5 Best Retail Commission Percentage Models for 2025

Learn how the right retail commission percentage model can drive sales, retain top talent, and improve profits. Explore the best commission structures and rates for retail success.

On this page

Every retail business pays out huge sums as sales commissions. The profits they earn is the revenue from sales minus the commission paid to sales reps. Do these commissions affect profits? Well, no, since the commissions are paid for the sales generated by the sales reps, and the better they are paid, the more they are inspired to improve sales, ultimately boosting profits.

In this blog, we highlight the various retail sales commissions that employers offer for their employees.

What is retail commission?

A retail sales commission is a percentage of the sales value that is achieved by the sales employee which is paid out to the retail sales employee for the achievement of the sales quota or target as set by the employer. Retail commissions are usually set between 5 and 45 percent based on the type of product.

If the base pay is set to the industry standard or slightly above, the commissions may start at 5 percent. But the most common method of paying out commissions is by paying an average base pay and a higher percentage of commission value set between 20 and 30 percent - which helps in motivating sales employees to sell more in order to earn more.

Sales employees in the retail sector are going through ‘the great resignation‘- a time where employees are quitting their jobs to find better jobs that are worth their while. Almost 4 million people quit their jobs in 2021 which indicates poor sales structure and job satisfaction. Of the people who quit their jobs, 63 percent of employees revealed that the most important reason was the lack of satisfactory compensation which may include wages, salary, commissions and incentives.

how does commission work in retail?

5 Types of retail commission structures with examples on how it works

Attrition is extremely high at 60.5 percent in the retail space and therefore having a good salesforce that is compensated well with a good commission structure helps in retaining high performing, trained, valuable resources.

Here are some popular commission structures in most retail companies and an explanation on how commission work in retail.

1. Straight commission

A straight commission plan is the simplest form, where salespeople earn a percentage of their total sales. This is a pure incentive structure, meaning earnings are directly tied to performance.

2. Base salary plus commission

This structure combines a fixed base salary with a commission on sales, offering a balance of security and incentive. The base salary provides a safety net, while the commission motivates employees to exceed targets.

3. Tiered commission

Tiered commission structures offer increasing commission rates as salespeople reach higher sales targets. This motivates employees to push beyond their comfort zone and achieve exceptional results.

0-5 cars sold: 1% commission per car

6-10 cars sold: 1.5% commission per car

11+ cars sold: 2% commission per car

If a salesperson sells 12 cars, their commission would be calculated as follows: (5 * 1%) + (5 * 1.5%) + (2 * 2%)

4. Pool commission plan

A pool commission plan involves pooling a percentage of total sales revenue, which is then distributed among the sales team based on various factors, such as individual sales, seniority, or performance reviews. This fosters teamwork and shared responsibility for overall sales success.

5. Residual commission

Common in industries with recurring revenue (like subscription services), residual commission pays salespeople a commission on initial sales and a continuing commission on renewals or repeat business. This encourages building strong customer relationships and ensuring customer retention.

How retail commissions drive more sales

Retail commissions play a crucial role in driving sales by motivating sales teams, rewarding performance, and attracting top talent. By implementing a well-structured commission retail system, businesses can ensure their sales reps are motivated to close more deals and enhance customer experiences.

Here are the key benefits of commission in retail and how they contribute to business growth.

1. Motivate employees

A commission-based structure encourages retail sales associates to go the extra mile to meet or exceed sales targets. Additionally, commissions incentivize excellent customer service, as employees are motivated to build better relationships with shoppers.

2. Reward employees based on performance

According to Gallup’s State of the Global Workplace: 2022 Report, nearly 44% of employees experienced high daily stress levels in 2021. Recognizing and rewarding top performers through a well-defined commission retail structure can help boost morale and engagement. Compensation tied to performance makes employees more invested in increasing sales and contributing to the company’s success.

But there are a few drawbacks to it as well.

Drawbacks of commission-based pay

While a retail commission structure has many benefits, there are some challenges that businesses must address.

1. Complicates payroll

Commission-based pay structures can make payroll management more complex. Calculating commissions based on sales volume, transaction value, and tiered percentages requires precision and efficiency.

2. Negative competition among employees

A commission-based system may sometimes lead to unhealthy competition, where employees prioritize earnings over teamwork. This can result in aggressive sales tactics that harm customer experience.

