Commissioni degli agenti immobiliari negli Stati Uniti: una guida completa per il 2025

Scoprite le provvigioni degli agenti immobiliari negli Stati Uniti. Comprendete le tariffe medie, le strategie di negoziazione e i fattori chiave che influenzano le provvigioni.

In questa pagina

Per le società immobiliari che operano negli Stati Uniti, una delle considerazioni finanziarie più importanti è la struttura delle commissioni per gli agenti immobiliari. Quanto devono essere pagati gli agenti? Qual è lo standard del settore per le commissioni? Si tratta di domande fondamentali che possono avere un impatto significativo sulla redditività, sulla fidelizzazione degli agenti e sul successo generale dell'azienda.

Nel competitivo mercato immobiliare statunitense, l'offerta di un modello di provvigioni attraente ma sostenibile è essenziale per attrarre gli agenti più performanti e mantenere una solida linea di fondo. Sia che siate un'agenzia di intermediazione agli inizi o che stiate cercando di ottimizzare la struttura esistente, è fondamentale comprendere i vari modelli di provvigione, le tendenze del mercato e i fattori che lo influenzano.

In questo blog analizzeremo i diversi tipi di strutture di provvigioni per gli agenti immobiliari, esploreremo i fattori che determinano i tassi di provvigione e forniremo informazioni sugli attuali standard di mercato negli Stati Uniti. Tuffiamoci!

Qual è la commissione dell'agente immobiliare?

La commissione dell'agente immobiliare si riferisce al compenso pagato all'agente immobiliare per i suoi servizi nel facilitare una transazione immobiliare. Questocalcolo della commissioneè solitamente concordato in un contratto tra l'agente e il venditore ed è calcolato come percentuale del prezzo finale di vendita dell'immobile.

La provvigione compensa il tempo e gli sforzi dell'agente nel gestire le pratiche, negoziare le transazioni, commercializzare l'immobile e assistere i clienti nel complicato processo di acquisto di un immobile.

L'agente dell'acquirente e l'agente del venditore in genere si dividono la commissione, ma a volte un agente rappresenta entrambe le parti e riceve l'intero importo. Tuttavia, questo importo può variare in base a fattori che discuteremo più avanti.

Commissioni per l'agente dell'acquirente e per l'agente di collocamento

Quando una casa viene messa sul mercato, sono molti i soggetti coinvolti. Da una parte c'è il venditore, rappresentato da un agente e da una società di intermediazione che assume o sostiene l'agente.

Dall'altra parte c'è l'acquirente che è rappresentato da un altro agente e da un broker che lo sostiene. Il valore della commissione, fissato al 5 o 6 percento, è in genere destinato alla commissione degli agenti di entrambe le parti.

In qualità di agente acquirente, potete aiutare a definire tutti i dettagli della casa, a ottenere il giusto prezzo per l'immobile e a documentare la casa per il vostro cliente. In qualità di agente inserzionista, il vostro ruolo comprende la vendita della casa al miglior valore possibile, l'assistenza alla documentazione e la chiusura dell'affare nel più breve tempo possibile. Entrambi gli agenti possono negoziare la ripartizione della commissione che, negli Stati Uniti, è solitamente 50-50.

Tipi comuni di strutture di commissioni immobiliari negli USA

Ecco le tre strutture commissionali più comuni per gli agenti immobiliari negli Stati Uniti:

1. Commissioni basate sulla percentuale

- Nel settore immobiliare, questo è il sistema di commissioni più comune e frequentemente utilizzato.

- Gli agenti ricevono la percentuale di commissione in base al prezzo finale di vendita dell'immobile.

- Di solito la percentuale di commissione è compresa tra il 5% e il 6% del prezzo di vendita, ma l'importo può variare in base ai termini del contratto tra agente e cliente.

2. Commissioni fisse

- In questa struttura, l'agente immobiliare viene pagato per i suoi servizi sotto forma di un compenso fisso, a differenza di una percentuale del prezzo di vendita dell'immobile.

- Indipendentemente dal prezzo di vendita finale dell'immobile, l'importo della commissione rimane invariato e non cambia in nessun caso.

