Cómo desarrollar un plan anual de incentivos que funcione: Un enfoque estratégico

Un plan anual de incentivos bien estructurado es algo más que una prima: es una herramienta estratégica para impulsar el rendimiento y alinear a los empleados con los objetivos empresariales. Aprenda a diseñar un plan anual de incentivos que impulse el rendimiento.

En esta página

A research conducted by the Incentive Research Foundation found that organizations with well-designed incentive programs see a 44% boost in worker productivity.

Optimizar el rendimiento de las ventas es esencial para la rentabilidad y el crecimiento a largo plazo. Las empresas han descubierto que la implantación de planes anuales de incentivos (PAI) es una táctica que da buenos resultados. Estos programas pretenden motivar a los empleados, alinear su trabajo con los objetivos de la organización y, en última instancia, mejorar los resultados de ventas.

Este artículo aborda el concepto de planes de incentivos anuales, incluidos los distintos tipos, sus ventajas y las estrategias ideales de aplicación.

¿Qué es un plan anual de incentivos?

Un plan anual de incentivos (PIA) es un programa de retribución estructurado que recompensa a los empleados en función de sus resultados a lo largo de un año. Los principales objetivos son aumentar la productividad, inspirar a los empleados para que cumplan los objetivos y vincular sus esfuerzos a los objetivos estratégicos de la empresa.

Aunque el diseño de los PIA puede variar mucho, suelen incluir determinados objetivos, una estructura de pagos y medidas de rendimiento. Los planes anuales de incentivos tienen dos componentes principales:

- Métricas de rendimiento: Las normas por las que se evalúa el rendimiento de un empleado se conocen como métricas de rendimiento. Pueden incluir índices de satisfacción del cliente, objetivos de ventas u otros indicadores clave de rendimiento (KPI) que sean relevantes para los objetivos de la empresa.

Por ejemplo, una empresa tecnológica podría utilizar métricas como el crecimiento de los ingresos, la captación de nuevos clientes y las tasas de retención de clientes como métricas de rendimiento para el equipo de ventas.

- Estructura de retribución: La estructura de retribución describe cómo se reparten los incentivos a los empleados. Puede tratarse de opciones sobre acciones, primas en metálico u otros incentivos. Para garantizar la motivación y la igualdad, la estructura debe ser explícita e inequívoca.

Por ejemplo, la estructura de primas de Google incluye tanto incentivos económicos como opciones sobre acciones para retener el talento. Para mantener el talento en plantilla, Google ofrece opciones sobre acciones además de incentivos monetarios. La estrategia está altamente personalizada para satisfacer las demandas específicas de su organización y de los ejecutivos que intentan atraer o retener, en lugar de ser una fórmula única para todos.

Difference between an annual incentive plan and an annual bonus

While both an annual incentive plan (AIP) and an annual bonus reward employees for performance, they differ in structure, purpose, and criteria.

In short, AIPs are structured and performance-driven, while annual bonuses are more general, discretionary rewards.

Tipos de planes de incentivos anuales

Annual Incentive Plans (AIPs) are structured compensation programs designed to reward employees for achieving specific business goals. These incentives not only drive performance but also align individual and team efforts with the company’s strategic objectives. Here’s a closer look at the different types of AIPs and how they function:

1. Revenue-based incentive plan

This plan directly links incentives to revenue generation. Employees, particularly in sales and business development roles, receive bonuses based on meeting or exceeding revenue targets. The goal is to encourage growth and ensure that teams are consistently working toward increasing company earnings.

2. Profit-sharing plan

A profit-sharing model distributes a percentage of the company’s profits among employees. Unlike revenue-based incentives, this plan rewards overall profitability rather than individual sales performance. It fosters a sense of shared responsibility, motivating employees to contribute to cost efficiency and overall financial success.

3. Goal-based incentive plan

Companies often set non-revenue-specific objectives that drive business growth, such as expanding into new markets, improving customer retention, or increasing production efficiency. Employees are rewarded for meeting these predetermined goals, ensuring that business priorities beyond just revenue are addressed.

