How Insurance Sales Gamification Drives Performance & Motivation

Insurance sales can be challenging, but gamification in the insurance industry turns it into an exciting, rewarding experience. From real-time incentives to AI-driven leaderboards, gamification boosts agent performance, engagement, and CRM adoption.

On this page

Insurance sales can be challenging, repetitive, and mentally exhausting, leading to low engagement, high attrition, and motivation gaps among sales professionals. Many insurance companies struggle to keep their agents enthusiastic, productive, and committed to hitting sales targets. But what if closing policies felt more like winning a game rather than just another transaction?

This is where gamification transforms the insurance sales landscape. By introducing game-like elements such as leaderboards, instant rewards, and AI-powered nudges, insurance companies can turn routine sales activities into engaging, high-energy experiences. Gamification not only boosts productivity and morale but also encourages learning, improves CRM adoption, and enhances overall sales performance.

In this blog, we’ll explore why gamification is crucial for insurance sales, how it works, real-world examples, and how Compass simplifies its implementation for sales teams.

Why gamification is crucial for insurance sales

The insurance industry has traditionally relied on conventional sales tactics, where agents make endless calls, process complex paperwork, and push to close deals under constant pressure. This repetitive nature often leads to low engagement, high burnout, and declining sales performance. This is where insurance gamification emerges as a game-changer—infusing motivation, fun, and rewards into the sales process.

Challenges in the insurance sales industry

Despite its importance, insurance sales is one of the most challenging industries for sales professionals. Here’s why:

1. Lack of motivation and engagement

Unlike retail or tech sales, where products can be exciting, selling insurance policies can feel mundane and transactional. Many sales agents struggle with repetitive cold calls, tedious paperwork, and long sales cycles, which often result in disengagement and loss of motivation over time.

Without an engaging work environment or frequent recognition, even the most talented sales reps may struggle to stay inspired.

2. Slow CRM adoption and inefficient tracking

A well-maintained customer relationship management (CRM) system is critical for insurance companies to track leads, policy renewals, and customer interactions. However, many insurance sales agents hesitate to update CRM records consistently, either because it feels like extra work or because there’s no immediate reward for doing so.

As a result, poor data tracking leads to missed opportunities, follow-up failures, and inefficiencies in closing deals.

3. Delayed incentives and lack of real-time rewards

In many insurance firms, commission payouts and bonuses are processed at the end of the month or quarter, leaving sales reps waiting for long periods before receiving their earnings. This lack of instant gratification can lead to low morale and reduced enthusiasm to push harder for more sales. Without real-time recognition or immediate incentives, reps often feel disconnected from their achievements.

4. Complex product education and training gaps

The insurance industry evolves constantly, with new policies, regulations, and coverage plans introduced regularly. Agents must continuously learn and adapt, but traditional training methods—such as long presentations or thick policy manuals—fail to keep them engaged.

Many sales reps struggle to retain information, which affects their confidence when interacting with potential clients.

How gamification solves these challenges

Gamification in the insurance industry introduces game-like mechanics such as leaderboards, reward points, digital badges, and AI-driven nudges to transform sales into a dynamic and engaging experience.

By creating healthy competition and instant recognition, it encourages agents to close more policies, improve CRM adoption, and enhance their product knowledge.

For instance, when insurance companies gamify sales performance, agents can see their progress in real time, compete with peers, and earn instant rewards for hitting milestones—turning daily tasks into an exciting challenge rather than a mundane routine.

How gamification transforms insurance sales teams

The introduction of insurance gamification is reshaping how sales teams operate by injecting excitement, competition, and instant rewards into daily workflows.

Traditional insurance sales models often focus solely on quotas and revenue, but gamification in the insurance industry ensures that every small win, learning milestone, and effort is recognized—keeping sales reps engaged and motivated.

Here’s how gamification in insurance transforms sales teams:

1. Driving competition with leaderboards & scorecards

Sales teams thrive on healthy competition, and leaderboards make it easy to track who’s leading the race. By ranking agents based on deals closed, CRM updates, and training completion, sales reps are motivated to push harder, outperform peers, and improve daily performance.

