza e protezione. Quando si lavora con un broker ipotecario, una comunicazione aperta sulle commissioni e sui compensi è fondamentale per garantire una partnership di successo e reciprocamente vantaggiosa.

Domande frequenti

1. Do mortgage brokers earn more than loan officers?

Mortgage brokers and loan officers both play pivotal roles in facilitating home loans, but their compensation structures differ. Mortgage brokers typically earn commissions by connecting borrowers with suitable lenders, while loan officers, employed by specific financial institutions, may receive a combination of salary and performance-based bonuses.

According to data from April 2023, mortgage brokers have an average base salary of $58,304, whereas mortgage loan officers have an average base salary of $49,369. However, total earnings for both can vary based on factors like experience, location, and transaction volume.

2. Do mortgage brokers need a license?

Yes, mortgage brokers are required to be licensed to operate legally. In the United States, the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) mandates that mortgage brokers complete pre-licensing education, pass a national exam, and fulfill annual continuing education requirements. Licensing ensures that brokers adhere to industry standards and regulations.

3. How can I ensure a mortgage broker is legitimate?

To verify the legitimacy of a mortgage broker:

- Check licensing: Use the Nationwide Multistate Licensing System (NMLS) Consumer Access portal to confirm the broker's licensing status and review any disciplinary actions.

- Review credentials: Ensure the broker has relevant experience and professional affiliations.

- Seek recommendations: Consult friends, family, or real estate professionals for referrals to reputable brokers.

- Assess transparency: A trustworthy broker will clearly explain fees, loan options, and the lending process.

- Read reviews: Look up online reviews and ratings to gauge the broker's reputation and client satisfaction.

4. How much do mortgage brokers make in commission?

Mortgage brokers typically earn commissions ranging from 0.5% to 2.75% of the total loan amount. For instance, on a $300,000 mortgage, a broker might earn between $1,500 and $8,250. The exact percentage can vary based on the broker's agreement with the lender, the complexity of the loan, and regional market conditions.

5. How much do brokers charge for commission?

The commission charged by mortgage brokers generally falls between 0.5% and 2.75% of the loan amount. This fee is often paid by the lender, the borrower, or a combination of both, depending on the agreement. It's essential for borrowers to discuss and understand the fee structure upfront to avoid any surprises at closing.