4. Team performance incentive plan

In environments where collaboration is key, team-based incentives encourage collective performance. Instead of rewarding individuals, bonuses are distributed based on group achievements, ensuring that all team members contribute toward shared objectives. This structure is particularly useful in project-based industries and cross-functional teams.

5. Individual performance-based plan

This type of plan measures and rewards employees based on personal performance metrics. Key performance indicators (KPIs) such as sales quotas, customer satisfaction scores, or project completion rates determine incentive payouts. By focusing on individual achievements, businesses can drive personal accountability and continuous improvement.

6. Discretionary bonus plan

Unlike structured incentive programs, a discretionary bonus is awarded at the company’s discretion. Management evaluates overall contributions, company performance, and exceptional achievements to determine bonuses. Since these bonuses are not fixed, they allow flexibility in recognizing outstanding performance.

7. Tiered incentive plan

A tiered system encourages employees to exceed their basic targets by offering increasing levels of rewards. Employees who meet minimum goals receive a base incentive, while those who surpass expectations qualify for higher payouts. This approach motivates top performers to consistently push their limits.

8. Balanced scorecard plan

A balanced scorecard plan ties incentives to multiple performance indicators rather than a single metric. Employees may be evaluated on revenue generation, customer satisfaction, operational efficiency, and innovation. This ensures a well-rounded approach to performance evaluation, preventing overemphasis on one specific area.

The effectiveness of an annual incentive plan depends on aligning incentives with business goals and employee roles. Some companies implement a combination of these plans to create a well-rounded system that drives motivation and long-term success. A structured, data-driven approach ensures that incentives contribute to both individual growth and overall business performance.

Ventajas de aplicar planes de incentivos anuales

He aquí las 3 principales ventajas de contar con un plan anual de incentivos:

- Increased sales motivation: Annual incentive plans, which offer measurable prizes and specific, attainable goals, greatly increase employee motivation. Employees are more inclined to go above and beyond to meet goals when they are confident that their efforts will be appreciated.

- Alineación con los objetivos de la empresa: Los AIP ayudan a coordinar las acciones de los trabajadores con los objetivos estratégicos de la organización. Los empleados son más conscientes de cómo su trabajo afecta al conjunto de la organización cuando los incentivos están vinculados a determinados indicadores de rendimiento, lo que garantiza que todos persiguen los mismos objetivos.

Retención y satisfacción de los empleados: La satisfacción y la retención de los empleados pueden aumentar con la implantación de los PAI. La retención de los empleados a largo plazo reduce la rotación y fomenta una cultura positiva en el lugar de trabajo cuando los trabajadores se sienten apreciados y recompensados por sus contribuciones.

Reward High Performers with Transparent Incentives

Automate commission payouts and align rewards with sales goals. With Compass, you can motivate your team and improve overall sales effectiveness.

How to design an effective annual incentive plan

An annual incentive plan (AIP) must be more than just a financial reward; it should serve as a strategic tool to drive performance, reinforce key business objectives, and align employee efforts with corporate goals.

Designing an effective plan requires careful structuring to ensure transparency, motivation, and sustainable results. Below is a methodical approach to creating an AIP that delivers measurable impact.

1. Establish clear business objectives

A well-designed AIP should be a direct extension of corporate strategy. The first step is defining what the business aims to achieve over the incentive period. These could be revenue growth, margin improvement, market share expansion, customer retention, or operational efficiency.

Key considerations:

- The objectives must be specific, quantifiable, and time-bound (e.g., "increase revenue by 15% year over year" rather than "improve sales").

- Prioritize a balance of financial and non-financial goals to prevent short-term decision-making at the expense of long-term stability.

- Ensure alignment across departments so that incentives do not drive conflicting behaviors (e.g., aggressive sales targets that compromise customer service).

2. Define the performance metrics that matter

Performance metrics should be precise, measurable, and controllable by the participants. Choosing the wrong metrics can lead to misaligned behaviors that harm long-term business health.

Considerations for selecting metrics:

- Revenue-based metrics: Gross revenue, net revenue, or revenue growth percentage.