Gamification ensures that sales leaders can set dynamic, performance-based targets, encouraging agents to consistently chase higher milestones. This fosters an environment where every sale counts, and every effort is acknowledged in real time.

2. Real-time sales tracking & instant recognition

Long feedback cycles often leave sales reps disconnected from their achievements. With gamification, every deal closed, milestone achieved, and customer follow-up completed gets recorded instantly.

Sales reps receive immediate recognition through badges, rewards, or leaderboard promotions, ensuring they stay motivated throughout the day, not just at the end of the quarter.

Additionally, managers can track performance in real time, helping them intervene, guide, and celebrate wins without waiting for end-of-month reports.

3. Incentivized learning & product training programs

Insurance agents must stay updated on policies, regulations, and product offerings, but traditional training programs can be dry and overwhelming. Insurance gamification makes learning interactive and rewarding by offering points, progress badges, and certificates for completing training modules.

This not only encourages reps to stay informed but also ensures they can confidently sell complex insurance products, leading to higher conversion rates and better customer interactions.

4. AI-driven nudges & smart notifications

Many sales agents forget follow-ups, neglect CRM updates, or miss deadlines due to workload pressure. Gamification in the insurance industry integrates AI-powered nudges and smart notifications that remind reps to complete tasks, follow up on leads, and update CRM records—ensuring no opportunity slips through the cracks.

These automated reminders keep agents on track without feeling micromanaged, making them more proactive and accountable for their performance.

5. Transparent & engaging incentive programs

One of the biggest motivators in insurance sales is compensation, but if incentives aren’t structured well, they can demotivate reps instead of driving performance. Gamification in insurance sales introduces clear, transparent, and real-time incentive tracking, ensuring sales reps always know how much they’ve earned, how close they are to their next milestone, and what they need to do to maximize rewards.

Instead of waiting for monthly or quarterly payouts, gamified incentive models allow instant recognition through digital rewards, commission tracking, and performance-based bonuses—keeping sales teams engaged and goal-oriented.

By implementing insurance gamification, companies create a dynamic, performance-driven sales culture where effort, learning, and success are continuously rewarded. Sales teams no longer see their roles as just another job—they see them as a challenge worth winning.

Real-world examples of insurance sales gamification

The impact of gamification in the insurance industry is already visible in companies that have successfully integrated game-inspired elements into their sales strategies. From improving customer engagement to motivating sales reps, gamification has proven to be a powerful tool in driving performance.

Here are some real-world examples of how insurance gamification is reshaping sales and customer experiences:

1. Gamification in automobile insurance

Auto insurance companies are leveraging gamification to promote safe driving and increase policyholder engagement. By using telematics-based apps that monitor driving behavior, companies reward customers with discounts on premiums for maintaining safe driving habits.

For example, Aviva UK’s Drive App scores drivers based on acceleration, braking, and cornering. Customers with high scores unlock premium discounts, encouraging safer driving while reducing risk for insurers.

2. Gamification in health insurance

Health insurers are introducing fitness-based reward programs to promote a healthy lifestyle among policyholders. Companies integrate wearable devices like Fitbit and Apple Watch to track physical activity, offering rewards such as reduced premiums, cashback, or loyalty points for meeting fitness goals.

South African insurer Discovery’s Vitality Program is a great example. It gamifies wellness by rewarding policyholders with points for exercising, eating healthy, and getting medical check-ups, ultimately improving customer retention while reducing long-term claims.

3. Gamification in CRM adoption & sales data management

One of the biggest challenges in insurance sales is ensuring that agents consistently update CRM systems. Many companies now use gamification in insurance sales to encourage CRM adoption by introducing leaderboards, rewards for accurate data entry, and point-based incentives for completing tasks on time.

This approach ensures better data accuracy, improved sales forecasting, and seamless pipeline management, leading to a more organized and efficient sales process.

