7 Reasons Why Sales Commission Management Is Crucial for Business Growth

Effective sales commission management drives business growth by improving accuracy, reducing disputes, and motivating sales teams. Learn how automation can streamline commissions for better efficiency and sales performance.

On this page

Sales commissions are performance-based compensation structures crucial in motivating and rewarding top sales performers. By tying commissions to specific sales goals, you can ensure that your teams are focused on the most vital objective–driving more sales.

However, designing and managing sales commissions can be a tough nut to crack for many businesses.

In this article, we will understand commission management and how you can design an effective commission plan to boost sales performance and facilitate business growth.

What is a sales commission?

A sales commission is a powerful financial incentive designed to reward sales professionals for meeting or exceeding specific performance goals. It plays a crucial role in driving motivation, enhancing productivity, and ultimately boosting business revenue.

Typically, a commission plan outlines how a sales representative earns their commission—whether as a percentage of sales closed, a fixed amount per deal, or a tiered structure based on performance milestones. A well-structured commission system ensures timely and transparent payouts, whether on a monthly, quarterly, or one-time basis.

What is sales commission management, and why is it important?

Sales commission management is administering, calculating, and distributing commissions to salespeople for their efforts in selling a company's products or services.

A proper commission management system is vital for accurately calculating and tracking commissions and timely distribution of payouts to the sales team. Without one, there may be issues with delayed payments, leading to frustration and decreased morale among sales staff.

Additionally, a lack of a transparent and fair commission process can lead to a lack of trust in the company, potentially leading to employee turnover.

Therefore, it is essential to have a reliable sales commission management system to improve employee morale and performance and produce positive business results.

An effective sales commission management system offers the following benefits:

- Streamlined administration: Streamlines sales commissions process end-to-end, freeing up time for other tasks, such as strategizing new sales plans, focusing on customer needs, and growing the business.

- Accurate calculation: Automates tracking and calculating commissions, ensuring accuracy to prevent errors and disputes among stakeholders. This ensures that sales staff are paid correctly and on time.

- Greater transparency: Provides sales managers and representatives complete real-time visibility into targets, earnings, and program details. This helps them to act proactively and optimize plans to achieve sales targets.

- Improved motivation: Motivates salespeople to drive more sales by tying commission structures to targets and providing visibility into their earnings and performance. With a transparent and fair commission system, sales staff are more likely to feel motivated and valued, leading to higher retention rates.

Why is sales commission management so challenging?

Despite advancements in compensation management and financial modeling, businesses continue to struggle with an efficient and seamless commission management process. In an era driven by artificial intelligence and automation, why does sales commission remain such a pain point?

The complexity of commission systems arises from several key factors—intricate team dynamics, layered commission structures, disparate data sources, and the ever-changing nature of sales organizations. Let’s explore why sales commission management is one of the toughest challenges for businesses today.

1. Complex team dynamics

Sales teams are rarely straightforward, especially in high-growth startups and enterprise-level organizations. A typical sales team consists of business development representatives, account executives, and even commissioned employees beyond sales, such as sales engineers, account managers, and customer success professionals.

Each of these roles follows a distinct commission plan based on their responsibilities. A business development representative may earn incentives based on the number of meetings booked, whereas an account executive might receive a commission based on closed-won revenue. As sales teams expand and diversify, their commission structures grow increasingly complex, making it difficult to implement a streamlined commissions management system.

2. Intricate commission structures

Every organization tailors its commission system to align with specific goals, such as revenue growth, employee motivation, and targeted behavioral incentives. To balance these objectives, businesses incorporate elements like commission caps, clawbacks, accelerators, and tiered incentives.

While these tactics help refine sales compensation plans, they also make sales commission management more challenging. The more layers within a commission plan, the harder it becomes to track payouts, maintain transparency, and ensure employees fully understand their earnings.

