Comisión de agente de seguros: ¿Qué es y cómo funciona?

Aprenda cómo ganan los agentes de seguros a través de comisiones, primas y renovaciones. Entender las comisiones de los agentes de seguros y los factores que afectan a sus ingresos.

En esta página

La gestión de las comisiones de los agentes de seguros va más allá del simple cálculo de los pagos: se trata de crear un sistema que mantenga motivados a los agentes, garantice la precisión e impulse mayores ventas de pólizas. Con diferentes estructuras de comisiones, tarifas que varían en función del tipo de seguro y múltiples canales de venta, la gestión eficaz de las comisiones puede resultar compleja para las aseguradoras.

Los jefes de ventas deben equilibrar unas comisiones competitivas con la rentabilidad del negocio, al tiempo que se aseguran de que los agentes se mantienen comprometidos e incentivados para vender pólizas de altos ingresos.

Un modelo de comisiones bien estructurado desempeña un papel fundamental en el mantenimiento de la lealtad y el rendimiento de los agentes. Entender cómo se determinan las comisiones, los factores que influyen en ellas y los componentes esenciales de las estructuras de comisiones ayuda a las empresas a diseñar un sistema de pago eficaz y transparente.

Ya se trate de seguros de vida, salud o propiedad, las estructuras de comisiones varían, lo que influye en la forma en que los agentes abordan las ventas.

Esta guía explica cómo funcionan las comisiones de seguros, los elementos clave que conforman las estructuras de comisiones y cómo las empresas pueden optimizar sus modelos de pago.

Además, exploraremos cómo las soluciones modernas de gestión de comisiones pueden agilizar el proceso, reducir los errores y mejorar la transparencia, ayudando a los jefes de ventas y a los agentes a trabajar de forma más eficiente.

Tipo | Primera vez | Sobre la renovación |

Seguro de enfermedad | 5% a 10% | 1% a 2% |

Seguro de vida | 40% a 120% | 1% a 2% |

Seguro de hogar | 5% a 15% | 2% a 5% |

Pueden parecer sencillas, pero comprender los factores y conceptos que subyacen a estas comisiones proporciona una visión completa de la comisión del agente de seguros.

Tanto si es un jefe de ventas que busca optimizar los pagos como si es un agente que busca claridad sobre los ingresos, esta guía le ayudará a gestionar las comisiones de seguros con eficacia.

A continuación, desglosamos las estructuras de comisiones, las tarifas y los factores clave que afectan a los ingresos de los agentes, para que pueda diseñar un sistema de comisiones competitivo y rentable.

¿Cómo funcionan las comisiones de seguros?

Las comisiones de seguros varían en función de la aseguradora y el tipo de póliza. Veamos cómo suelen funcionar las comisiones de los seguros.

Dado que los ingresos de un agente de seguros se basan principalmente en las comisiones, es fundamental fijar un objetivo de ingresos anuales. Basándonos en el ejemplo anterior, la venta constante podría generar más de 48.000 dólares en comisiones durante el primer año. Muchos reclutadores consideran que éste es un objetivo razonable. Los agentes que aspiren a mayores ingresos pueden simplemente aumentar sus esfuerzos de venta para alcanzar sus objetivos.

Algunas compañías ofrecen primas a los nuevos agentes para apoyar sus ingresos y fomentar un buen rendimiento, reconociendo que el primer año puede ser difícil.

Una ventaja clave que ofrecen algunas aseguradoras es el pago inmediato de comisiones en el momento de la emisión de la póliza. Esto significa que usted recibe una parte de sus comisiones de seguros tan pronto como comienza la cobertura, en lugar de esperar a que el tomador del seguro realice los pagos. Esto puede mejorar significativamente el flujo de caja de los nuevos agentes de seguros.

Comisiones de los agentes de seguros en función del tipo de seguro en EE.UU.