4. Sales contests & leaderboard-driven incentives

Insurance companies are turning sales targets into fun competitions, where agents earn points for closing deals, following up with leads, and completing training programs. Live leaderboards keep agents engaged, while top performers receive cash bonuses, gift cards, or even paid vacations.

Companies using this strategy report higher sales productivity and lower turnover, as agents feel more connected to their goals and motivated to succeed.

These real-world examples show how insurance gamification is revolutionizing the industry by making sales and customer interactions more engaging, rewarding, and effective. From improving agent motivation to increasing customer loyalty, gamification is a game-changer for insurance companies looking to boost performance.

Boost insurance sales gamification with Compass

Selling insurance isn’t just about offering policies—it’s about motivating agents, streamlining operations, and optimizing incentives to create a high-performance sales culture.

The insurance industry operates across multiple sales channels, including direct agents, brokers, and independent agencies, making sales tracking, incentive management, and engagement strategies more complex.

Compass is the #1 gamification platform for the insurance industry, designed to automate, gamify, and enhance sales operations, ensuring that every agent—whether in-house or third-party—stays motivated, engaged, and aligned with company goals.

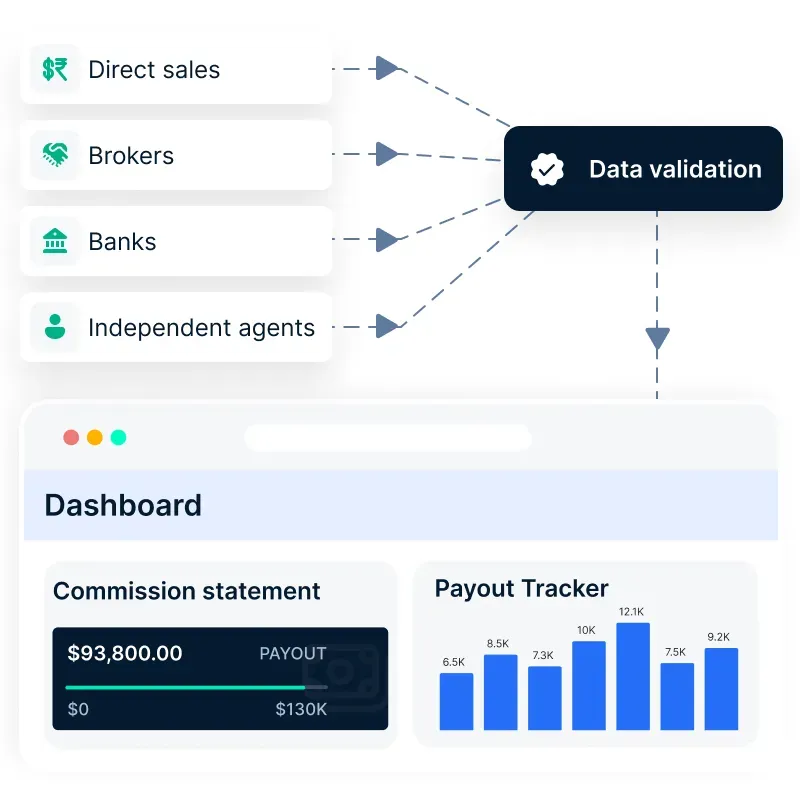

1. Replace excel & track all policy sales with a centralized dashboard

Tracking sales performance across multiple channels and agents can be challenging, especially when using outdated spreadsheets. Compass eliminates the need for manual sales tracking, ensuring:

✔ Automated commission calculations, reducing errors and disputes.

✔ Real-time visibility into policy sales, making performance tracking seamless.

✔ Accurate sales attribution to direct agents, brokers, and advisors.

With Compass, insurance companies gain complete control over sales tracking, ensuring accurate payouts and reducing administrative burden.

2. Implement clawback & chargeback provisions without errors

Insurance companies frequently adjust agent commissions due to policy cancellations, misrepresentation, or breach of contract. Without automation, these adjustments can lead to payment disputes and revenue loss. Compass automates clawback provisions, ensuring:

✔ Error-free commission adjustments based on policy status.

