Real Estate Agent Commissions in the USA: A Comprehensive Guide for 2025

Learn about real estate agent commissions in the United States. Understand the average rates, negotiation strategies, and key factors influencing commissions.

On this page

For real estate companies operating in the US, one of the most crucial financial considerations is the real estate agent commission structure. How much should agents be paid? What is the industry standard for commissions? These are key questions that can significantly impact profitability, agent retention, and overall business success.

In the competitive US real estate market, offering an attractive yet sustainable commission model is essential for attracting top-performing agents while maintaining a strong bottom line. Whether you're a brokerage just starting out or looking to optimize your existing structure, understanding the various commission models, market trends, and influencing factors is critical.

In this blog, we’ll break down the different types of real estate agent commission structures, explore the factors that shape commission rates, and provide insights into the current market standards in the US. Let’s dive in!

What is the real estate agent commission?

The real estate agent commission refers to the fee paid to a real estate agent for their services in facilitating a property transaction. This commission calculation is usually agreed upon in a contract between the agent and the seller and is computed as a percentage of the property's final sale price.

The commission compensates for the agent's time and efforts in managing paperwork, negotiating transactions, marketing the property, and assisting clients with the tricky process of purchasing property.

The buyer's agent and the seller's agent typically share the commission however, sometimes one agent represents both parties and gets the full amount. However, this amount may vary depending on factors that we will discuss further.

Buyer's agent vs. listing agent commissions

When a house comes on the market, there are many people who get involved. One side is the seller who is represented by an agent and a broker company that hires or backs the agent.

On the other side is the buyer who is represented by another agent and a broker that backs him. The commission value which is set at 5 or 6 percent is typically allotted to commission of the agents on both sides.

As a buyer agent, you may help iron out all the details of the house, get the right price for the property and help with documentation of the house for your client. As a listing agent, your roles include selling the house for the best possible value, helping with the documentation and closing the deal as soon as possible. Both agents can negotiate the commission split and, in the US, it is usually 50 - 50.

Common types of real estate commission structures in the USA

Here are the three most common commission structures for real estate agents in the USA:

1. Percentage-based commissions

- In real estate, this is the most common and frequently used commission system.

- Agents get the percentage of commission based upon the property's final sale price.

- Usually the commission percentage is between 5% and 6% of the sale price, but the amount may change according to the terms of the agent-client contract.

2. Fixed-fee commissions

- Under this structure, the real estate agent receives payment for their services in the form of a fixed fee in contrast to a percentage of the sale price of the property.

- Regardless of the property's final selling price, the commission amount remains the same and does not change in any circumstance.

- For the client, fixed-fee commissions might provide greater cost predictability and transparency.

3. Hybrid commission structures

- Hybrid commission structures combine components from fixed-fee and percentage-based commission structures. This can be better understood with an example.

- Suppose an agent provides a hybrid commission plan with a $7,000 minimum fixed fee and a 2% commission on the sale price.

- If the property sells for $4,00,000 the agent will receive $8000- 2% of $400000. Here the agent will get 2% commission that is higher then fixed commission $7000.

- In other cases, if the property sells for $3,00,000 - 2% commission will be $6000, which is less then the fixed fee $7000. Here the agent will receive $7000 as the commission.

- Clients who prefer a lower commission rate but still want to make sure the agent is well compensated for their services can find this structure useful.

Factors influencing the real estate commission rates in the USA

Understanding these factors helps companies know how commission for real estate agents are determined and enables them to make informed decisions when engaging with real estate agents.

1. Property value and location

- The commission rates are mostly determined by the location and worth of the property. Bigger transaction amounts are frequently associated with more expensive assets, which could make an impact on the commission percentage.

- Within a state, different cities and districts can have major differences in property values, due to prime locations. As a neighborhood's inventory, foreclosure rate, and demographics can all have an impact on the value of a property.

2. Market conditions and demand

- The level of demand for real estate, market trends and the national economy can have an impact on commission rates across the country.

- When there is more competition among buyers in a seller's market with limited inventory, agents may be able to ask for higher commission rates in such high-demand situations.

