On this page

If you ask a salesperson what motivates them, you might be in for a surprise. Because it's not what you expect conventionally conditioned coin-operated sales reps to say. Meaningful work, satisfaction and knowing that they are valued is the answer!

Like other employees, sales reps also come to work to do what they are best at, selling.

But if enough effort isn't put into motivating sales reps, they leave. And the cost of a sales person leaving is high.

Research shows that it takes 3 years on average for a sales rep to reach peak performance. 3 years is a considerable amount of time, so good reps should be seen as an investment. Unfortunately, this investment is entirely lost when a good rep leaves over sales commission issues – the #1 reason why sales reps leave.

But why is losing reps so costly?

Simply because the cost of sales rep is not just the tangible cost of salary + incentives paid to him but includes a lot of intangible and hidden costs.

So, the cost of losing a rep is a combination of recruitment costs of hiring a new sales rep + training costs of old rep + training costs of newly hired rep + the cost of lower performance in the training period of both the old and new rep + cost of lost business opportunities.

So why do sales reps leave?

The number one reason has got everything to do with incentives.

This isn't surprising at all, considering incentives are a major component of the pay structure for sales reps, making it crucial for organizations to get it right.

A strong commission structure is essential for retaining top sales talent. However, when sales reps feel shortchanged, they’re more likely to seek better opportunities elsewhere. Here are the key commission-related mistakes that drive sales reps away—and how to avoid them.

1. Delayed commission payments

Sales reps rely on timely payments to cover their expenses. Delays in commission payouts can create financial strain, frustration, and ultimately push them to look for more reliable employers.

2. Inaccurate commission calculations

Nothing is more frustrating for a salesperson than receiving an incorrect paycheck. If reps consistently find errors in their commissions, they may lose trust in your organization and leave for a company with a more transparent system.

3. Poorly communicated incentive plans

If sales reps don’t fully understand their incentive plans, they may feel misled or that their efforts aren’t properly rewarded. Clear communication ensures reps know what to expect and stay motivated to achieve their targets.

4. Unfair treatment or favoritism

A level playing field is crucial for maintaining morale. If some reps receive preferential treatment—whether through better leads, exclusive deals, or different commission structures—others may feel undervalued and start searching for new opportunities.

5. Unrealistic quotas

Setting quotas too high can discourage even the best sales reps. Ideally, about 75% of your team should be able to meet or exceed their quotas. If your targets are consistently unattainable, top performers may leave for a company with a more realistic approach.

6. Complicated or restrictive commission structures

Salespeople want to maximize their earnings, and overly complex commission plans can make them feel like their compensation is being capped or manipulated. A simple, transparent commission structure helps prevent misunderstandings and keeps reps motivated.

The true cost of losing a sales rep over commission disputes

But what’s the cost? According to a study, the average cost of replacing a rep is $115,000. And it takes an average of 6.2 months to replace a rep. With an average turnover rate of 28%, this is indeed a huge cost.

Beyond losing a valuable team member, the financial impact of sales rep turnover can exceed $100K. To fully understand the cost of losing a rep due to sales commission issues, consider the following factors:

Sales churn disrupts organizations, forcing teams to dedicate significant time to screening, interviewing, and training new hires. To stop losing salespeople, businesses must focus on retention strategies, including offering the best incentives for sales reps to keep top talent engaged and motivated.

If you’re making mistakes with commission payouts, it’s going to cost you. Here’s what you stand to lose if your commission structure fails.

1. Culture erosion

Commission errors are a bell you can’t unwring. A single mistake can erode trust, casting doubt on your organization's ability to get things right. Once trust is lost, it’s difficult—if not impossible—to rebuild. And once doubt sets in, it spreads fast.

Sales reps will start scrutinizing every commission statement, wondering if they’re being short-changed. That lack of trust is toxic.

The same applies when reps feel their commission rates are too low or their sales goals are unrealistic. If your incentive plan is perceived as unfair, it quickly turns into a disincentive. Providing the best incentives for sales reps isn’t just about motivation—it’s about retention and performance.

2. Decline in productivity

A demotivated sales team translates to lower productivity—fewer calls, fewer emails, and fewer follow-ups. It can even impact close rates. When faced with tough objections, a disheartened rep might wonder, “What’s the point?” instead of pushing forward.

This isn’t just a temporary dip in performance; it compounds over time, dragging overall sales results down. When sales incentives are mismanaged, you risk losing salespeople who would otherwise be top performers.

3. Increased attrition and hiring challenges

A flawed commission plan doesn’t just impact current employees—it makes it harder to attract new talent. High performers won’t stick around if they feel their compensation is unpredictable or unfair. Instead, they’ll seek opportunities at organizations that offer well-structured commission plans with transparent payouts.

Even worse, dissatisfied employees often share their experiences on platforms like Glassdoor and Payscale. A negative reputation around compensation can make hiring even more difficult, leaving you with empty seats and an underperforming sales team.

4. Human error and legal risks

Beyond lost productivity and talent, commission mistakes can have serious legal consequences. Did you know that errors in commission payouts can expose your company to class-action lawsuits?

For example, in 2017, Oracle faced a $150 million class-action lawsuit for underpaying commissions. In 2019, IBM lost a similar lawsuit for withholding commission payouts.

These cases highlight the high stakes of mismanaging sales compensation. A simple miscalculation or lack of transparency can quickly escalate into a costly legal battle.

When you factor in lost trust, reduced productivity, higher attrition, hiring difficulties, and legal liability, the real cost of commission mistakes is staggering.