- Per il cliente, le commissioni a quota fissa potrebbero garantire una maggiore prevedibilità e trasparenza dei costi.

3. Strutture commissionali ibride

- Le strutture commissionali ibride combinano componenti di strutture commissionali a quota fissa e a percentuale. Questo aspetto può essere meglio compreso con un esempio.

- Supponiamo che un agente offra un piano di provvigioni ibrido con una commissione fissa minima di 7.000 dollari e una commissione del 2% sul prezzo di vendita.

- Se la proprietà viene venduta a 4.00.000 dollari, l'agente riceverà 8000 dollari - il 2% di 400.000 dollari. In questo caso l'agente otterrà una commissione del 2%, superiore alla commissione fissa di 7000 dollari.

- In altri casi, se l'immobile viene venduto a 3.00.000 dollari - la commissione del 2% sarà di 6.000 dollari, che è inferiore alla commissione fissa di 7.000 dollari. In questo caso l'agente riceverà 7000 dollari come commissione.

- I clienti che preferiscono un tasso di commissione più basso ma vogliono comunque assicurarsi che l'agente sia ben ricompensato per i suoi servizi possono trovare utile questa struttura.

Fattori che influenzano le commissioni immobiliari negli USA

La comprensione di questi fattori aiuta le aziende a sapere come vengono determinate le commissioni per gli agenti immobiliari e consente loro di prendere decisioni informate quando si impegnano con gli agenti immobiliari.

1. Valore e posizione della proprietà

- Le commissioni sono determinate principalmente dalla posizione e dal valore dell'immobile. Le transazioni di importo maggiore sono spesso associate a beni più costosi, il che potrebbe avere un impatto sulla percentuale di commissione.

- All'interno di uno stesso Stato, città e distretti diversi possono presentare notevoli differenze nei valori degli immobili, a causa della posizione privilegiata.L'inventario di un quartiere, il tasso di pignoramenti e i dati demografici possono avere un impatto sul valore di una proprietà.

2. Condizioni di mercato e domanda

- Il livello di domanda di immobili,tendenze del mercatoe l'economia nazionale possono avere un impatto sui tassi di commissione in tutto il Paese.

- Quando c'è più concorrenza tra gli acquirenti in un mercato di venditori con scorte limitate, gli agenti possono chiedere commissioni più elevate in situazioni di forte domanda.

- D'altro canto, gli agenti possono abbassare i prezzi per attirare i clienti dove c'è meno domanda e più immobili disponibili per gli acquirenti.

3. Esperienza e competenza dell'agente

- Gli agenti che hanno un solido curriculum e sono ben consolidati tendono ad applicare commissioni più elevate.

- Spesso gli agenti esperti sono broker con una propria società e ricevono una quota di provvigioni più elevata. Hanno una solida reputazione locale e una grande visibilità, che attrae una clientela di qualità superiore.

- Rispetto agli agenti meno esperti, la loro comprensione del mercato, la loro capacità di negoziazione e il loro curriculum di vendite di successo giustificano l'applicazione di una commissione più elevata per i loro servizi.

4. Negoziazione e concorrenza

- I tassi di commissione sono soggetti a negoziazione tra l'agente immobiliare e il cliente.

- I clienti possono contrattare per ottenere commissioni più basse in base a ciò che desiderano, alla gamma di servizi offerti dall'agente e ai prezzi correnti del mercato.

- Inoltre, poiché gli agenti competono per accaparrarsi i clienti offrendo prezzi competitivi, i tassi di commissione possono variare tra gli agenti immobiliari di una determinata località.

Tassi di commissione standard degli agenti immobiliari negli Stati Uniti

La commissione media di un agente immobiliare negli Stati Uniti è in genere compresa tra il 5% e il 6% del prezzo di vendita dell'immobile.

Ma secondo un recente sondaggio condotto da FastExpert nel secondo trimestre del 2023, il tasso medio di commissione per gli agenti immobiliari negli Stati Unitiagente immobiliare negli Stati Uniti è pari al 5,57%..

