Cálculo de Incentivos en Hojas Excel: 11 Problemas Comunes y Cómo Solucionarlos

Excel no está hecho para cálculos complejos de incentivos: los errores manuales, los retrasos y la falta de transparencia le frenan. Compass automatiza las comisiones, garantiza la precisión y aumenta la motivación de las ventas con la gamificación. ¡Escale sin esfuerzo hoy mismo!

En esta página

El cálculo de incentivos en Excel ha dominado el mercado de las hojas de cálculo desde los años 90, y sigue siendo una potente herramienta para el análisis de datos. Es una potente herramienta para manejar diversos cálculos financieros y decálculos de comisiones.

No nos malinterpretes. Excel es increíble porque:

- Es versátil

- Facilita el cotejo de datos

- Permite resumir y visualizar datos

- Fórmulas de apoyo

- Se utiliza en todo el mundo

Sin embargo, un estudio reveló queel 88% de las hojas de cálculocontienen uno o más errores graves. Acaso no recordamos todos la debacle de la Ballena de Londres de JP Morgan, donde JP Morgan sufrió una pérdida de 6.000 millones de dólares en operaciones bursátiles causada nada menos que por un error de Excel en 2012.

Por lo tanto, tanto sigestión de comisiones de ventasprimas a los empleados u otros incentivos, Excel puede simplificar el proceso. Sin embargo, como cualquier software, no es inmune a los problemas.

En este blog, exploraremos los problemas más comunes que la gente encuentra al calcular incentivos en Excel y ofreceremos soluciones para solucionarlos.

Problemas con el cálculo de incentivos en hojas Excel y cómo Compass ayuda a solucionarlos

Las hojas de cálculo nunca se crearon para calcular incentivos. Se crearon para automatizar cálculos matemáticos sencillos, que tenían más de matemática que de lógica. Nunca se construyeron como un lenguaje de programación pesado que pudiera simplificar 28 niveles de ifs anidados.

Así que dejemos de obligarles a hacer algo para lo que no están hechos.

Problemas frecuentes con el cálculo de incentivos en hojas Excel y cómo resolverlosCompassayuda a solucionarlos.

1. Manual y lento

Las hojas de Excel no pueden importar datos de fuentes existentes y deben administrarse manualmente, lo que resulta tedioso, lleva mucho tiempo y deja mucho margen para el error manual.

Los datos que hay que analizar tienen que copiarse y pegarse o, peor aún, introducirse manualmente. Puede hacerse para un puñado de repeticiones con poco esfuerzo, pero a medida que aumentan las filas y columnas de los datos, resulta prácticamente imposible, por lo que resulta extremadamente lento.