3. Disparate data sources

A seamless commission management system relies on accurate data—but sales commission calculations often pull from multiple sources, including CRMs, ERPs, and spreadsheets. When these systems aren’t fully integrated, organizations lack a single source of truth, leading to errors, delayed payments, and disputes.

Disconnected data systems result in miscalculations, reporting inconsistencies, and increased friction across departments. Without an automated commission management solution, businesses face prolonged payout cycles, productivity losses, and potential compliance risks.

4. Constant change in commission plans

Incentive structures are never static. New product launches, market fluctuations, territory realignments, and organizational shifts constantly impact commission plans. Managing these ongoing changes manually can be overwhelming and prone to errors, leading to dissatisfaction among sales teams.

To keep up with evolving business needs, companies require a commission management system that is flexible, automated, and easy to configure—one that seamlessly integrates with existing tools while providing real-time visibility and accuracy in commission tracking.

But how is the legacy system missing the mark and the automated system are leading the industry?

When it comes to commission management, businesses have traditionally relied on two solutions: spreadsheets and legacy commission systems. While both have their place, neither is built to handle the complexities of modern sales commission management. As organizations strive for efficiency, accuracy, and scalability, legacy systems are proving to be a bottleneck—paving the way for smarter, automated commission management systems.

The shortcomings of spreadsheets in commission management

Spreadsheets are widely used for sales commission management because they are familiar, cost-effective, and easy to implement. However, they come with major drawbacks:

- Not built for sales compensation: Managing commission plans in spreadsheets is tedious, prone to errors, and lacks real-time data integration.

- Error-prone & inefficient: Manual data entry leads to frequent miscalculations, while disputes require time-consuming investigations.

- Lack of real-time data: Without integration into CRM or ERP systems, commission calculations are always lagging behind actual sales performance.

The limitations of legacy commission systems

To overcome spreadsheet inefficiencies, many businesses have turned to legacy commission automation platforms. While these solutions offer some improvements, they also introduce new challenges:

- Complex & difficult to use: Many legacy platforms require custom coding and steep learning curves, making adoption difficult.

- Rigid & inflexible: Long implementation cycles, slow adjustments to commission plans, and heavy reliance on IT support make legacy systems inefficient.

- Limited adaptability: Unlike spreadsheets, legacy systems aren’t universally understood or easily transferable across different organizations.

Why automated commission management systems are the future

The best commission management system doesn’t force businesses to choose between spreadsheets and legacy automation—it bridges the gap. A modern commission management platform offers:

- Real-time sales commission management: Seamless integrations with CRM and ERP ensure accurate, up-to-date commission tracking.

- Scalability & flexibility: Easily modify commission plans as business needs evolve.

- Error reduction & efficiency: Automated calculations eliminate manual errors, saving time and reducing commission disputes.

- User-friendly experience: Unlike legacy systems, modern commission management platforms combine the accessibility of spreadsheets with the power of automation.

How does a sales commission management system work?

A sales commission management system streamlines the entire commission process by automating calculations, tracking payouts, and providing real-time visibility into earnings. It ensures accurate, timely payments while eliminating the hassle of manual tracking.

A commission management system consists of two key components:

1. Admin component

The admin side of the system makes commission management seamless by allowing administrators to:

- Define commission plans and rules, and integrate data from existing accounting or CRM systems.

- Automate commission calculations based on predefined structures such as flat rates, tiered commissions, or performance-based incentives.

- View, manage, and track commissions, sales performance, and payout schedules—all in one place.