You might get away with a mistake here and there, and some reps might tolerate a flawed commission structure. But is it really worth the risk?

Consider leveraging technology to automate incentive pay calculations, ensuring accuracy and transparency. A well-designed compensation management system doesn’t just prevent errors—it helps you stop losing salespeople and build a high-performing, motivated sales team.

And that's where Compass comes in!

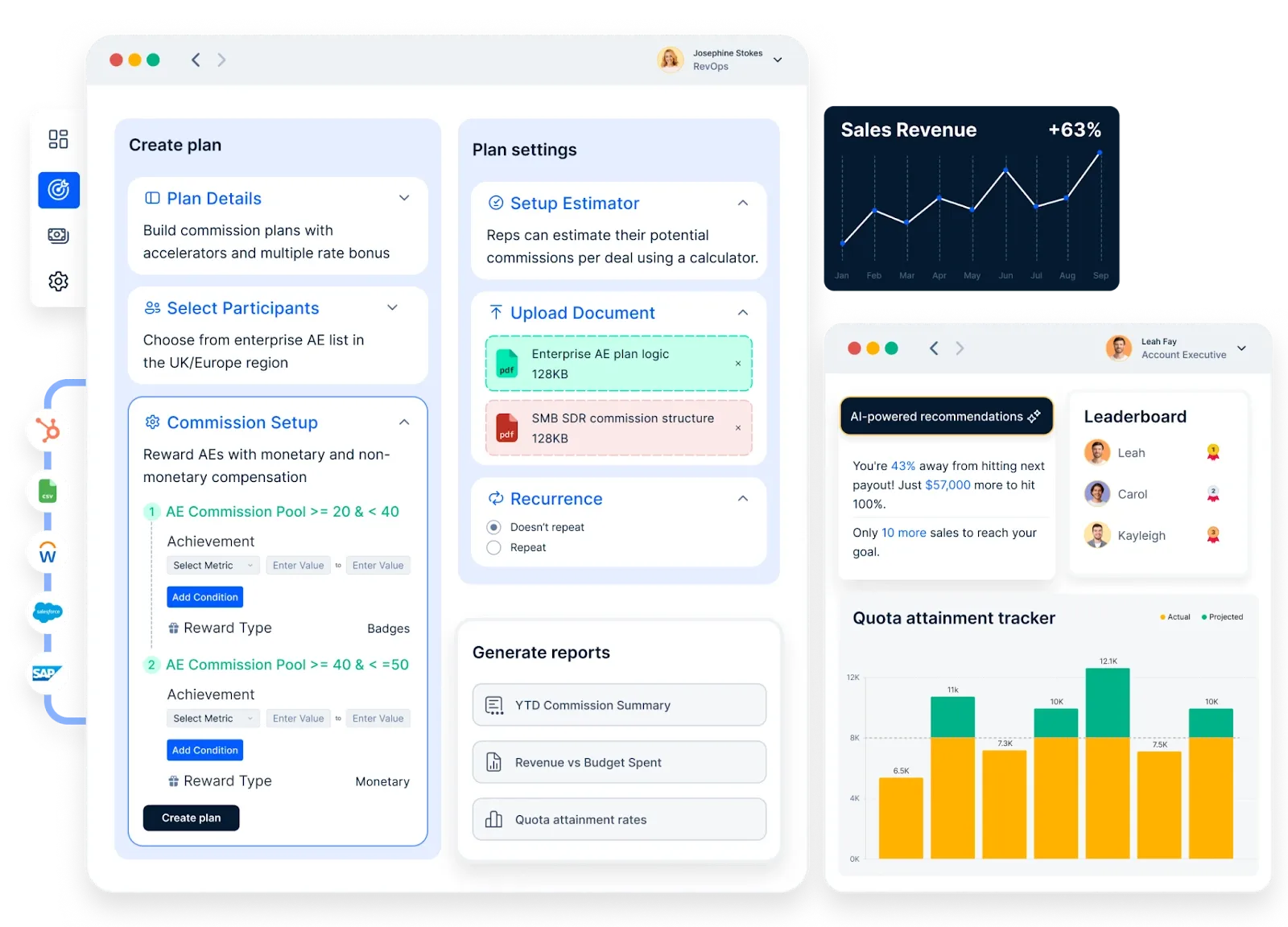

Compass is an unorthodox product built for orthodox problems in the most traditional function, sales.

Compass is the ultimate personification of the bilateral vision of democratizing sales incentives and making sales fun and is judicious for all industries across geographies.

Compass helps you easily build complex incentive programs with the familiarity of Excel within a few clicks, choose a game template and publish the program, all under 10 minutes.

With Compass, the sales reps, managers, admins, HR teams, finance team and the management have real-time access to incentive statements. Having this data readily available motivates sales reps to see what they’ve earned and how they can earn more. Apart from motivating your sales team, Compass provides complete transparency into the actual calculations behind the numbers and your team can trust the numbers they see because they have visibility into how they’re calculated.

Compass also lets you automate the process and all changes can be handled with just a few clicks. It also saves a lot of time and eliminates inaccuracies and allows your team to spend time on other critical areas of the business.

With Compass, you can handle geographical tax implications and compliance before incentive payouts. You can consider any or all types of incentive payouts like bank transfers, reward catalog of more than 20000 digital gift cards, prepaid cards, experiences, and wallets across 80+ countries, credit notes or good old bank transfers. Payouts can be managed across multiple geographies & currencies seamlessly.

The secret to retaining a salesperson lies in discovering their “hot buttons” and making sales incentives crystal clear is the way. Schedule a call now to know more about how Compass can help you!