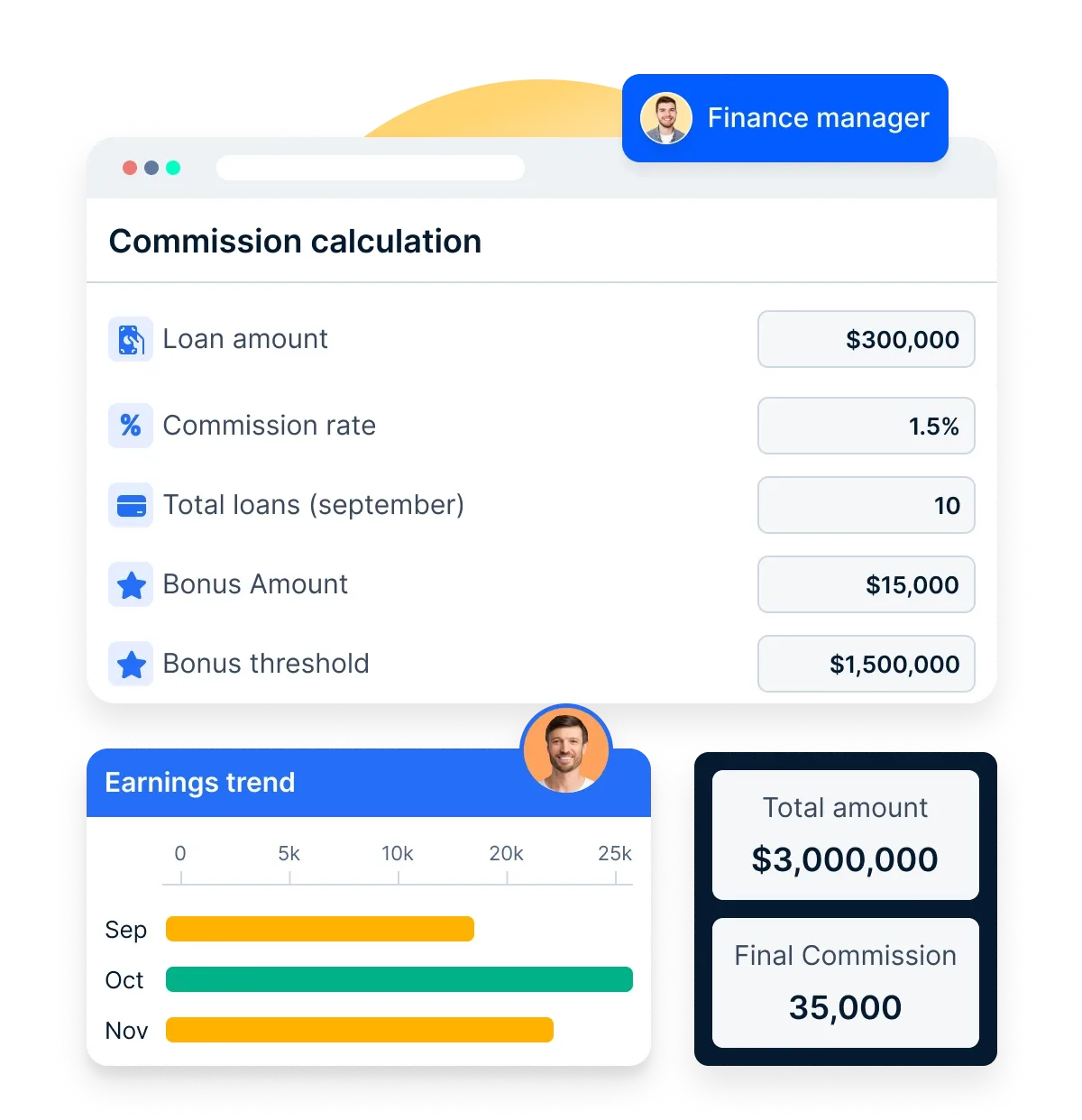

Con Compass, puede capturar fácilmente datos en directo y dejar que Compass los autocalcule en tiempo real.

2.Propenso al error humano

Además de consumir mucho tiempo, las hojas de Excel son propensas a los errores manuales. No es principalmente un lenguaje de codificación y solo puede manejar cálculos matemáticos complejos, pero no lógica compleja.

El cálculo de incentivoses exactamente lo contrario. Es más lógica y menos matemática. Aquí es exactamente donde se requiere la intervención humana. Aquí es donde un analista de negocio construye una consulta con 50 índices y 25 ifs anidados para calcular el incentivo.

Dios nos libre si uno de ellos sale mal. Es muy fácil que un error del usuario se cuele en el proceso y distorsione los resultados, pudiendo pagar de más o de menos a los representantes de ventas.

Con Compass, puede crear fácilmente programas de incentivos complejos con la familiaridad de Excel en unos pocos clics.

3.Falta de visibilidad y transparencia en tiempo real

En las hojas de Excel o incluso en sus versiones en línea, a menos que alguien las actualice manualmente cada minuto, los datos quedan desfasados rápidamente. Las hojas de Excel no están conectadas a CRM y ERP y, por tanto, no pueden actualizarse en tiempo real. Como resultado, no hay transparencia ni visibilidad de los datos.

