11 Incentive Compensation Plans with Examples for 2025

Discover how top companies enhance employee motivation and performance and know the reasons behind successful incentive compensation programs.

On this page

An effective incentive compensation plan is one of the most powerful tools for driving employee motivation, improving performance, and aligning individual efforts with business objectives. Companies that implement well-structured compensation plan not only boost sales but also enhance employee satisfaction and retention. However, designing the right plan requires careful consideration of various incentive structures that cater to both short-term and long-term goals.

This blog explores 11 of the best incentive compensation plan examples for 2025, covering diverse strategies such as profit-sharing, commissions, retention bonuses, and non-monetary incentives. Whether you're looking to incentivize your sales team, reward high-performing employees, or create a culture of accountability, these examples will help you design a plan that maximizes productivity and engagement.

What is incentive compensation?

Incentive compensation is a form of payment given to employees based on their performance or achievements. It is designed to motivate employees to meet specific goals or exceed expectations, often in the form of bonuses, commissions, or other financial rewards. This part can be included in

- The total pay for employees.

- Or an extra amount earned when employees meet specific performance goals.

So how does this work? The benefits of incentive compensation include:

- Increased employee motivation,

- Improved performance,

- Higher productivity.

Generally, the incentive competition for salespeople aligns individual goals with organizational objectives, encourages employees to achieve specific targets, and fosters a culture of accountability.

