Guía paso a paso para crear el acuerdo de comisiones de ventas adecuado

Un acuerdo de comisión de ventas es un documento formal esencial para los empleados que trabajan como agentes o representantes de ventas.

En esta página

Imagine Sarah, a high-achieving sales professional, just secured a major deal. However, without a well-defined commission agreement, disagreements emerge regarding her payout. Such uncertainties can lead to dissatisfaction, lower morale, and even turnover. This is why having a clear sales commission agreement is vital.

A well-structured sales commission agreement ensures that both the company and its sales team are aligned on compensation terms. It defines expectations, performance goals, and commission payouts, creating transparency that builds trust and keeps sales reps motivated.

For businesses relying on strong sales teams, having a transparent commission agreement template is more than just a formality—it’s a necessity for retention and long-term success. Therefore, this blog will share an outline of the sales commission agreement so that you stay prepared for what needs to be added.

¿Qué es un acuerdo de comisiones de venta?

Sales commissions refer to payments provided to sales agents as compensation for completing specific sales or achieving predetermined sales targets. Typically, these commissions are calculated as a percentage of the total sale value. For instance, a car salesperson might earn 20% of the vehicle's final price. While some sales agents rely solely on commissions for income, others receive a combination of commissions and hourly wages.

Sin embargo, un acuerdo de comisiones de ventas es un documento formal esencial para los empleados que trabajan como agentes o representantes de ventas. En él se describen los términos y condiciones relativos a la remuneración basada en comisiones que perciben los representantes de ventas. Este tipo de acuerdos suelen incorporarse al contrato de trabajo general y pueden abarcar:

- Ambas partes implicadas en el contrato. Sus datos de contacto y otros datos identificativos.

- La cantidad de porcentaje que recibirán tras cerrar cada venta.

- Cuotas mensuales o semanales que debe cumplir un comercial en términos de volumen de ventas.

- El salario por hora que podría cobrar el vendedor.

What are the different types of commission agreement?

Commission agreements come in various forms, each tailored to different sales arrangements:

- Employee commission agreements: These apply to salaried employees who receive commissions in addition to their base pay. A well-defined sales commission agreement ensures transparency in earnings, keeping sales teams motivated to achieve their targets.

- Independent contractor commission agreements: Designed for contractors whose income relies solely on commissions. A structured commission agreement template helps set clear terms, ensuring both parties understand the payment structure and expectations.

- One-time vs. recurring commission agreements: A one-time commission agreement applies when commissions are paid per sale, whereas a recurring sales commission agreement template is ideal for businesses that offer ongoing incentives for repeat sales or subscription-based models.

The amount for sales commission structure is typically determined through negotiation before a sales position is filled. These terms are then formalized within a sales commission agreement. The specified commission amount and the agreement itself can generally be adjusted as the employee gains more experience in the sales role. Therefore, the following aspects may impact the terms that could go into the agreement:

- Normas del sector.

- Los registros de ventas del representante de ventas.

- El volumen de ventas del representante a lo largo de su empleo.

- Factores dependientes de la geografía, como el coste de la vida en un determinado estado o ciudad.

Ahora que ya hemos hablado de lo que afecta a su comisión de ventas, repasemos los detalles básicos del acuerdo.

The basics of a sales commission agreement

Los aspectos básicos del acuerdo de ventas y comisiones que uno debe conocer para entender su acuerdo incluyen:

Parties involved

- Salesperson/agent: the individual responsible for driving sales and earning commissions based on performance.

- Company/employer: the organization that engages the salesperson and commits to paying commissions as per the agreed terms.

Commission structure and compensation

- Commission rates: defines how earnings are calculated, whether through a flat fee, tiered model, or percentage of revenue. A well-defined sales commission structure template helps establish transparent expectations.

- Payment terms: specifies when commissions are processed—whether monthly, quarterly, or upon deal closure. These details should align with the sales commission agreement template to avoid any confusion.