- On the other hand, agents may lower their prices to bring clients where there is less demand and more properties available for buyers.

3. Agent experience and expertise

- Agents that have a solid track record and are well-established tend to charge higher commission rates.

- A lot of times experienced agents are brokers with their own company who receive a higher commission share. They have a strong local reputation and a lot of exposure, which attracts a higher-quality clientele.

- When compared to less experienced agents, their understanding of the market, negotiating ability, and track record of successful sales justifies charging a higher commission for their services.

4. Negotiation and competition

- The commission rates are subject to negotiation between the real estate agent and the client.

- Clients can bargain for lower commission rates based on what they want, the range of services the agent offers, and current pricing in the market.

- Besides, as agents compete for clients by providing competitive pricing, commission rates may vary among real estate agents in a given location.

Standard real estate agent commission rates in the USA

The average real estate agent commission in the USA is typically between 5% to 6% of the property’s sale price.

But as per a recent survey done by FastExpert in Q2 2023 the average real estate agent commission rate in the USA comes out to be 5.57%.

However, agent commissions can range from as little as 4% in some locations for house sellers to as much as 7% and 10% in other cities for residential and commercial properties, respectively.

For better clarity, we have listed the average real estate agent commission by state from highest to lowest.

Average real estate agent commission in the USA

Historically, typical real estate agent commissions have ranged from 5% to 6% of the home sale price, equating to approximately $20,000 to $24,000 on a $400,000 home. However, this structure may change due to the introduction of a new commission system in August 2024.

Under the previous system, the seller negotiated the commission with the listing agent, who then split the payment with the buyer's agent at closing. Typically, both the seller's and buyer's agents received a commission of around 2.5% to 3%. Under the new system, buyers are now responsible for negotiating the commission for their own agents, which could result in an adjustment to commission amounts.

It may take several months, or even years, for a new "typical" commission rate to be established as agents adapt to the changes, competing on pricing and the level of service they provide.

Top tax deductions a real estate agent can avail

As a real estate agent, understanding the tax deductions available to you can significantly reduce your taxable income. Here are five key deductions relevant as of 2025:

1. Home office

When you use a part of your home for business purposes, you can claim a home office deduction. For this, you have to satisfy two conditions:

- You must regularly and exclusively use your home for business.

- Your home should be the only primary place of business.

You can deduct rent, insurance, utility bills, maintenance, repairs, depreciation, mortgage interest, etc.

Deductions can be computed in two ways: actual expenses or the simplified method. In the simplified method, the home office deduction for the year 2023 is $5 per square foot of your home office, up to 300 square feet.

The IRS follows strict procedures and allows deductions only if the criteria mentioned are satisfied.

2. Local taxes

You can deduct the property tax and other state taxes that you pay on your personal property. The total amount of such taxes eligible for deduction is limited to $10,000 in a year. Any other local taxes that fall under Lines 5-6 of Section A are also deductible.

3. Self-employment deduction

A self-employment tax at the rate of 15.3% is applicable on commission income of more than $400. Half of this tax can be claimed as self-employment tax deductions

While submitting your tax returns, this should be mentioned under Line 15 on Schedule 1 so as to claim deductions.

4. Commission payments to others

Real estate agents employ sub-agents to help them in their work. In such cases, they pay commissions to these agents for the work done. Commissions paid to agents who work under real estate agents are fully deductible from the taxable amount.

The sub-commission amount paid must be mentioned in Line 10 of Schedule C to claim this deduction. This amount can bring in huge deductions and tax savings to real estate agents.

5. Car deductions

The work of real estate agents entails a lot of travel to the work site, client’s place, office, etc. Since travel is a part of work, mileage traveled can be claimed as deductions. This can contribute to a huge amount of tax savings since the more miles traveled means the more deductions. For the year 2023, the standard deduction is $0.655 per mile driven for work. This should be declared in Line 9 of Schedule C to claim deduction.

Another method to claim deductions is the actual expense method. This applies when miles traveled are much less and expenses on car payments are more. In this case, actual receipts should be submitted to claim deductions.