3. Discourages employee growth

When employees focus solely on hitting sales targets, their professional development can take a backseat. They may neglect broader retail skills, such as customer relationship management, leadership, and teamwork.

Now that we know how we can use Compass to combat the drawbacks of retail commission. Let’s understand how to set it up in 7 steps.

7 steps to create a retail commission structure

Studies reveal that in 60 percent of companies, the commissions are created by the senior management or CEO with the help of the sales managers. Here is a simple and effective way to create and implement a retail commission strategy:

1. Choose the appropriate commission structure

Based on the type of product or service and the complexity of sale, companies must choose the right type of commission structure that they want to offer to their employees. Not all employees may benefit from the ‘one size fits all’ approach.

2. Set realistic targets

Targets or quotes for retail sales employees must be set by taking into account the overall sales objective for the year and the number of sales employees using which, realistic goals must be provided as sales quotas for month, quarter and annually.

3. Communicating with sales team

Sales employees in the retail sector tend to shuffle a lot - this means that companies may have to deal with new employees a lot. Keeping quotas and commission structure clear and communicating them effectively helps in better productivity from the employee.

4. Establish effective tracking and reporting systems

Employees in retail usually lack the technology to report and track their sales data and their achievements. Make sure that employees have the right tools to record their day to day sales achievements and proper reporting format for the same on a weekly or monthly basis.

5. Consider tax implications

Commissions are taxable under the income tax and IRS norms of the US. This means that employers must withhold the tax before paying them as commissions to the employees. Make sure that tax amounts are calculated properly and the right commission structure and payment is made as per the taxation laws for employers.

6. Track employee performance

Tracking of employee performance helps the management to identify areas where intervention is required and areas where the employees are doing well. This helps in adjusting the commission structure or introducing additional training, sales incentives or rewards programs to help the employees out.

7. Continuous improvement

As employers in the retail space, strategies and payment structures should be dynamic and adjust to the market conditions and competition in the industry. Creation of strategy and making sure all employees are benefitting from the same must include activities such as:

- Gathering feedback from sales team on their satisfaction level with regards to the current compensation and commission structure - 63 percent employees agreed that collecting their feedback to create a better workplace would make them keener.

- Adapting to changing market conditions and checking for competitor compensation strategies using competitor analysis tools

- Staying informed about industry trends and creating provisions for other monetary and non monetary benefits for employees.

Walmart is one of the biggest retail stores and an employer of over thousands of workers. Walmart aims to reduce its turnover in their sales division and help employees with better standards of pay and quality of work. Walmart uses various benefits and perks to capture employee retention and improve their quality of life including:

Recognizing employees for their performance

Additional benefits based on hierarchy

Higher wages and better performance based incentives

Healthcare insurances starting at 25 USD per day

Employee discounts etc

One such example of this is Walmart. Walmart created and structured a retail commission that provided them with success.

In case you are short of retail commission ideas, unlike Walmart, we have a few in store for you.

6 Retail sales commission ideas for 2025

Following are the 6 retail sales commission ideas you can consider implementing in 2025.

1. Product-specific bonus

Introduce a bonus commission for selling specific products or product categories. This can be particularly effective if there are new or high-margin products you want to promote

- Sell Product X: Earn an additional 3% commission on the sale of Product X.

- Achieve a certain target in a specific product category: Receive a one-time bonus of $500.

2. Gift card power-ups

Incorporate a gift card incentive into your commission structure. Allow salespeople to earn gift cards for reaching specific milestones, achieving outstanding performance, or consistently hitting targets. The gift cards can be for popular retail stores, restaurants, or other enticing options.

- Achieve 150% of monthly sales target: Receive a $50 gift card of your choice.

- Close the highest sales in a quarter: Earn a $100 gift card.

3. Experience-based commission

Instead of traditional monetary incentives, offer salespeople the opportunity to earn unique experiences based on their performance. This could include spa days, concert tickets, adventure activities, or travel vouchers.

- Exceed quarterly sales targets: Enjoy a weekend getaway package.

- Achieve the highest sales in a specific product category: Receive tickets to a popular show or event.

4. Customer retention bonus

Encourage salespeople to not only focus on acquiring new customers but also on retaining existing ones. Implement a commission bonus for sales generated from repeat business or from customers who make frequent purchases

- Generate sales from a returning customer within a specific period: Earn an extra 2% commission.

- Achieve a certain percentage of sales from repeat customers in a month: Receive a loyalty bonus.

