Incentive Calculation in Excel Sheets: 11 Common Problems & How to Fix Them

Excel isn’t built for complex incentive calculations—manual errors, delays, and lack of transparency slow you down. Compass automates commissions, ensures accuracy, and boosts sales motivation with gamification. Scale effortlessly today!

On this page

Incentive calculation in Excel has dominated the spreadsheet market since the 1990s, and it remains a powerful tool for data analysis. It is a powerful tool for handling various financial and commission calculations.

Don’t get us wrong. Excel is amazing because:

- It’s versatile

- Makes data collation easy

- Let’s you summarize & visualize data

- Supports formulas

- Is used across the world

However, one study found that 88% of all spreadsheets contain one or more severe errors. Don’t we all remember the JP Morgan London Whale debacle, where JP Morgan was hit with a $6 billion trading loss caused by none other than an Excel error back in 2012.

So, whether you're managing sales commissions, employee bonuses, or other incentives, Excel can simplify the process. However, like any software, it's not immune to issues.

In this blog, we'll explore the common problems people encounter when calculating incentives in Excel and provide solutions to fix them.

Problems with incentive calculation in Excel sheets & how Compass helps fix them

Spreadsheets were never built to calculate incentives. They were built to automate simple mathematical calculations, which had more math than logic. They were never built as a heavy-duty programming language that could simplify 28 levels of nested ifs.

So, let’s stop forcing them to do something they are not meant to do.

Here are the common problems with incentive calculation in Excel sheets & how Compass helps fix them.

1. Manual and time-consuming

Excel sheets cannot import data from existing sources and must be administered manually, which is tedious, time-consuming, and leaves plenty of room for manual error.

Data to be analyzed has to be copied and pasted or, even worse, manually entered. It can be done for a handful of reps with little effort, but as the rows and columns in the data increase, it becomes virtually impossible, making it extremely slow.

