8 Steps on How to Calculate Sales Commission with Commission Structure, Formulas and Examples

Have you ever submitted incorrect earnings on your sales commissions and faced a loss? Or have you seen that happen to someone and are afraid you may do so too? Then look at this easy sales commission percentage formula and always submit the correct figures.

On this page

A study indicates that organizations risk losing up to 30% of their sales opportunities to competitors. It highlights the importance of evaluating the sales process and metrics. With appropriate tools, an organization can increase its sales quota attainment by 20% and establish a streamlined, accurate sales process.

Such an occurrence was demonstrated by one of the leading CNC manufacturers worldwide that easily changed the sales trajectory and scaled rapidly. With a large team spread across more than 32 sales and service locations worldwide, this company faced challenges in automating commissions.

Their primary goals were to empower their sales representatives with easy access to their incentive data, significantly reduce the time spent calculating commissions, and eliminate the manual workload previously handled by the sales manager.

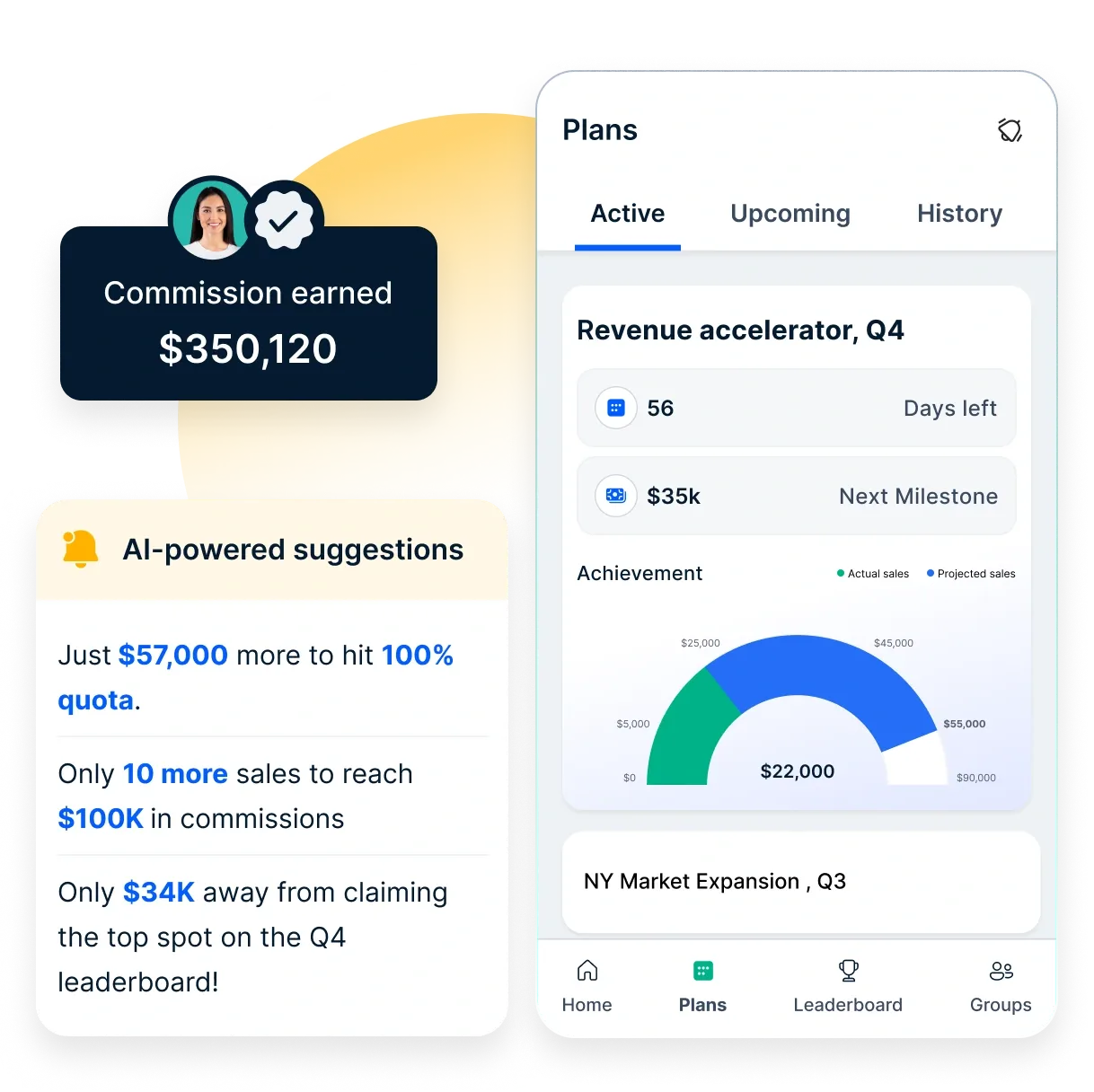

They integrated Compass, a sales commission management software. Compass offered features such as program workflows, automated rule engines, approval processes, leaderboards, scorecards, and a mobile app for real-time performance tracking. The organization got real-time visibility to incentive calculation.

