A Comprehensive Guide to ASC 606: The Need for Revenue Recognition Compliance

ASC 606 is the new standard for revenue recognition. This blog discusses the standard, the five-step model, and revenue recognition criteria.

On this page

Business transactions involve the transfer of monetary considerations in exchange for the transfer of goods or services. The monetary consideration received is the revenue for a business.

Do you know when businesses should recognize this revenue? Businesses were following different practices of revenue recognition. This impacted the financial reporting and statements of accounts of organizations and led to legal complications.

Since the recognition of revenues is an important part of a business, a new revenue recognition standard was introduced in 2018. This is Accounting Standard Codification (ASC) 606, which replaced ASC 605. The article below explains what it is, to whom it is applicable, and the mode of revenue recognition.

What is ASC 606?

ASC 606, or Accounting Standards Codification 606, is a revenue recognition standard. It sets clear rules for how companies recognize revenue from customer contracts. Revenue is recognized when control of goods or services is transferred to the customer.

ASC 606 provides a comprehensive framework for accurate revenue recognition. It helps ensure consistency in financial reporting and transparency in financial statements. Companies must disclose detailed information about revenue streams, deferred revenue, and performance obligations.

The Financial Accounting Standards Board (FASB) issued ASC 606 in May 2014. It applies to companies following Generally Accepted Accounting Principles (GAAP). Public companies adopted this standard in 2017, while private companies and non-profits followed in 2018.

ASC 606 aims to improve financial health visibility by aligning revenue recognition processes across industries. It covers aspects like transaction price, standalone selling price, and significant financing components in customer contracts.

Why was ASC 606 introduced?

The reasons for the introduction of ASC 606 are enlisted below:

- ASC 606 aims to provide a framework whereby revenue recognition can be more consistent.

- IASB and FASB aimed to update the existing revenue recognition standards to make them more relevant across industries.

- Variations were observed in the accounting for revenues of similar transactions across industries that needed to be changed.

- The difference in accounting procedures failed to provide a basis for comparing results from the stakeholder's point of view.

- With the introduction of ASC 606, IASB and FASB intended to create guidelines for revenue computation for tax purposes.

However, there is a significant difference between ASC and IFRS.

IFRS 15 vs. ASC 606: What’s the difference?

ASC 606 and IFRS 15 are similar. Both offer a clear framework for revenue recognition in customer contracts. They focus on identifying performance obligations and recognizing revenue when these obligations are met by transferring goods or services.

Both standards aim to ensure accurate revenue recognition in financial statements. This gives a clear picture of financial performance and helps stakeholders understand the company's cash flow and revenue streams better.

Here’s a comparative table.

Aspect | ASC 606 | IFRS 15 | Key Differences |

Collectability Threshold | Requires a higher probability of collection, setting the threshold at 75-80%. | Sets a lower threshold at 50%, requiring only that collection is “more likely than not.” | ASC 606 demands greater certainty about payment collection compared to IFRS 15. |

Shipping and Handling Disclosure | Treats shipping and handling as fulfilment activities but allows for separate presentation in financial statements. | Does not specifically mandate separate disclosure of shipping and handling fees. | ASC 606 emphasizes separate disclosure more than IFRS 15, which offers less guidance on this aspect. |

Contract Costs | Allows broader capitalization of incremental costs incurred in obtaining a contract (e.g., sales commissions). | Applies more restrictive criteria for recognition, requiring costs to be directly attributable and expected to generate future economic benefits. | IFRS 15's stricter criteria may lead to fewer costs being capitalized compared to ASC 606, affecting financial statement comparability. |

Sales Taxes | Generally requires exclusion of sales taxes collected from customers from the transaction price. | Offers flexibility, allowing companies to choose whether to present sales taxes as part of revenue or separately. | ASC 606 has a prescriptive approach, while IFRS 15 allows for varying practices regarding sales taxes, potentially affecting comparability of reported revenue figures. |

License Renewals | Explicitly prohibits revenue recognition for license renewals before the renewal period begins. | Allows for potentially earlier revenue recognition if the customer can utilize and benefit from the license. | IFRS 15 permits earlier revenue recognition for license renewals compared to the more restrictive approach under ASC 606. |

Five steps for ASC 606 revenue recognition

Revenue recognition can be tricky for subscription businesses. Changes like refunds, disputes, and prorations add complexity. Following these steps helps companies recognize revenue accurately under the ASC 606 standard.