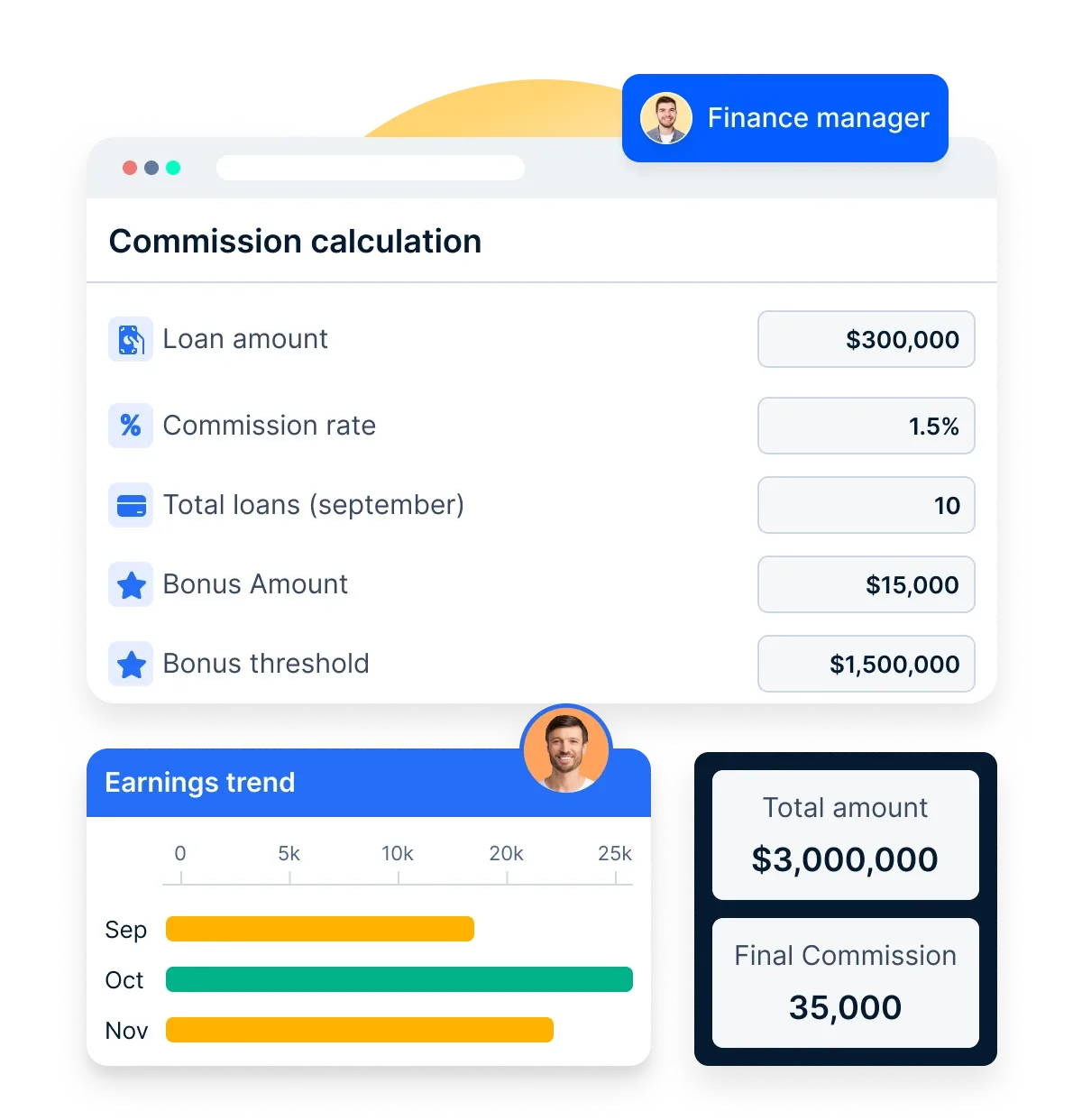

With Compass, you can easily capture live data and leave it to Compass to auto-calculate in real-time.

2. Prone to human error

Besides being extremely time-consuming, Excel sheets are prone to manual errors. It is not primarily a coding language and can only handle complex mathematical calculations but not complex logic.

Incentive calculation is the exact opposite. It is more logic and less math. This is exactly where human intervention is required. This is where a business analyst builds a query with 50 indexes and 25 nested ifs to calculate incentive.

God forbid if one of them goes wrong. It's fatally easy for user error to creep into the process and skew the results, potentially overpaying or underpaying your sales reps.

With Compass, you can easily build complex incentive programs with the familiarity of Excel within a few clicks.

3. Lacks real-time visibility and transparency

On Excel sheets or even its online versions, unless someone is manually updating it every minute, the data quickly becomes outdated. Excel sheets are not connected to live CRMs and ERPs and, hence, cannot be updated real-time. As a result of this, there is no transparency or visibility of data.

With Compass, the sales reps, managers, admins, HR teams, finance team, and the management have real-time access to incentive statements. Having this data readily available motivates sales reps to see what they’ve earned and how they can earn more.

Apart from motivating your sales team, Compass provides complete transparency into the actual calculations behind the numbers, and your team can trust the numbers they see because they have visibility into how they’re calculated.

4. Not built for scale

Experts describe Excel as a functional programming language. Even though Excel combines data analysis, visualization, and programming together, it only works well when the data is small and limited to hundreds of records, can be entered manually or can be copied and pasted, and the logic is more mathematical than complex.

Organizations face significant challenges when they try to build incentive software within Excel that requires complex logic, making it impossible to calculate incentives at scale.

With Compass, you get the best of Excel, like an intuitive interface along with variables and payout options, and it is scalable for small and gigantic enterprises and start-ups alike.

5. Expensive

When you use Excel for calculating sales incentives, you put in significant resources, technology, human resources, and time, and these resources have a cost associated with them.

Considering that 88% of the spreadsheets contain errors, every time you come across an error, you incur the cost of all of these resources again, making it uneconomical at all levels, thus shattering the balance.