It also ensured payout accuracy, removed the dependency on the sales managerial team to manually handle the commission process, and relied on the commission sales calculation to automate the procedure end-to-end.

As a result, quota attainment rose 20% in under 90 days, with program participation increasing 22% and platform adoption reaching 73%.

Since fair compensation is crucial to motivate salespeople, a commission sales calculator becomes a significant tool. Therefore, this blog will explore important aspects of sales commission calculators to help you understand their usefulness.

What is a sales commission calculator?

A commission sales calculator or sales comp calculator is a tool that helps calculate the amount of money a salesperson earns based on their sales performance. It typically involves entering the sales amount and the commission rate, and the calculator provides the commission earned. A commission sales calculator can help an organization maintain:

- Accuracy. A SaaS commission calculator ensures the correct calculation of commissions to avoid manual errors.

- Efficiency as it saves time by automating calculations. As a result, it allows salespeople to focus on selling.

- Transparency because such a tool provides clear and immediate information about potential earnings.

Let's go through a statistical study of sales tech to understand how such a tool in your addition to the tech stack can shape the business outcome.

- According to a McKinsey study, 80% of chief sales officers have opined that having an effective sales tech stack is crucial to smashing revenue targets.

- The same study revealed that 80% of sales leaders believe analytical and quantitative skills are among the top cap.

- Another McKinsey study revealed that B2B players that employ omnichannel sales teams; advanced sales technology, automation, and data analytics record 10% market share growth.

- The same study suggests that over 30% of tasks and processes within the sales cycle can be automated to some degree. This includes activities ranging from commission sales calculation, planning, and lead management to generating quotes.

- It also revealed that automation increases revenue and leads to cost-to-serve reductions of up to 20% each, while also fostering customer and employee satisfaction.

While many sales tasks can be automated, not all efforts are equally successful. Leading companies focus on automating specific areas like lead management, contract drafting, incentive generation using a commission sales calculator, and sales commission planning.

Advanced technology can automate many time-consuming sales tasks to free up salespeople to focus on more valuable activities. This can lead to increased revenue, lower costs, and greater satisfaction for both customers and employees.

Essential factors required for calculating sales commission

Calculating sales commissions is essential for many businesses, especially those that rely on a sales team to generate revenue. Considering the importance of the process, it is necessary to understand that several essential factors must be considered when determining how much commission to pay a salesperson.

So, before we tell you how to calculate sales commission, it is best to familiarize yourself with the essential factors that influence the calculation of your sales commission.

1. Commission base

The commission base is the revenue or profit a salesperson's commission is based on. This can be the total sales revenue, the profit margin on sales, or some other metric that reflects the salesperson's contribution to the company's bottom line.

2. Commission rate

The commission rate is the percentage of the commission base that a salesperson will receive as a commission. For example, if the commission base is $100,000 and the commission rate is 10%, the salesperson would receive a commission of $10,000.

3. Commission period

The commission period is the time over which the commission is calculated. This could be a week, a month, a quarter, or some other period appropriate for the business and the sales cycle.

4. Commission tier

A commission tier is a structure that sets different commission rates based on varying performance levels. For example, a sales representative might receive a commission rate of 10% on the first $50,000 of sales, 12% on the next $50,000, and 15% on any sales above $100,000.

In this case, applying the appropriate commission tier is essential to ensure that the sales representative is compensated somewhat based on their performance.

5. Override

An override is an additional commission paid to a salesperson who manages a team of other salespeople. The override is calculated as a percentage of the commission earned by the salespeople on the team.

6. Split

A split is used when two or more salespeople work together on a sale. In this case, the commission is split between the salespeople based on some agreed-upon formula. For example, the commission might be split 50/50 between two salespeople who worked together on a sale.

These factors are important to consider when calculating sales commission, as they can significantly impact the commission a salesperson receives. By considering these factors and creating a fair and transparent commission structure, businesses can motivate their sales team to achieve their goals and drive revenue growth.

How to calculate sales commission in 8 simple steps?

Calculating sales commissions involves several steps to ensure that sales representatives are compensated fairly for their work. While there are technologies in 2023 that allow you to automate your commission calculation, you may want to do it all manually.

So, here is a detailed explanation of the steps involved in calculating sales commission if you wish to go about the manual calculation way:

Step 1: Determine the commission period

The first step is to determine the commission period, the period over which the commission will be calculated. This could be weekly, monthly, quarterly, or annually. So, choose the period you seek commissions for and then round up the sales you conducted in this period.