1. Identify the customer contract

A valid contract must meet these criteria:

- Both parties approve the agreement and commit to it.

- The rights and payment terms for goods or services are clear.

- The contract impacts future cash flows.

- The business expects to collect payment.

2. Identify performance obligations

List every promise to deliver goods or services. Each distinct performance obligation must add value and be independently transferable.

3. Determine the transaction price

Calculate the total price, including cash, noncash items, or discounts. Adjust for upgrades, price concessions, and variable consideration.

4. Allocate the transaction price

Divide the price among performance obligations based on their relative standalone selling price. For subscriptions, this can be challenging but ensures deferred revenue is accurate.

5. Recognize revenue as obligations are met

Revenue is recognized when goods or services are delivered. For single obligations, like a custom sofa, recognize revenue on delivery. For ongoing obligations, like software subscriptions, attribute revenue to each period of service.

These steps align with ASC 606 and improve financial reporting, helping businesses maintain compliance with accounting standards.

Why should your business comply with revenue recognition?

ASC 606 impacts the policies of an organization in several ways. The following pointers indicate why it is important to comply with the standard:

1. Legal requirement

It is a requirement under the law for every business to comply with ASC 606, irrespective of whether they are private, public, or not-for-profit organizations. You are bound by the standard if your business is involved in a contract to transfer goods or services for monetary consideration. There are no exceptions to this under the law.

2. Financial clarity

A business's performance and financial position are important information for several stakeholders. They are interested to know the revenues earned in a period.

Compliance with ASC 606 eliminates inconsistencies in revenue reporting and gives clarity to all. The comparison of revenues across industries is made easier with this new standard.

3. Business acumen

The new revenue recognition method benefits your organization by providing a deep insight into the organization's workings. A business should have definite knowledge of its financial position so that predictions on cash flow can be made precisely. Revenues that have not yet accrued are not accounted for here; therefore, it gives a correct view of the financial position of a business.

4. Identifying refunds

Identifying refunds and processing them, specifically for subscription-based companies, becomes easier with revenue recognition. ASC 606 emphasizes revenue recognition for completed services, and therefore if a subscription is canceled mid-way, a refund is issued for the portion of the contract that has not been performed.

5. Tax purposes

As per IASB and FASB, compliance with ASC 606 is necessary for tax purposes also. Reporting the right amount of taxes is possible only when the revenues are recognized without any flaw. It may otherwise invite investigations by tax authorities.

Assessment criteria for revenue recognition

Revenue recognition follows the below-mentioned criteria:

1. Evidence of arrangements in financial terms

There should be clear evidence in the form of a written contract between the customer and the business. The agreement should establish that the customer intends to buy the product or service from the business for a specified monetary consideration.

2. Delivery of goods

As per the contract, the products or services mentioned should be delivered. Revenue recognition can be accounted for only when the delivery is completed in full. There have been complications before ASC 606, with assessing revenues as industry practices differ. But after ASC 606, delivery of goods is also one of the important criteria for revenue recognition.

3. Price fixed by the seller

The price is fixed, and the buyer agrees to the same by entering into a contract. There can be no two views on this since it is only based on the contract. Negotiations, if any, can be done before the contract is finalized. The seller fixes the price, and the contract is executed for the same price.

4. Reasonable assurance of collectability

Reasonable assurance is mentioned as a criterion to make a provision for uncollectible amounts in certain cases. This happens when the seller observes that the collectability of debt is doubtful. In such cases, cash-basis transactions are allowed to maintain reasonable assurance of collection.

Penalties for non-compliance

Companies are monitored for non-compliance with ASC 606, and a lapse could impact them greatly. IASB and FASB, along with the Securities and Exchange Commission, lay down strict rules for complying with ASC 606. In case of non-compliance, companies face heavy penalties and may even face a jail term. Your business may also invite a tax audit by the IRS in case the reported revenue differs from the actuals.

Benefits of compliance with ASC 606

We have stressed the importance of complying with ASC 606. Apart from the legal requirement, there are some benefits you should look into while complying with the new standard. These are the main benefits of complying with ASC 606:

- Your business may get a clean chit for a public offer. This is possible only when you comply with ASC 606, as this implies compliance with IPO regulations too.

