El precio de un plan de incentivos de ventas mal diseñado o deficiente es más alto de lo que cree

Un plan de incentivos de ventas mal diseñado puede ser perjudicial para el rendimiento de una empresa. Cuando un plan de incentivos de ventas es malo, puede desmotivar al equipo de ventas, obstaculizar la consecución de objetivos y, en última instancia, provocar una reducción de los ingresos.

En esta página

¿Conoce las consecuencias de un plan de comisiones de ventas mal diseñado o de un mal plan de incentivos de ventas? En una palabra, son DESASTROSAS.

Antes de mostrarle el impacto con un ejemplo, veamos algunas estadísticas sobre por qué tener un buen plan de incentivos de ventas es crucial para su empresa.

El caso de XYZ Electronics: Cuando los incentivos son contraproducentes

Imaginemos XYZ Electronics, un minorista ficticio de electrónica de consumo. La empresa decide renovar su plan de comisiones de ventas para aumentar los ingresos.

El nuevo plan giraba en torno a un factor principal: el número de unidades vendidas, con comisiones significativamente más altas ofrecidas por superar objetivos de ventas específicos. Así, cuanto mayor sea el volumen de ventas, mayor será la comisión.

El problema de centrarse exclusivamente en el volumen A primera vista, el nuevo plan de comisiones parece prometedor. Sin embargo, un examen más detenido revela su defecto inherente. El plan hace mucho hincapié en el volumen de ventas sin tener en cuenta la calidad de las transacciones ni las relaciones a largo plazo con los clientes.

¿Qué ocurre a continuación?

Los comerciales no tardan en darse cuenta de que el camino más rápido para conseguir comisiones más altas es centrarse únicamente en vender tantos productos como sea posible.

Como resultado de esta estructura de comisiones, empiezan a surgir comportamientos de venta indeseables:

❌ Venta bajo presión: Los vendedores empiezan a emplear tácticas de alta presión para persuadir a los clientes de que compren productos, aunque no satisfagan sus necesidades. Con el tiempo, la atención pasa de centrarse en comprender las necesidades de los clientes a la venta agresiva.

❌ Descuida el apoyo postventa: El incentivo de cerrar acuerdos rápidamente deja a los vendedores con poco tiempo para ofrecer asistencia posventa o abordar las preocupaciones de los clientes. Los clientes que tienen problemas con sus compras a menudo quedan insatisfechos, lo que provoca altas tasas de devolución y erosiona la reputación de la marca.

❌ Fuga de clientes: El personal de ventas da prioridad a la captación de nuevos clientes frente al mantenimiento de las relaciones existentes. Esto conduce a una menor lealtad de los clientes y a una alta tasa de rotación.

❌ Prácticas poco éticas: Para cumplir sus cuotas de ventas y ganar comisiones más altas, algunos representantes de ventas recurren a prácticas corruptas, como engañar a los clientes sobre las características del producto u ocultar información sobre posibles inconvenientes.

Comienza el efecto dominó y los resultados negativos se suceden en cascada.

Las consecuencias de estos comportamientos de venta indeseables son nefastas:

La lección: Alinear siempre los incentivos con los valores

El caso de XYZ Electronics es un ejemplo perfecto de las posibles repercusiones de unos planes de comisiones de ventas mal diseñados. Destaca la importancia de alinear las estructuras de comisiones con valores y objetivos organizativos más amplios.

✅ Un plan de comisiones más equilibrado que recompense no sólo el volumen de ventas, sino que también tenga en cuenta la satisfacción del cliente, la repetición de la compra y las relaciones a largo plazo para evitar la aparición de comportamientos de venta negativos.

✅ Un enfoque holístico del diseño del plan de comisiones, en el que los incentivos financieros armonizan con las prácticas éticas y los objetivos estratégicos para fomentar una cultura de ventas sostenible y próspera.

¿Cuánto cuestan los malos planes de incentivos de ventas?

En una palabra, es ALTA.

Veámoslo con un ejemplo.

Imaginemos una empresa que vende suscripciones de software. La empresa tiene 50 vendedores y su principal objetivo es vender suscripciones anuales a su producto de software. Los ingresos de la empresa por suscripción son de 1.000 dólares, y se espera que el vendedor medio cierre 10 operaciones al mes.