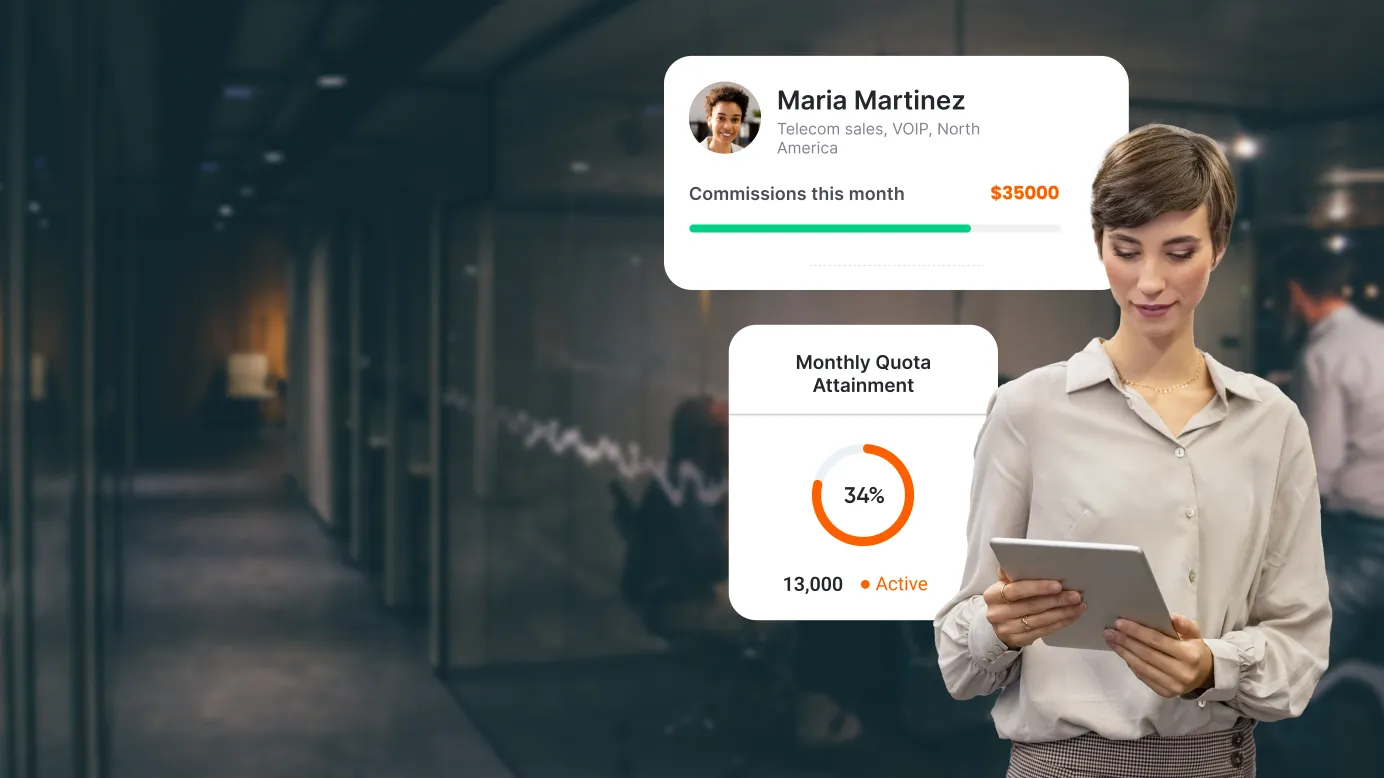

2. Manager & sales rep component

For sales reps and managers, a commission system enhances visibility and keeps teams motivated:

Sales reps can:

- View, download, and track their credited deals and expected commission payouts.

- Monitor earnings in real time, review past statements, and raise disputes if needed.

Managers can:

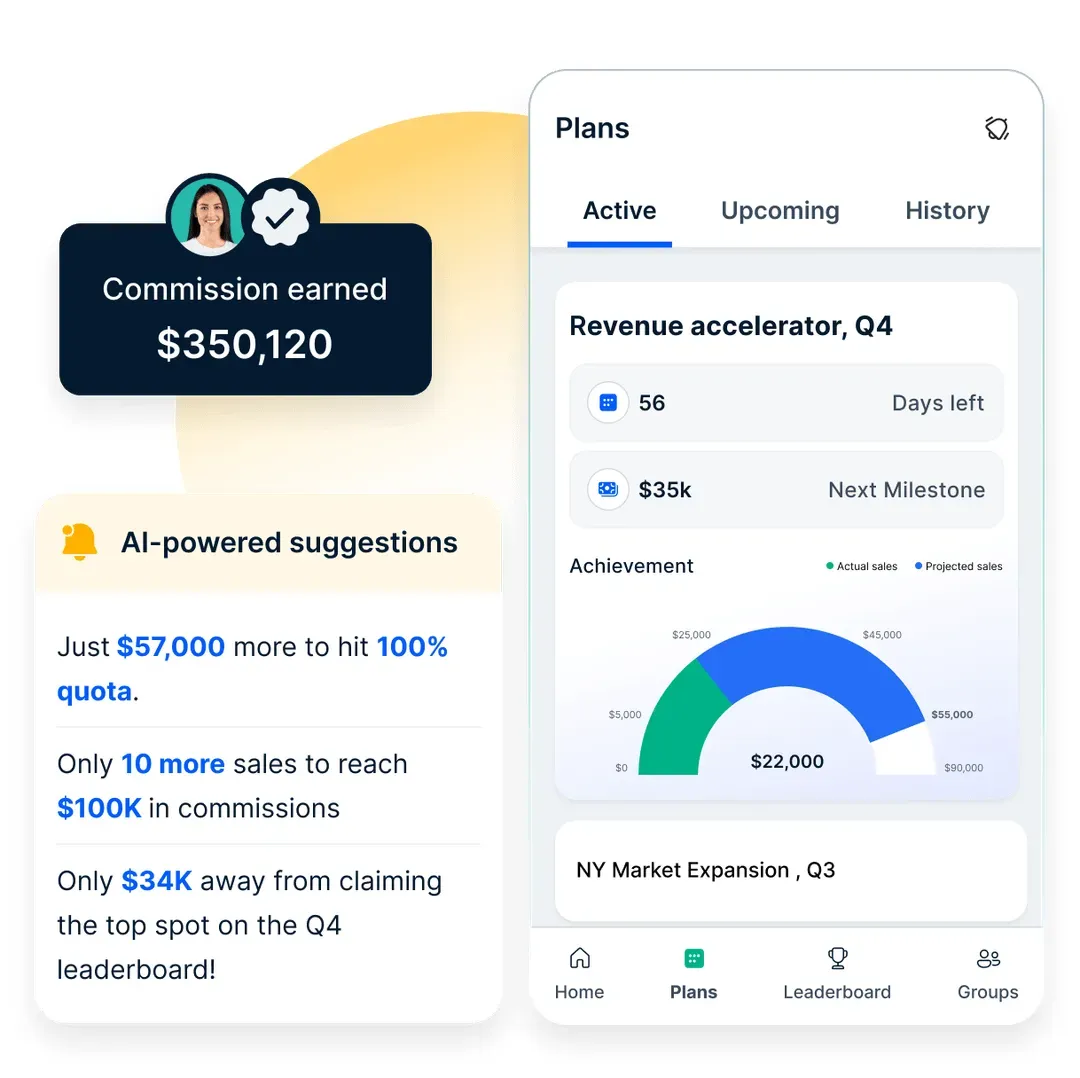

- Set clear sales goals, drive engagement through gamification, and analyze team performance.

- Compare individual sales data, track commission trends, and ensure quota attainment.

Simplify sales commission management with Compass

The best commission management systems come equipped with powerful features that optimize the commission process:

Automated commission calculation: Instantly compute commissions based on sales performance and predefined commission plans.

Real-time commission tracking: Provide detailed reports and personalized dashboards to monitor payouts.

Flexible payment scheduling: Set commission payment frequencies—weekly, monthly, or upon goal completion.

Customizable incentives: Configure incentive structures that align with business objectives.

Seamless integrations: Sync with CRM, ERP, and other systems to streamline commission payouts and ensure accurate sales tracking.

By leveraging a robust commissions management system like Compass, businesses can reduce errors, enhance transparency, and motivate sales teams to perform at their best. Schedule a call now!