Sales targets and performance expectations

- Defining clear targets: sets achievable sales goals that align with business objectives and incentivize strong performance.

- Impact of unmet targets: outlines potential consequences if targets are not met, such as reduced commission rates or additional performance assessments.

Agreement duration and terms

- Start and end dates: specifies when the commission agreement takes effect and its validity period.

- Renewal and termination conditions: clarifies circumstances under which the agreement can be extended or terminated, ensuring clarity for both parties.

Confidentiality and non-compete clauses

- Safeguarding business interests: includes clauses to protect confidential company data, trade secrets, and strategic information.

- Limitations on working with competitors: may include restrictions preventing the salesperson from joining a competitor for a defined period.

Conflict resolution and legal considerations

- Dispute resolution methods: specifies whether mediation, arbitration, or other methods will be used to resolve conflicts related to commissions.

- Jurisdiction and governing law: identifies the legal framework under which the sales commission agreement will be enforced. This ensures that all parties understand their rights and obligations.

By using a well-structured commission agreement template, businesses can create a fair and transparent system that benefits both the company and its salesforce.

Hay que conocer estos aspectos del acuerdo para resolver inteligentemente cualquier litigio. Tomemos el ejemplo de Wells Fargo.

Since 2002, the bank's leadership has been aware of fraudulent account openings to meet sales targets. Despite repeated occurrences, the relevant regulatory body failed to publicly address or take action against Wells Fargo until 2017.

Despite employees creating over two million fraudulent accounts, Wells Fargo did not initially impose clawbacks as outlined in its sales commission agreement. Instead, the company terminated 5,300 employees and paid substantial government fines.

However, in September 2016 when Wells Fargo's CEO, John Stumpf, faced intense scrutiny during a Senate Banking Committee hearing. Shortly thereafter, the company enacted its contractual clawback provision, citing reputational damage.

As a result, Stumpf and Carrie Tolstedt, head of the Community Bank division, forfeited significant bonuses and equity awards. Wells Fargo ultimately reclaimed over $180 million from executives as their sales commission agreement stipulated that the company could recover compensation if certain conditions were met, such as fraudulent activities, misconduct, or material misrepresentations.

Wells Fargo used the sales and commission agreements as a basis to initiate clawback. They argued that the fraudulent activities of employees violated the terms of their employment and compromised the integrity of the sales process.

This underscores the importance of creating a thorough sales commission agreement

Due to Wells Fargo’s scandal, we also know what pitfalls to avoid.

Avoid these common mistakes in a sales commission agreement

A well-structured sales commission agreement is key to a motivated sales team. However, certain pitfalls can lead to confusion and disputes.

- Unclear terms – A vague sales commission agreement template can cause misunderstandings about payouts, quotas, and payment schedules. Clear terms prevent disputes and build trust.

- Unrealistic goals – A commission structure template should set achievable targets to keep sales teams motivated rather than discouraged.

- No dispute resolution – A strong sales commission agreement should outline conflict resolution methods to prevent disagreements from escalating.

- Restrictive non-compete clauses – An overly strict commission agreement can drive away top sales talent. A balanced approach protects the business while keeping employees engaged.

A well-crafted sales commission structure template ensures fairness, transparency, and long-term success. The Wells Fargo case serves as a cautionary tale about the potential pitfalls of poorly designed sales and commission agreements. So, referring to a best-laid sales commission agreement template is your best option.

Sales commission agreement best practices

El estudio de caso del acuerdo de comisiones de ventas de Wells Fargo y las consiguientes consecuencias ofrece varias buenas prácticas para diseñar y gestionar planes de compensación de ventas.

- Maintain transparency: Clearly outline the commission rate, calculation methodology, and payment schedule. Indicate the sales targets, quotas, and performance criteria determining commission eligibility. Also, include provisions for product returns, discounts, chargebacks, and other relevant factors that may impact commissions.

