Insurance Agent Commission: What It Is and How It Works?

Learn how insurance agents earn through commissions, bonuses, and renewals. Understand insurance agent commission rates and factors affecting their income.

On this page

Managing insurance agent commissions goes beyond just calculating payouts—it’s about creating a system that keeps agents motivated, ensures accuracy, and drives higher policy sales. With different commission structures, varying rates based on insurance type, and multiple sales channels involved, handling commissions efficiently can be complex for insurance companies.

Sales leaders must balance competitive commission rates with business profitability while ensuring agents stay engaged and incentivized to sell high-revenue policies.

A well-structured commission model plays a critical role in maintaining agent loyalty and performance. Understanding how commission rates are determined, the factors that influence them, and the essential components of commission structures helps businesses design an efficient and transparent payout system.

Whether it’s life, health, or property insurance, commission structures vary, impacting how agents approach sales.

This guide breaks down how insurance commission rates work, the key elements that shape commission structures, and how companies can optimize their payout models.

Plus, we’ll explore how modern commission management solutions can streamline the process, reduce errors, and improve transparency—helping sales heads and agents work more efficiently.

Type | First Time | On Renewal |

Health Insurance | 5% to 10% | 1% to 2% |

Life Insurance | 40% to 120% | 1% to 2% |

Home Insurance | 5% to 15% | 2% to 5% |

These might look simple, but understanding the factors and concepts underlying these commissions gives complete insight into the insurance agent commission.

Whether you’re a sales head looking to optimize payouts or an agent seeking clarity on earnings, this guide will help you navigate insurance commissions effectively.

Below, we break down commission structures, rates, and key factors affecting agent earnings, so you can design a competitive and profitable commission system.

How do insurance commission rates and commission structures work?

Insurance commission rates differ based on the insurance carrier and policy type. Let's explore how insurance commissions generally work.

Since an insurance agent's income is primarily commission-based, setting an annual income target is crucial. Based on the previous example, consistent selling could generate over $48,000 in commissions during the first year. Many recruiters find this is a reasonable goal. Agents aiming for higher earnings can simply increase their sales efforts to achieve their goals.

Some carriers provide bonuses to new agents to support their income and encourage strong performance, recognizing that the initial year can be challenging.

One key advantage some carriers offer is immediate commission payments upon policy issuance. This means you receive a portion of your insurance commissions as soon as coverage begins, rather than waiting for the policyholder to make payments. This can significantly improve cash flow for new insurance agents.

Insurance agent commission rates based on insurance type in the USA

Insurance agent commission rates in the USA can vary widely depending on the type of insurance, the insurance company, the agent's experience, and the specific policies sold. Here are some general guidelines for common types of insurance:

Insurance Type | Commission Structure | Example |

Life Insurance | 40%-100% of first-year premium, lower renewals | $5,000 policy, 70% commission = $3,500 |

Health Insurance (Individual Market) | Average $170.76 per member annually | Varies by market segment and region |

Property & Casualty Insurance | 10%-20% of premium for new policies, lower renewals | $1,000 Auto Policy: Captive agent starts at $100, Independent agent earns $150 each year |

Commercial Insurance | 10%-15% or more of the premium | Based on policy complexity and size |

Annuities and Investments | 1%-7% of invested amount | Varies by product and terms |

Medicare/Long-Term Care Insurance | 15%-25% or more of the premium | Medicare Advantage: $600-$700 per plan, renewals $300-$400. Medicare Part D: Up to $100, lower renewals. |

Motivated, incentivized insurance agents are better performers. Insure against low sales productivity with Xododay Compass. An automated commissions platform can now easily manage and track commission programs and team KPIs.Want to know how? Talk to our commission expert.

5 Components of insurance commission structures

Here are a few components that you might need to know:

1. Base commission

The basic commission that an agent gets from an insurance company when a policy is successfully sold is base commission. It is the primary source of income an agent receives, irrespective of how well they close deals; a salesperson always gets paid this set amount of money.

2. Renewal commissions

If a client renews their contract, a salesperson receives a renewal commission. This ongoing commission promotes consistent service and encourages agents to uphold long-term client connections.

3. Performance-based bonuses

Extra incentives given to agents in response to hitting predetermined goals, performance benchmarks, or sales targets. These incentives encourage agents to perform above and beyond expectations.