Tuttavia, le commissioni degli agenti possono variare da un minimo del 4% in alcune località per i venditori di case a un massimo del 7% e del 10% in altre città, rispettivamente per gli immobili residenziali e commerciali.

Per maggiore chiarezza, abbiamo elencato le commissioni medie degli agenti immobiliari per Stato, dalla più alta alla più bassa.

Commissione media dell'agente immobiliare negli Stati Uniti

Storicamente, le commissioni tipiche degli agenti immobiliari variano dal 5% al 6% del prezzo di vendita della casa, pari a circa 20.000-24.000 dollari per una casa da 400.000 dollari. Tuttavia, questa struttura potrebbe cambiare a causa dell'introduzione di un nuovo sistema di commissioni nell'agosto 2024.

Nel sistema precedente, il venditore negoziava la commissione con l'agente inserzionista, che poi divideva il pagamento con l'agente dell'acquirente al momento della chiusura. In genere, sia l'agente del venditore che quello dell'acquirente ricevevano una commissione di circa il 2,5% - 3%. Con il nuovo sistema, gli acquirenti sono ora responsabili della negoziazione della commissione per i propri agenti, il che potrebbe comportare un adeguamento degli importi della commissione.

Potrebbero essere necessari diversi mesi, o addirittura anni, per stabilire un nuovo tasso di commissione "tipico", poiché gli agenti si adattano ai cambiamenti, competendo sui prezzi e sul livello di servizio offerto.

Le principali detrazioni fiscali di cui può usufruire un agente immobiliare

In qualità di agente immobiliare, la comprensione delle detrazioni fiscali disponibili può ridurre in modo significativo il reddito imponibile. Ecco cinque detrazioni chiave rilevanti a partire dal 2025:

1. Ufficio domestico

Quando si utilizza una parte della propria abitazione per scopi professionali, è possibile richiedere una detrazione per l'home office. A tal fine, è necessario soddisfare due condizioni:

- L'abitazione deve essere utilizzata regolarmente ed esclusivamente per lavoro.

- La vostra casa dovrebbe essere l'unico luogo di lavoro primario.

È possibile detrarre l'affitto, l'assicurazione, le bollette, la manutenzione, le riparazioni, l'ammortamento, gli interessi ipotecari, ecc.

Le detrazioni possono essere calcolate in due modi: spese effettive o metodo semplificato. Con il metodo semplificato, la detrazione per l'ufficio domestico per l'anno 2023 è pari a 5 dollari per piede quadrato dell'ufficio domestico, fino a un massimo di 300 piedi quadrati.

IlIRSsegue procedure rigorose e ammette le detrazioni solo se sono soddisfatti i criteri citati.

2. Imposte locali

È possibile dedurre l'imposta sulla proprietà e altre imposte statali pagate sui beni personali. L'importo totale di tali imposte deducibili è limitato a 10.000 dollari in un anno. Qualsiasi altra imposta locale che rientra nelle righe 5-6 della sezione A.Sezione Asono anch'esse deducibili.

3. Detrazione per lavoro autonomo

Aimposta sul lavoro autonomoal tasso del 15,3% è applicabile ai redditi da commissione superiori a 400 dollari. La metà di questa imposta può essere richiesta come detrazione fiscale per il lavoro autonomo.

Al momento della presentazione della dichiarazione dei redditi, questo dato deve essere indicato alla riga 15 del prospetto 1, in modo da poter richiedere le detrazioni.

4. Pagamenti di commissioni a terzi

Gli agenti immobiliari impiegano dei subagenti per aiutarli nel loro lavoro. In questi casi, pagano delle commissioni a questi agenti per il lavoro svolto. Le commissioni pagate agli agenti che lavorano alle dipendenze degli agenti immobiliari sono completamente deducibili dalla base imponibile.

L'importo della sottocommissione pagata deve essere indicato inriga 10del Prospetto C per richiedere questa deduzione. Questo importo può portare a enormi detrazioni e risparmi fiscali per gli agenti immobiliari.