- Profitability metrics: EBITDA, operating margin, or contribution margin.

- Productivity metrics: Sales efficiency, revenue per employee, or quota attainment.

- Customer-centric metrics: Retention rate, customer lifetime value (CLV), or net promoter score (NPS).

- Strategic metrics: Expansion into new markets, reduction in cost of acquisition, or innovation KPIs.

Best practices:

- Use a weighted approach. Not all metrics should have equal importance; assign weight based on priority (e.g., 50% on profitability, 30% on growth, 20% on customer retention).

- Ensure line of sight. Participants should be able to see how their individual efforts influence the metrics, avoiding "black box" calculations that undermine trust.

- Incorporate a cap and floor. Set a minimum threshold below which no payout occurs and a maximum cap to prevent excessive, unpredictable payouts.

3. Structure the payout model for maximum impact

The payout structure must motivate performance without introducing excessive risk to the company’s financials.

Common structures:

- Threshold-target-stretch model

- Threshold: The minimum acceptable performance (e.g., 80% of target).

- Target: The expected performance level.

- Stretch: An ambitious but achievable level (e.g., 120% of target) with a premium payout.

- Tiered payouts

- Graduated payments based on levels of achievement (e.g., 5% bonus for 90% of target, 10% for 100%, 15% for 110%).

- Multipliers and accelerators

- Higher incentive percentages for overperformance, which drive exceptional effort.

Key considerations:

- Balance risk and reward. Avoid overly generous payouts that strain profitability or overly restrictive plans that demotivate employees.

- Ensure external competitiveness. Benchmark against market standards to keep incentives compelling.

- Minimize unintended consequences. Ensure payout formulas do not encourage manipulation of revenue timing or excessive risk-taking.

4. Align the incentive plan with role-specific contributions

A one-size-fits-all approach dilutes effectiveness. Tailor the incentive structure based on function-specific KPIs.

- Revenue-generating roles (sales, business development): Revenue growth, deal conversion rates, pipeline velocity.

- Operations and support roles: Efficiency gains, cost savings, process improvement.

- Customer-facing roles (account management, customer success): Retention rates, customer satisfaction scores, cross-sell effectiveness.

- Product and innovation teams: Milestone completion, new product revenue contribution.

Key principle: Keep incentives aligned with what employees can directly influence. For example, a software engineer should not be evaluated based on company revenue but rather on project milestones and product success metrics.

5. Build a transparent communication and tracking system

Even the most well-designed incentive plans fail if employees do not understand how they work. Transparency builds motivation and trust.

Key implementation steps:

- Detailed documentation: Clearly outline eligibility, performance metrics, payout formulas, and timelines.

- Regular progress updates: Implement a real-time dashboard where employees can track their progress.

- Frequent check-ins: Conduct quarterly reviews to reinforce alignment and adjust expectations if necessary.

Avoid these pitfalls:

- Complexity that reduces engagement. Employees should not need a finance degree to understand their incentives.

- Subjectivity in payouts. If employees perceive favoritism or discretionary adjustments, motivation declines.

- Unclear timelines. Define when and how payouts will be distributed (e.g., annually, quarterly with year-end adjustments).

6. Regularly evaluate and refine the plan

AIPs should not remain static. They must evolve alongside the business, market conditions, and workforce expectations.

Annual review considerations:

- Did the plan drive the desired behaviors and business outcomes?

- Were incentive payouts competitive with industry benchmarks?

- Were there any unintended consequences, such as excessive risk-taking or short-term decision-making?

Adjustments might include:

- Rebalancing metric weightings based on company priorities.

- Refining payout tiers to maintain competitiveness.

- Introducing new performance indicators as business strategy evolves.