5. Team-based performance pool

Create a shared commission pool where a percentage of each sale goes into a collective fund. At the end of a set period, the pool is distributed among the entire sales team based on overall team performance, fostering a sense of collaboration. This encourages teamwork and collaboration among sales team members.

- 2% of each sale goes into the team performance pool.

- At the end of the quarter, the pool is divided among team members based on a weighted average of individual sales contributions.

6. Upselling and cross-selling bonus

Incentivize salespeople to upsell and cross-sell by offering a bonus for each successful upsell or cross-sell. This encourages them to focus not only on individual product sales but also on increasing the overall transaction value.

- Successfully upsell a higher-tier product: Earn a 5% bonus on the upsell amount.

- Cross-sell complementary products with the main purchase: Earn an additional 3% on the cross-sell amount.

Now comes the hot question about retail commission. How much do the retail sales rep make?

How much commission does a retail sales rep make?

The projected overall compensation for a Retail Commission Sales position in the United States area is approximately $94,953 per year, with an average annual salary of $61,666. These figures denote the median, signifying the midpoint of the ranges derived from our exclusive Total Pay Estimate model, based on user-contributed salary data.

The anticipated supplementary pay is estimated at $33,287 annually, encompassing potential components such as cash bonuses, commissions, tips, and profit-sharing. The "Most Likely Range" reflects values falling within the 25th and 75th percentiles of all available pay data for this role.

How is retail commission calculated?

Studies reveal that only 32 percent of employees in the retail sector were actually satisfied with their compensation from their employers.

This is the reason why people move away from retail jobs which leads to loss of money and valuable human resource for the employers. By putting in place a solid retail commission structure, employers can retain more employees.

Cities like New York and Chicago paid a good basic pay structure of 55,983 and 52,087 USD per year. Commissions are paid over and above this value based on the sales quota achievement.

Employees who have more than 10 years of experience are paid between 65K and 70,000 USD per year as base pay which supports the earning potential of sales employees in the long run.

Sales commission is calculated by multiplying the commission percentage with the sales quota that needs to be achieved. Typical sales commission percentage for B2C is 10 to 30 percent based on the product. For B2B clients, this value is estimated at 7 to 15 percent. In garments and fashion, the percentage for commission is set between 10 and 20 percent.

For example: if an employee's base salary is 10,000 USD and his sales commission is 10 percent for target achievement, then his commission on achieving 100 percent quota achievement of 20,000 USD would be: 10,000 + (10 X 10,000) = 11,000 USD.

This is an example of the base + commission model. If employees in the commission only model, the sales quotas are higher with higher percentage and value of commission.

