Comisiones de los agentes hipotecarios en EE.UU.: cómo funcionan y qué esperar

Descubra cómo ganan comisiones los agentes hipotecarios, los tipos de honorarios que cobran, la normativa del sector y cómo los prestatarios pueden optimizar los costes al obtener un préstamo hipotecario.

En esta página

Conseguir una hipoteca es una decisión financiera importante que a menudo requiere la experiencia de un agente hipotecario. Estos profesionales actúan como intermediarios entre prestatarios y prestamistas, ayudando a las personas a encontrar las opciones de préstamo más adecuadas.

Aunque los agentes hipotecarios prestan servicios valiosos, es fundamental que los prestatarios entiendan cómo se compensa a estos profesionales. En Estados Unidos, las comisiones de los agentes hipotecarios desempeñan un papel fundamental en el proceso del préstamo hipotecario.

¿Quiénes son los agentes hipotecarios?

Aagente hipotecarioes un profesional financiero que actúa como intermediario entre los particulares o empresas que solicitan un préstamo hipotecario y los prestamistas que proporcionan los fondos para el préstamo.

Los agentes hipotecarios ayudan a los prestatarios a navegar por el complejo proceso de conseguir una hipoteca poniéndoles en contacto con prestamistas que ofrecen productos de préstamo adecuados a su situación y necesidades financieras.

Las comisiones de los agentes hipotecarios

Las comisiones de los agentes hipotecarios son honorarios que se pagan a los agentes por sus servicios para facilitar el proceso de solicitud y aprobación de una hipoteca. En Estados Unidos, estas comisiones suelen ser de dos tipos: iniciales y continuas.

1. Comisiones iniciales

- Comisión de apertura: Se trata de una comisión inicial habitual que cobran los agentes hipotecarios. Suele ser un porcentaje del importe del préstamo y puede oscilar entre el 0,5% y el 1,5%. La comisión de apertura compensa al agente por tramitar la solicitud de préstamo, evaluar la solvencia del prestatario y coordinarse con el prestamista.

- Puntos de descuento del préstamo:Los prestatarios también pueden encontrarse con puntos de descuento del préstamo, que son comisiones pagadas por adelantado para reducir el tipo de interés de la hipoteca. Cada punto suele costar el 1% del importe del préstamo y puede dar lugar a un tipo de interés más bajo, con el consiguiente ahorro potencial a lo largo de la vida del préstamo.

2. Tasas en curso

- YSP (Yield Spread Premium): Aunque hoy en día es menos común, la YSP es una comisión que pagan los prestamistas a los intermediarios por conseguir un préstamo con un tipo de interés más alto del que el prestatario puede obtener. Esta práctica ha sido objeto de escrutinio, y se han establecido normas para garantizar que los intermediarios actúen en el mejor interés del prestatario.

- Comisiones de seguimiento: En algunos casos, los agentes hipotecarios pueden recibir comisiones continuas, conocidas como comisiones de seguimiento, durante toda la vida del préstamo. Estas comisiones se basan en el saldo pendiente de la hipoteca e incentivan a los agentes a mantener una relación a largo plazo con el prestatario.

En los últimos años, los cambios normativos han tenido como objetivo aumentar la transparencia en el sector hipotecario y proteger a los consumidores. La Ley Dodd-Frank de Reforma de Wall Street y Protección del Consumidor, por ejemplo, obliga a los agentes hipotecarios a revelar su remuneración a los prestatarios. Esto incluye detallar las comisiones de apertura, los puntos de descuento y cualquier otra comisión asociada al préstamo.

¿Cuánto ganan los agentes hipotecarios?

Los ingresos anuales de un agente hipotecario pueden variar en función de su ubicación y del volumen de negocio que realice. Normalmente, su remuneración es un porcentaje del importe de la hipoteca, lo que hace más lucrativas las regiones con elevados precios de la vivienda, ya que los prestatarios de esas zonas suelen necesitar préstamos de mayor cuantía.

Los agentes hipotecarios establecidos y proactivos que realizan numerosas transacciones suelen ganar más en comparación con los que son nuevos en el sector o trabajan a tiempo parcial.