Con Compass, los representantes de ventas, los gerentes, los administradores, los equipos de RR.HH., el equipo financiero y la dirección tienen acceso en tiempo real a los extractos de incentivos. Tener estos datos fácilmente disponibles motiva a los representantes de ventas a ver lo que han ganado y cómo pueden ganar más.

Además de motivar a su equipo de ventas, Compass proporciona una transparencia total en los cálculos reales que hay detrás de las cifras, y su equipo puede confiar en las cifras que ven porque tienen visibilidad de cómo se calculan.

4. No construido a escala

Los expertos describen Excel como un lenguaje de programación funcional. Aunque Excel combina el análisis de datos, la visualización y la programación, sólo funciona bien cuando los datos son pequeños y se limitan a cientos de registros, pueden introducirse manualmente o copiarse y pegarse, y la lógica es más matemática que compleja.

Las organizaciones se enfrentan a importantes retos cuando intentan crear programas de incentivos en Excel que requieren una lógica compleja, lo que hace imposible calcular incentivos a escala.

Con Compass, obtendrá lo mejor de Excel, como una interfaz intuitiva junto con variables y opciones de pago, y es escalable tanto para pequeñas como para gigantescas empresas y start-ups.

5. Caro

Cuando se utiliza Excel para calcular los incentivos de ventas, se invierten recursos importantes, tecnología, recursos humanos y tiempo, y estos recursos tienen un coste asociado.

Teniendo en cuenta que el 88% de las hojas de cálculo contienen errores, cada vez que te encuentras con un error, vuelves a incurrir en el coste de todos estos recursos, lo que lo hace antieconómico a todos los niveles, rompiendo así el equilibrio.

Con Compass, puede automatizar el proceso y todos los cambios se gestionan con unos pocos clics. También ahorra mucho tiempo y elimina imprecisiones, además de permitir que su equipo dedique tiempo a otras áreas críticas de la empresa.

6. No auditable

¿Alguna vez has vuelto a tu hoja de Excel sólo para descubrir que no está como la dejaste? ¿O has sobrescrito alguna vez tu fórmula sólo para encontrar #ERROR! en las celdas? Si esto te da una sensación de Deja Vu, déjame decirte que no estás solo.

Excel no ofrece un historial de todos los cambios realizados en cada celda, y no puedes ver quién hizo los cambios o si siquiera tenía la aprobación para hacerlo. Tampoco puedes establecer una cadena de soporte. A pesar de que Google Sheets ha introducido funciones para superar estos problemas, es imposible comprobar el historial de cambios de cada celda.

Con Compass, puede realizar fácilmente un seguimiento del historial y facilitar la auditabilidad mostrando a los usuarios quién ha cambiado qué y cuándo. También facilita la automatización y permite añadir fácilmente una jerarquía de aprobación.

7. No compartible

Excel es fácil de compartir, ¿verdad? Basta con adjuntarlo a un correo electrónico.

Puede que sí. Pero no cuando tienes un equipo masivo de cientos y miles de empleados que quieren acceder al mismo archivo. Aquí es donde Excel se derrumba. Puedes crear una hoja de cálculo de incentivos en Excel para tu empresa, pero ¿y si quieres compartirla con 50000 representantes?

Ahora, imagine que esos representantes están agrupados en 15 planes de incentivos diferentes. Añada ahora la complejidad de que los jefes de equipo puedan ver los incentivos de los miembros de su equipo, pero no los de los demás.

Puedes construir tu hoja de cálculo Excel, pero no puedes dividirla y compartirla de forma que los usuarios sólo puedan ver la información que necesitan ver. Esto es precisamente lo que hace que no se pueda compartir y suponga un reto.