Las comisiones de los agentes de seguros en EE.UU.pueden variar mucho en función del tipo de seguro, la compañía aseguradora, la experiencia del agente y las pólizas concretas que venda. Estas son algunas pautas generales para los tipos de seguros más comunes:

Tipo de seguro | Estructura de comisiones | Ejemplo |

Seguro de vida | 40%-100% de la prima del primer año, renovaciones más bajas | Póliza de 5.000 $, comisión del 70% = 3.500 $. |

Seguro de enfermedad (mercado individual) | Media anual de 170,76 dólares por afiliado | Varía según el segmento de mercado y la región |

Seguros de bienes y accidentes | 10%-20% de la prima para pólizas nuevas, renovaciones más bajas | Póliza de automóvil de 1.000 $: Agente cautivo a partir de 100 $, agente independiente gana 150 $ cada año. |

Seguros comerciales | 10%-15% o más de la prima | En función de la complejidad y el tamaño de la política |

Rentas vitalicias e inversiones | 1%-7% del importe invertido | Varía según el producto y las condiciones |

Medicare/Seguro de dependencia | 15%-25% o más de la prima | Medicare Advantage: 600-700 $ por plan, renovaciones 300-400 $. Medicare Parte D: Hasta 100 $, renovaciones más bajas. |

Los agentes de seguros motivados e incentivados rinden más. Asegúrese contra la baja productividad de ventas con Xododay Compass. Una plataforma de comisiones automatizadasplataforma de comisiones automatizadasahora puede gestionar y seguir fácilmente los programas de comisiones y los KPI del equipo.¿Quiere saber cómo?Hable con nuestro experto en comisiones.

5 Componentes de las estructuras de comisiones de seguros

He aquí algunos componentes que quizá necesite conocer:

1. Comisión de base

La comisión básica que un agente recibe de una compañía de seguros cuando consigue vender una póliza es la comisión base. Es la principal fuente de ingresos que recibe un agente, independientemente de lo bien que cierre operaciones; un vendedor siempre cobra esta cantidad fija de dinero.

2. Comisiones de renovación

Si un cliente renueva su contrato, el vendedor recibe una comisión por renovación. Esta comisión continua fomenta un servicio constante y anima a los agentes a mantener relaciones duraderas con los clientes.

3. Bonificaciones en función de los resultados

Incentivos adicionales concedidos a los agentes en respuesta a la consecución de objetivos predeterminados, puntos de referencia de rendimiento u objetivos de ventas. Estos incentivos animan a los agentes a rendir por encima de las expectativas.

4. Primas de retención

Las primas que se conceden a los agentes por retener a los clientes y asegurarse de que los asegurados conservan su seguro durante largos periodos son primas de retención. Esto motiva a los agentes a concentrarse en mantener y satisfacer a su clientela.

5. Comisiones complementarias

Los agentes que cumplen determinados requisitos impuestos por la aseguradora y venden productos de seguros especializados pueden optar a esta retribución adicional. Estas comisiones adicionales actúan como un incentivo añadido por vender determinados tipos de pólizas.

Acelere la venta de pólizas con la automatización de comisiones

Los agentes de seguros motivados e incentivados rinden más. Asegúrese contra la baja productividad de ventas con Xododay Compass. Una plataforma de comisionesplataforma de comisiones automatizadaahora puede gestionar y seguir fácilmente los programas de comisiones y los KPI del equipo. ¿Quiere saber cómo?Hable con nuestro experto en comisiones.

¿Qué factores influyen en lo que ganan los agentes de seguros?

Las estructuras de comisiones desempeñan un papel importante en los ingresos de los agentes de seguros, pero hay otros factores que también influyen en ellos. Entre ellos figuran:

1. Tipo de agente

Hay dos tipos de agentes de seguros:

- Los agentes cautivos venden pólizas para un proveedor de seguros.

- Los agentes independientes trabajan con múltiples aseguradoras.

Los agentes independientes suelen ganar comisiones más altas, pero también cubren sus propios gastos empresariales, como alquiler, material de oficina y marketing.