Consideremos ahora dos escenarios:

👉 Escenario #1: Uno con un plan de incentivos bien diseñado

👉 Escenario #2: La otra con un plan de incentivos mal diseñado

1. Plan de compensación bien diseñado

En este escenario, la empresa tiene un plan de compensación bien estructurado que motiva a los vendedores a alcanzar objetivos a corto y largo plazo. Los vendedores son recompensados no sólo por el número de suscripciones vendidas, sino también por la retención de clientes y el upselling. El plan incluye bonificaciones por alcanzar los objetivos de retención trimestrales y por aumentar las ventas de funciones adicionales a los clientes existentes.

Como resultado:

- Los vendedores se centran en establecer relaciones sólidas con los clientes para garantizar su retención.

- Se hace hincapié en identificar las oportunidades de venta, aumentando los ingresos de la empresa por cliente.

- La satisfacción del cliente sigue siendo alta gracias al enfoque centrado en el cliente del equipo de ventas.

- La reputación de la empresa mejora, lo que se traduce en más referencias y nuevos clientes.

2. Plan de compensación mal diseñado

En este caso, la empresa tiene un plan de retribución mal diseñado que sólo recompensa a los vendedores por el número de suscripciones vendidas, sin tener en cuenta la retención de clientes o las ventas adicionales.

Como resultado:

- Los vendedores se centran únicamente en cerrar tratos para maximizar sus comisiones.

- Se presta poca atención a la satisfacción del cliente o a las relaciones a largo plazo.

- La tasa de rotación de clientes aumenta debido a la desatención de sus necesidades tras la venta inicial.

- Los ingresos de la empresa por cliente siguen estancados.

Calcular los costes

Supongamos que en el escenario de un plan bien diseñado:

- La retención de clientes aumenta un 10% y la rotación se reduce del 20% al 18%.

- Los esfuerzos de upselling se traducen en un aumento del 15% de los ingresos por cliente.

Mientras que en el escenario del plan mal diseñado:

- La tasa de rotación de clientes aumenta del 20% al 30% debido a la falta de atención a las relaciones con los clientes.

- No aumentan los ingresos por cliente.

He aquí cómo se acumulan los costes a lo largo de un año (teniendo en cuenta los 50 vendedores):

👉 Escenario nº 1. Para un plan de incentivos bien diseñado:

- Ingresos anuales iniciales: 1.000 $/suscriptor x 10 operaciones/suscriptor x 12 meses = 120.000 $/vendedor

- Reducción de la rotación en un 10%: 0,10 x 0,18 x 120.000 $ = 2.160 $/vendedor

- Aumento del 15% de los ingresos por ventas adicionales: 0,15 x 120.000 $ = 18.000 $/vendedor

- Ingresos anuales totales por vendedor: 120.000 $ + 2.160 $ + 18.000 $ = 140.160 $.

- Ingresos totales de los 50 vendedores: 140.160 $ x 50 = 7.008.000 $.

👉 Escenario nº 2. Para un plan de incentivos mal diseñado:

- Ingresos anuales iniciales: 120.000 $/vendedor

- 10% de aumento de la rotación: 0,10 x 0,30 x 120.000 $ = 3.600 $/vendedor

- No aumentan los ingresos por ventas adicionales

- Ingresos anuales totales por vendedor: 120.000 $ - 3.600 $ = 116.400 $.

- Ingresos totales de los 50 vendedores: 116.400 $ x 50 = 5.820.000 $.

Este ejemplo muestra que un plan de retribución mal diseñado puede costar a la empresa más de 1 millón de dólares en ingresos perdidos en comparación con un plan bien diseñado. Ilustra cómo un plan mal diseñado puede repercutir negativamente en los resultados financieros de una empresa.

Las trampas de los planes de incentivos de ventas mal diseñados

En el mundo de las ventas, un buen plan de compensación de ventas actúa como una Compassguiando correctamente el comportamiento de su fuerza de ventas. Mientras que un plan de compensación de ventas bien estructurado puede elevar el rendimiento de su organización, uno mal diseñado puede tener consecuencias catastróficas.

He aquí una serie de escollos asociados a un mal diseño del plan de incentivos de ventas:

1. El corto plazo prima sobre la estrategia a largo plazo

Uno de los errores más comunes en el diseño de planes de compensación de ventas es hacer demasiado hincapié en los objetivos a corto plazo. Aunque es natural querer resultados rápidos, basarse únicamente en objetivos de ingresos inmediatos puede socavar la sostenibilidad de la empresa a largo plazo.

Descuidar el panorama general en favor de victorias rápidas puede comprometer las relaciones con los clientes, obstaculizar la innovación y erosionar la cuota de mercado.