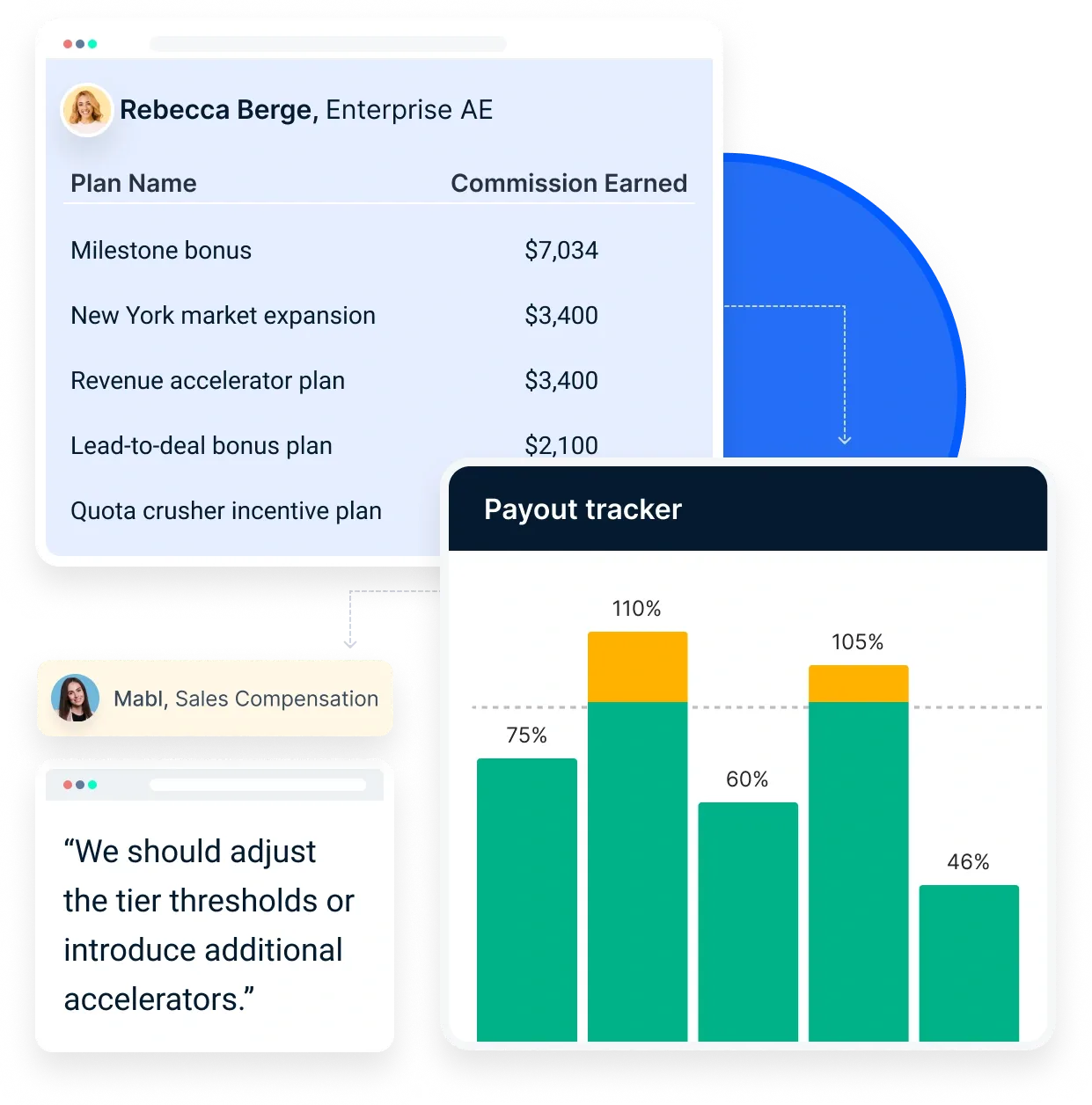

Con Compass, obtendrá controles de usuario. Puedes controlar quién ve qué datos y siempre se comparten entre las partes interesadas.