2. Tipo de póliza

Los agentes de seguros pueden especializarse en uno o varios tipos de pólizas. Por ejemplo, un agente de seguros del hogar puede vender también seguros de automóvil. Los agentes de seguros de vida pueden ampliarse a los seguros de salud. Para ello, deben cumplir los requisitos de autorización de su jurisdicción.

3. Ubicación

El lugar donde opera un agente afecta a su potencial de ingresos. Una gran ciudad con mucha población ofrece más oportunidades de venta que un pueblo pequeño. Otros factores basados en la ubicación son:

- Acceso a los servicios públicos

- Coste de la vida

- Tasas de empleo

- Seguridad ciudadana y siniestralidad

Estos elementos configuran la demanda del mercado e influyen en lo que ganan los agentes de seguros.

¿Cuánto ganan los agentes de seguros?

Los salarios de los agentes de seguros varían. Según la Oficina de Estadísticas Laborales (BLS), el salario medio anual es de 79.650 $, lo que equivale a 37 $ por hora. Los puestos de nivel inicial suelen pagar menos. Los agentes con experiencia y una sólida base de clientes pueden alcanzar ingresos de seis cifras. Estos datos incluyen varios tipos de seguros. Estos abarcan propiedad y accidentes, vida y salud, entre otros. El BLS calcula que hay 455.540 empleos de agente de seguros.

La siguiente tabla presenta los percentiles salariales detallados de los agentes de seguros. Se basa en las últimas Estadísticas de empleo y salarios (OEWS). Ofrece información sobre los ingresos potenciales a distintos niveles.

Percentil | Salario anual |

Décimo | $38,210 |

25º aniversario | $51,200 |

50º (Mediana) | $65,580 |

75ª | $99,840 |

90 | $128,660 |

Retos habituales a los que se enfrentan los jefes de ventas a la hora de gestionar las comisiones de los agentes de seguros, y cómo Compass los resuelve

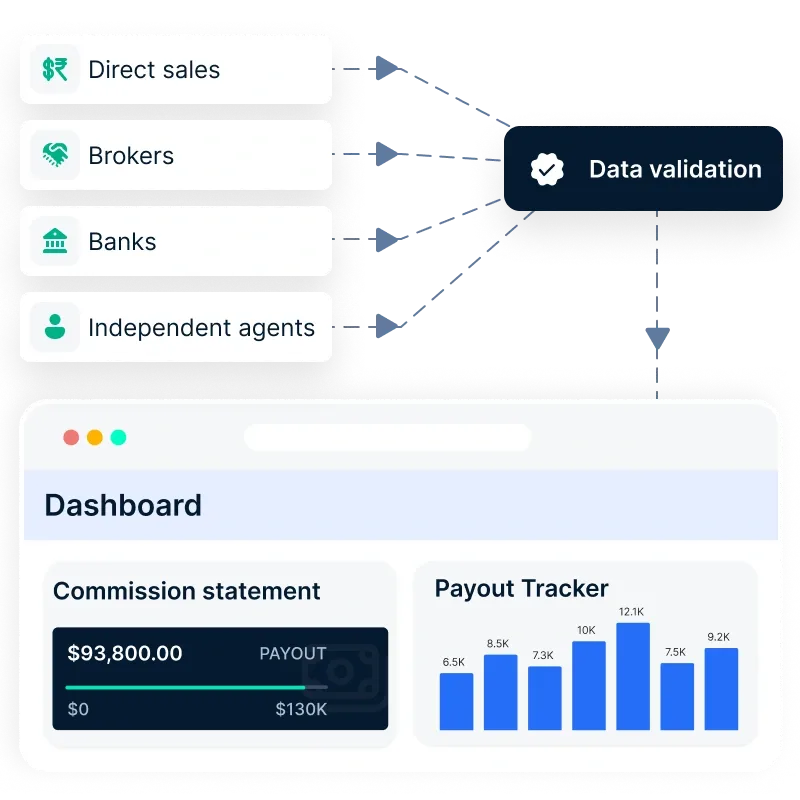

Los responsables de ventas del sector de los seguros se enfrentan a varios obstáculos a la hora de gestionar las comisiones de los agentes. Con múltiples tipos de pólizas, estructuras de pago complejas y una mezcla de agentes directos, corredores y agencias independientes, garantizar la precisión y la motivación se convierte en una tarea de enormes proporciones.

