Top 3 Account Manager Compensation Plans: Strategies to Drive Retention & Revenue Growth

Account manager compensation plan outlines how their efforts translate into financial rewards and provide motivation for them to achieve specific goals.

On this page

Account manager compensation plans are designed to align with their unique role in driving customer retention and growth. Unlike sales roles that focus on acquiring new customers, account managers (AMs) and customer success managers (CSMs) concentrate on nurturing existing relationships, ensuring client satisfaction, and uncovering opportunities for upselling and cross-selling.

This focus on retention is critical, especially considering that retaining customers is far more cost-effective than acquiring new ones. Research shows that it costs five times more to attract a new customer than to retain an existing one. Moreover, improving customer retention rates by just 5% can boost profits by 25% or more.

Given the strategic importance of retaining customers for sustained growth, account manager compensation plans must reflect their pivotal contributions. This includes incentives tied to customer success metrics, upselling efforts, and overall satisfaction to ensure long-term client loyalty and profitability.

An effective account manager compensation plan is a cornerstone for motivating account managers, retaining existing customers, and driving revenue growth.

Why fixed salaries don’t work for account managers?

Account management roles, such as account managers and account executives, often bridge customer retention and new business acquisition. While the average base salary for account managers in the U.S. is $70,000 annually, on-target earnings (OTE) can exceed $100,000.

To strike the right balance, a comprehensive compensation plan blends fixed salaries with variable pay, incorporating growth bonuses, a commission structure, and incentives tied to net revenue retention or sales quotas.

A well-structured compensation plan not only reduces customer churn but also empowers the entire sales team to focus on existing accounts, shorter sales cycles, and additional client services, ultimately boosting overall revenue growth and ensuring agency profitability.

What are the best account manager compensation plans to drive retention?

While a competitive base salary is important, the best account manager compensation plans to drive retention focus on bonuses that incentivize the right behaviors:

Plan 1: Retention-based commission

This compensation plan is ideal for account managers whose primary responsibility is to retain existing customers. Account managers are rewarded based on their ability to renew contracts and retain revenue from existing accounts.

An Account Manager has a monthly retention quota of $35,000 ARR and earns a 12% commission on every deal they close.

- Retention-based commission with 1 path to earnings

- Quarterly net revenue quota: $300,000

Earnings rule:

- 0% – 100% = 7.5% commission rate

- 100% – 150% = 12.5% commission rate

- 150% = 15% commission rate

Such a compensation structure motivates account managers to focus on retaining existing customers, contributing to net revenue retention and reducing customer churn.

Plan 2: Retention & upsell bonus

This plan incorporates both retention and account growth by rewarding account managers for renewals and upsells. It aligns with strategic objectives like increasing customer lifetime value and achieving business growth.

An Account Manager has a quarterly retention quota of $250,000 ARR and earns a 9% commission on every renewal they manage. Additionally, they have a quarterly upsell quota of $80,000 ARR and earn a 12% commission for every upsell deal.

Retention and upsell bonus with 2 paths to earnings

1. Quarterly retention revenue quota: $250,000

- 0% – 100% = 9% bonus

- 100% – 150% = 12% bonus

- 150% = 15% bonus

2. Quarterly upsell revenue quota: $80,000

- Earnings rule: 12% bonus

This well-structured compensation plan ensures account managers are incentivized to retain existing clients while identifying additional client service opportunities to drive overall revenue growth.

Plan 3: Retention-based bonus

This approach rewards account managers for achieving specific revenue retention targets through fixed bonuses. Such a plan offers financial security while encouraging focus on retaining customer relationships and reducing customer churn.

An Account Manager has a monthly retention quota of $40,000 ARR and earns a $40 bonus for every percentage of their quota they meet.

- Retention-based bonus with 1 path to earnings

- Quarterly net revenue quota: $300,000

Earnings rule:

- 0% – 80% = $90 bonus per percentage point

- 80% – 100% = $110 bonus per percentage point

- 100% – 150% = $130 bonus per percentage point

- 150% = $150 bonus per percentage point

A comprehensive compensation plan like this drives account manager motivation, aligns with company goals, and boosts net revenue retention. Regularly reviewing sales compensation plans ensures they effectively achieve business objectives and drive revenue growth. Take this commercial company as an example.