8. No se integra con sus sistemas actuales, como ERP, CRM, etc.

Excel, a pesar de sus versiones en línea, no está conectado. Los cálculos complejos de incentivos necesitan datos en tiempo real de todas las fuentes, como CRM, ERP y nóminas.Es casi imposible extraer datos de estas fuentes, trabajar con ellos y mantenerlos actualizados en tiempo real. Este proceso es lento, manual, propenso a errores y no se realiza en tiempo real.

Con Compass, puede extraer fácilmente estos datos de sus sistemas existentes. Puede integrar Compass mediante webhooks, API o SDK. Vincule y añada filtros de puerta en caso de múltiples fuentes de datos.

9. No está diseñado para la elaboración de informes financieros y el cumplimiento de la legislación

Excel es una herramienta empresarial creada para realizar cálculos matemáticos con un mecanismo sencillo de entrada, proceso y salida. No permite configurar implicaciones fiscales, y mucho menos basadas en losas o geografías, y hace que los informes financieros y el cumplimiento legal sean independientes del cálculo y los pagos de incentivos.

Con Compass, además de permitir cálculos de incentivos justos, sin errores y transparentes, se encarga de la autenticación de los usuarios y de todas las medidas de seguridad como GDPR o ISO y gestiona las implicaciones fiscales geográficas y el cumplimiento de la normativa.

10. No puede automatizar los pagos

Excel es una herramienta de cálculo que puede ayudarle con el cálculo final del incentivo. No puede ir ni un paso más allá. Mantiene el cálculo de incentivos independiente depago de incentivos.

Para procesar los pagos, tendrá que liberarlos manualmente a través del banco o mediante tarjetas regalo, lo que deja muchas posibilidades de cometer errores manuales. Excel no te permite conectarlo a ninguna API o pasarela de pagos para procesar los pagos.

Con Compass, puede gestionar las implicaciones fiscales geográficas y el cumplimiento antes del pago de incentivos. Puede considerar cualquier tipo de pago de incentivos, como transferencias bancarias, un catálogo de recompensas de más de 20000 tarjetas regalo digitales, tarjetas prepago, experiencias y monederos en más de 80 países, billetes de crédito o las antiguas transferencias bancarias. Los pagos pueden gestionarse en múltiples geografías y divisas sin problemas.

11. No construido para incentivos

Excel es un lienzo en blanco con dos dimensiones. No puede manejar cálculos complejos con capas de lógica. Tendrás que recurrir a decenas y decenas de if e índices anidados para llegar al valor final. Dios nos libre si te equivocas con uno de esos 20.

Con Compass, puede construir rápidamente una lógica con n número de variables donde su única entrada es definir la variable, y Compass se encargará del resto. Además de facilitar el cálculo de incentivos, Compass le ayuda amotivar a sus comerciales con concursos de ventas gamificadoscon una biblioteca de plantillas para elegir. Compass también se ha creado para gestionar implicaciones fiscales complejas en distintas zonas geográficas y tramos impositivos para permitir pagos sin problemas.

5 ventajas clave de implantar un sistema de cálculo de incentivos

He aquí un cuadro comparativo que muestra las ventajas de instalar un sistema de cálculo de incentivos para diferentes personas.