2. La complejidad genera confusión

En la búsqueda de la equidad y la precisión, algunas organizaciones crean planes de compensación que parecen intrincados rompecabezas. Sin embargo, esta complejidad suele generar confusión entre los equipos de ventas.

La motivación y el rendimiento pueden caer en picado cuando los vendedores tienen dificultades para entender cómo sus esfuerzos se traducen en ganancias debido a fórmulas enrevesadas y métricas oscuras. Un diseño sencillo del plan de incentivos garantiza que el personal de ventas comprenda rápidamente la relación entre sus acciones y las recompensas.

3. La falacia de la talla única

Un plan de compensación único y estandarizado puede hacer más mal que bien. Las diferentes funciones de ventas, regiones geográficas y líneas de productos requieren incentivos a medida que reflejen los retos y oportunidades únicos de cada grupo.

Ignorar esta diversidad puede provocar resentimiento y desmotivación, ya que los vendedores sienten que sus contribuciones no se reconocen o recompensan adecuadamente.

4. Comportamientos desalineados

Los planes de compensación mal diseñados pueden animar inadvertidamente a los representantes de ventas a centrarse en actividades que maximicen sus comisiones a expensas de los objetivos más amplios de la organización.

Esta desalineación puede dar lugar a prácticas poco éticas, como la sobreventa a clientes que no necesitan realmente el producto o servicio, lo que en última instancia puede dañar la reputación de la empresa y erosionar la confianza de los clientes.

5. Disminución de la atención al cliente

Una gran consecuencia de los planes de comisiones mal estructurados es la tentación de que los comerciales empleen tácticas de venta agresivas para maximizar sus ganancias. Esto puede incluir la venta de productos o servicios innecesarios, hacer promesas que no se pueden cumplir o presionar a los clientes para que tomen decisiones precipitadas.

Estas prácticas pueden generar ventas inmediatas, pero a largo plazo pueden erosionar la confianza y provocar la insatisfacción del cliente.

6. Elevadas tasas de rotación de personal

Los representantes de ventas suelen ser personas orientadas a los resultados. Si perciben que su remuneración no es proporcional a sus esfuerzos, es más probable que busquen empleo en otro lugar.

Una alta rotación de empleados no sólo es cara en términos de contratación y formación, sino que también puede perturbar las relaciones con los clientes y afectar negativamente a la reputación de la empresa. Para evitarlo, debe revisar y ajustar periódicamente las estructuras de comisiones para asegurarse de que siguen siendo competitivas y atractivas para los mejores vendedores.

7. Conflictos internos y descontento

Cuando los planes de comisiones de ventas carecen de claridad o crean competencia entre los miembros del equipo, pueden producirse conflictos interpersonales dentro del equipo de ventas. Estos conflictos pueden ser perjudiciales y dificultar la colaboración, que es crucial para el éxito general.

Además, cuando los miembros del equipo se ven unos a otros como competidores, esto puede dar lugar a un comportamiento poco ético o a intentos de sabotear a los compañeros para conseguir comisiones más altas. Un plan de comisiones bien estructurado debe fomentar el trabajo en equipo y la cooperación, sin dejar de reconocer las contribuciones individuales.

8. 8. Inestabilidad financiera

Los planes de comisiones de ventas mal diseñados pueden tener graves consecuencias financieras para la organización. Si la estructura de comisiones es insostenible, puede provocar cargas financieras inesperadas, como obligaciones de pago excesivas en periodos de vacas flacas o desbordamientos presupuestarios.

Esta inestabilidad financiera puede obstaculizar la capacidad de la empresa para invertir en iniciativas de crecimiento o responder a retos imprevistos. Para evitar la inestabilidad financiera, debes estudiar detenidamente las implicaciones financieras de sus planes de comisiones y establecer límites presupuestarios claros.

El arte de diseñar planes de compensación de ventas

En el centro de todo plan eficaz de compensación de ventas se encuentra un profundo conocimiento de los objetivos de la organización y de los comportamientos necesarios para alcanzarlos.

Un plan meticulosamente diseñado tiene en cuenta varios factores:

- Dinámica del mercado

- Panorama competitivo

- Complejidad del producto

- Ciclo de ventas

¡Redefina su plan de incentivos de ventas con Compass!