6. Advertisement

Marketing and advertisements are much needed to promote your business. IRS allows the deduction of reasonable advertisement expenses such as brochures, signage, photography, online advertisements, media advertising, etc.

Advertisement expenses should be claimed on Line 8 of Schedule C while filing tax returns.

7. Professional memberships

There are many professional groups related to the real estate business. Many real estate agents enroll themselves in such unions, trade associations, etc., for which a membership fee is payable. Since this is directly related to the work of a real estate agent, such fees are fully deductible from the tax due.

Real estate agents have to declare such expenses under Line 27a of Schedule C in order to be eligible. Membership license renewal fees and other such expenses are also included under this head.

8. Health insurance premium

Real estate agents who are self-employed can claim deductions for health insurance premiums paid. Health expenses that exceed 7.5% of their adjusted gross income are also eligible to be deducted.

Premiums paid for your family are also deductible. In the case of working under an employer, such expenses are not deductible if there is an employer-sponsored insurance plan. Medical, dental, and other long-term coverage are included in this head. To claim this deduction, you should declare the amount of premium paid under Line 17 of Schedule 1.

9. Donations

IRS grants deductions for charitable donations made. Such deductions can be claimed under Lines 11-13 of Schedule A. In case you have made a non-cash donation, deductions can be claimed for the fair market value of the item subject to valuation.

Deductions up to 60% of adjusted gross income are eligible for donations made in cash. Regarding payments to charity event tickets, the difference between the amount you paid and the fair market value can be claimed as deductions.

10. Office supplies and equipment

Real estate agents can claim office-related expenses on stationery, photocopying, paper clips, inks, cartridges, staplers, postage, and envelopes. These should be declared under Line 18 of Schedule C.

Expenses on equipment like landline telephones, printers, computers, fax machines, etc. are also deductible. If it is a mobile phone, only calls related to business purposes can be deducted.

11. Meals

You may be dining with clients, colleagues, or other business-related people or may be eating out while traveling on account of business. Expenses on meals in such situations are fully deductible as per IRS rules and need to be shown under Line 24b of Schedule C.

By diligently tracking and reporting these expenses, real estate agents can optimize their tax savings and retain more of their earnings.

The role of technology in real estate as a trend

A survey by the National association of realtors revealed that 95 percent of agents used mobile phones to report their activities to the brokers. Around 66 percent of agents used a website to report their day to day activities to their brokers or firms that they worked with.

It was also noted that facebook, instagram and Linkedin were the popular social media platforms that agents used to collect data, make client contact and close deals faster in 2022 - 2023.

Today, there are many real estate agent enabling software and solutions in the market that can help agents with various sales related activities such as:

- Keep track of their leads

- Create multiple listings for their properties

- Enroll in multiple listing services

- Manage ads for their properties

- Track details of upcoming deals

- Documentation and maintaining paperwork in connection with closing deals

- Referral network and database etc

By enabling real estate agents with such software and solutions, brokers can help increase the rate at which sales deals can be closed and therefore benefit from the commissions. This is where Compass comes in.

Compass empowers real estate agents with cutting-edge tools to streamline commission management, enhance efficiency, and boost transparency.