✔ Scalable, rule-based commission corrections, reducing manual interventions.

✔ Transparent deductions, ensuring agents understand adjustments in real-time.

This prevents financial discrepancies while maintaining agent trust in the commission structure.

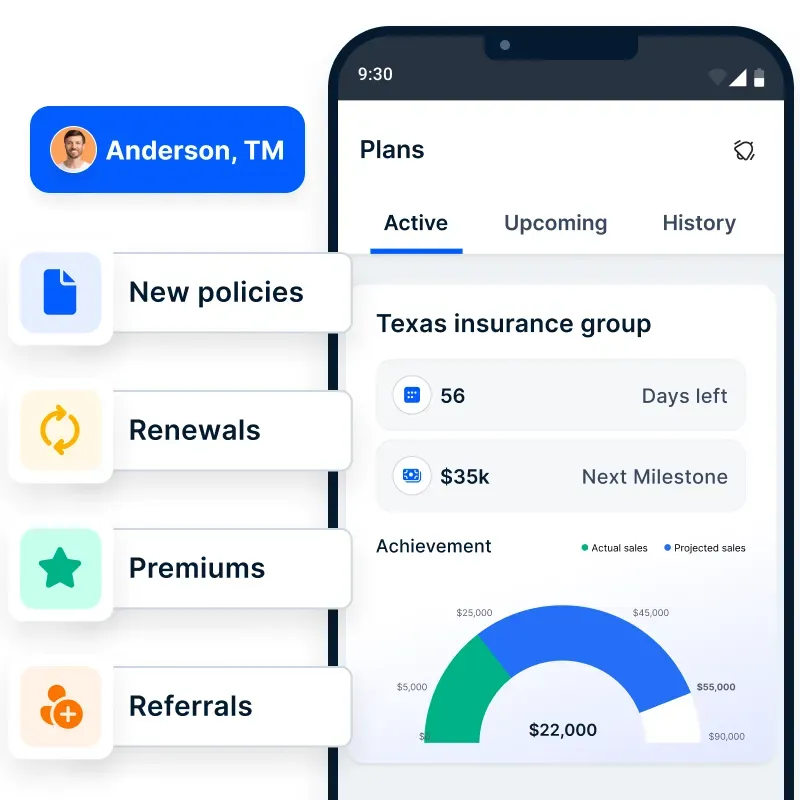

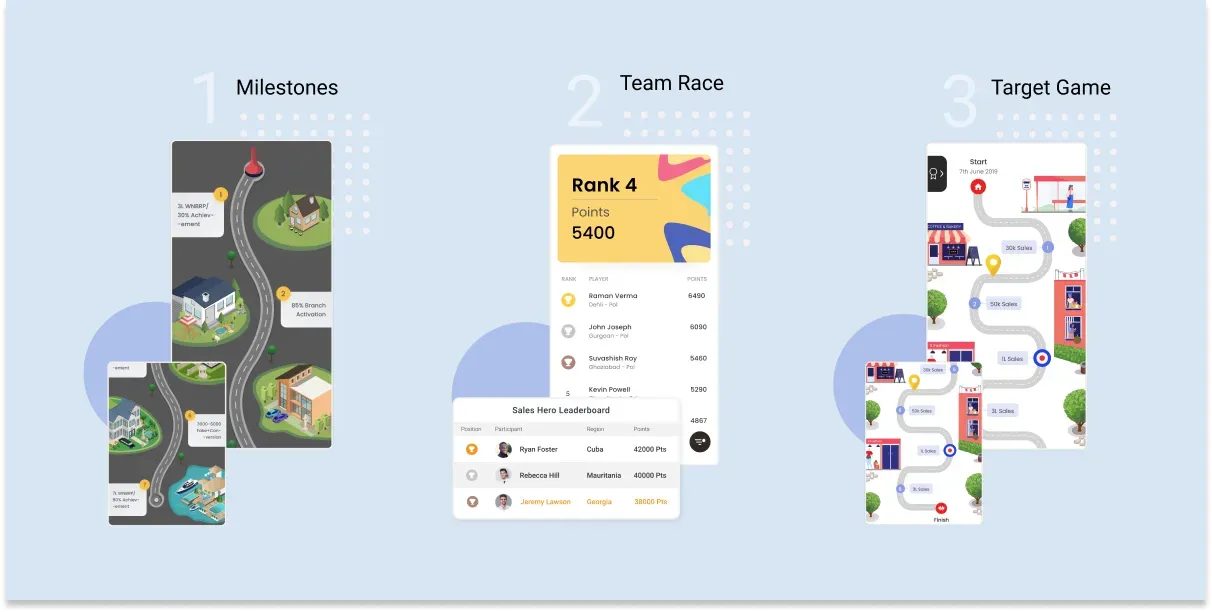

3. Gamify insurance sales with ai-powered leaderboards & contests

A major challenge in insurance sales gamification is keeping agents engaged. Compass introduces AI-powered sales gamification, turning routine sales activities into exciting challenges through:

✔ Live leaderboards, ranking agents based on sales performance.

✔ Gamified sales contests, rewarding agents for meeting specific targets.

✔ Mobile app integration, allowing agents to track scores and earnings on the go.

Sales teams thrive in competitive environments—Compass makes every sale feel like a win.