Account managers in the commercial products company face challenges in retaining current customers and expanding the number of products and services sold to those customers.

The solution was to create a bonus plan that rewarded Account Executives for exceeding goals in revenue renewal, sales of new products to existing customers, days sales outstanding, and key account plan implementation. The results are not discussed in the document.

The company needed to increase revenues from existing customers and generate new ones that fit their desired profile. The company also aimed to retain current customers and expand the number of products/services offered to them.

There was a need to invest time in new markets and leverage current customer relationships to generate business from new customers. So, to address these challenges, the company designed a comprehensive account manager sales compensation plan.

They also set participation requirements to maintain transparency and used metrics based on unit performance and types of performance. They also added a bonus plan for account management, with specific bonuses tied to monthly revenue renewal and new product sales.

They defined methods for crediting sales and sharing goals among team members. As a result of integrating the incentive program, including the account manager compensation plan, the commercial product company noticed, The bonus structure provided clear financial incentives for account managers which encouraged them to meet and exceed their goals.

- The account managers would get the maximum bonus of $6,000 after achieving a perfect 100% renewal rate.

- Multiple account managers claimed $1,000 after selling multiple new products to the same existing customer.

- Collaboration between sales executives and account executives.

- Enhanced customer satisfaction and contract renewals.

What metric to tie your AM comp plans to?

The best metric for your AM compensation plan depends on your company's goals.

If you want to prioritize customer retention, then you should:

Try to implement the GRR or Gross Revenue Retention plan. The metric for this plan will solely focus on retaining the existing revenue stream from your existing customer pool.

By tying this type of metric into the account manager compensation plan, you can reward the AMs based on how well they keep the customer churn in check. Such a method would ensure that the AMs get the push to get the existing contracts renewed.

Suppose the quarterly quota is $300,000 in GRR. So, if they achieve 80% or higher of the quota, the account manager earns a bonus of what amount you set. For reference, the structure is $125 per $1,000 in GRR exceeding quota.

If you want to prioritize customer growth, then you should:

Use the NRR or Net Revenue Retention. This rewards AMs for both retaining existing customers and growing revenue through upsells and expansions. Tying up NRR with account manager compensation plan would prompt the AMs to open themselves to upselling opportunities.

This metric considers customer retention and upselling opportunities. With this, you can retain existing clients and encourage them to expand their service subscriptions or purchase additional products. Such a type of metric holds the potential to drive overall revenue growth.

Net Revenue Retention considers revenue from existing customers. This compensation plan incentivizes exceeding targets. Suppose the quarterly quota is $300,000. Their performance bonus is $125 per percentage point achieved above the quota. For instance, an AM exceeds their quota by 20% and earns a bonus of $2,500 (125 x 20).

If you want to balance both growth and retention, then use a combined Gross & Net Revenue Retention plan:

This blended approach motivates AMs to achieve success in both areas. There are a few elements that could also be used to uphold the AM's performance. They are:

- Achievement of quota: This measures the AM's ability to secure a specific amount of revenue or sales within a set timeframe.

- Customer acquisition cost (CAC): A lower CAC indicates the AM is efficiently bringing in new customers.

- Customer lifetime value (CLTV): This metric rewards AMs for acquiring customers who bring long-term value to the company.

- Customer retention rate: A high retention rate signifies AM’s success in keeping existing customers happy.

Consider a balanced approach that combines metrics. Let us go through how this globally acclaimed luxury auto-brand implemented a well-structured compensation plan for the whole team that led to their overall success, with a 96.2% increase in payout adoption.

Now we have identified the key metrics for evaluating account manager performance. Let's now discuss how to create a comprehensive compensation plan for account managers.

How to create the best account manager compensation plans?

Designing a successful account manager compensation plan is critical for achieving your company goals while keeping account managers motivated. Here’s how you can create a well-structured compensation plan:

1. Align with company goals

Your compensation strategy should directly support your sales organization’s goals. Whether your focus is on client retention, revenue growth, or acquiring new customers, your account manager compensation plan must incentivize actions that align with these objectives.