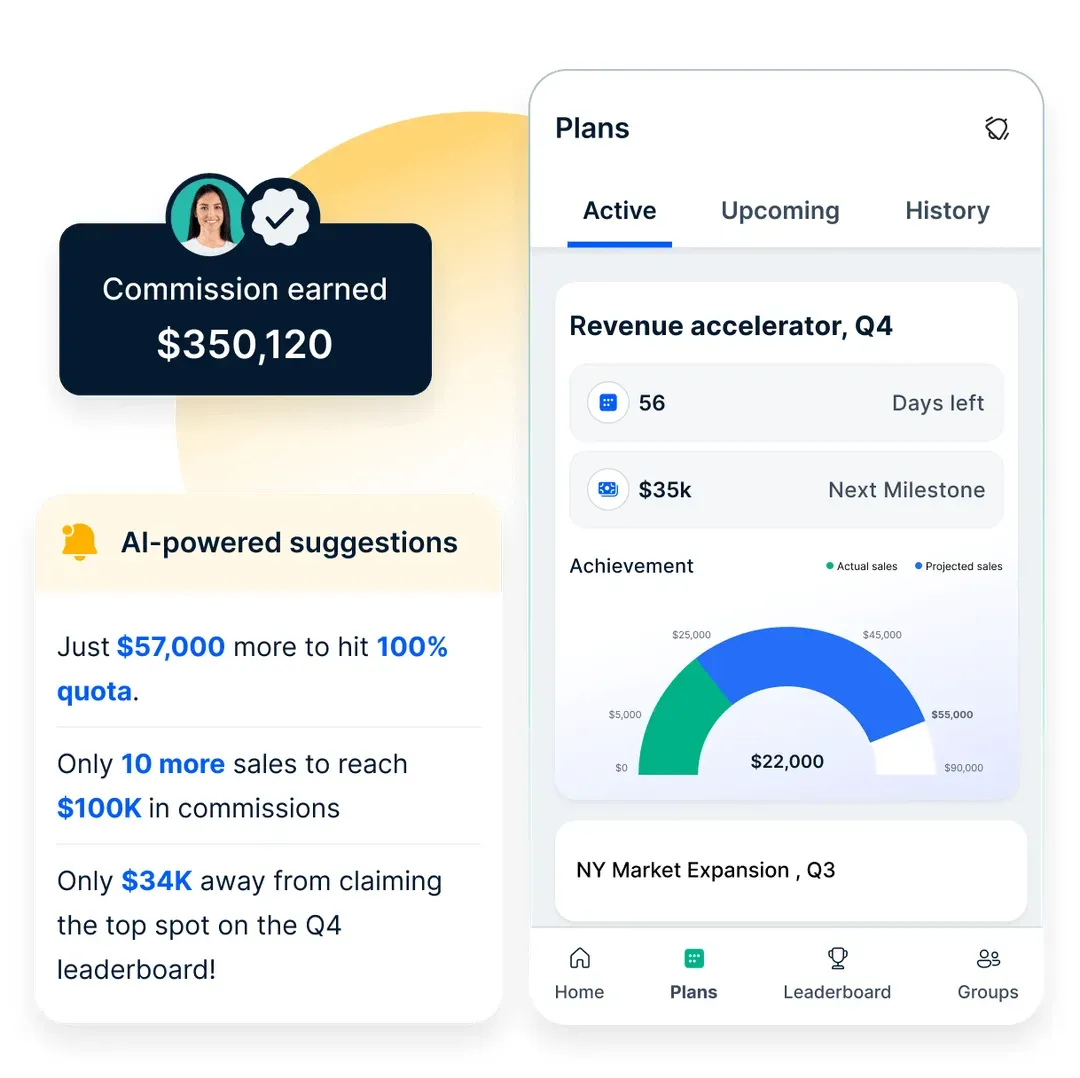

By leveraging Compass's intuitive platform, the company streamlined its compensation processes. Compass enabled its sales team to easily understand its earnings and performance metrics. As a result, the company experienced a significant increase in sales team satisfaction, with 95% of the sales team reporting that Compass helped them better understand their compensation.

Before we move to discussing the incentives plan examples, let us share the difference between long term and short term incentives.

What are long-term incentives vs. short-term incentives?

Incentive compensation is usually divided into two main types: long-term incentives and short-term incentives.

The equity program is intended to draw in, keep, and inspire employees while bringing them into line with the company's long-term goals.

The company also seeks to provide other avenues for wealth development, such as the Employee Special Investment Program, which provides qualifying employees with access to Goldman Sachs assets.

8 Effective incentive compensation plan with examples

Incentive compensation helps attract and retain top talent while enhancing overall job satisfaction and loyalty. The following are the incentive compensation examples you can include.

1. Gainsharing

Gainsharing is a program that rewards employees for improving productivity. Companies use financial incentives to encourage employees to reach specific business goals. These goals might include:

- Higher sales.

- Better customer service.

- Reduced employee turnover.

- Quicker production times.

Gainsharing plans are cost-effective because bonuses are given only to those who show measurable improvements. Typically, these bonuses are paid monthly, allowing managers to track progress and adjust the program as needed.

Baseline monthly sales: $50,000

After team efforts: Sales increase to $55,000

Extra revenue: $5,000

Gainsharing split (20% for employees):

Company keeps: $4,000

Employees share: $1,000

If there are 10 employees, each gets a $100 bonus as a reward for improving sales!

2. Profit-sharing

Profit-sharing, another performance incentive program example, involves sharing a portion of the company's profits with employees through bonuses. Unlike gainsharing, this plan focuses on the overall performance of the company. Profit-sharing bonuses are usually distributed once a year. The more profitable the company is, the larger the bonuses.

3. Retention bonus

A retention bonus is a one-time payment offered to key employees who may be considering leaving the company. This incentive encourages them to stay during critical times, such as mergers or other significant changes. The amount can range from 10% to 25% of an employee's salary, depending on the agreement.

Employee signs a 2-year agreement to stay.

Company offers a $10,000 retention bonus if they complete 2 years.

If the employee leaves early, they don’t get the bonus.

This motivates employees to stay longer and reduces turnover!

4. Spot awards

Spot awards, or spot bonuses, are immediate rewards given for exceptional performance in specific tasks. These awards recognize achievements that may not fit into standard evaluation criteria. The value of spot awards can range from $50 to $5,000, typically representing 0.25% to 1% of total payroll.

A dinner at a nice restaurant.

A trophy for outstanding performance.

Gift cards.

Cash bonuses.

A weekend getaway at a resort.

It is a good performance incentive program example.

5. Annual bonus

Annual bonuses, a performance incentive program example, are lump-sum payments made to employees in addition to their regular salaries. These bonuses can be cash or stock options and are usually calculated at the end of the fiscal year. The amount may depend on overall company performance, individual performance, or both.

A retail store offers a $1,000 bonus for each sales representative after a successful year.

A tech company provides annual bonuses ranging from 5% to 11% based on individual performance.

A manufacturing business gives its production team a fixed annual bonus equal to 10% of their base salaries.

6. Commissions

Commissions are part of an employee's pay structure designed to reward performance. Employees earn commissions based on their sales or targets achieved. Commission rates can be capped or uncapped.

You earn a 5% commission on your sales revenue.

You receive a $2 commission for each product sold.

You earn $1 for every sale up to 50 units and then $1.50 for each sale after that.