5. Deduzioni auto

Il lavoro degli agenti immobiliari comporta molti spostamenti per raggiungere il luogo di lavoro, la sede del cliente, l'ufficio, ecc. Poiché gli spostamenti sono parte integrante del lavoro, il chilometraggio percorso può essere chiesto in detrazione. Ciò può contribuire a un enorme risparmio fiscale, poiché più chilometri si percorrono, più detrazioni si ottengono. Per l'anno 2023, la detrazione standard è di 0,655 dollari per ogni chilometro percorso per lavoro. Tale importo deve essere dichiarato nellariga 9del Prospetto C per richiedere la detrazione.

Un altro metodo per richiedere le detrazioni è il metodo delle spese effettive. Questo metodo si applica quando i chilometri percorsi sono molto meno e le spese per il pagamento dell'auto sono maggiori. In questo caso, per richiedere le detrazioni è necessario presentare le ricevute effettive.

6. Pubblicità

Il marketing e la pubblicità sono molto necessari per promuovere la vostra attività. L'Agenzia delle Entrate consente la deduzione di spese pubblicitarie ragionevoli come opuscoli, insegne, fotografie, pubblicità online, pubblicità sui media, ecc.

Le spese pubblicitarie devono essere dichiarate suriga 8della Tabella C durante la presentazione della dichiarazione dei redditi.

7. Associazioni professionali

Esistono molti gruppi professionali legati al settore immobiliare. Molti agenti immobiliari si iscrivono a tali sindacati, associazioni di categoria, ecc. e devono pagare una quota di iscrizione. Poiché si tratta di un'attività direttamente collegata al lavoro dell'agente immobiliare, tali quote sono completamente deducibili dall'imposta dovuta.

Gli agenti immobiliari devono dichiarare tali spese alLinea 27adella Tabella C per poterne beneficiare. Anche le spese per il rinnovo della licenza associativa e altre spese di questo tipo sono incluse in questa voce.

8. Premio dell'assicurazione sanitaria

Gli agenti immobiliari che sono lavoratori autonomi possono richiedere la detrazione dei premi di assicurazione sanitaria pagati. Possono essere detratte anche le spese sanitarie che superano il 7,5% del loro reddito lordo rettificato.

Anche i premi pagati per la famiglia sono deducibili. In caso di lavoro alle dipendenze di un datore di lavoro, tali spese non sono deducibili se esiste un piano assicurativo sponsorizzato dal datore di lavoro. Le spese mediche, dentistiche e altre coperture a lungo termine sono incluse in questa voce. Per richiedere questa detrazione, è necessario dichiarare l'importo dei premi pagati alla riga 17 della Tabella 1.

9. Donazioni

L'IRS concede detrazioni per le donazioni di beneficenza effettuate. Tali deduzioni possono essere richieste alle righe 11-13 dellaSchedule A.Nel caso in cui abbiate effettuato una donazione non in contanti, le detrazioni possono essere richieste per il valore equo di mercato dell'articolo soggetto a valutazione.

Per le donazioni in contanti sono ammesse detrazioni fino al 60% del reddito lordo rettificato. Per quanto riguarda i pagamenti di biglietti per eventi di beneficenza, è possibile richiedere la detrazione della differenza tra l'importo pagato e il valore equo di mercato.

10. Forniture e attrezzature per ufficio

Gli agenti immobiliari possono dichiarare le spese d'ufficio relative a cancelleria, fotocopie, graffette, inchiostri, cartucce, cucitrici, spese postali e buste. Queste spese devono essere dichiarate alla voceriga 18del Prospetto C.

Sono deducibili anche le spese per apparecchiature come telefoni fissi, stampanti, computer, fax, ecc. Se si tratta di un telefono cellulare, possono essere dedotte solo le chiamate effettuate per scopi professionali.

11. Pasti

Può capitare di cenare con clienti, colleghi o altre persone legate al mondo del lavoro o di mangiare fuori durante un viaggio di lavoro. Le spese per i pasti in queste situazioni sono completamente deducibili secondo le regole dell'IRS e devono essere indicate alla voceriga 24bdel Prospetto C.