Step 2: Identify the commission base

Identify and keep handy the commission base for each sales transaction you are seeking commission for. Since the base amount can be different for each sale you succeeded in generating, it is essential to keep strict track of it for easy calculation later on.

Step 3: Multiply the commission rate by the commission base

Now that you have the commission base ready multiply it by the commission rate to get the base amount of commission you are due.

But remember, this is not the final value since there may be additions or even deductions on this base commission value depending on your contract terms.

Step 4: Consider various commission rates

Change the value of your commission rates in the case of instances where your rate is different from your regular rate.

For example, if your commission rate for one business or transaction is 10% but 12% for another business/transaction, then multiply the commission base for that particular business/transaction with the respective commission rate for accurate calculation.

Step 5: Apply commission tier (if applicable)

In addition to the different commission rates, you must be mindful of, you must also track any businesses/transactions with tiered rates. Since most sales transactions are not tiered, it is easy to miss out on one, in which case, you will be compensated much less than what you are due.

So, keeping a separate list of businesses offering tiered commissions along with the tiers for convenient calculation at the end of the commission period is best.

Step 6: Calculate the override commission

Claim the commission you are entitled to from sales successfully closed by reps you manage. Multiply the commission rate by the total commission your team members have earned and then add the resulting value to your commission calculation.

Step 7: Deduct any returns

Note the commission value you received until the last step and deduct any earnings from sales that the client canceled or returned.

While you may have closed the deal initially, such dealings are considered void if your company ultimately has to return the money or did not receive it in the first place due to the client canceling the sale.

Step 8: Split the commission (if applicable)

From the commission value you arrived at, deduct the share of your fellow reps if you were involved in closing any of the sales with them.

By the steps, the final commission calculation of all your sales can be determined to be:

A = Commission base for determined commission period x Respective commission rates for different transactions

B = A + Commission value as per different tiers

C = B + Portion on commission earned by team members

D = C - Sales commission value for returned or called sales transactions

E = D - Sales portion of colleagues in case of split commissions

To further calculate the sales commission percentage formula, take the value of 'E' from the above formula and divide it by '100.'

8 Sales commission structures and how to calculate them with formula

Sales commission plans are not one-size-fits-all. The ideal structure depends on your company's goals, sales cycle, and revenue model.

A well-designed plan can drive motivation and performance while ensuring fair compensation. Below are eight common commission structures, along with commission formulas to calculate earnings.

1. Base salary + commission

This model combines a fixed salary with a commission based on sales performance, offering financial stability with incentives for growth. Following is its commission formula:

Example: A sales rep earns a $45,000 base salary plus a 12% commission. If they generate $120,000 in sales, their total earnings would be $45,000 + ($120,000 x 0.12) = $59,400.

Best for: Businesses with unpredictable sales cycles

Pros: Encourages consistent performance while reducing financial risk for reps

Cons: Higher fixed costs for employers; may reduce urgency to maximize sales

2. Quota-based commission

This plan rewards reps with commission only when they exceed a set sales quota, making it an effective strategy to push high performance.

Example: A rep has a $3,500 base salary and earns 18% commission on sales exceeding a $12,000 quota. If they generate $15,000 in sales, their earnings would be $3,500 + ($3,000 x 0.18) = $4,040.

Best for: Experienced sales teams with aggressive targets

Pros: Motivates reps to surpass goals, boosting revenue

Cons: May discourage reps if quotas feel unattainable

3. Straight commission

Reps earn a percentage of total sales without a base salary. The commission rate determines their entire income. Following is its commission formula:

Example: A rep sells $8,000 in products with a 15% commission rate. Their earnings would be $8,000 x 0.15 = $1,200.

Best for: Independent sales professionals or companies with short sales cycles

Pros: High earning potential and direct correlation between effort and income

Cons: Income variability can create financial instability

4. Residual commission

This model rewards sales reps with recurring commissions from long-term clients.

Example: A client subscribes to a $1,500/month service. The rep earns a 6% commission, receiving $90 per month as long as the client stays subscribed.

Best for: SaaS and subscription-based businesses

Pros: Encourages long-term customer retention

Cons: Can take time to build substantial earnings

5. Territory volume commission

A team-based model where commission is split among reps based on their contribution to total territory sales. Following is its commission formula:

Example: A rep’s territory generates $70,000 in sales, and the total team sales reach $700,000 with a 9% commission rate. The rep's earnings would be ($70,000 / $700,000) x 0.09 x $700,000 = $6,300.

Best for: Large sales teams covering geographic territories

Pros: Promotes teamwork and regional market development

Cons: May create disputes if contributions are not equally recognized

6. Tiered commission

Reps earn higher commission rates as they hit higher sales thresholds, incentivizing them to push beyond their initial targets.