Diversas plataformas y recursos en línea ofrecen una serie de ingresos medios para los agentes hipotecarios asalariados a partir de abril de 2023:

- SegúnIndeedel salario base medio nacional de los agentes hipotecarios es de 98.162 dólares al año, aunque algunos reciben comisiones adicionales. En zonas concretas, como la bahía de San Francisco, el salario medio es notablemente superior, 141.240 dólares, aunque se basa en una pequeña muestra de solo tres agentes.

- PayScaleinforma de un salario medio de 64.630 dólares para los agentes hipotecarios basado en 57 informes, con comisiones que oscilan entre los 12.000 y los 178.000 dólares. Los que tienen menos de un año de experiencia tienen una remuneración total media de 47.000 dólares, mientras que los que tienen más de 20 años de experiencia tienen una media de 69.000 dólares. Estas cifras proceden de muestras relativamente pequeñas.

- Glassdoorindica un salario base medio de 136.620 dólares para los agentes hipotecarios, con un rango de 111.000 a 352.000 dólares. La remuneración adicional, que incluye bonificaciones en efectivo, comisiones, propinas y participación en los beneficios, se estima en 55.484 dólares al año.

- Por último,ZipRecruiterinforma de un salario medio nacional de agente hipotecario de 129.346 $, con un rango que va desde los 11.500 $ hasta los 297.500 $.

Es importante señalar que estas cifras son medias y pueden verse influidas por diversos factores, como la ubicación geográfica, el nivel de experiencia y las circunstancias específicas de cada corredor.

¿Cómo se benefician los agentes hipotecarios de las transacciones?

Los agentes hipotecarios suelen ganar una comisión basada en el importe del préstamo,que suele oscilar entre el 1% y el 2%.. Esta comisión puede ser pagada tanto por el prestatario como por el prestamista, y suele rondar el 2% del valor del préstamo. Los préstamos de mayor cuantía dan lugar a comisiones más elevadas para los agentes, lo que supone un incentivo financiero para que consigan préstamos de mayor cuantía para sus clientes.

Dado que los ingresos de un agente hipotecario se basan en comisiones, están directamente vinculados al valor de la operación. Por ejemplo, un agente que cobre un tipo del 2% por un préstamo de 250.000 dólares ganaría 5.000 dólares.

Sin embargo, factores como el mercado inmobiliario local y el nivel de experiencia del agente pueden influir significativamente en sus ingresos anuales. Según ZipRecruiter, el salario medio anual de un agente hipotecario en los distintos estados varía, y factores como la demanda y la experiencia desempeñan un papel crucial.

Aunque los agentes hipotecarios prestan valiosos servicios al simplificar el proceso de préstamo, los prestatarios deben ser conscientes de las posibles comisiones. Una forma de mitigar los costes es obtener varios presupuestos hipotecarios de distintos prestamistas.

Según uninforme de Freddie Mac de 2018, los prestatarios pueden ahorrar un promedio de $ 3,000 durante la vida del préstamo asegurando al menos cinco cotizaciones. Si la comisión de un agente supera este ahorro potencial, los prestatarios pueden considerar explorar alternativas con diferentes estructuras de tarifas.

¿Cómo se paga a los agentes hipotecarios?

El pago a los agentes hipotecarios puede adoptar diversas formas, como en efectivo o como un añadido al saldo del préstamo. Si el prestatario es responsable de la comisión, se abona al cierre del préstamo.

Sin embargo, si el prestamista cubre el coste, éste puede integrarse en el importe total del préstamo, lo que significa que el prestatario sigue soportando la carga financiera. Como las estructuras de comisiones varían de un intermediario a otro, se aconseja a los prestatarios que entiendan bien las condiciones antes de comprometerse con un intermediario concreto.

¿Qué influye en el sueldo de un agente hipotecario?

Los agentes hipotecarios suelen ganar un salario base junto con una comisión que varía en función de varios factores, como las condiciones del préstamo, los acuerdos con el cliente y las condiciones del mercado.

1. Las condiciones del préstamo

Por término medio, los agentes hipotecarios cobran una comisión del 2% al 2,5% por préstamo. Sin embargo, la normativa federal prohíbe a los agentes cobrar más del 3% del importe total del préstamo. Por ejemplo, si un agente hipotecario cobra un 2,25% por un préstamo de 500.000 $, ganaría 11.250 $ de comisión.