2. Account size and complexity

Larger or more complex accounts require more time and effort to manage. Ensure account managers handling high annual contract value or intricate client needs are compensated better than those managing smaller accounts.

3. Tailor for experience

Experienced account executives or senior account managers often bring more value through shorter sales cycles, client retention, and additional client services. Reflect this in their base salary, variable pay, or growth bonuses.

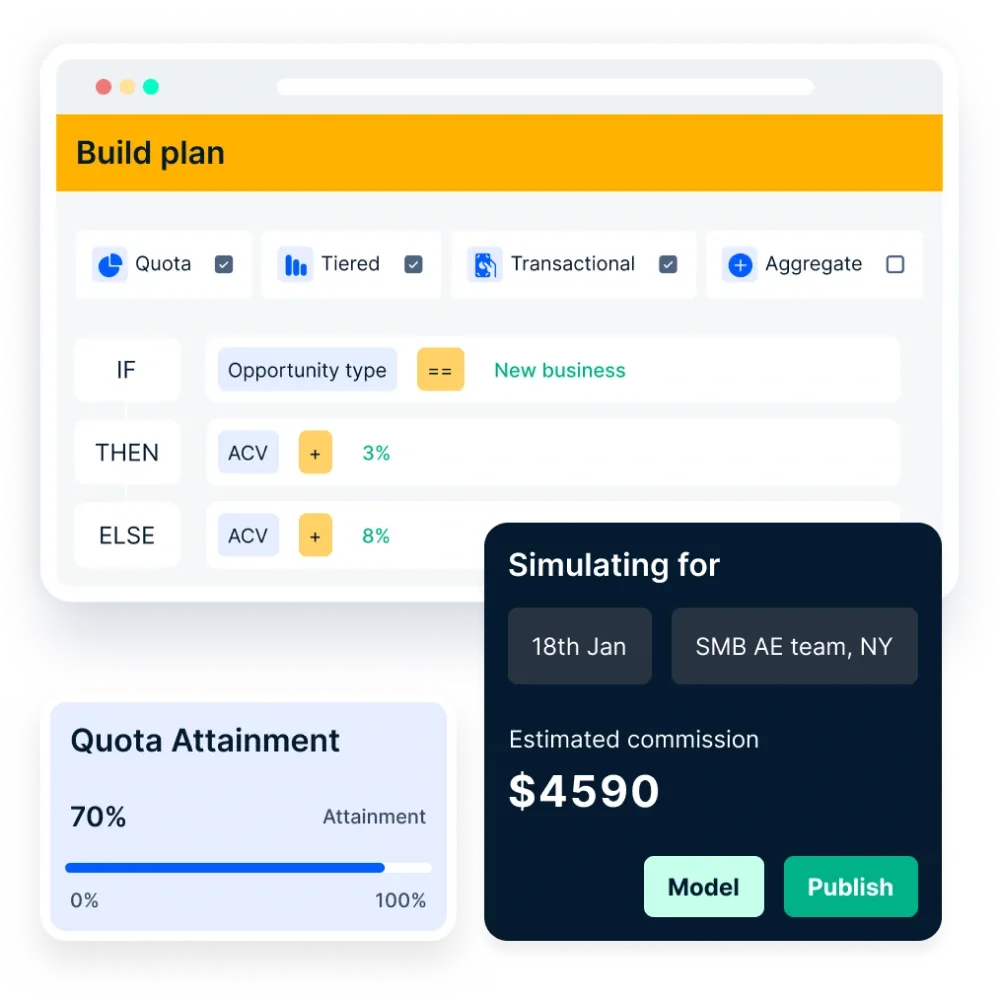

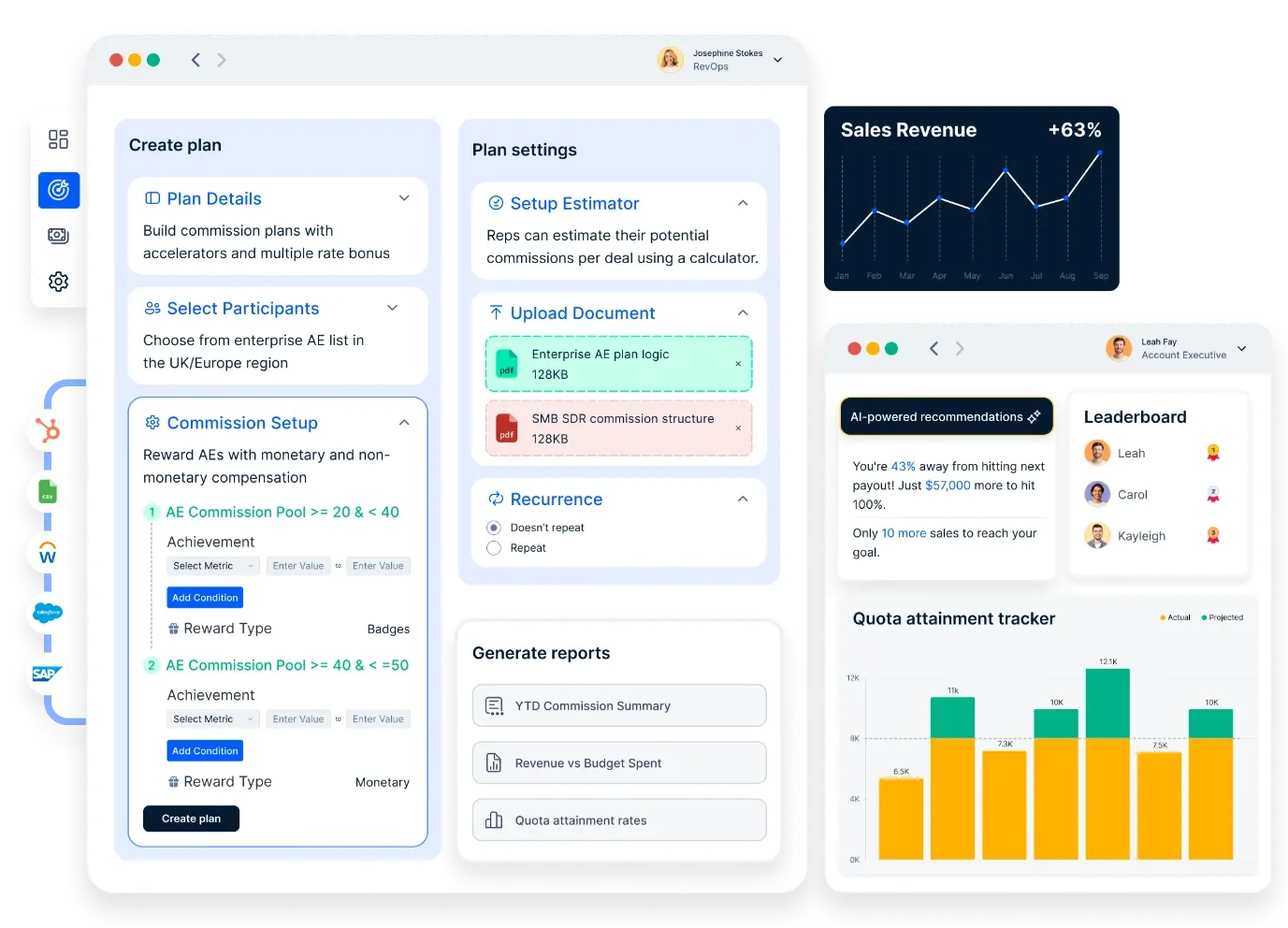

Compass can significantly enhance the AM compensation plan by allowing you to test draft incentive compensation plans before they go live. With its powerful what-if scenario modeling, you can analyze how different roles will be impacted.

Additionally, Compass enables you to analyze and clone successful compensation plans that have previously led to increased quota attainment and maximum profitability. This means you can replicate effective strategies easily.

You can adjust your incentive or commission plans at any time to align with changing market trends and revenue objectives, ensuring your compensation strategy remains relevant and effective.

4. Competitive compensation plans

Benchmark your compensation programs against industry standards. Offering competitive fixed salaries, on-target earnings, and commissions can help attract and retain top talent within your sales team.