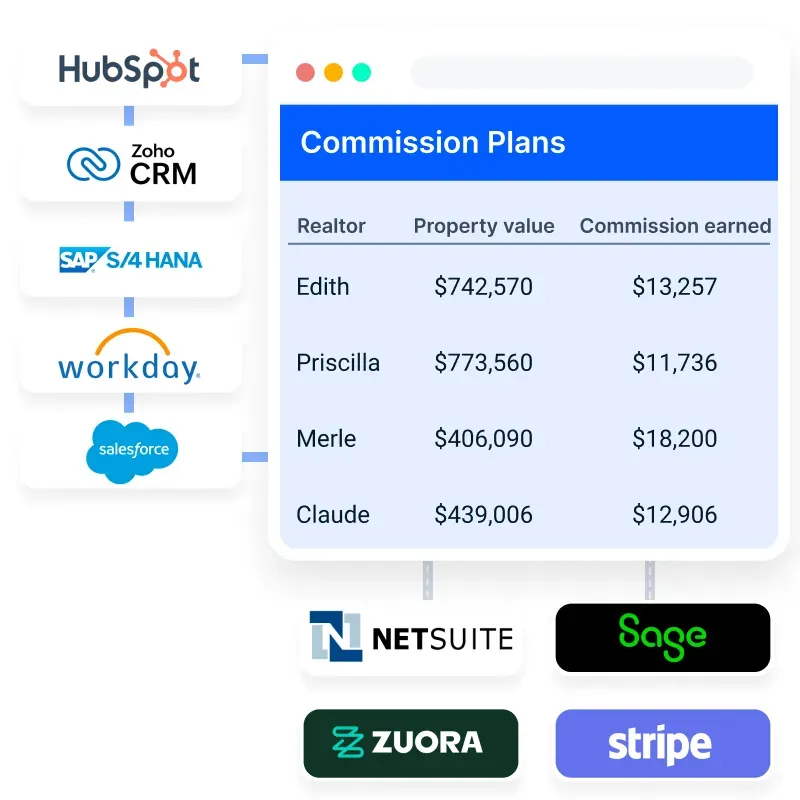

Seamless integration with property management systems

Compass connects effortlessly with platforms like Yardi Voyager, AppFolio, Buildium, and MRI Software, centralizing data and simplifying commission tracking for real estate professionals.

Eliminate legacy commission tracking methods

By replacing outdated spreadsheets and error-prone systems, Compass enables 10X faster commission calculations for leases, rentals, and referrals, ensuring accuracy and efficiency.

Real-time commission tracking and transparency

Agents gain complete visibility into their commission structure, performance metrics, and payouts through Compass. Adjustments due to splits, clawbacks, or bonuses are easily accessible, eliminating ambiguity.

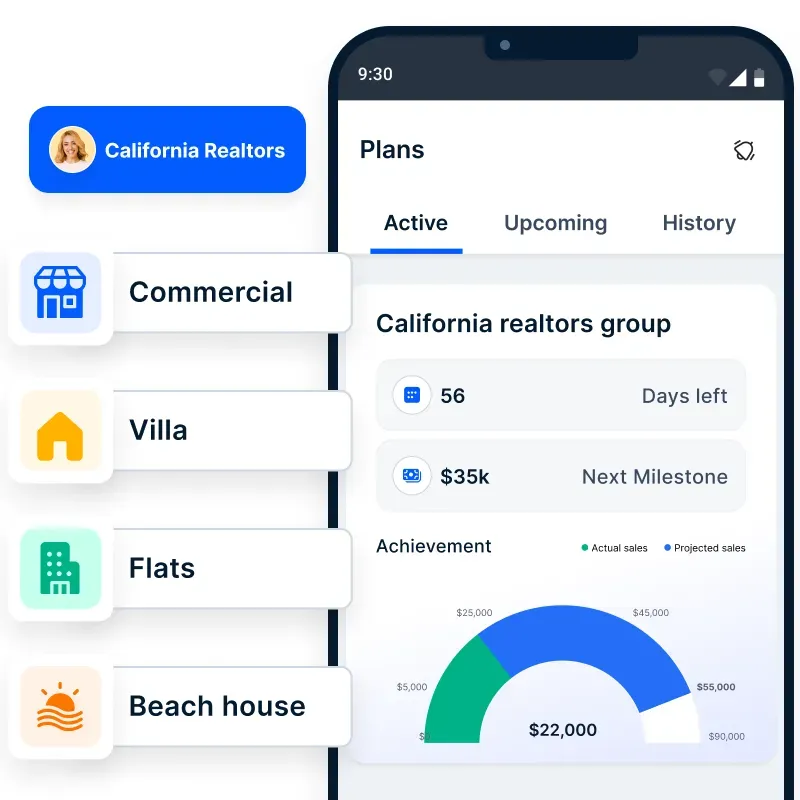

Mobile-enabled commission insights

With Compass’ mobile app, agents can track commission history, including payment dates and amounts, and forecast future earnings based on key performance indicators and property sales trends.