2. El acuerdo con el cliente

Los agentes hipotecarios pueden trabajar para prestatarios o prestamistas, y sus honorarios dependen de estos acuerdos. Los prestamistas suelen pagar comisiones más altas que los prestatarios. Cuando los prestamistas compensan a los agentes, suelen pagar entre el 0,5% y el 2,75% del importe total del préstamo. Si pagan los prestatarios, los intermediarios cobran una comisión de apertura, que suele ser inferior al 3% del importe del préstamo.

3. El mercado de la vivienda

El mercado inmobiliario local también influye en las comisiones de los agentes hipotecarios. En mercados muy competitivos, los agentes pueden bajar sus comisiones para atraer a más clientes. En cambio, en mercados menos competitivos y con menos opciones, los agentes pueden cobrar comisiones más altas.

Cálculo de las comisiones de los agentes hipotecarios

Desglosemos un ejemplo de cómo podría calcularse la comisión de un agente hipotecario.

1. Importe del préstamo: 300.000 $

2. Tipo de interés: 4%

3. Plazo del préstamo: 30 años

Dónde,

- Importe del préstamo: Es la cantidad total de dinero prestada por el prestatario.

- Tipo de interés: El tipo de interés es el porcentaje del importe del préstamo que el prestatario paga como interés al prestamista durante la vida del préstamo.

- Plazo del préstamo: El plazo del préstamo es el número de años a lo largo de los cuales se reembolsará el préstamo.

Estructura de las comisiones

Comisión del agente: 1% del importe del préstamo

Cálculo:

1. Importe del préstamo: $300,000

2. Comisión: 1%

3. Importe de la comisión: Tipo de comisión * Importe del préstamo

Importe de la comisión= 0.01 * $300,000

Importe de la comisión= $3,000

Así, en este ejemplo, el agente hipotecario ganaría una comisión de 3.000 $ por facilitar el préstamo hipotecario de 300.000 $ a un tipo de comisión del 1%.

Es importante tener en cuenta que las estructuras de comisiones pueden variar y que algunos intermediarios también pueden recibir bonificaciones o incentivos adicionales en función de factores como el volumen de préstamos o la satisfacción del cliente.

Además, los agentes pueden recibir comisiones tanto del prestatario como del prestamista, o pueden cobrar honorarios al prestatario además o en lugar de una comisión. Consulte siempre las condiciones específicas del acuerdo entre el corredor y el prestamista para realizar cálculos precisos.