5. Clear communication

Clearly explain the commission structure, renewal quota, and growth bonuses. A comprehensive compensation plan that is easy to understand will empower account managers to exceed expectations.

6. Seasonality and sales cycles

Account for variations in sales cycles and renewals. During slower periods, offer incentives to maintain motivation and sales efficiency. Consider bonuses tied to shorter sales cycles or additional client services during off-peak times.

7. Regular reviews and adjustments

Regularly assess your compensation plans. Factors such as sales cycle length, customer churn, and revenue generated should guide necessary updates to keep the plan effective and aligned with company goals.

By considering these elements, you can create motivating compensation plans that incentivize account managers, drive overall revenue growth, and ensure alignment with the organization’s revenue targets.

Account manager compensation plan best practices

We will develop best practices by analyzing case studies, focusing on German luxury car manufacturers, and considering the needs of commercial product organizations.

From the global commercial product company, we learned to:

- Align the compensation for the account managers with the company goal. The company designed the account manager compensation plan to align with its key objectives, which included retaining current customers, expanding sales of new products to existing customers, and improving days sales outstanding. This helped the organization greatly to deliver the account managers with compensation that they needed to push through.

- Implement key account plans aggressively. By tying account manager bonuses to these metrics, the plan incentivized behaviors that supported the company's overall strategy.

- Create a thorough bonus structure. The commercial product company placed a structured bonus plan, which included participation requirements to maintain transparency, metrics based on unit performance and types of performance, and specific bonuses tied to monthly revenue renewal and new product sales. Not only that, but they incorporated methods for crediting sales and sharing goals among team members. Structuring the bonuses with set rules provided clear financial incentives for account managers to meet and exceed their goals.

By maintaining the best practices for the account manager compensation plan, you will notice:

- Enhanced collaboration between sales executives and account executives

- Customer satisfaction and contract renewals, as noticed via the commercial product company, and the German luxury auto brand that recorded a 96% Compass adoption rate.

- The bonus structure effectively motivated account managers to focus on renewals upsells, and customer relationships, leading to better business outcomes for the company.

Conclusion

Sales compensation plans should motivate account managers to grow accounts. This can be done by creating a pay structure that rewards account growth and ensuring that plans are clear and detailed.

The path to growth starts with sales leaders understanding where and how sales efforts fall short of identifying and implementing appropriate account manager compensation plan changes. This can be done by evaluating current sales performance on renewals, cross-sells/upsells, and new revenue against projections and growth targets. Therefore, implement an accelerator like Compass to:

- Automate the incentive program. This automation helps to eliminate errors and delays associated with manual processes.

- Get real-time performance insights. Get visibility into performance metrics and commission information.

- Create a flexible compensation plan for your account managers. Compass can handle both simple and complex compensation structures, making it adaptable to various business needs.

Lastly, Compass offers predictive analytics and powerful insights so that organizations can plan better across teams and make informed decisions regarding compensation strategies. So, schedule a demo call with our specialists to find out how you can draft a perfect account manager compensation plan for your AMs.

FAQs

1. How should account managers be compensated?

Account managers should have a compensation structure that balances base salary with performance-based incentives. A competitive base salary ensures financial stability, while bonuses or commissions linked to client retention, upselling, cross-selling, and customer satisfaction drive performance. Additionally, offering non-monetary benefits like career development opportunities enhances motivation.

2. What is the compensation plan for an account executive?

An account executive’s compensation plan typically includes a base salary plus commissions. Commissions are often tied to achieving or exceeding sales targets, new client acquisition, or upselling existing clients. Incentives like bonuses for surpassing quotas or team performance may also be included.

3. How do account managers make commissions?

Commissions are earned by meeting or exceeding revenue goals, upselling, cross-selling, or retaining key accounts.

4. Does an account manager get a commission?

Yes, account managers often receive commissions for meeting retention, upselling, or cross-selling targets.

5. What is the commission structure for account executives?

Account executives typically earn a percentage of sales, with higher rates for new client acquisition, larger deals, or exceeding quotas. Some plans include tiered commission rates.