Beneficio | HRs | Operaciones de venta | DIRECTOR FINANCIERO | CRO |

Mayor eficacia y reducción de costes | Automatiza los cálculos, liberando a RRHH para que se centre en tareas estratégicas. | Ahorra tiempo en cálculos manuales, lo que permite centrarse más en la estrategia de ventas. | Reduce los costes operativos al disminuir los errores y agilizar los procesos. | Mejora el seguimiento de las ventas, aumentando la eficacia general. |

Mayor precisión y transparencia | Reduce los errores humanos, garantizando recompensas justas para los empleados. | Proporciona métricas claras para el rendimiento de las ventas, fomentando la confianza. | Garantiza la exactitud de informes financieros y el cumplimiento de la normativa. | Mejora la visibilidad del rendimiento de las ventas, alineando las estrategias. |

Mayor motivación y compromiso de los empleados | Motiva a RRHH a crear mejores programas de gestión del talento. | Mantiene el compromiso de los equipos de ventas con el seguimiento de las recompensas en tiempo real. | Aumenta la productividad general al vincular las recompensas al rendimiento. | Impulsa una cultura de alto rendimiento mediante estructuras de incentivos claras. |

Racionalización de la administración del programa | Simplifica la gestión de diversos programas de incentivos. | Automatiza inscripción y el seguimiento, reduciendo la carga administrativa. | Facilita la gestión del presupuesto para el pago de incentivos. | Permite ajustar rápidamente los programas en función de los datos de rendimiento. |

Información basada en datos | Proporciona datos valiosos para mejorar las estrategias y los programas de RRHH. | Ofrece información sobre tendencias de ventas y métricas de rendimiento del equipo. | Ayuda a analizar ROI de los incentivos, optimizar estrategias financieras. | Permite tomar decisiones con conocimiento de causa para mejorar las tácticas y los objetivos de ventas. |

¿Cómo pasar de Excel a un sistema automatizado de incentivos?

Pasar de Excel a un sistema automatizado de incentivos puede mejorar la eficacia y la precisión en la gestión de las recompensas. Aquí tienes una guía sencilla sobre cómo hacer esta transición.

1. Comprender la necesidad de automatización

En primer lugar, reconozca por qué la automatización es beneficiosa. Los sistemas automatizados ayudan a gestionar y realizar un seguimiento de los incentivos de forma más eficaz que Excel. Reducen los errores y ahorran tiempo automatizando tareas como la distribución de recompensas y el seguimiento del rendimiento.

2. Elegir la plataforma adecuada

Seleccione una plataforma de automatización de incentivos que se adapte a sus necesidades. Busque funciones como análisis en tiempo real, programas personalizables y fácil integración con sistemas existentes como CRM o software de RRHH. Esto garantizará que la plataforma pueda gestionar sus requisitos específicos.

3. Establecer normas y criterios claros

Defina las normas de sus programas de incentivos. Esto incluye establecer métricas de rendimiento y criterios de elegibilidad para las recompensas. Unas directrices claras ayudarán al sistema a calcular los incentivos con precisión.

4. Integrar las fuentes de datos

Conecte el sistema de automatización a sus fuentes de datos. Esto podría incluir datos de ventas, métricas de rendimiento de los empleados o interacciones con los clientes. La integración permite al sistema acceder a los datos en tiempo real necesarios para calcular las recompensas.

5. Automatizar cálculos y notificaciones

Una vez configurado, el sistema debe calcular automáticamente las recompensas en función de los criterios definidos. También debe enviar notificaciones a los empleados o socios cuando alcancen hitos o ganen incentivos.

6. Supervisar el rendimiento y realizar los ajustes necesarios

Utilice las herramientas de análisis proporcionadas por la plataforma para realizar un seguimiento del rendimiento del programa. Revise periódicamente los índices de participación y la eficacia de las recompensas. Esta información le ayudará a realizar ajustes para optimizar sus estrategias de incentivos.

7. Forme a su equipo

Asegúrese de que su equipo entiende cómo utilizar el nuevo sistema. Proporcione formación sobre cómo acceder a sus métricas de rendimiento y comprender la estructura de incentivos. Esto fomentará el compromiso y la responsabilidad entre los participantes.

Siguiendo estos pasos, puede pasar sin problemas de utilizar Excel a un sistema de incentivos automatizado, mejorando la eficiencia y eficacia de su programa. Tomemos como ejemplo Mahindra Finance. Pasaron a un sistema de cálculo de incentivos y observaron un 98% menos de errores en los cálculos.