4. Reduce agent churn & align sales behavior with high-revenue policies

Many insurance agents prioritize quick sales over long-term, high-value policies. Compass helps companies drive better sales behaviors by:

✔ Implementing revenue-driven KPIs, ensuring agents focus on high-value policies.

✔ Providing real-time commission tracking, allowing agents to see how much they’ve earned instantly.

✔ Offering smart nudges and AI-driven recommendations, guiding agents toward better sales decisions.

When agents understand how their performance impacts earnings, they stay motivated to sell more and stay longer.

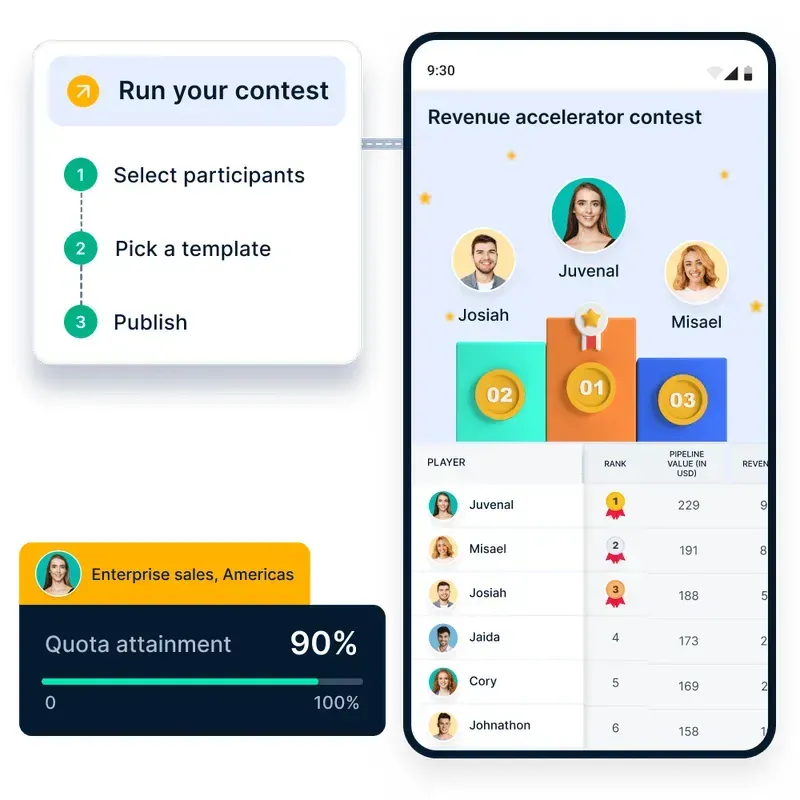

5. Publish sales programs in under 10 minutes

Manual sales programs require endless reporting, approvals, and follow-ups. Compass eliminates inefficiencies by allowing companies to:

✔ Create sales gamification programs in minutes using pre-built templates.