Tracciando e segnalando diligentemente queste spese, gli agenti immobiliari possono ottimizzare i loro risparmi fiscali e trattenere una parte maggiore dei loro guadagni.

Il ruolo della tecnologia nel settore immobiliare come tendenza

Un sondaggio dell'AssociazioneAssociazione nazionale degli agenti immobiliari ha rivelato che il 95 percentodegli agenti ha utilizzato i telefoni cellulari per segnalare le proprie attività agli intermediari. Circa il 66% degli agenti ha utilizzato un sito web per segnalare le proprie attività quotidiane ai broker o alle aziende con cui lavora.

È stato inoltre rilevato che Facebook, Instagram e Linkedin sono le piattaforme di social media più utilizzate dagli agenti per raccogliere dati, entrare in contatto con i clienti e chiudere più rapidamente le trattative nel 2022-2023.

Oggi esistono molti software e soluzioni di abilitazione per agenti immobiliarisoftware e soluzionisul mercato che possono aiutare gli agenti a svolgere diverse attività legate alla vendita, come ad esempio:

- Tenere traccia dei loro contatti

- Creare annunci multipli per le loro proprietà

- Iscriversi a servizi di quotazione multipla

- Gestire gli annunci per le loro proprietà

- Traccia i dettagli delle offerte in arrivo

- Documentazione e mantenimento della documentazione cartacea in relazione alla chiusura delle transazioni

- Rete e database di riferimento, ecc.

Grazie all'utilizzo di tali software e soluzioni per gli agenti immobiliari, i broker possono aumentare il tasso di chiusura delle transazioni di vendita e quindi beneficiare delle commissioni. È qui che Compass entra in gioco.

Compass mette a disposizione degli agenti immobiliari strumenti all'avanguardia per semplificare la gestione delle commissioni, migliorare l'efficienza e aumentare la trasparenza.

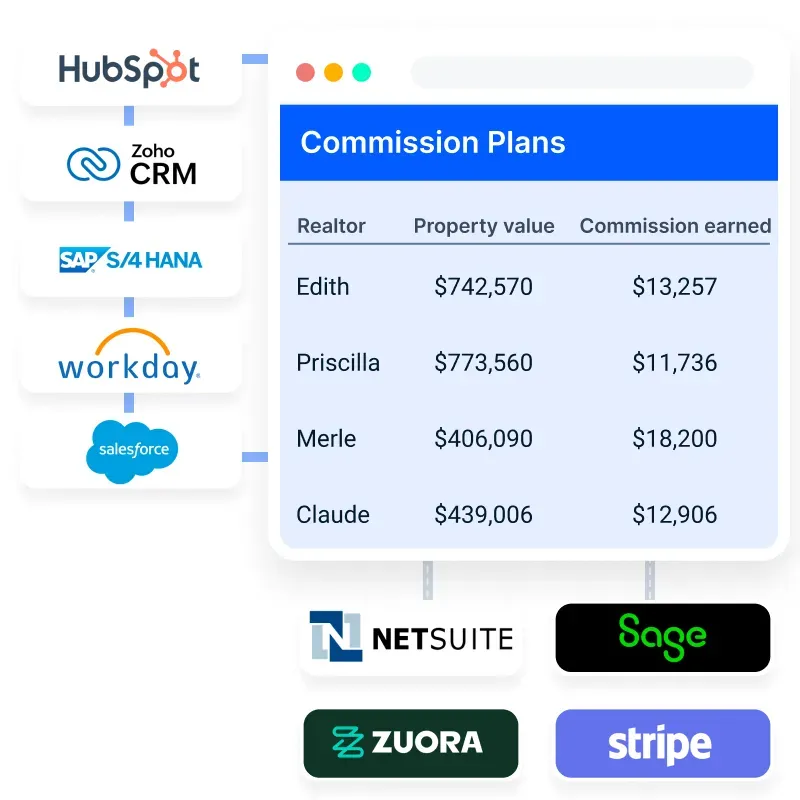

Integrazione perfetta con i sistemi di gestione immobiliare

Compass si connette senza sforzo con piattaforme come Yardi Voyager, AppFolio, Buildium e MRI Software, centralizzando i dati e semplificando il monitoraggio delle commissioni per i professionisti del settore immobiliare.