Various stakeholders involved in sales commission management and their roles

Here’s a structured table summarizing the various stakeholders involved in sales commission management along with their respective roles:

Use sales commission management software to streamline your sales commissions

Sales commission management software is a tool that automates calculating and tracking commissions for a sales team. The benefits include:

- Streamlining the commission calculation

- Tracking real-time performance

- Providing visibility into the sales pipeline and commission payout schedule

This technology automates and simplifies the management of complex commission structures end-to-end. Not only does it save time and resources, but it also helps disburse accurate and timely commission payments.

Furthermore, the software's ability to provide actionable insights into performance and earnings can drive sales predictability and growth. As the demand for such software continues to rise, the market is projected to experience significant growth, reaching a value of US $6.4 Billion by 2032. The benefits of using commission management software are:

- Streamlined commission calculation: Automates calculating commissions, reducing the risk of manual errors.

- Improved commission tracking: Provides a central repository for commission data, making it easier for salespeople and managers to track and access commission information.

- Simplified reporting: Generates reports that provide sales leaders with insights into commission performance and trends, making it easier to make informed decisions.

- Enhanced visibility: Provides salespeople and managers with real-time visibility into commission performance, allowing them to track their progress and identify areas for improvement.

- Improved accuracy: Improves commission data accuracy by eliminating manual errors and ensuring up-to-date and consistent data

- Integration with other systems: Integrates with other systems, such as CRM and accounting software, to streamline commission management.

- Ensuring compliance: Ensures compliance with relevant regulations by tracking and reporting on commissions to meet security and compliance requirements.

To effectively launch and scale the program nationwide, eKart partnered with Compass. Through automation and digitization of incentives for DEs, eKart saw a significant improvement in delivery efficiency by 79% and a reduction in attrition rate by 48%.

Final thoughts

Effective commission management is vital for the growth of any sales organization. By designing a commission structure that aligns with the company's objectives and the sales team's needs, businesses can motivate and incentivize their sales team the right way, resulting in improved productivity and performance.

However, commission management can be a complex and labor-intensive task. Companies need to have the appropriate tools and strategies to simplify the process. Compass is a valuable tool that can streamline your commission management, reducing processing time by 100% and boosting sales productivity by 80%.

FAQ's

What is the meaning of commission management?

Commission management involves strategically handling commission-related tasks, primarily focusing on the calculation, tracking, and payment of commissions to sales representatives or rep agencies. Effective commission management ensures sales representatives are fairly and promptly compensated for their efforts, which motivates them to drive sales and revenue. In the insurance industry, commission management includes administering and overseeing the calculation, tracking, and disbursement of commissions paid to insurance agents and brokers.

How do you manage commissions?

Managing commissions includes organizing, calculating, and paying out commissions to sales representatives based on implemented incentive and commission plans. Utilizing commission management software can streamline operations, foster transparency, and supercharge partnerships with rep agencies. This software automates the import of data, enabling easy and precise calculation of commissions, reducing the risk of errors that can occur with manual calculations. A commission management solution can also track sales activity automatically to ensure that commissions are calculated correctly and that sales reps are compensated fairly.

How do you solve commission problems?

Commission management software addresses the challenges associated with manual commission calculations, which are time-consuming and prone to errors. By automating these processes, the software saves time and reduces the potential for disputes over commissions, fostering a better working relationship between companies and their sales force. Features like a centralized deal repository, accurate calculations, and a progress tracker can help solve commission problems by ensuring transparency and accuracy.

Who manages sales commissions?

Skilled administrators often perform the challenging job of commission management. Sales leaders, the finance department, and the operations team are also stakeholders in sales commission management [they help to set commission rates and goals, track commission payments, and track and record sales activity, respectively.

What is the commission manager system?

A sales commission management system is software that helps companies track and manage total sales and employee commissions. It increases sales efficiency through custom reports and sales tracking. The best systems have features like commission calculation, commission tracking, commission scheduling, incentives, and integration with existing systems