With Compass, you can automate the process, and all changes can be handled with just a few clicks. It also saves a lot of time and eliminates inaccuracies and allows your team to spend time on other critical areas of the business.

6. Not auditable

Have you ever returned to your Excel sheet only to discover that it is not how you left it? Or have you ever overwritten your formula only to find #ERROR! across cells? If this gives you a sense of Deja Vu, let me tell you, you are not alone.

Excel doesn’t offer a history of every change made to each cell, and you can’t see who made the changes or if they even had the approval to do so. You also can’t set up a chain of support. Despite Google Sheets introducing features to overcome these problems, checking the change history for individual cells is impossible.

With Compass, you can easily track history and make auditability easy by showing users who changed what and when. It also facilitates automation and lets you easily add an approval hierarchy.

7. Not sharable

Excel is easy to share, right? Just drop it as an attachment in an email.

Perhaps it is. But not when you have a massive team of hundreds and thousands of employees who want to access the same file. This is where Excel collapses. You can create an incentive spreadsheet in Excel for your company, but what if you want to share it with 50000 reps?

Now, imagine those reps are grouped across 15 different incentive plans. Now add in the complexity of team leaders being able to see the incentives of their team members but no other team members.

You can build your Excel spreadsheet, but you can’t divide and share it in a way where the users can only see the information that they need to see. This is precisely what makes it non-sharable and challenging.

With Compass, you get user controls. You can control who sees what data and it is always shared between stakeholders.

8. Does not integrate with your current systems like ERP, CRMs, etc.

Excel, despite its online versions, is not connected. Complex incentive calculations need real-time data for all sources like CRM, ERP, and payroll. It is almost impossible to extract data from these sources, work on them, and keep them updated real time. This process is slow, manual, error-prone, and not real-time.

With Compass, you can easily pull this data from your existing systems. You can integrate Compass via webhooks, APIs or SDKs. Link and add gate filters in case of multiple data sources.

9. Not built for financial reporting & legal compliance

Excel is a business tool built for mathematical calculations with a simple input, process, and output mechanism. It does not allow you to configure tax implications, let alone based on slabs or geographies, and makes financial reporting and legal compliance independent of incentive calculation and payouts.

With Compass, apart from enabling fair, error-free, and transparent incentive calculations, takes care of user authentication and all security measures like GDPR or ISO and handles geographical tax implications and compliance.

10. Cannot automate payments

Excel is a calculation tool that can help you with the final incentive calculation. It cannot go even a step beyond that. It keeps incentive calculation independent of incentive payouts.

To process payouts, you will have to manually release payments through the bank or through gift cards, which leaves plenty of opportunity for manual errors. Excel does not allow you to connect it to any APIs or payment getaways to process payments.

With Compass, you can handle geographical tax implications and compliance before incentive payouts. You can consider any or all types of incentive payouts like bank transfers, a reward catalog of more than 20000 digital gift cards, prepaid cards, experiences, and wallets across 80+ countries, credit notes, or good old bank transfers. Payouts can be managed across multiple geographies & currencies seamlessly.

11. Not built for incentives

Excel is a blank canvas with two dimensions. It cannot handle complex calculations coupled with layers of logic. You will have to resort to using 10s and 20s of nested ifs and indexes to arrive at the final value. God forbid if you go wrong with one of those 20.

With Compass, you can quickly build a logic with n number of variables where your only input is defining the variable, and Compass will take care of the rest. Apart from easy incentive calculation, Compass helps you motivate your sales reps with gamified sales contests with a library of templates to choose from. Compass is also created to handle complex tax implications across geographies and tax brackets to enable seamless payouts.

5 key benefits of implementing an incentive calculation system

Here is a comparative table that showcases the benefits of installing an incentive calculation system for different personas.