Mahindra Financeun proveedor de servicios financieros líder en la India, se enfrentaba a retos en la gestión de sus complejos programas de incentivos de ventas. Los cálculos manuales eran propensos a errores, los tiempos de procesamiento eran largos y la falta de transparencia desmotivaba a los representantes de ventas.

Mahindra Finance se asoció con Compass, proveedor de soluciones de automatización de comisiones de ventas, para implantar la plataforma Xoxoday . Plum automatizó todo el proceso de gestión de incentivos:

- Los representantes de ventas podían ver cómo se acumulaban sus ganancias en función de reglas y esquemas predefinidos, lo que garantizaba pagos puntuales y precisos.

- Gestión de esquemas personalizable: Mahindra ganó flexibilidad para actualizar y gestionar fácilmente varios programas de incentivos en diferentes regiones y líneas de productos.

- Mayor transparencia: Un sistema transparente permitió a los representantes de ventas hacer un seguimiento de su rendimiento y de los cálculos de incentivos en tiempo real.

- Se desarrollaron algoritmos para gestionar las excepciones y los valores atípicos, lo que redujo la necesidad de realizar ajustes manuales y mejoró la precisión.

La automatización del proceso de comisiones de ventas dio lugar a mejoras significativas:

- Aumento de los incentivos: Más de un 25% más de representantes recibieron sus incentivos, fomentando una cultura de reconocimiento.

- Reducción de errores: Los errores de cálculo se redujeron en más de un 98%, aumentando la precisión y la fiabilidad.

- Velocidad de procesamiento: los tiempos de procesamiento de los incentivos se redujeron en un asombroso 99%, y los pagos se completaron en cuestión de horas en lugar de días.

- Satisfacción de los empleados: La moral y la productividad aumentaron un 30%, lo que se tradujo en un aumento directo del rendimiento de las ventas.

- Eficacia operativa: La racionalización de las operaciones se tradujo en una reducción del 40% del tiempo dedicado a la gestión de incentivos.

- Se consiguió el pleno cumplimiento de los requisitos de auditoría, lo que minimizó el riesgo de problemas normativos y multas.

Al automatizar su proceso de comisiones de ventas, Mahindra Finance transformó su sistema de gestión de incentivos. La integración de la gestión avanzada de datos, el procesamiento en tiempo real y la transparencia no sólo mejoraron la eficacia operativa, sino que también impulsaron la satisfacción de los empleados y el rendimiento de las ventas.

Compass como sistema fiable de cálculo de incentivos

Compass es un sistema eficaz de cálculo de incentivos tanto para los Chief Revenue Officers (CRO) como para los departamentos de Recursos Humanos (RRHH). He aquí cómo beneficia a cada función:

Para directores financieros

- Integración con los sistemas de nóminas: Compass puede integrarse perfectamente con varios sistemas de nóminas, como QuickBooks, Oracle Netsuite y Stripe. Esto permite a los directores financieros programar y enviar los pagos de comisiones a los representantes de ventas de forma eficiente.

- Pagos masivos agilizados: El sistema permite procesar varias transacciones a la vez. Esta característica reduce el esfuerzo manual y ahorra un tiempo valioso, haciendo que el proceso de pago sea más eficiente.

- Soporte multidivisa: Compass admite transacciones en varias divisas, lo que resulta beneficioso para las empresas que operan a escala internacional.

- Informes detallados: La plataforma genera informes detallados que proporcionan información sobre el rendimiento de la inversión (ROI) de los planes de comisiones. Esto permite a los equipos financieros tomar decisiones informadas sobre futuras asignaciones presupuestarias.

- Cumplimiento fiscal y seguridad de los datos: Compass calcula y retiene automáticamente los impuestos en función de la normativa local. También garantiza el cifrado de datos para proteger la información confidencial de los pagos, manteniendo el cumplimiento de normas como la ASC 606.