- Propose a balanced compensation structure: Sales compensation plans should strike a balance between base pay and variable pay. Wells Fargo's aggressive pay mix, which favored variable compensation, contributed to a high-pressure environment that incentivized unethical behavior. A reasonable balance can help maintain motivation without fostering desperation among employees, which can lead to misconduct.

- Maintain fairness and motivation: Ensure the commission plan incentivizes behaviors that contribute to overall company objectives. Establish sales targets that motivate salespeople without being unrealistic or discouraging. Provide compensation packages that attract and retain top sales talent.

- Gobernanza y supervisión sólidas: Unas estructuras de gobierno eficaces son esenciales para supervisar el cumplimiento de las normas éticas. El hecho de que Wells Fargo no abordara las actividades fraudulentas de sus empleados durante muchos años pone de relieve la necesidad de contar con mecanismos de supervisión sólidos. Las organizaciones deben aplicar auditorías periódicas y tener una clara responsabilidad sobre las prácticas de venta para mitigar los riesgos asociados a un comportamiento poco ético.

- Considere la posibilidad de realizar una auditoría del plan de comisiones: Realice revisiones periódicas para identificar posibles discrepancias o áreas de mejora. Además, utilice software de comisiones. Puede emplear herramientas especializadas para agilizar los cálculos, hacer un seguimiento del rendimiento y mejorar la eficiencia.

How to draft sales commission agreement template with example?

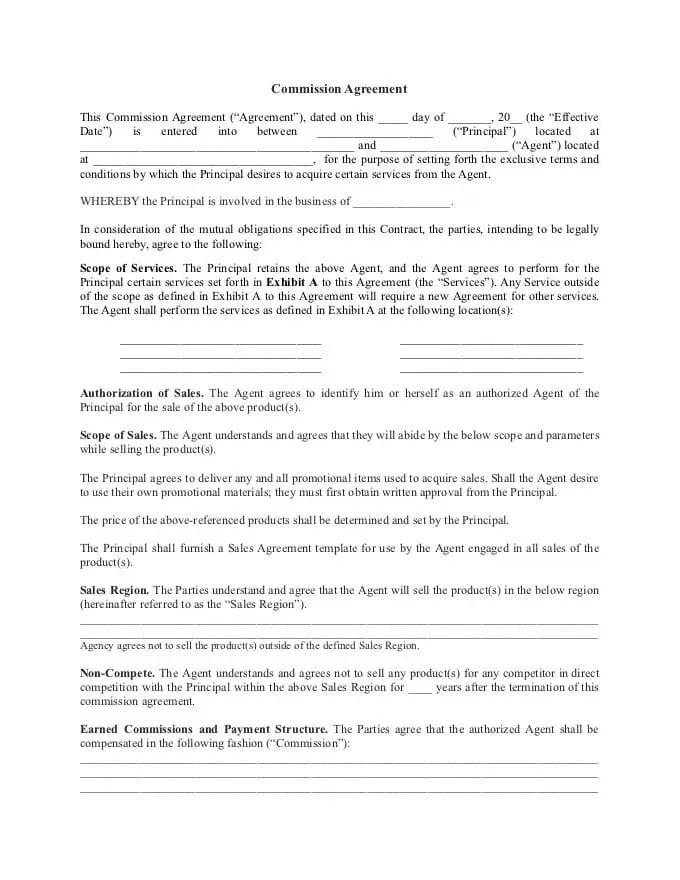

El acuerdo comenzaría con la descripción de los detalles de ambas partes. Incluiría la información sobre las partes, la fecha, los detalles sobre las empresas de la siguiente manera. Todos los acuerdos de comisión de ventas tienen los siguientes elementos:

Use a sales commission agreement template

A well-structured sales commission agreement template serves as a reliable starting point for drafting a clear and enforceable contract. By using a commission agreement template, you can ensure that all essential details—such as commission rates, payment terms, and responsibilities—are included without missing crucial elements. These templates can be customized to align with your specific sales compensation model.