Los errores en el pago de comisiones, las disputas sobre las deducciones y la falta de herramientas de compromiso pueden provocar una elevada rotación de agentes y la pérdida de oportunidades de ingresos. Compass simplifica la gestión de comisiones automatizando los pagos, mejorando la transparencia e introduciendo la gamificación para impulsar el rendimiento de las ventas.

Aquí Compass aborda los principales retos:

1. Inexactitud de los datos y litigios sobre pagos

El seguimiento manual de las comisiones mediante hojas de cálculo suele dar lugar a errores de cálculo, pagos incorrectos y una atribución incoherente entre los distintos canales de venta. Los agentes que reciben comisiones incorrectas pueden perder la confianza en el sistema, lo que provoca un aumento de las disputas y una disminución de la motivación. Resolver estas disputas puede llevar mucho tiempo a los jefes de ventas, lo que desvía su atención de las actividades de ventas principales.

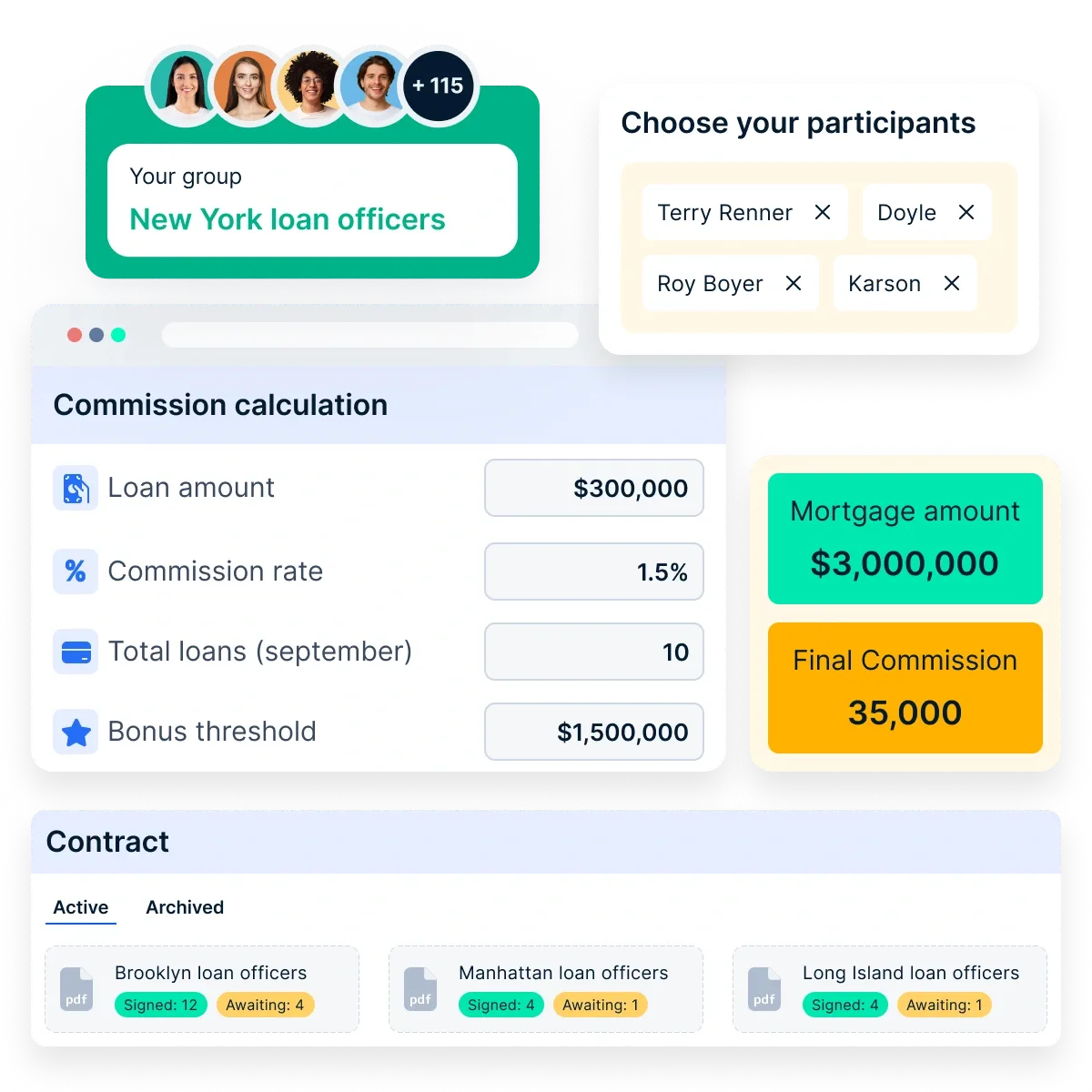

SoluciónCompass : Compass elimina la necesidad de hojas de cálculo centralizando el seguimiento de las comisiones en un único panel de control. Los cálculos automatizados garantizan que cada venta de póliza se atribuya con precisión, lo que reduce los errores de pago. Los agentes reciben información actualizada en tiempo real sobre sus ingresos, lo que reduce las disputas y fomenta la confianza en la estructura de comisiones.