4. Retention bonuses

Bonuses given to agents for retaining customers and making sure policyholders keep their insurance for long periods are retention bonuses. This motivates agents to concentrate on maintaining and satisfying their clientele.

5. Supplementary commissions

Agents who meet certain requirements imposed by the insurance company and sell specialized insurance products are eligible for this additional pay. These additional commissions act as an added incentive for selling particular kinds of policies.

Accelerate policy sales with commission automation

Motivated, incentivized insurance agents are better performers. Insure against low sales productivity with Xododay Compass. An automated commissions platform can now easily manage and track commission programs and team KPIs. Want to know how? Talk to our commission expert.

What factors impact how much insurance agents earn?

Commission structures play a major role in how insurance agents earn, but other factors also influence their income. These include:

1. Type of agent

There are two types of insurance agents:

- Captive agents sell policies for one insurance provider.

- Independent agents work with multiple insurance carriers.

Independent agents usually earn higher commissions, but they also cover their own business expenses, such as rent, office supplies, and marketing.

2. Type of policy

Insurance agents can specialize in one or multiple policy types. For example, a home insurance agent might also sell auto insurance. Life insurance agents can expand into health insurance. To do so, they must meet licensing requirements in their jurisdiction.

3. Location

Where an agent operates affects their earning potential. A large city with a high population offers more sales opportunities than a small town. Other location-based factors include:

- Access to public services

- Cost of living

- Employment rates

- Public safety and accident rates

These elements shape market demand and influence how much insurance agents make.

How much do insurance agents make?

Insurance agents' salaries vary. The Bureau of Labor Statistics (BLS) reports an average annual salary of $79,650, or $37 per hour. Entry-level positions typically pay less. Experienced agents with strong client bases can achieve six-figure incomes. This data includes various insurance types. These encompass property and casualty, life and health, among others. The BLS estimates 455,540 insurance agent jobs.

The following table presents detailed wage percentiles for insurance agents. This is based on the latest BLS Occupational Employment and Wage Statistics (OEWS). It offers insights into potential earnings at different levels.

Percentile | Annual Wage |

10th | $38,210 |

25th | $51,200 |

50th (Median) | $65,580 |

75th | $99,840 |

90th | $128,660 |

Common challenges faced by sales heads in managing insurance agent commissions – and how Compass solves them

Sales leaders in the insurance industry face several roadblocks when managing agent commissions. With multiple policy types, complex payout structures, and a mix of direct agents, brokers, and independent agencies, ensuring accuracy and motivation becomes a daunting task.

Errors in commission payments, disputes over deductions, and a lack of engagement tools can lead to high agent churn and lost revenue opportunities. Compass simplifies commission management by automating payouts, improving transparency, and introducing gamification to boost sales performance.

Here’s Compass tackles key challenges:

1. Data inaccuracy and payment disputes

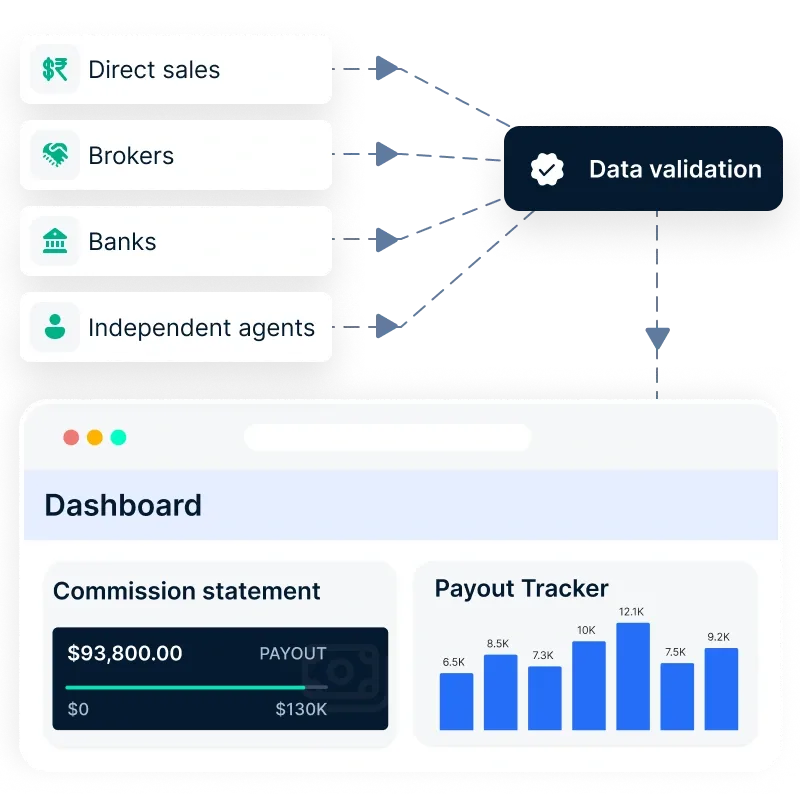

Tracking commissions manually using spreadsheets often results in miscalculations, incorrect payouts, and inconsistent attribution across different sales channels. Agents who receive incorrect commissions may lose trust in the system, leading to an increase in disputes and a decrease in motivation. Resolving these disputes can be time-consuming for sales heads, diverting attention from core sales activities.

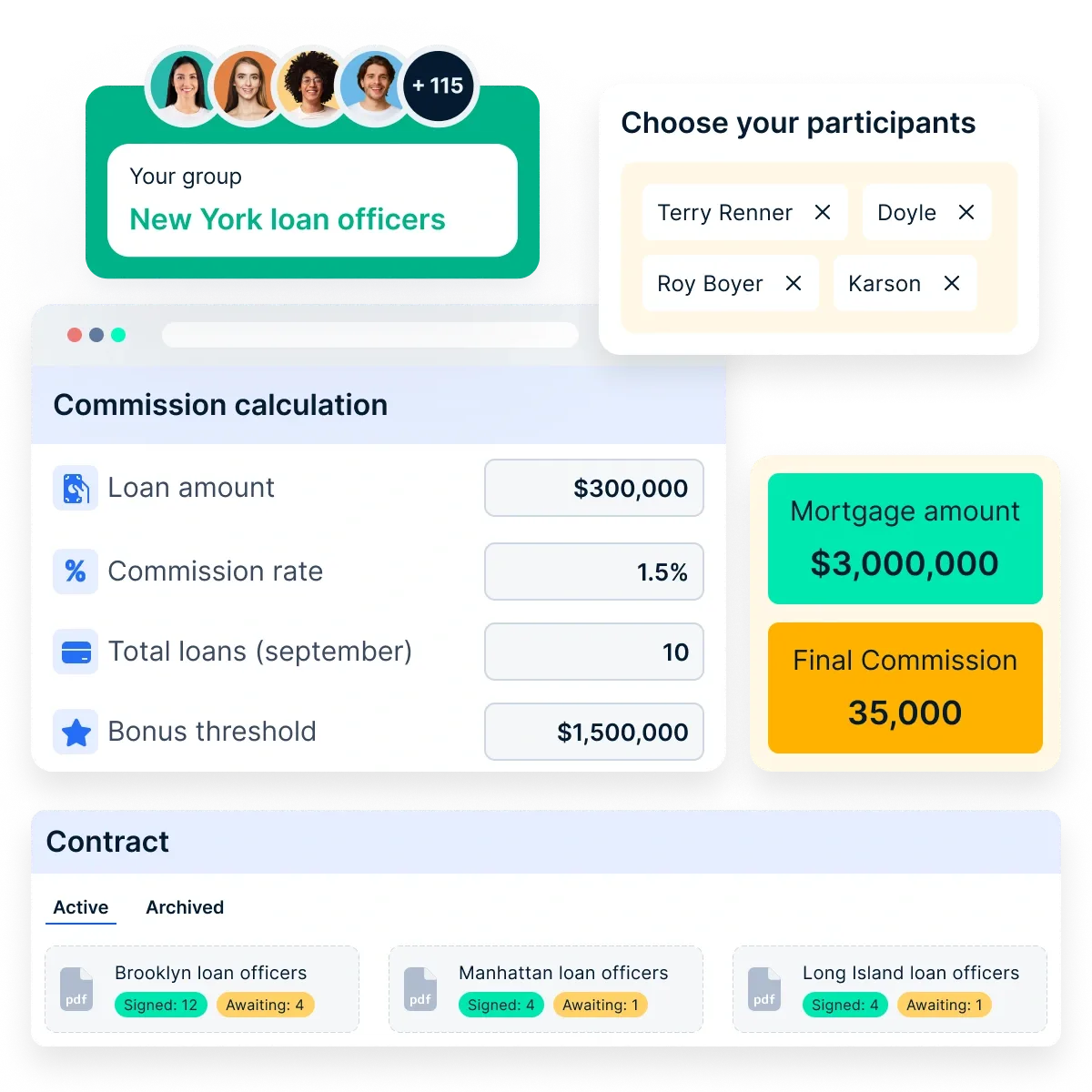

Compass solution: Compass eliminates the need for spreadsheets by centralizing commission tracking on a single dashboard. Automated calculations ensure that every policy sale is accurately attributed, reducing payment errors. Agents receive real-time updates on their earnings, reducing disputes and fostering trust in the commission structure.