Define worker type and commission structure

The approach to structuring a sales commission agreement depends on whether the recipient is a salaried employee, an independent contractor, or a commission-based salesperson. The sales commission structure should outline how commissions are determined based on the worker’s role. Common structures include:

- Base salary plus commission: Employees receive a guaranteed salary along with additional commission-based earnings.

- Straight commission: Compensation is solely based on sales performance, often with higher commission percentages.

- Gross margin commission: Commission is calculated after deducting sales-related costs, ensuring the salesperson benefits from profitable transactions.

Once you've selected the best commission structure template for your team, ensure the agreement explicitly details how commissions are earned and under what conditions. Transparency reduces potential disputes and clarifies expectations.

List commissionable activities

A sales commission structure template should specify which activities qualify for commission payments. Some contracts limit commissions to closed deals, while others extend them to lead generation or contract renewals. A clear breakdown of commission-eligible activities will help prevent misunderstandings.

Set the commission rate

After defining commission eligibility, determine the applicable commission agreement rate. Whether it's a fixed percentage or a tiered system, the agreement must outline the exact formula used to calculate commissions. Providing a concrete example can further enhance clarity.

Outline bonuses and incentives

Many sales commission agreements include additional incentives beyond standard commissions. Bonuses might be based on reaching sales targets, maintaining client accounts, or securing high-value contracts. If your business offers such perks, ensure they are well-documented within the commission agreement to motivate your sales team.

Address termination and post-employment commissions

Clarify what happens to outstanding commissions if a salesperson leaves the company. Will they still receive payments for past sales? Your sales commission agreement should define post-employment commission policies to avoid conflicts and ensure a fair transition.

Consider a confidentiality clause

If your sales process involves sensitive client or company data, include a confidentiality clause in the commission agreement template. This protects proprietary information and prevents former salespeople from using privileged insights for competitors' benefit.

By using a structured sales commission agreement and leveraging a sales commission structure template, businesses can create transparent, fair, and motivating compensation plans for their sales teams.

Conclusión

Los acuerdos de comisiones de ventas son esenciales para definir los términos de la compensación entre una empresa y sus representantes de ventas. Estos acuerdos describen la estructura de las comisiones, las condiciones de pago y la naturaleza de la relación laboral, protegiendo así a ambas partes de malentendidos y posibles problemas legales.

Moreover, clearly defined commission structures can motivate sales representatives to achieve their targets, as they understand how their efforts translate into earnings. To streamline the commission process, rely upon Compass. It is a platform designed to streamline the management of sales commission agreements and related processes. Compass can:

- Automatice el cálculo de comisiones en función de criterios predefinidos;

- Realice un seguimiento del rendimiento y las comisiones en tiempo real para fomentar la transparencia en el proceso de retribución;

- Integrarse con los sistemas CRM existentes.

Make it easier to manage sales data and commission calculations in one place with Compass. Schedule a demo call with our experts to learn how Compass can be the solution to your disoriented commission calculation, and management in the agreement.

Preguntas frecuentes

What is an example of a sales commission policy?

An example of a sales commission policy could be a tiered commission structure where sales reps earn 10% on sales up to $100,000 and 15% on any amount above that. This incentivizes higher sales performance by rewarding reps for exceeding specific revenue thresholds.

What does a commission agreement look like?

A commission agreement typically consists of a formal document that specifies the commission rate, sales targets, payment frequency, and any other relevant terms. It may also include provisions for disputes and the responsibilities of both parties.

What is a typical sales commission contract?

A typical sales commission contract outlines the terms under which sales representatives earn commissions. It includes details such as commission rates, payment terms, qualifying activities for commission, and conditions for withholding or refunding payments.

How do you write a sales commission agreement?

To write a sales commission agreement, include sections on parties involved, commission structure (e.g., percentage of sales, tiered rates), payment schedule, and termination clauses. It's essential to clearly define what constitutes a sale and any conditions that may affect commission payments.