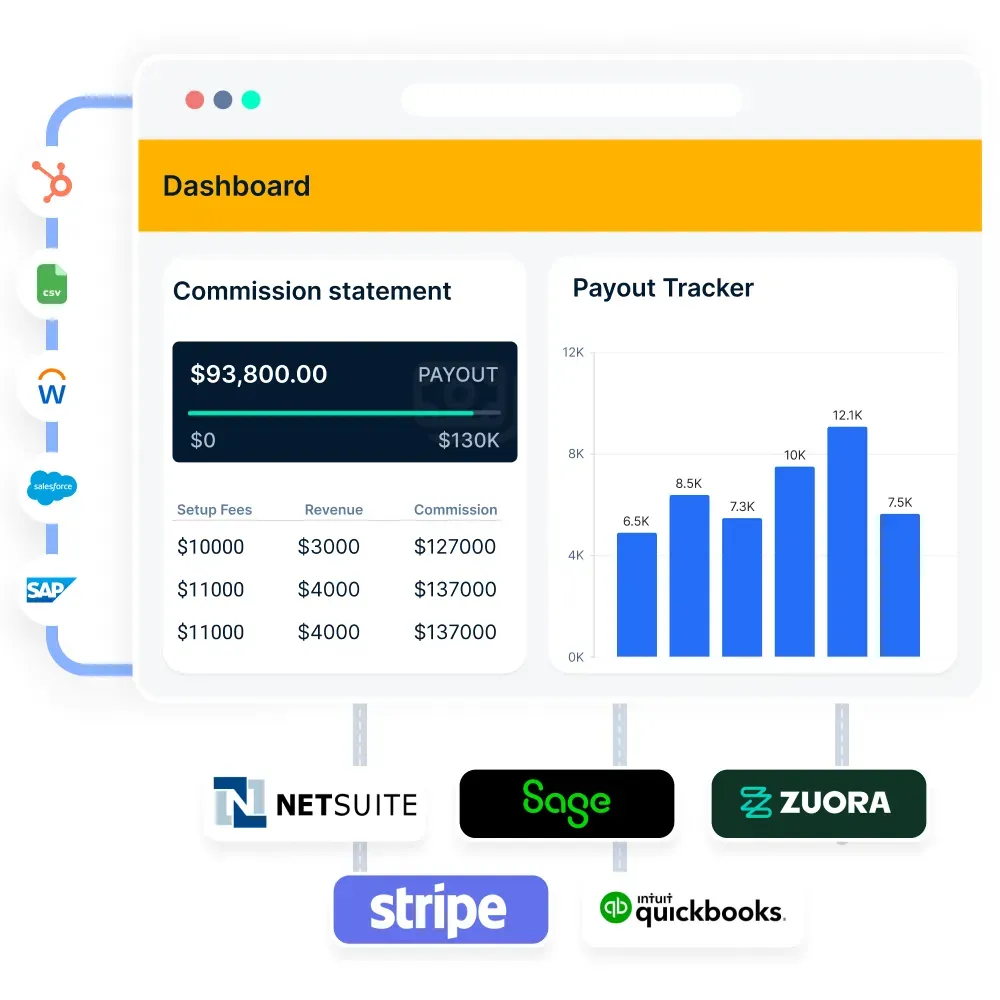

Using incentive compensation software can help automate these calculations for your team.

Automate commission with Compass

Compass offers a comprehensive solution for sales commission management, enabling organizations to streamline their incentive compensation processes effectively.

Schedule a call now!

7. Sales Performance Incentive Fund (SPIFs)

A Sales Performance Incentive Fund (SPIF) is a short-term reward program aimed at achieving specific sales goals quickly. While SPIFs are primarily focused on sales teams, they can also be applied in other departments.

8. MBO Bonus

A Management By Objectives (MBO) bonus links employee rewards to specific goals set in their MBO plans. Managers and employees work together to establish these objectives.

9. Sales commission

A mainstay of incentive compensation, sales commissions are particularly relevant for positions that directly involve generating income. Financial incentives known as sales commissions are mostly determined by an employee's percentage of sales revenue.

10. Profit sharing

Employees receive a percentage of the company's profits through profit sharing, which is decided upon by predefined standards like total profitability or individual contributions. It makes employees feel more involved in the success of the company as a whole.

11. Non-monetary incentives

The main goals of non-monetary incentives are to foster a positive work atmosphere, opportunities for personal development, and recognition. According to a LinkedIn Learning survey, 94% of workers said they would stay with a firm longer if it supported their professional growth. Consider:

- Recognition programs: These encourage desired behaviors by recognizing employee accomplishments with prizes, accolades, or public recognition.

- Opportunities for Career Development: investment in possibilities for growth and job advancement, such as training, mentoring, or career promotion.

How to design an effective incentive compensation plan?