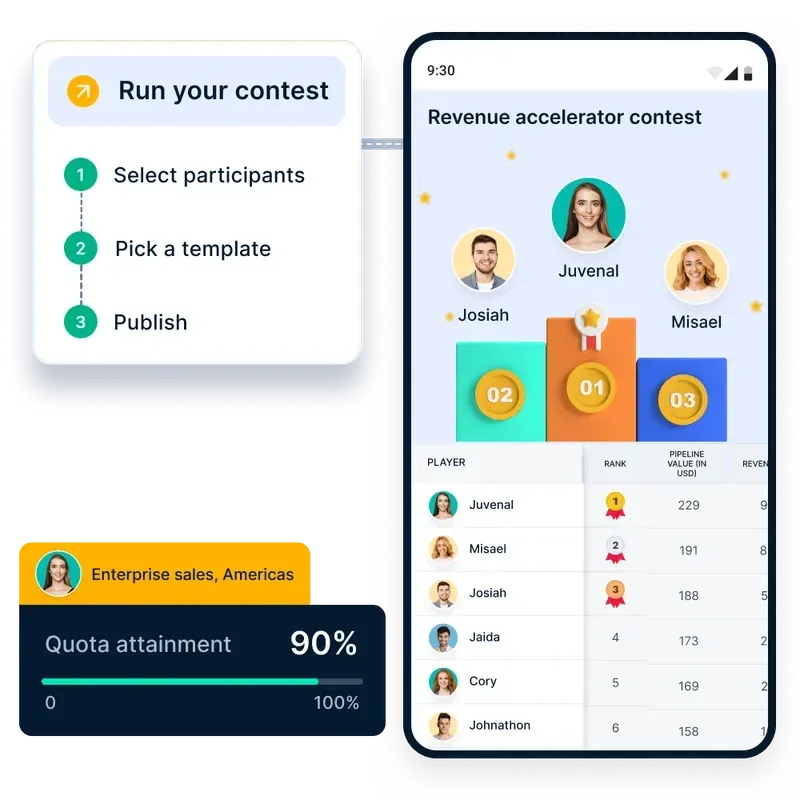

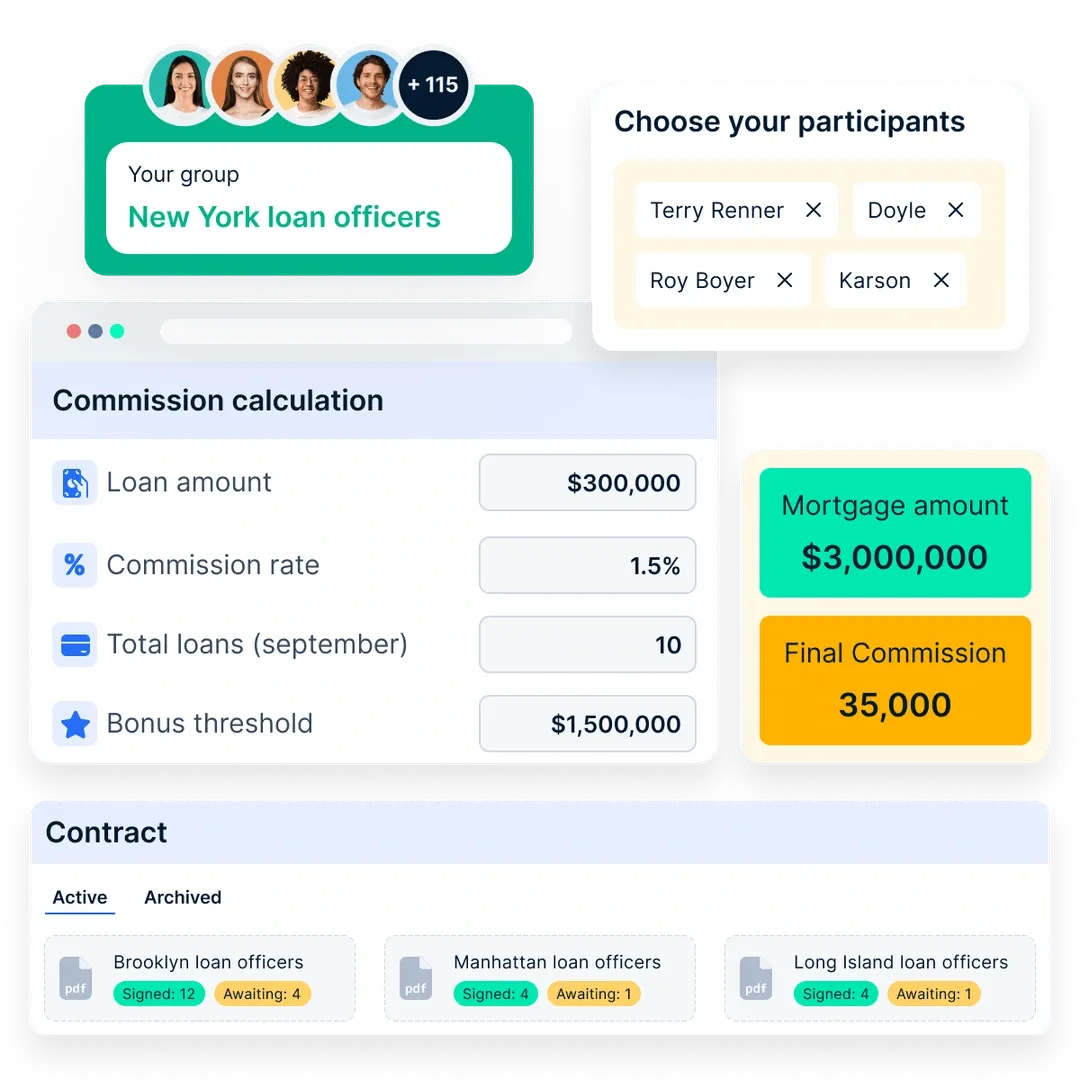

Power your annual incentive plan with Compass

Managing an Annual Incentive Plan (AIP) can get overwhelming—miscalculations, unclear targets, and delayed payouts can lead to disengaged teams. Compass eliminates these challenges by automating and optimizing your AIP, ensuring seamless execution and motivating employees with transparent, real-time insights.

How Compass transforms AIPs:

- Automated incentive calculations: No more spreadsheets or manual errors. Compass ensures accurate payouts based on predefined performance metrics.

- Customizable plan design: Align incentives with company goals by tailoring structures for different roles and teams.

- Real-time performance tracking: Give employees instant visibility into their progress, driving motivation and accountability.

- Seamless integrations: Sync effortlessly with your CRM and sales tools for accurate, up-to-date performance data.

A well-structured AIP can boost performance, retain top talent, and drive revenue growth—but only if it’s executed right.

Ready to take the guesswork out of incentive management? Try Compass today!

Conclusión

Annual incentive plans are powerful tools for maximizing sales performance and achieving company goals. Businesses may establish incentive programs that encourage employees, match their efforts with organizational goals, and drive corporate success by understanding the essential elements, advantages, and best practices for designing and implementing them, as mentioned in the blog