- Compliance with ASC 606 ensures that inconsistencies in contracts are reduced. This is done by standardizing the quoting process. Similar contracts see consistent treatment under this standard.

- The stakeholders, mainly investors, are confident about the business due to compliance with ASC 606. This will invite more investments and lead to the growth of the company.

Revenue recognition methods

Some common revenue recognition methods followed by companies are mentioned hereunder.

1. Sales-basis method

This method of revenue recognition is mostly used in the retail sector, where payment and delivery follow each other almost immediately. Even if payment is not received, but the seller believes there is a high likelihood of the buyer paying, revenue can be recognized.

When the sale happens and the product is delivered, revenue is recognized. Here we see that only the delivery of goods matters the most in this method.

2. Percentage of completion method

When there is a long-term contract, there are various stages at which revenue is recognized. Waiting till the completion of the entire term of the contract may not be possible in that case.

In such cases, detailed terms are laid down in the contract that mention the various stages at which payment has to be made by the buyer. Payment is made for the percentage of work that is completed or products that have been delivered.

3. Installment method

This method of revenue recognition is best used when the seller does not have sufficient information about when payments will be received. This happens mostly in high-value transactions. The company cannot trust the buyer's credibility and so recognizes revenue in installments, i.e., as and when received.

This method is not followed by companies that have put down, in writing, the expected receipt of payment.

4. Completed contract method

As the name suggests, this completed contract method recognizes revenue after completing the contract terms in full. This is not suitable for long-term contracts, as we have seen above in the percentage of completion method. The completed contract method is used by companies when they enter into a short-term contract.

5. Cost-recoverability method

This is quite similar to the installment method but with a small difference. In the installment method, the company can identify/estimate the cost of goods and services mentioned in the contract, but the date by which the buyer will make the payment has yet to be ascertained. Under the cost-recoverability method, the company is not sure of the associated costs and follows a conservative approach to revenue recognition.

Revenue is recognized only when all the costs incurred are recovered, and the obligations as per the contract are completed.

Conclusion

It is clear from the above that ASC 606 applies to all companies that enter into contracts. Do refer to the five-step model that can help identify the right time for revenue recognition. The standard is more complex and has to be assessed with respect to each industry. Get the help of an expert to assist you in this process in case it is overwhelming.

While there are many benefits for complying with the standard, non-compliance can prove costly too. Businesses should keep track of their revenues with reference to the criteria mentioned for the same. This can keep them stress-free and also abide by the standard at the same time.