2. Gestión de las devoluciones y los reembolsos

Uno de los aspectos más complicados de la gestión de comisiones es la recuperación de las comisiones pagadas por pólizas canceladas o falsificadas. Gestionarlas manualmente puede ser ineficaz y propenso a errores, lo que puede dar lugar a pagos excesivos o a relaciones tensas con los agentes. La falta de claridad en las políticas de recuperación puede dar lugar a disputas y disuadir a los agentes de vender pólizas de alto valor.

SoluciónCompass : Compass automatiza las disposiciones de reembolso, garantizando que las deducciones por pólizas canceladas, incumplimientos de contrato o tergiversaciones se procesen sin problemas. El sistema proporciona documentación clara y en tiempo real de los cálculos de recuperación, lo que garantiza que los agentes entienden las deducciones y minimiza los conflictos.

3. Falta de visibilidad de las estructuras de comisiones

Una frustración común entre los agentes de seguros es la falta de claridad en el cálculo de sus comisiones. Sin visibilidad de las estructuras de comisiones, los agentes pueden sentirse desmotivados o escépticos sobre sus pagos. Los jefes de ventas suelen tener dificultades para comunicar actualizaciones o cambios en las estructuras de comisiones de forma eficaz, lo que provoca malentendidos y falta de compromiso.