Example: A plan offers 5% commission on the first $10,000 in sales, 10% on sales between $10,000-$20,000, and 15% on sales over $20,000. A rep selling $25,000 would earn: ($10,000 x 0.05) + ($10,000 x 0.10) + ($5,000 x 0.15) = $2,250.

Best for: High-performing teams with scalable sales potential

Pros: Rewards top sellers and drives ongoing motivation

Cons: May discourage lower performers if higher tiers seem out of reach

7. Gross margin commission

This plan calculates commission based on profit margins rather than revenue, aligning incentives with profitability.

Example: A product with a $300 gross margin and a 12% commission rate earns a rep $300 x 15 x 0.12 = $540.

Best for: Companies prioritizing profit over revenue volume

Pros: Encourages selling high-margin products

Cons: More complex to calculate than standard revenue-based commission

8. Draw against commission

This model provides sales reps with an advance payment that must be repaid through future commissions.

Example: A rep receives a $2,500 draw. If they later earn $4,000 in commission, their final payout is $4,000 – $2,500 = $1,500.

Best for: New sales hires or roles with fluctuating income

Pros: Provides financial security for reps during slow sales periods

Cons: May lead to financial strain if sales don’t meet expectations

How Compass can help with sales commission calculation?

Compass can significantly streamline sales calculation automation by eliminating manual processes and ensuring accurate, real-time commission tracking. Here’s how Compass can help:

1. Automated commission calculations

- Compass automates sales commission calculations using predefined formulas for sales quota calculator and customizable rules, reducing human errors and ensuring transparency.

- Supports multiple commission structures, including tiered commissions, quota-based incentives, and residual commissions.

- It works as a quota attainment calculator as well because it showcases the milestones and send nudges based on the achieved target.

2. Real-time quota attainment tracking

- Sales teams can track their quota attainment and progress toward incentives using live dashboards.

- Managers gain insights into sales performance trends and can adjust compensation strategies accordingly.

3. Customizable commission rate formulas

- Compass allows businesses to set different commission rate formulas based on roles, revenue targets, and performance levels.

- Works well for SaaS commission models, high-margin product sales, and territory-based structures.

4. Seamless integration with sales and finance tools

- Integrates with CRM platforms (Salesforce, HubSpot), ERP systems, and payroll software, ensuring smooth data flow.

- Reduces manual reconciliation efforts by pulling real-time sales data for automated payout processing.

Whether you're a startup or an enterprise, Compass scales with your team, making it easy to adjust commission structures as the business evolves. Handles multi-region, multi-currency, and multi-tier compensation models effortlessly with Compass. Schedule a call now!

Conclusion

Converting leads into sales takes considerable effort, and you must ensure you get adequately compensated. This begins by submitting the correct calculations considering everything that needs to be added or deducted.

With this easy guide on calculating sales commission, you can now ensure that all your efforts are recognized and that you get every penny of the commission you deserve. So, round up all your sales transactions and calculate your commission with this sales commission percentage formula that is as easy as "ABCD!"

FAQs

1. How often are commission rates reviewed and updated?

It depends on the company's policies. Some companies review commission rates annually, while others may review them more frequently or less frequently.

2. Is the commission paid on the sale price or the profit margin?

It depends on the company's policies. Some companies pay a commission on the sale price, while others pay a commission on the profit margin.

3. Are commissions subject to taxes?

Yes, commissions are considered income and are subject to taxes. The taxes owed will depend on the individual's tax bracket and other factors.

4. How do you calculate sales commission?

The basic calculation formula is commission = (sales total x commission rate). However, calculating commissions can be tricky because it depends on the commission structure, the industry, and the specific terms of the agreement.

Some basic steps for calculating commissions include determining the commission period, calculating the total commission base made during that period, and multiplying the commission rate by the commission base.

Also, it's essential to consider variable and tiered commission rates and complete any additional applicable calculations and adjustments like overrides, deductions for returns, and commission splits for shared territories.

5. What is a 3% commission on $100?

To calculate a 3% commission on $100, multiply $100 by 3%3. The calculation is as follows: $100 x 0.03 = $33.

6. What is the formula for profit commission?

The formula for gross profit commission is revenue ($) - costs ($) = gross profit margin ($) x commission rate (%) = total commission ($)1. To calculate gross profit commission in a spreadsheet, you can use the formula =(SUM(A1:A10)-SUM(B1:B10))*C1, where A1:A10 is the range of cells containing the sales amounts, B1:B10 is the range of cells containing the cost of goods sold, and C1 is the commission percentage.

7. What is the average commission structure for sales?

The average commission structure for sales typically involves a base salary combined with a percentage of the revenue generated from sales. Commissions can range from 5% to 20%, depending on the industry, product, and individual performance, with higher commissions often tied to achieving specific sales targets. Bottom of Form