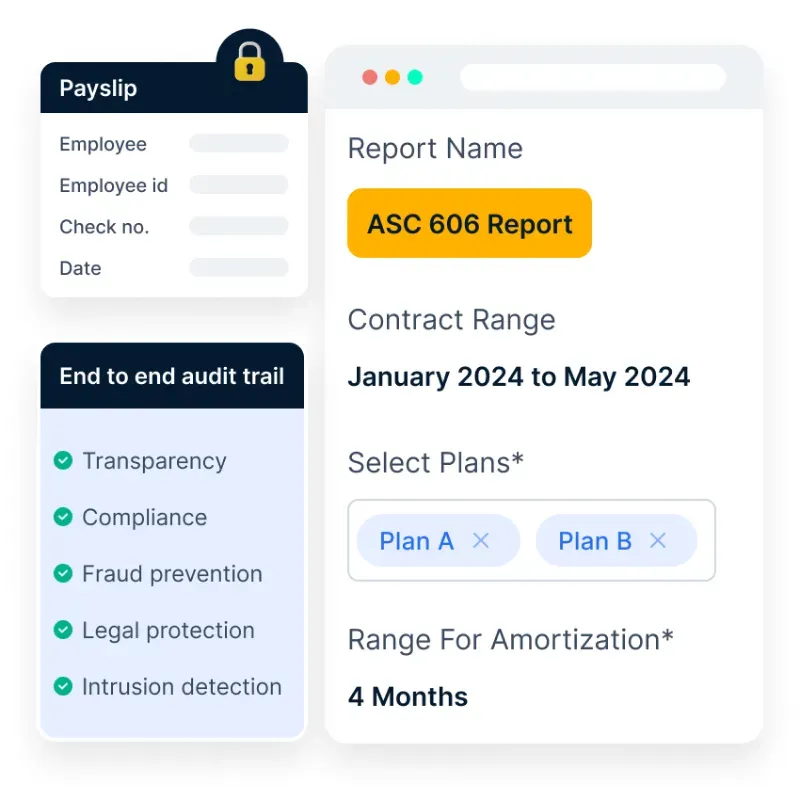

Regulatory compliance and security

Compass adheres to CFPB and RESPA standards, safeguarding payment data with enterprise-grade SOC 2-certified encryption, ensuring trust and compliance.

End-to-end audit trail for accountability

A comprehensive audit trail eliminates shadow accounting, providing detailed records of commission adjustments and payouts, fostering transparency and ethical business practices.

By leveraging Compass, real estate agents can focus on closing deals faster, strengthening client relationships, and maximizing their commission potential. Schedule a call now!

In a nutshell

Companies dealing in the complex space of real estate need to know the nuances of real estate agent commissions in order to stand in the competition.

Above mentioned are the various commission structures, factors influencing the commission rates and the current average real estate agent commission which will help you make an informed decision to make sure a clear, fair contract is made that satisfies both agents demands and the state of the market.

In the end, a successful and rewarding real estate transaction experience depends on striking the correct balance between the services provided, and commission rates.

FAQ's

How can I avoid real estate commission?

Real estate commissions can be negotiated with an agent. You can also sell with a company that offers pre-negotiated low commission rates.

What is the 50% rule in real estate?

I am unable to find information about the 50% rule in real estate from the given search results.

What is the 80 20 rule for realtors?

I am unable to find information about the 80/20 rule for realtors from the given search results.

What percentage do most realtors take?

The national average Realtor commission in 2024 was 5.32 percent total, which is split between the seller's agent (2.74%) and the buyer's agent (2.58%). However, rates can range from 4.78% to 6.67%. Some agents may accept a lower commission for higher-priced homes1. The standard commission is 2% to 4% of the home's listing price but may change.

What percentage do most real estate agents charge?

Real estate agent commissions typically range between 5% and 6% of the property's sale price4. The nationwide average is 5.49%.