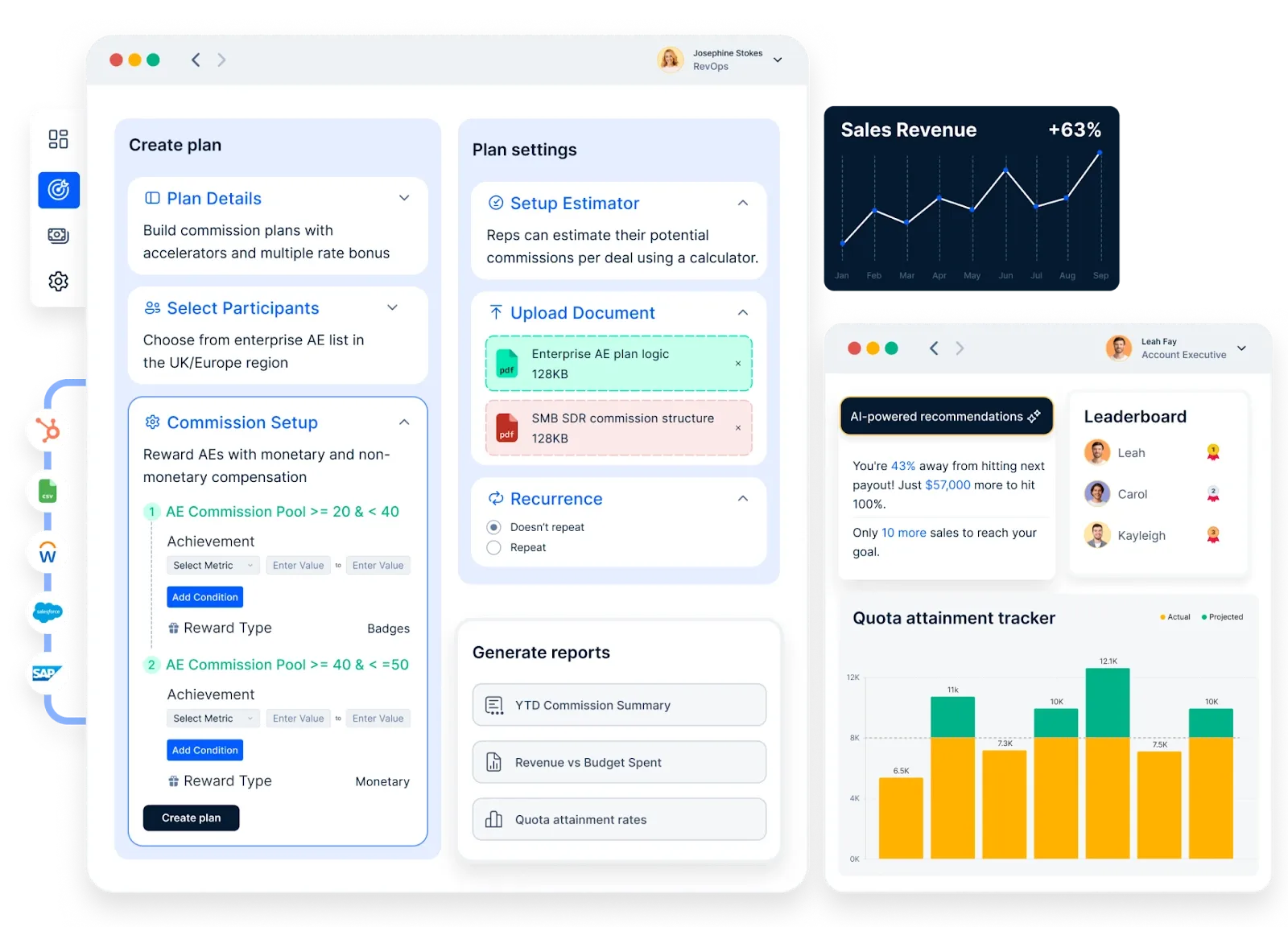

¿Cómo puede Compass simplificar el cálculo de las comisiones de los agentes hipotecarios?

Así se haceCompasssoftware de automatización de comisiones hipotecarias, que podría simplificar los cálculos de comisiones de los agentes hipotecarios:

- Integración con sistemas hipotecarios: Compass podría integrarse con varios sistemas relacionados con las hipotecas, como el software de originación de préstamos y las herramientas de gestión de relaciones con los clientes (CRM), para acceder a datos relevantes para el cálculo de comisiones.

- Estructuras de comisiones personalizables: La plataforma podría permitir a los agentes hipotecarios establecer y personalizar estructuras de comisiones basadas en acuerdos con diferentes prestamistas. Esta flexibilidad garantiza que los cálculos se ajusten a las condiciones específicas de cada relación crediticia.

- Automatización de los procesos de cálculo: Compass podría automatizar el cálculo de las comisiones, reduciendo la necesidad de introducir datos manualmente y minimizando el riesgo de errores. La automatización garantiza que los cálculos se realicen de forma coherente y eficiente.

- Actualización de datos en tiempo real: Al acceder a datos en tiempo real, Compass puede proporcionar cálculos de comisiones precisos y actualizados. Esto es crucial en un mercado hipotecario dinámico en el que los tipos y las condiciones pueden cambiar con frecuencia.

- Gestión del cumplimiento: La plataforma puede incorporar funciones de cumplimiento para garantizar que los cálculos de comisiones se adhieren a las regulaciones y normas del sector. Esto ayuda a los agentes hipotecarios a cumplir los requisitos legales.

- Informes transparentes: Compass podría ofrecer herramientas de elaboración de informes que proporcionen información detallada sobre los ingresos por comisiones. Unos informes claros y transparentes ayudan a los agentes hipotecarios a entender cómo se calculan las comisiones y sirven de base para la comunicación con clientes y prestamistas.