Eliminare i metodi di tracciamento delle commissioni tradizionali

Sostituendo i fogli di calcolo obsoleti e i sistemi a rischio di errore, Compass consente di calcolare le commissioni in modo 10 volte più rapido per i contratti di locazione, affitto e referral, garantendo precisione ed efficienza.

Tracciamento e trasparenza delle commissioni in tempo reale

Gli agenti ottengono una visibilità completa della struttura delle commissioni, delle metriche di performance e dei pagamenti attraverso Compass. Gli aggiustamenti dovuti a frazionamenti, clawback o bonus sono facilmente accessibili, eliminando l'ambiguità.

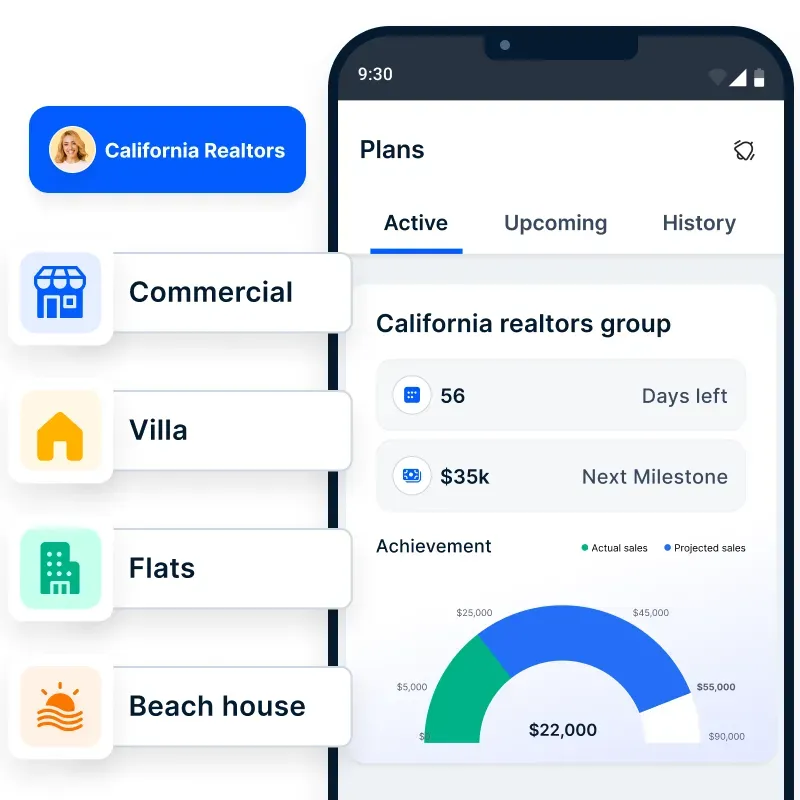

Approfondimenti sulle provvigioni tramite cellulare

Con l'applicazione mobile di Compass, gli agenti possono tenere traccia dello storico delle provvigioni, comprese le date e gli importi dei pagamenti, e prevedere i guadagni futuri in base agli indicatori chiave di prestazione e alle tendenze di vendita degli immobili.