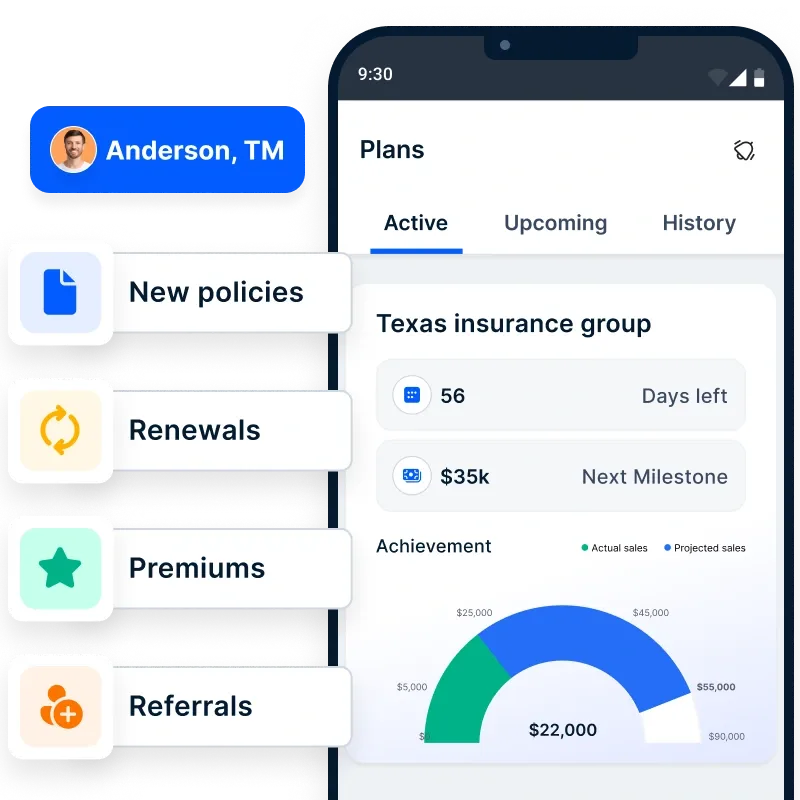

SoluciónCompass : Compass ofrece un sistema transparente de gestión de comisiones en el que los agentes pueden acceder a desgloses en tiempo real de sus ingresos. A través de un panel de control móvil, los agentes pueden hacer un seguimiento de su rendimiento, ver los cálculos de los pagos y descargar los documentos de la estructura de incentivos. Este nivel de transparencia ayuda a los agentes a mantenerse motivados y reduce las consultas sobre sus ingresos.

4. Motivar a los agentes para que vendan pólizas de alto rendimiento

Muchos agentes de seguros se centran en pólizas fáciles de vender y de poco valor, que pueden no contribuir significativamente a los ingresos de la empresa. Sin incentivos claros basados en los ingresos, los agentes pueden carecer de motivación para dar prioridad a las pólizas que producen mayores beneficios para la empresa. El resultado es un rendimiento de ventas inferior al óptimo y la pérdida de oportunidades de crecimiento.

SoluciónCompass : Compass permite a los jefes de ventas implantar indicadores clave de rendimiento estructurados en función de los ingresos que alinean las comisiones con las pólizas que generan más ingresos. Al ofrecer mayores incentivos por las pólizas que generan más valor comercial, Compass garantiza que los agentes estén motivados para dar prioridad a estas ventas. El sistema automatizado actualiza dinámicamente las proyecciones de ingresos, mostrando a los agentes los beneficios financieros directos de vender pólizas más lucrativas.