- Reducción de errores: Mediante mecanismos de automatización y validación, Compass podría ayudar a reducir la probabilidad de errores en los cálculos de comisiones, minimizando el riesgo de discrepancias y disputas financieras.

- Optimización del flujo de trabajo: Compass puede agilizar el flujo de trabajo general de las comisiones, desde la introducción de datos hasta la distribución de los pagos. Esta optimización puede ahorrar tiempo a los agentes hipotecarios, permitiéndoles centrarse en establecer relaciones con los clientes y hacer crecer su negocio.

- Integración con sistemas contables: La plataforma podría integrarse perfectamente con los sistemas contables, lo que facilitaría la transferencia fluida de los datos de las comisiones para la gestión financiera y la elaboración de informes.

Conclusión

Navegar por el mundo de las comisiones de los agentes hipotecarios en EE.UU. requiere una comprensión clara de las distintas comisiones y de cómo repercuten en el coste total de una hipoteca. A medida que la normativa evoluciona, los prestatarios pueden esperar una mayor transparencia y protección. Cuando se trabaja con un agente hipotecario, la comunicación abierta sobre las comisiones y la compensación es clave para garantizar una asociación fructífera y beneficiosa para ambas partes.

Preguntas frecuentes

1. ¿Ganan más los agentes hipotecarios que los gestores de préstamos?

Tanto los agentes hipotecarios como los gestores de préstamos desempeñan un papel fundamental en la concesión de préstamos hipotecarios, pero sus estructuras retributivas difieren. Los agentes hipotecarios suelen ganar comisiones por poner en contacto a los prestatarios con prestamistas adecuados, mientras que los agentes de préstamos, empleados por entidades financieras concretas, pueden recibir una combinación de salario y bonificaciones por rendimiento.

Según datos de de abril de 2023, los agentes hipotecarios tienen un salario base medio de 58.304 dólares, mientras que los agentes de préstamos hipotecarios tienen un salario base medio de 49.369 dólares. Sin embargo, los ingresos totales de ambos pueden variar en función de factores como la experiencia, la ubicación y el volumen de transacciones.

2. ¿Necesitan licencia los agentes hipotecarios?

Sí, los agentes hipotecarios deben tener licencia para operar legalmente. En Estados Unidos, la Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) exige que los agentes hipotecarios completen una formación previa a la obtención de la licencia, aprueben un examen nacional y cumplan unos requisitos anuales de formación continua. La concesión de licencias garantiza que los agentes cumplan las normas y reglamentos del sector.

3. ¿Cómo puedo asegurarme de que un agente hipotecario es legítimo?

Para verificar la legitimidad de un agente hipotecario:

- Comprobar licencia: Utilice el portal de acceso al consumidor del Sistema Nacional de Licencias Multiestatal (NMLS) para confirmar el estado de la licencia del agente y revisar cualquier acción disciplinaria.

- Revise las credenciales: Asegúrese de que el agente tiene experiencia y afiliaciones profesionales relevantes.

- Busque recomendaciones: Consulte a amigos, familiares o profesionales inmobiliarios para que le recomienden agentes de confianza.

- Evalúe la transparencia: Un intermediario de confianza explicará claramente las comisiones, las opciones de préstamo y el proceso de concesión.

- Lea las opiniones: Busque opiniones y valoraciones en Internet para calibrar la reputación del corredor y la satisfacción de sus clientes.

4. ¿Cuánto ganan en comisiones los agentes hipotecarios?

Los agentes hipotecarios suelen ganar comisiones que oscilan entre el 0,5% y el 2,75% del importe total del préstamo. Por ejemplo, por una hipoteca de 300.000 $, un agente puede ganar entre 1.500 $ y 8.250 $. El porcentaje exacto puede variar en función del acuerdo del agente con el prestamista, la complejidad del préstamo y las condiciones del mercado regional.

5. ¿Cuánto cobran de comisión los intermediarios?

La comisión que cobran los agentes hipotecarios suele oscilar entre el 0,5% y el 2,75% del importe del préstamo. Esta comisión suele pagarla el prestamista, el prestatario o una combinación de ambos, según el acuerdo. Es esencial que los prestatarios hablen y entiendan la estructura de comisiones por adelantado para evitar sorpresas en el momento del cierre.