2. Managing clawbacks and chargebacks

One of the most challenging aspects of commission management is clawbacks—retrieving commissions paid for policies that get canceled or found to be misrepresented. Handling these manually can be inefficient and prone to errors, leading to overpayment or strained relationships with agents. Unclear clawback policies may cause disputes and discourage agents from selling high-value policies.

Compass solution: Compass automates clawback provisions, ensuring that deductions for canceled policies, breaches of contract, or misrepresentations are processed seamlessly. The system provides clear and real-time documentation of clawback calculations, ensuring agents understand deductions and minimizing conflicts.

3. Lack of visibility into commission structures

A common frustration among insurance agents is the lack of clarity in how their commissions are calculated. Without visibility into commission structures, agents may feel demotivated or skeptical about their payouts. Sales heads often struggle to communicate updates or changes in commission structures effectively, leading to misunderstandings and disengagement.

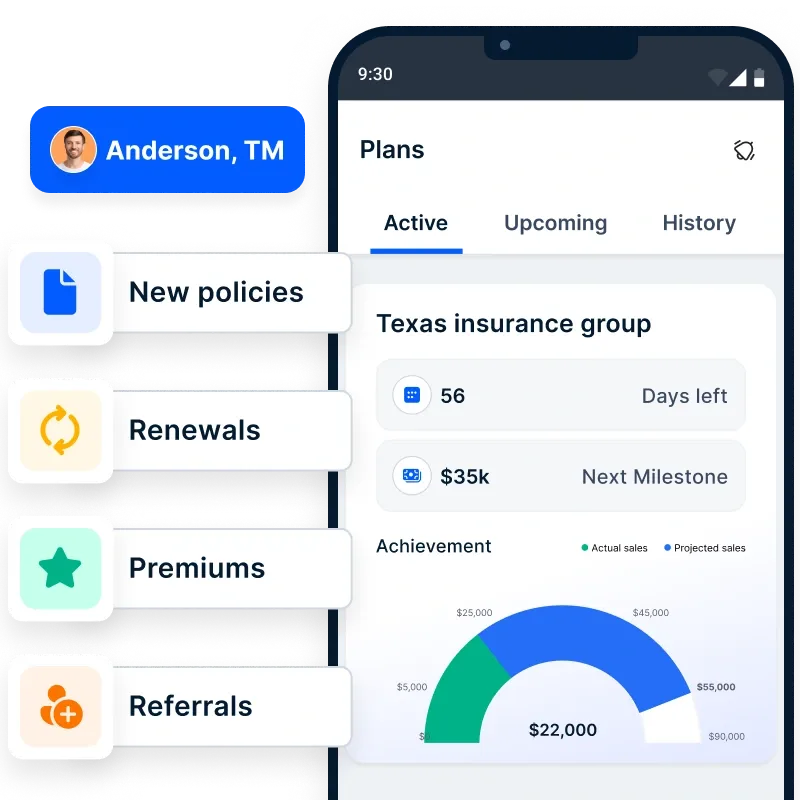

Compass solution: Compass provides a transparent commission management system where agents can access real-time breakdowns of their earnings. Through a mobile-friendly dashboard, agents can track their performance, view payout calculations, and download incentive structure documents. This level of transparency helps agents stay motivated and reduces inquiries about earnings.

4. Motivating agents to sell high-revenue policies

Many insurance agents focus on easy-to-sell, low-value policies, which may not contribute significantly to company revenue. Without clear revenue-driven incentives, agents may lack the motivation to prioritize policies that yield higher profits for the company. This results in suboptimal sales performance and misses growth opportunities.

Compass solution: Compass allows sales heads to implement structured revenue-driven KPIs that align commissions with high-revenue policies. By offering higher incentives for policies that generate more business value, Compass ensures that agents are motivated to prioritize these sales. The automated system dynamically updates earnings projections, showing agents the direct financial benefits of selling more lucrative policies.