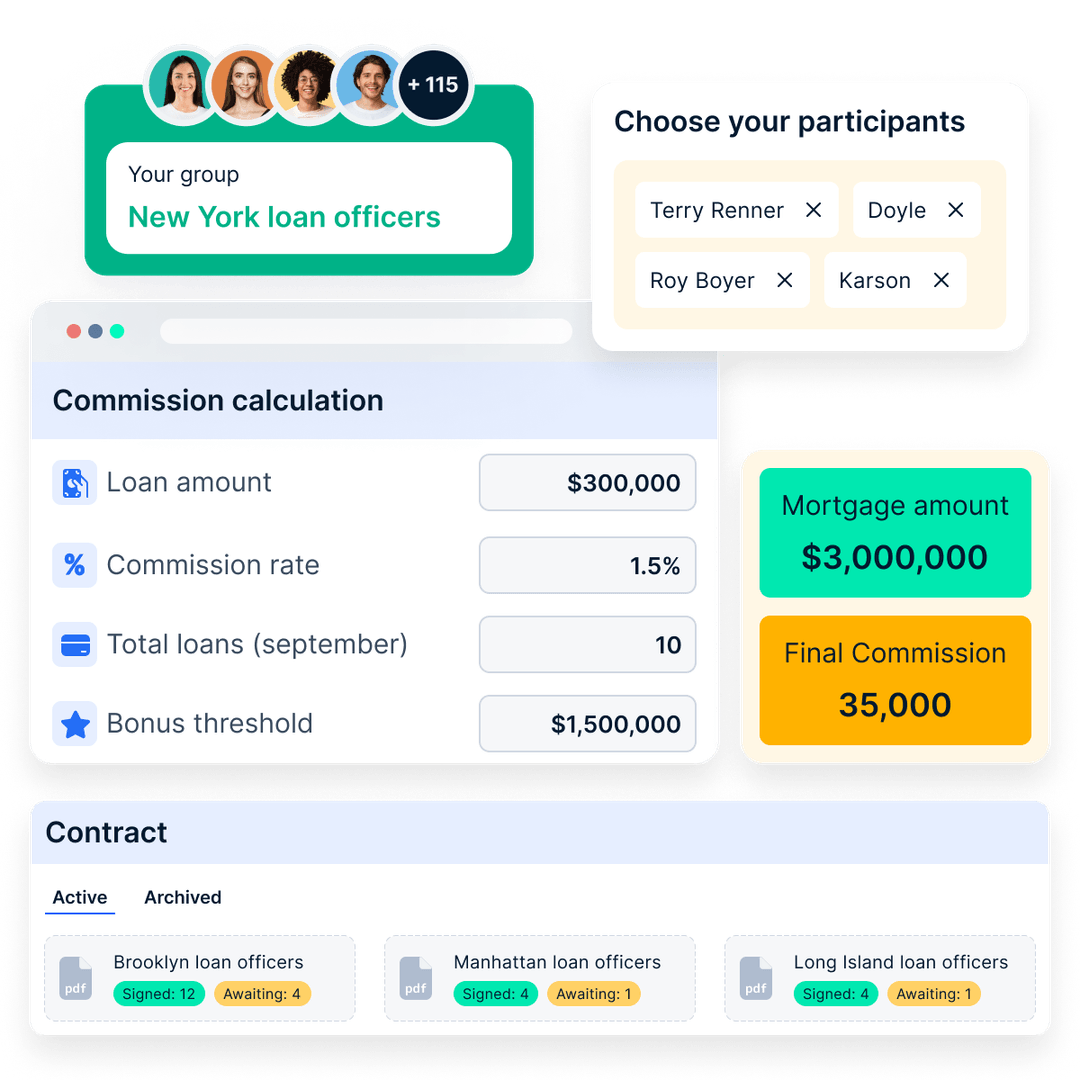

No deje que los sistemas de comisiones obsoletos o los cálculos manuales de comisiones le frenen. Diseñe planes de incentivos de ventas con nuestra solución fácil de usar y de bajo código para garantizar que sean inteligentes, rápidos y estratégicos.

7 errores comunes que hay que evitar al diseñar planes de incentivos de ventas

El diseño y la ejecución de un plan de compensación de ventas requieren una meticulosa atención al detalle y un profundo conocimiento de los objetivos de la organización y de las complejidades del proceso de ventas.