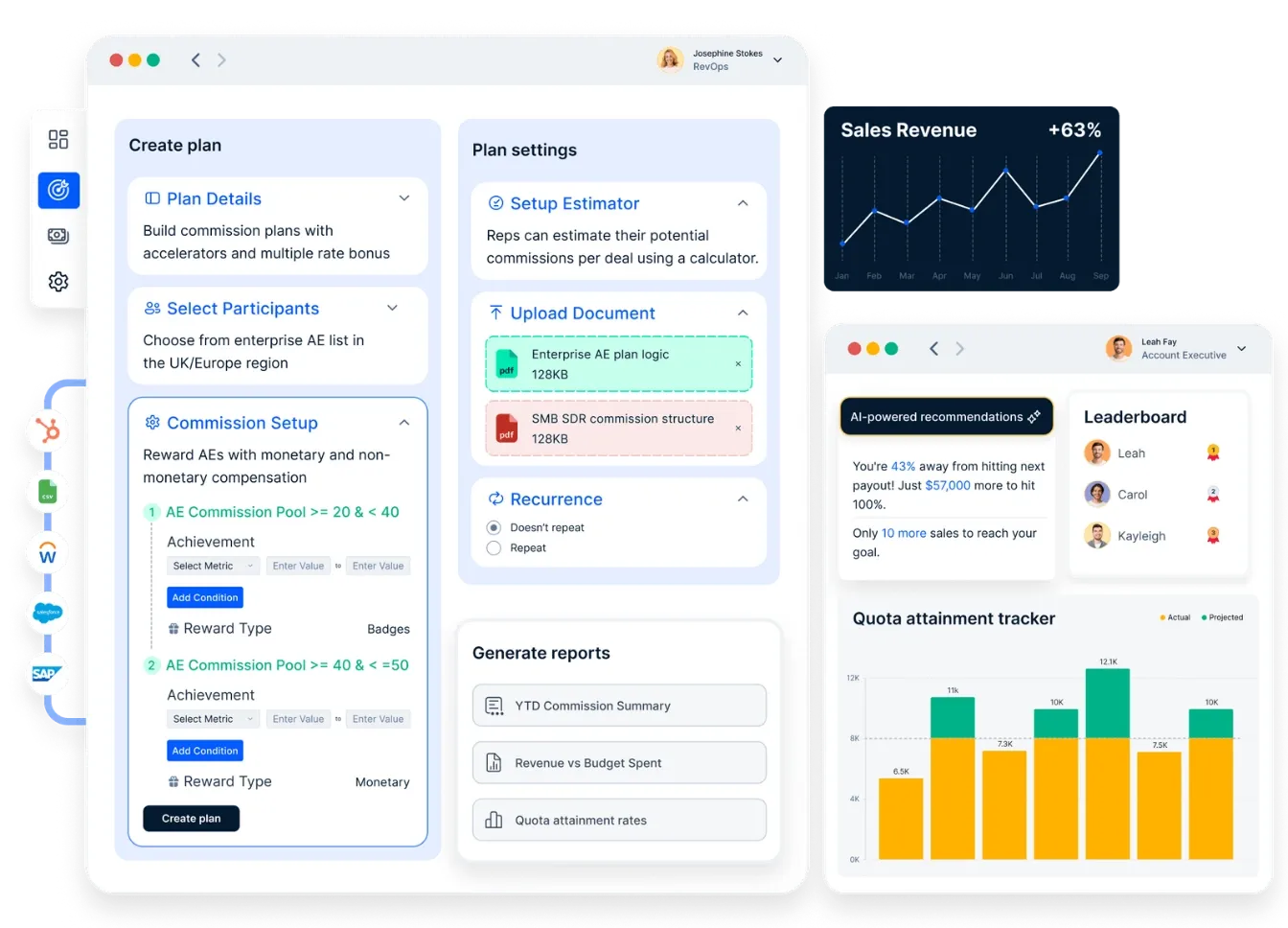

Compass can help simplify ASC 606 compliance. It offers a comprehensive framework for managing contracts, performance obligations, and transaction prices. It integrates seamlessly with accounting systems to track revenue streams, deferred revenue, and variable consideration.

Service-based businesses can use Compass to allocate transaction prices, manage contract costs, and ensure accurate revenue recognition. By doing so, businesses can maintain compliance, improve financial performance, and support strategic decision-making.

FAQs

1. What does ASC 606 stand for in accounting?

ASC 606, Accounting Standards Codification Topic 606, issued by the Financial Accounting Standards Board (FASB). It provides a robust framework for recognizing revenue from customer contracts.

2. What is the ASC 606?

ASC 606 is a revenue recognition standard for contracts with customers. It ensures companies recognize revenue consistently and accurately. The standard applies to promised goods or services, focusing on performance obligations and transaction prices. It improves financial reporting, helping entities align with generally accepted accounting principles (GAAP).

3. What is the ASC 606 revenue recognition checklist?

The checklist helps ensure ASC 606 compliance and covers the following:

- Reviewing customer contracts for distinct performance obligations.

- Identifying transaction prices and any variable considerations.

- Allocating transaction prices using relative standalone selling prices.

- Tracking revenue for performance obligations.

- Recording deferred revenue for obligations not yet satisfied.

Careful planning helps maintain compliance and smooth revenue recognition processes.

4. What is the difference between ASC 606 and ASC 842?

ASC 606 focuses on revenue recognition from customer contracts, while ASC 842 handles lease accounting. ASC 606 emphasizes recognizing revenue when a company transfers goods or services, while ASC 842 deals with lease obligations, payment terms, and how they impact financial statements and cash flows.

5. What are the five steps of revenue recognition?

The five steps of revenue recognition align with ASC 606:

- Recognize contracts with customers.

- List performance obligations.

- Set the transaction price.

- Divide it by the relative standalone selling price.

- Record revenue recognized as obligations are met.

- This process simplifies financial reporting and ensures accuracy.

6. How does ASC 606 affect sales commissions?

ASC 606 requires companies to track incremental costs, such as sales commissions if tied to customer contracts. These costs are capitalized and amortized over the contract term or longer. It improves the financial health of service-based businesses and ensures proper revenue recognition practices.