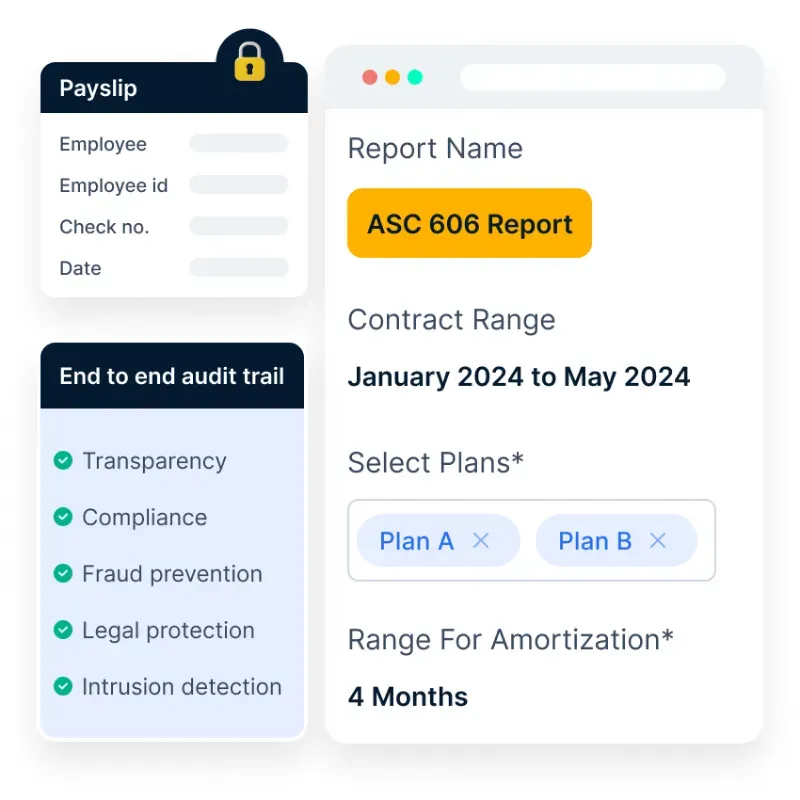

Conformità normativa e sicurezza

Compass aderisce agli standard CFPB e RESPA, salvaguardando i dati di pagamento con una crittografia certificata SOC 2 di livello aziendale, garantendo fiducia e conformità.

Traccia di audit end-to-end per la responsabilità

Una traccia di audit completa elimina la contabilità ombra, fornendo registrazioni dettagliate degli aggiustamenti delle commissioni e dei pagamenti, favorendo la trasparenza e le pratiche commerciali etiche.

Sfruttando Compass, gli agenti immobiliari possono concentrarsi sulla chiusura più rapida degli affari, sul rafforzamento delle relazioni con i clienti e sulla massimizzazione del loro potenziale di commissioni. Programmate una chiamata ora!

In breve

Le aziende che operano nel complesso settore immobiliare devono conoscere le sfumature delle commissioni degli agenti immobiliari per poter competere.

Le varie strutture di provvigione, i fattori che influenzano i tassi di provvigione e l'attuale provvigione media degli agenti immobiliari vi aiuteranno a prendere una decisione informata per assicurarvi che venga stipulato un contratto chiaro ed equo che soddisfi sia le richieste degli agenti che lo stato del mercato.

Alla fine, un'esperienza di transazione immobiliare di successo e gratificante dipende dalla ricerca del giusto equilibrio tra i servizi forniti e le tariffe delle commissioni.

Domande frequenti

Come posso evitare le commissioni immobiliari?

Le commissioni immobiliari possono essere negoziate con un agente. È anche possibile vendere con una società che offre commissioni basse prenegoziate.

Che cos'è la regola del 50% nel settore immobiliare?

Non riesco a trovare informazioni sulla regola del 50% nel settore immobiliare tra i risultati della ricerca.

Qual è la regola dell'80-20 per gli agenti immobiliari?

Non riesco a trovare informazioni sulla regola dell'80/20 per gli agenti immobiliari tra i risultati della ricerca.

Quale percentuale prende la maggior parte degli agenti immobiliari?

La media nazionale delle commissioni degli agenti immobiliari nel 2024 è stata del 5,32% in totale, suddivisa tra l'agente del venditore (2,74%) e l'agente dell'acquirente (2,58%). Tuttavia, le tariffe possono variare dal 4,78% al 6,67%. Alcuni agenti possono accettare una commissione inferiore per le case di prezzo più elevato1. La commissione standard va dal 2% al 4% del prezzo di listino della casa, ma può variare.

Che percentuale applica la maggior parte degli agenti immobiliari?

Le commissioni degli agenti immobiliari variano in genere tra il 5% e il 6% del prezzo di vendita dell'immobile4. La media nazionale è del 5,49%.