To create an effective incentive compensation plan, you need a clear and organized approach. This applies to any department. Here are some key steps to help you build this plan:

Step 1: Planning and design

What are your goals? Do you want to boost revenue, improve customer retention, or raise brand awareness?

Start by defining what you want to achieve and how it aligns with the company’s overall goals.

Next, choose the type of incentive compensation plan that will best support these objectives.

Finally, outline a detailed framework for your plan.

Step 2: Buy-in from key stakeholders

With your framework ready, it’s time to share it with key stakeholders for their input.

This group typically includes upper management, senior managers, team leaders, and some senior team members.

After discussing and revising the plan together, get their approval by having them sign off on it.

Step 3: Communication and implementation

Now it’s time to communicate the plan to the entire company!

Effective communication is crucial at this stage. It would be a shame to have a great plan but not ensure that employees fully understand it.

Use clear and simple messages, and share information regularly to make sure the implementation goes smoothly.

Step 4: Review and optimization

This step is ongoing. You should regularly review the plan by looking at individual and team performances.

Is the plan delivering the results you expected? Or have things changed?

It’s normal for plans to need adjustments over time. The key is to identify any issues early and make necessary changes as you move forward.

Best practices for implementing incentive compensation plan

Following are the best practices that you must mind to implement the incentive compensation.

- Communicate clearly: To encourage comprehension and support, clearly convey to employees about program specifics, eligibility requirements, and performance standards.

- Balance short- and long-term incentives: To encourage consistent success, combine short-term benefits with long-term ones like stock options or professional growth.

- Frequent evaluation and modification: Keep an eye on the success of the program, seek input, and make the required modifications to maximize its impact and relevance.

- Integration with performance management: To align individual objectives with more general organizational goals, integrate incentive compensation with performance management systems.

- Legal and compliance awareness: Keep up with the latest legal and regulatory requirements to make sure that your program complies with the rules on employment, taxes, and industry standards.

Automate commissions with Compass

Here’s how Compass can assist in managing sales commissions:

No-Code Design: Compass allows users to build and launch complex sales commission plans quickly, utilizing a no-code commission plan designer that can create plans 10X faster than traditional methods.

Flexibility in Structures: Users can implement various incentive structures, including spiffs, accelerators, bonuses, multipliers, ramps, and clawbacks, tailored to different sales roles.

Automated calculations: The platform automates commission calculation, significantly reducing manual errors and freeing finance teams from tedious calculations. This ensures accurate payouts on autopilot.

Real-time data integration: Compass integrates seamlessly with CRM systems to automatically fetch sales data, ensuring that all commission calculations are based on current information.

Signature collection: Before rolling out new commission plans, Compass facilitates the collection of signatures from sales representatives to ensure buy-in and transparency.

Audit trails: The system maintains an audit log that tracks adjustments and overrides made to any commission plan, enhancing accountability and compliance with financial guidelines.

Visibility for sales teams: Sales representatives can view their commission calculations in advance and monitor key performance metrics. This transparency helps align their efforts with organizational goals.

Collaboration across teams: Compass promotes collaboration between sales leaders, operations, and finance teams by providing visibility into the commission processes and resolving disputes efficiently.

Conclusion

Incentive compensation examples in this blog show how rewards can be strategically aligned with organizational goals to improve employee engagement and performance. Organizations may foster a motivated workforce that is ready for long-term success and gain an advantage in the market by putting in place balanced and transparent incentive programs.

By implementing balanced and transparent incentive programs, organizations can foster a motivated workforce poised for long-term success and gain a competitive edge in the market. Explore how Compass can help your organization design effective incentive compensation programs that drive success. Schedule a call now!

FAQ's

What are the strategies for an incentive compensation plan?

Strategies for an effective incentive compensation plan include:

- Aligning incentives with corporate goals

- Utilizing both monetary and non-monetary rewards

- Incorporating short-term and long-term incentives

- Regularly reviewing and optimizing the plan based on performance data

- Ensuring clear communication of goals and expectations to employees.

Is incentive pay good or bad?

Incentive pay can be beneficial as it motivates employees to achieve specific goals, but its effectiveness depends on how well it aligns with employee motivations and organizational objectives.

Is incentive compensation a bonus?

Yes, incentive compensation can include bonuses and additional payments made to meet performance metrics beyond regular job duties.

What is an incentive example?

An example of an incentive is a performance-based bonus, which rewards employees for achieving specific goals or targets related to their roles.

What is the most basic form of incentive compensation?

The most basic form of incentive compensation is sales commission plans, which provide a fixed amount based on individual sales performance.