Benefit | HRs | Sales Ops | CFO | CRO |

Increased efficiency and reduced costs | Automates calculations, freeing HR to focus on strategic tasks. | Saves time on manual calculations, allowing more focus on sales strategy. | Lowers operational costs by reducing errors and streamlining processes. | Improves sales tracking, enhancing overall efficiency. |

Improved accuracy and transparency | Reduces human error, ensuring fair employee rewards. | Provides clear metrics for sales performance, fostering trust. | Ensures accurate financial reporting and compliance with regulations. | Enhances visibility into sales performance, aligning strategies. |

Enhanced employee motivation and engagement | Motivates HR to create better talent management programs. | Keeps sales teams engaged with real-time reward tracking. | Increases overall productivity by linking rewards to performance. | Drives a high-performance culture through clear incentive structures. |

Streamlined program administration | Simplifies the management of various incentive programs. | Automates enrolment and tracking, reducing administrative burden. | Facilitates easier budget management for incentive payouts. | Allows for quick adjustments to programs based on performance data. |

Data-driven insights | Provides valuable data for improving HR strategies and programs. | Offers insights into sales trends and team performance metrics. | Helps in analysing ROI on incentives, optimizing financial strategies. | Enables informed decision-making to enhance sales tactics and goals. |

How to transition from excel to an automated incentive system?

Moving from Excel to an automated incentive system can improve efficiency and accuracy in managing rewards. Here’s a simple guide on how to make this transition.

1. Understand the need for automation

First, recognize why automation is beneficial. Automated systems help manage and track incentives more effectively than Excel. They reduce errors and save time by automating tasks like reward distribution and performance tracking.

2. Choose the right platform

Select an incentive automation platform that fits your needs. Look for features such as real-time analytics, customizable programs, and easy integration with existing systems like CRM or HR software. This will ensure that the platform can handle your specific requirements.

3. Set clear rules and criteria

Define the rules for your incentive programs. This includes setting performance metrics and eligibility criteria for rewards. Clear guidelines will help the system calculate incentives accurately.

4. Integrate data sources

Connect the automation system to your data sources. This could include sales data, employee performance metrics, or customer interactions. Integration allows the system to access real-time data needed for calculating rewards.

5. Automate calculations and notifications

Once set up, the system should automatically calculate rewards based on the defined criteria. It should also send notifications to employees or partners when they achieve milestones or earn incentives.

6. Monitor performance and adjust as needed

Use the analytics tools provided by the platform to track program performance. Regularly review participation rates and reward effectiveness. This information will help you make adjustments to optimize your incentive strategies.

7. Train your team

Ensure that your team understands how to use the new system. Provide training on how to access their performance metrics and understand the incentive structure. This will encourage engagement and accountability among participants.

By following these steps, you can smoothly transition from using Excel to an automated incentive system, enhancing your program's efficiency and effectiveness. Take Mahindra Finance as an example. They transitioned to an incentive calculation system and noticed 98% less errors in calculations.

Mahindra Finance, a leading financial services provider in India, faced challenges in managing their complex sales incentive programs. Manual calculations were prone to errors, processing times were lengthy, and a lack of transparency demotivated sales representatives.

Mahindra Finance partnered with Compass, a provider of sales commission automation solutions, to implement the Xoxoday platform. Plum automated the entire incentive management process, including:

- Sales reps could see their earnings accrue based on pre-defined rules and schemes, ensuring timely and accurate payouts.

- Customizable scheme management: Mahindra gained the flexibility to easily update and manage various incentive programs across different regions and product lines.

- Enhanced transparency: A transparent system allowed sales reps to track their performance and incentive calculations in real-time.

- Algorithms were developed to handle exceptions and outliers, reducing the need for manual adjustments and improving accuracy.

The automation of the sales commission process led to significant improvements:

- Increased incentive qualifiers: Over 25% more representatives received their incentives, fostering a culture of recognition.

- Error reduction: Calculation errors were slashed by over 98%, boosting accuracy and reliability.

- Processing speed: Incentive processing times were reduced by a staggering 99%, with payouts completed within hours instead of days.

- Employee satisfaction: Morale and productivity increased by 30%, leading to a direct boost in sales performance.