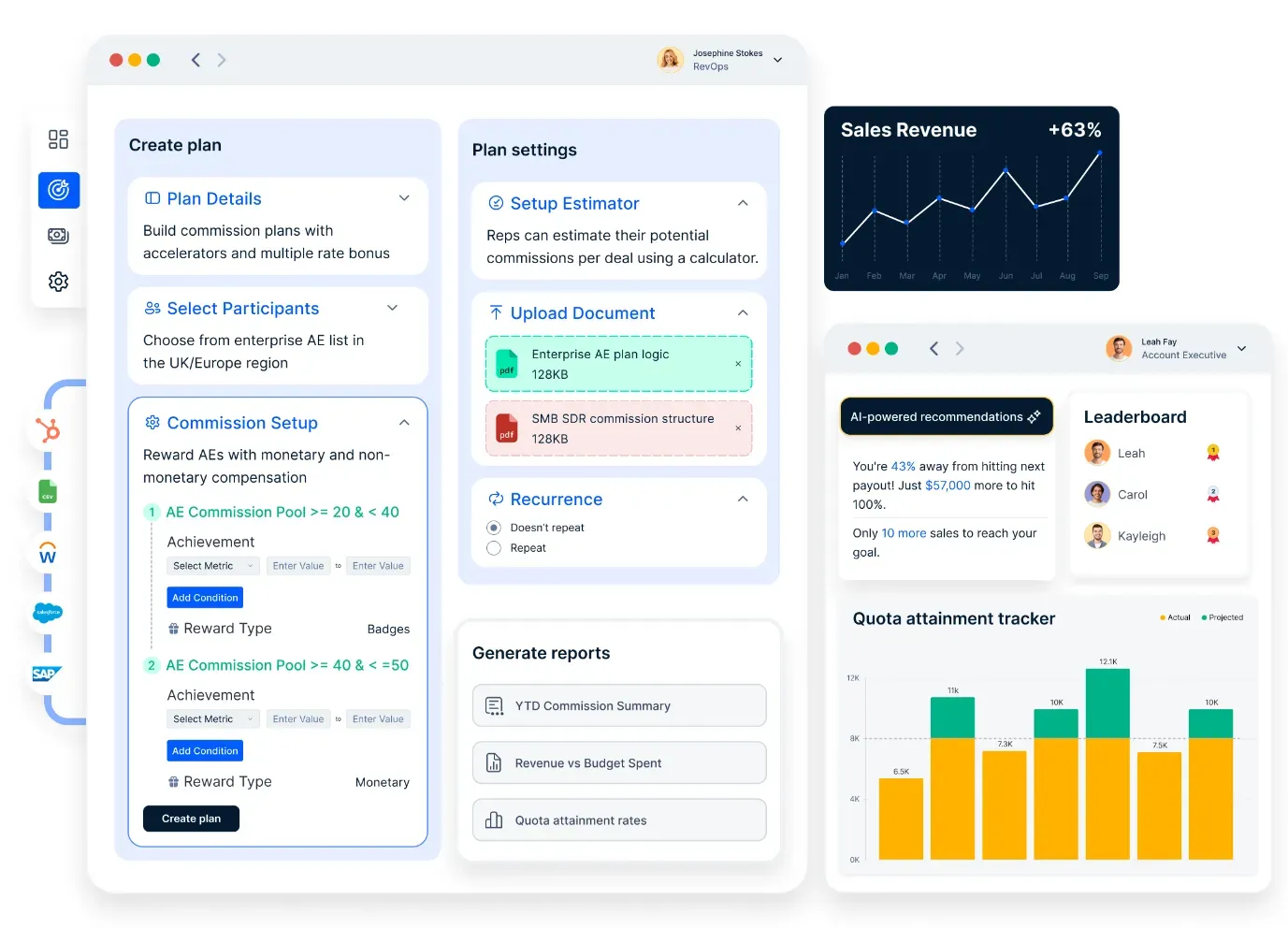

How Compass can optimize retail sales commissions for better performance?

Managing commission-based payroll can be complex, especially with tiered structures, varying percentages, and performance-based incentives. Compass simplifies this by:

1. Automating commission calculations for accuracy

- Automatically calculating commissions based on sales data.

- Reducing manual errors in payroll processing.

- Ensuring timely and accurate payouts to employees.

2. Encouraging fair competition and teamwork

- Tracking individual and team sales performance.

- Offering insights into fair commission distribution.

- Recognizing not just sales numbers but also collaboration and customer engagement.

3. Driving employee motivation through gamification

- Running sales contests with real-time leaderboards.

- Displaying top performers on sales floor TV screens.

- Introducing rewards that go beyond commissions, such as badges, gift cards, and experience-based bonuses.

4. Simplifying reporting and performance tracking

- Providing detailed sales reports and insights.

- Helping managers identify high-performing employees.

- Allowing employees to track their own earnings and progress.

Retail businesses often struggle with tracking commissions and sales performance in real time. Schedule a call with Compass now!

Wrapping up with key points:

The talent and efforts of the salespersons go a long way in influencing the productivity of you retail business. Due to this fact, sales commissions should not be considered an expense. The compensation to retain the best talent helps accelerate the productivity of the retail business store. In this blog, we learned,

- Offering competitive commissions motivates employees to sell more, leading to higher profits.

- Common models include straight commission, base salary plus commission, tiered commission, pool commission plans, and residual commission.

- Choosing the right structure depends on factors like product type, sales cycle, and business goals.

FAQ's

What is a typical commission for retail sales?

A typical commission for retail sales ranges from 5% to 30% depending on the type of product and sales structure.

What is a reasonable commission rate?

A reasonable commission rate is usually between 10% and 20% for most retail products, though it can vary.

How much commission does a salesperson earn if they get 25% of a $30,000 car?

The salesperson would earn $7,500 (25% of $30,000).

Do retail workers get commission?

Yes, many retail workers do earn commission, especially in industries like car sales, furniture, and high-end retail.

What is the normal commission in retail?

The normal commission in retail is typically between 5% and 10%, although it can be higher in certain sectors like luxury goods or automotive sales.