✔ Automate nudges and notifications, ensuring agents stay engaged.

✔ Remove reliance on email & WhatsApp MIS reports, replacing them with real-time sales dashboards.

With Compass, insurance companies can launch engaging sales programs effortlessly, ensuring high participation and instant traction.

6. Save on incentive budgets with one-click payments

Traditional brand vouchers and gift card incentives often go unused, leading to wasted budget and inefficient rewards distribution. Compass optimizes incentive spending by:

✔ Offering 20,000+ digital gift cards, prepaid cards, and wallets across 80+ countries.

✔ Reducing incentive costs by at least 6% through an on-redemption model.

✔ Ensuring incentives reach the right agents instantly through automated payouts.

With smarter, flexible rewards, Compass helps companies save money while maximizing agent motivation.

7. Boost CRM adoption with gamification

CRMs are powerful, but getting agents to use them is a challenge. Compass integrates gamification into CRM platforms, ensuring:

✔ Agents are rewarded for updating CRM records, improving data accuracy.

✔ Leaderboards track CRM adoption, driving healthy competition.

✔ AI nudges remind agents to log interactions, preventing missed follow-ups.

When CRM engagement improves, sales forecasting, pipeline visibility, and policy tracking become more efficient.

8. Empower branch managers with AI-driven sales optimization

Branch managers spend 90% of their time on administrative tasks, leaving little room for strategic decision-making. Compass frees up their time by:

✔ Providing real-time sales insights, eliminating the need for manual data gathering.

✔ Automating reporting, so managers can focus on optimizing branch performance.

✔ Offering AI-powered sales recommendations, guiding managers in improving agent productivity.

When managers have more time for strategy, insurance companies experience higher efficiency and better performance.

9. 100% adoption support for seamless gamification implementation

Deploying a new gamification platform can be overwhelming, but Compass provides full adoption support with:

✔ Pre-launch, launch, and post-launch engagement materials for a smooth transition.

✔ A 365-day adoption plan, ensuring teams are continuously supported.

✔ AI-based program recommendations, helping companies refine their gamification strategy.

From implementation to long-term success, Compass ensures gamification delivers ROI.

10. AI-enabled upgrades for next-level insurance sales gamification

Compass continuously evolves with AI-powered enhancements, including:

✔ New game templates released every quarter for fresh engagement strategies.

✔ AI-driven smart nudges, helping agents optimize performance.

✔ AI-based business simulations, guiding sales leaders in revenue planning.

✔ Predictive sales journeys, helping agents strategize how to maximize commissions.

These cutting-edge AI innovations ensure insurance gamification remains dynamic, data-driven, and impactful.

Why choose Compass for gamification in insurance?

The insurance industry thrives on engagement, motivation, and operational efficiency. Compass is designed to fuel all three by:

✔ Automating commission tracking & reducing manual errors.

✔ Turning sales into a game with leaderboards, challenges & rewards.

✔ Providing real-time visibility into sales performance & incentives.

✔ Offering seamless integration with CRM & agent platforms.

Conclusion: The future of insurance sales is gamified

The insurance industry is undergoing a transformation, where engagement, motivation, and data-driven decision-making are becoming just as critical as selling policies. Insurance gamification is no longer a trend—it’s a necessity for companies looking to boost agent productivity, streamline commission management, and drive higher policy conversions.

With gamification in the insurance industry, sales teams are no longer burdened by monotonous tasks, delayed incentives, and inefficient processes. Instead, they are empowered with real-time rewards, transparent tracking, and AI-driven insights, helping them stay engaged and perform at their best.

Turn your sales programs into a game-changing strategy with Compass. Book a demo today and see how gamification can drive real results for your sales teams!