- Operational efficiency: Streamlined operations resulted in a 40% reduction in time spent on incentive management.

- Full compliance with audit requirements was achieved, minimizing the risk of regulatory issues and fines.

By automating their sales commission process, Mahindra Finance transformed their incentive management system. Integration of advanced data handling, real-time processing, and transparency not only improved operational efficiency but also boosted employee satisfaction and sales performance.

Compass as a reliable incentive calculation system

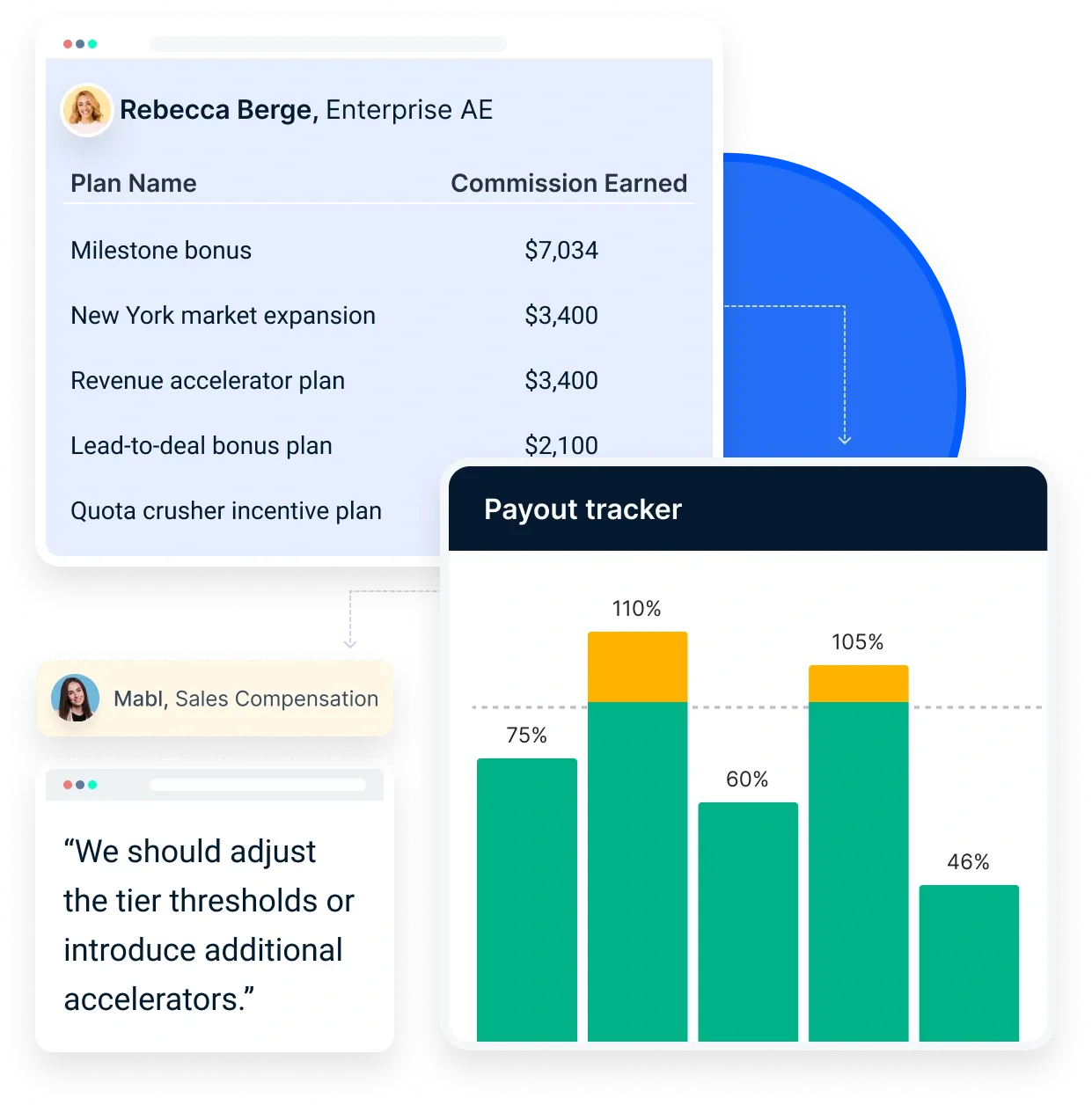

Compass serves as an effective incentive calculation system for both Chief Revenue Officers (CRO) and Human Resources (HR) departments. Here’s how it benefits each role:

For CFOs

- Integration with payroll systems: Compass can integrate seamlessly with various payroll systems, such as QuickBooks, Oracle Netsuite, and Stripe. This allows CFOs to schedule and send commission payouts to sales representatives efficiently.

- Streamlined bulk payments: The system enables the processing of multiple transactions at once. This feature reduces manual effort and saves valuable time, making the payment process more efficient.

- Multi-currency support: Compass supports transactions in multiple currencies, which is beneficial for businesses operating on an international scale.

- Insightful reporting: The platform generates detailed reports that provide insights into the return on investment (ROI) of commission plans. This empowers finance teams to make informed decisions regarding future budget allocations.

- Tax compliance and data security: Compass automatically calculates and withholds taxes based on local regulations. It also ensures data encryption to protect sensitive payment information, maintaining compliance with standards like ASC 606.

For HR

- Comprehensive sales performance management: Compass offers a complete solution for managing sales performance, fostering a competitive and collaborative culture among sales teams.

- Quick compensation plan creation: HR can create competitive compensation plans rapidly using pre-built templates. This allows for adjustments in response to changing economic conditions without lengthy delays.

- Transparency in compensation plans: The system provides visibility into the entire incentive plan, which helps eliminate disputes over calculations and potential earnings. This transparency boosts employee morale.

- Timely payouts: Compass ensures that incentive payouts are made on time, replacing cumbersome spreadsheets and enabling error-free commission plans at scale.

- Effectiveness analysis: HR can analyze the performance of incentive plans in real-time, using dashboards and comparison reports to measure their effectiveness and make necessary adjustments.

Compass enhances the efficiency of incentive calculations for both CROs and HR professionals by automating processes, providing valuable insights, and ensuring compliance with financial regulations.

Wrapping up

Excel, while a versatile tool, faces limitations when it comes to complex incentive calculations. The potential for manual errors, lack of real-time data, and difficulties in scalability can pose significant challenges.

Implementing an incentive calculation system offers a wealth of benefits for businesses of all sizes. By automating manual tasks, ensuring accuracy, and providing valuable data for program optimization, these systems can significantly enhance your incentive program management.

Compass offers a solution that streamlines incentive calculation processes, automates payments, and enhances transparency and accuracy. Leveraging Compass, businesses can supercharge their sales teams, reduce processing time, increase productivity, and eliminate communication opacity, all while ensuring the precision of their incentive calculations.

FAQs

1. What is the formula for calculating incentives?

The formula for calculating incentives is:

Incentive amount = (Actual Performance −Threshold) × Incentive Rate

This means you take the performance achieved, subtract a minimum threshold, and multiply by the incentive rate.

2. What is the formula of the incentive wage system?

The incentive wage system can be represented as:

Incentive pay = Base Pay + (Sales Achievement × Commission Rate)

This shows that incentive pay includes a base salary plus additional earnings based on sales performance.

3. What is the incentive pay system?

The incentive pay system is a compensation structure that rewards employees based on their performance. It aims to motivate employees to achieve specific goals or targets, often through bonuses or commissions.

4. How is incentive pay typically calculated?

Incentive pay is typically calculated by determining an employee's base salary, then applying an incentive percentage or fixed amount based on their performance. The calculation often involves multiplying the base salary by the incentive percentage.

5. What is a good incentive percentage?

A good incentive percentage can vary but is often around 10% to 20% of an employee's base salary. This range can effectively motivate employees while remaining financially sustainable for the company.