Preguntas frecuentes

1. ¿Cuáles son los componentes clave de un plan anual de incentivos?

Las medidas de rendimiento, los calendarios de pago y los incentivos acordes con los objetivos empresariales son los principales elementos de un plan anual de incentivos.

2. ¿Cómo aumentan los planes anuales de incentivos la motivación de los vendedores?

Los planes de incentivos anuales animan a los empleados a esforzarse más fijando objetivos claros y ofreciendo incentivos tangibles por alcanzarlos. Esto aumenta la motivación de los vendedores.

3. ¿Qué tipos de indicadores de resultados se utilizan habitualmente en los planes de incentivos anuales?

Los objetivos de ventas, los índices de satisfacción de los clientes y otros KPI relevantes para los objetivos de la organización son ejemplos de medidas de rendimiento habituales.

4. ¿Cómo pueden las empresas garantizar la equidad de sus planes anuales de incentivos?

Las empresas pueden garantizar la equidad estableciendo una estructura de remuneración clara, definiendo el proceso de evaluación del rendimiento y evaluando y modificando periódicamente el plan en caso necesario.

5. ¿Por qué es importante celebrar el éxito en los planes de incentivos anuales?

Recompensar los logros levanta el ánimo, demuestra el valor del programa de incentivos e inspira a los empleados a seguir aspirando a la grandeza.