He aquí algunas cosas que hay que evitar a la hora de diseñar uno:

1. Ignorar la alineación estratégica

Quizás, el error más fundamental en la compensación de ventas es no alinear el plan con los objetivos estratégicos de la organización. Cuando la estructura de comisiones no está sincronizada con los objetivos empresariales más amplios, los representantes de ventas pueden dedicarse a actividades que producen beneficios a corto plazo pero no contribuyen al éxito a largo plazo.

2. Centrarse únicamente en los ingresos

Un enfoque miope de los ingresos como única medida de compensación puede llevar a distorsionar las prioridades y a comportamientos contraproducentes. Cuando las comisiones están vinculadas únicamente al volumen de ventas, los vendedores pueden pasar por alto las necesidades de los clientes, descuidar el apoyo postventa y adoptar tácticas agresivas para cerrar acuerdos rápidamente.

3. Complicación excesiva de los planes de compensación

En la búsqueda de la precisión, algunas organizaciones caen en la trampa de la complejidad. Las complejas fórmulas de compensación y las enrevesadas métricas de rendimiento pueden confundir y desmotivar al personal de ventas.

4. Seguir un planteamiento único para los incentivos

Los equipos de ventas suelen ser diversos y estar formados por personas con distintos puntos fuertes y responsabilidades en el mercado. Un plan de retribución único puede no tener en cuenta estas diferencias, lo que llevaría a recompensas desiguales y a la desmotivación.

5. No revisar y adaptar

El panorama empresarial está en constante cambio. No revisar y adaptar periódicamente el plan de compensación de ventas para adaptarlo a la dinámica cambiante del mercado, los objetivos de la organización y las estrategias de ventas puede acarrear problemas.

6. No obtener información de los equipos de ventas

Los vendedores están en primera línea de las interacciones con los clientes y conocen de primera mano las tendencias del mercado y sus preferencias. Ignorar su opinión durante el proceso de diseño puede provocar una falta de aceptación y alienación.

7. No comunicar eficazmente

La transparencia en la retribución es vital para la confianza y la motivación. No comunicar con claridad los detalles del plan de retribución, especialmente cómo funciona y se alinea con los objetivos de la empresa, puede dar lugar a malentendidos y resentimientos.

Diseñe planes de incentivos de ventas más inteligentes con Compass

Un plan de incentivos de ventas bien diseñado alimenta la motivación, alinea los esfuerzos de ventas con los objetivos empresariales e impulsa resultados constantes. Compass elimina las conjeturas a la hora de diseñar incentivos mediante la automatización de las comisiones, el seguimiento del rendimiento en tiempo real y la garantía de que las recompensas sigan siendo competitivas y atractivas.

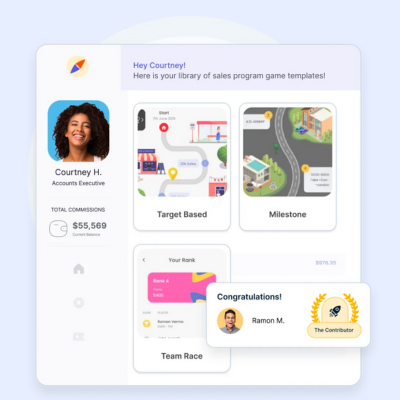

Estructuras de incentivos personalizables: Adapta los planes a los objetivos de tu equipo con modelos de comisiones flexibles, recompensas escalonadas y bonificaciones basadas en el rendimiento.

Seguimiento del rendimiento en tiempo real: Proporcione a los representantes de ventas visibilidad instantánea de sus ingresos, objetivos y progresos, manteniéndolos centrados y motivados.

✅ Gamificación para el compromiso: Impulsa la competición con tablas de clasificación, retos y recompensas basadas en logros que empujen a los representantes a alcanzar (y superar) sus objetivos.

Automatización perfecta de los pagos: Elimine los errores manuales con cálculos de comisiones basados en IA, garantizando pagos precisos y puntuales en todo momento.

Palabras finales

Diseñar un plan de compensación de ventas eficaz implica crear una sinfonía de incentivos, motivaciones y objetivos empresariales. Cuando se ejecuta mal, las consecuencias repercuten en toda la organización, afectando a la moral, la alineación y, en última instancia, a los resultados.

El efecto dominó de un plan de este tipo va más allá del incumplimiento de objetivos: erosiona la cultura, agota el talento y socava el crecimiento. A medida que las empresas se esfuerzan por alcanzar el éxito en un panorama cada vez más competitivo, un plan de compensación de ventas bien diseñado se convierte en un activo indispensable, que impulsa la excelencia y armoniza los esfuerzos hacia logros compartidos.