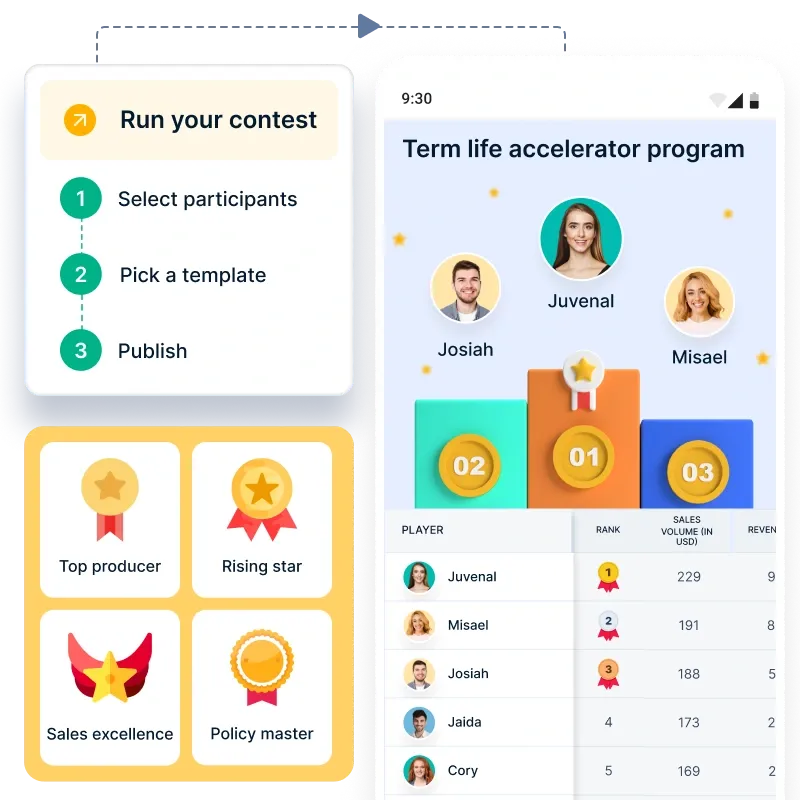

5. Mantener el compromiso de los agentes y reducir la rotación

Sin un compromiso continuo, los agentes pueden perder interés o buscar oportunidades con competidores que ofrezcan incentivos más atractivos. Las estructuras de comisiones tradicionales suelen carecer de elementos interactivos que mantengan motivados a los agentes. Los jefes de ventas tienen dificultades para mantener altos niveles de compromiso, lo que reduce la productividad y aumenta la rotación.

SoluciónCompass : Compass introduce la gamificación en el proceso de ventas, convirtiendo la venta basada en comisiones en una experiencia dinámica y atractiva. Los concursos de ventas, las tablas de clasificación en tiempo real y las tablas de puntuación del rendimiento incentivan a los agentes a superar sus límites. Las empresas pueden crear competiciones personalizadas para diferentes tipos de pólizas, recompensando a los mejores con bonificaciones, reconocimiento y oportunidades de desarrollo profesional. Este enfoque no sólo aumenta el rendimiento de las ventas, sino que también refuerza la fidelidad de los agentes.

En resumen

Conocer la economía de las comisiones de los agentes de seguros pone de relieve la conexión crucial entre los sistemas de incentivos que regulan su retribución y la forma en que motivan a los agentes.

Dado que el factor de motivación de los agentes es el pago de comisiones, es fundamental que las compañías de seguros gestionen eficazmente la remuneración de sus agentes.

Aquí es donde el software de compensación de ventas -Compasssurge como una herramienta vital.

Una solución integral que agiliza y gestiona las complejidades de las estructuras de comisiones.

Permite a las aseguradoras:

- calcular eficazmente,

- pista, y

- pagar comisiones a sus agentes

Si desea saber más sobre cómo Compass puede automatizar el pago de comisiones a sus agentes de seguros, entoncesreserve la demostraciónahora mismo.

Preguntas frecuentes

1. ¿Cuáles son las comisiones de los agentes de seguros?

Las comisiones de los agentes de seguros varían según el tipo de póliza, la aseguradora y la región. Normalmente, las comisiones de los seguros de vida oscilan entre el 30% y el 90% de la prima del primer año, mientras que las de los seguros de salud y propiedad rondan entre el 5% y el 20% por póliza.

2. ¿Cuál es la mejor comisión para un agente de seguros?

La mejor comisión depende del tipo de póliza. Los seguros de vida ofrecen las comisiones más altas (hasta el 90% el primer año), pero las de renovación bajan considerablemente. Los seguros de propiedad y accidentes ofrecen comisiones iniciales más bajas, pero las renovaciones son constantes.

3. ¿Ganan bien los vendedores de seguros?

Sí, los agentes de seguros con éxito pueden ganar bien, sobre todo los que venden pólizas con comisiones altas (por ejemplo, seguros de vida) y retienen clientes para obtener comisiones por renovación. Los ingresos varían en función de la experiencia, las habilidades de venta y la aseguradora.

4. ¿Cuál es un buen ratio de comisiones en los seguros?

Un buen ratio de comisiones equilibra las comisiones iniciales y las de renovación. Un buen porcentaje oscila entre el 40 % y el 70 % para los seguros de vida del primer año y entre el 10 % y el 15 % para las renovaciones, mientras que las comisiones de los seguros de propiedad suelen oscilar entre el 10 % y el 20 %, y las renovaciones entre el 5 % y el 10 %.