Para RRHH

- Gestión integral del rendimiento de las ventas: Compass ofrece una solución completa para gestionar el rendimiento de las ventas, fomentando una cultura competitiva y de colaboración entre los equipos de ventas.

- Creación rápida de planes de retribución: RR.HH. puede crear rápidamente planes de retribución competitivos utilizando plantillas predefinidas. Esto permite realizar ajustes en respuesta a las cambiantes condiciones económicas sin largos retrasos.

- Transparencia en los planes de compensación: El sistema proporciona visibilidad de todo el plan de incentivos, lo que ayuda a eliminar las disputas sobre los cálculos y las ganancias potenciales. Esta transparencia eleva la moral de los empleados.

- Pagos puntuales: Compass garantiza que los pagos de incentivos se realicen a tiempo, sustituyendo las engorrosas hojas de cálculo y permitiendo planes de comisiones sin errores a escala.

- Análisis de la eficacia: RR.HH. puede analizar el rendimiento de los planes de incentivos en tiempo real, utilizando cuadros de mando e informes comparativos para medir su eficacia y realizar los ajustes necesarios.

Compass mejora la eficacia de los cálculos de incentivos tanto para las CRO como para los profesionales de RR.HH. automatizando los procesos, proporcionando información valiosa y garantizando el cumplimiento de la normativa financiera.

Conclusión

Excel, aunque es una herramienta versátil, se enfrenta a limitaciones cuando se trata de cálculos complejos de incentivos. La posibilidad de errores manuales, la falta de datos en tiempo real y las dificultades de escalabilidad pueden plantear retos importantes.

La implantación de un sistema de cálculo de incentivos ofrece numerosas ventajas a empresas de todos los tamaños. Al automatizar las tareas manuales, garantizar la precisión y proporcionar datos valiosos para la optimización del programa, estos sistemas pueden mejorar significativamente la gestión de su programa de incentivos.

Compass ofrece una solución que agiliza los procesos de cálculo de incentivos, automatiza los pagos y mejora la transparencia y la precisión. Gracias a Compass, las empresas pueden potenciar sus equipos de ventas, reducir el tiempo de procesamiento, aumentar la productividad y eliminar la opacidad de la comunicación, todo ello garantizando la precisión de sus cálculos de incentivos.

Preguntas frecuentes

1. ¿Cuál es la fórmula para calcular los incentivos?

La fórmula para calcular los incentivos es la siguiente

Importe del incentivo = (Rendimiento real - Umbral) × Tasa de incentivo

Esto significa que se toma el rendimiento alcanzado, se le resta un umbral mínimo y se multiplica por la tasa de incentivos.

2. ¿Cuál es la fórmula del sistema de incentivos salariales?

El sistema de incentivos salariales puede representarse como:

Pago de incentivos = Sueldo base + (Logro de ventas × Tasa de comisión)

Esto demuestra que el pago de incentivos incluye un salario base más ganancias adicionales basadas en el rendimiento de las ventas.

3. ¿Qué es el sistema de retribución incitativa?

El sistema de retribución incitativa es una estructura retributiva que recompensa a los empleados en función de su rendimiento. Su objetivo es motivar a los empleados para que alcancen metas u objetivos específicos, a menudo mediante primas o comisiones.

4. ¿Cómo suele calcularse la remuneración incitativa?

La remuneración de incentivo suele calcularse determinando el salario base de un empleado y aplicando después un porcentaje de incentivo o una cantidad fija en función de su rendimiento. El cálculo suele consistir en multiplicar el salario base por el porcentaje de incentivo.

5. ¿Cuál es un buen porcentaje de incentivos?

Un buen porcentaje de incentivos puede variar, pero suele rondar entre el 10% y el 20% del salario base del empleado. Esta horquilla puede motivar eficazmente a los empleados sin dejar de ser financieramente sostenible para la empresa.