5. Keeping agents engaged and reducing churn

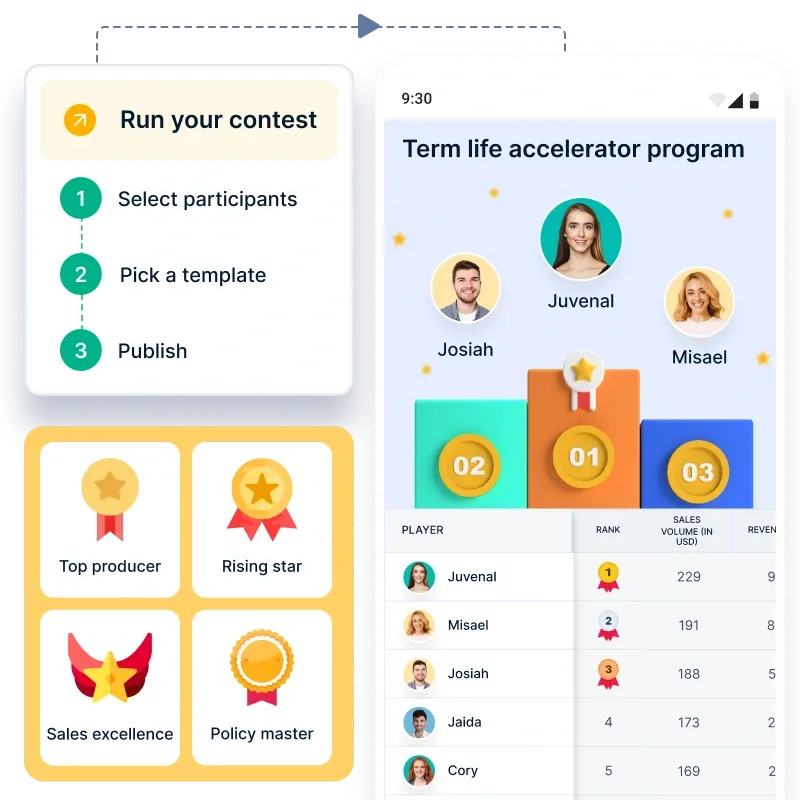

Without continuous engagement, agents may lose interest or seek opportunities with competitors offering more attractive incentives. Traditional commission structures often lack interactive elements that keep agents motivated. Sales heads struggle to maintain high levels of engagement, leading to lower productivity and higher turnover.

Compass solution: Compass introduces gamification to the sales process, turning commission-based selling into a dynamic and engaging experience. Sales contests, live leaderboards, and performance scorecards incentivize agents to push their limits. Companies can create custom competitions across different policy types, rewarding top performers with bonuses, recognition, and career growth opportunities. This approach not only boosts sales performance but also strengthens agent loyalty.

To sum up

Knowing about the insurance agent commissions' economics highlights the crucial connection between the incentive systems that regulates their pay and how it motivates the agents.

As commission pay being the motivation factor for agents, it becomes critical for insurance companies to handle their agents' pay effective.

This is where sales compensation software - Compass emerges as a vital tool.

A Comprehensive solution that streamlines and manages the complexities of commission structures.

Enables insurers to:

- effectively calculate,

- track, and

- disburse commissions to their agents

If you want to know more, how exactly Compass can automate your insurance agent commission pay then book the demo now!

FAQs

1. What are the commissions for insurance agents?

Commissions for insurance agents vary by policy type, insurer, and region. Typically, life insurance commissions range from 30% to 90% of the first-year premium, while health and property insurance commissions are around 5% to 20% per policy.

2. What is the best commission for an insurance agent?

The best commission depends on the policy type. Life insurance offers the highest commissions (up to 90% in the first year), but renewal commissions drop significantly. Property and casualty insurance provide lower initial commissions but offer steady renewals.

3. Do insurance salesmen make good money?

Yes, successful insurance agents can earn well, especially those selling high-commission policies (e.g., life insurance) and retaining clients for renewal commissions. Income varies based on experience, sales skills, and the insurer.

4. What is a good commission ratio in insurance?

A good commission ratio balances upfront and renewal commissions. A healthy range is 40-70% for first-year life insurance and 10-15% for renewals, while property insurance commissions typically range from 10-20% with renewals at 5-10%.