Un guide étape par étape pour créer le bon accord de commission sur les ventes

Un accord de commission sur les ventes est un document formel essentiel pour les employés travaillant en tant qu'agents ou représentants commerciaux.

Sur cette page

Imaginez que Sarah, une professionnelle de la vente très performante, vienne de conclure une affaire importante. Cependant, en l'absence d'un accord de commission bien défini, des désaccords apparaissent concernant sa rémunération. De telles incertitudes peuvent conduire à l'insatisfaction, à la baisse du moral et même à la rotation du personnel. C'est pourquoi il est essentiel de disposer d'un accord de commission de vente clair.

Un accord de commission sur les ventes bien structuré garantit que l'entreprise et son équipe de vente sont en phase sur les conditions de rémunération. Il définit les attentes, les objectifs de performance et le versement des commissions, créant ainsi une transparence qui renforce la confiance et maintient la motivation des commerciaux.

Pour les entreprises qui s'appuient sur des équipes de vente solides, disposer d'un modèle d'accord de commission transparent est plus qu'une simple formalité - c'est une nécessité pour la fidélisation et la réussite à long terme. C'est pourquoi ce blog présente les grandes lignes de l'accord sur les commissions de vente, afin de vous permettre de vous préparer à ce qui doit être ajouté.

Qu'est-ce qu'un accord de commission sur les ventes ?

Les commissions de ventedésignent les paiements effectués aux agents de vente en guise de compensation pour avoir réalisé des ventes spécifiques ou atteint des objectifs de vente prédéterminés. En règle générale, ces commissions sont calculées en pourcentage de la valeur totale de la vente. Par exemple, un vendeur de voitures peut percevoir 20 % du prix final du véhicule. Si certains agents commerciaux ne perçoivent que des commissions, d'autres reçoivent une combinaison de commissions et de salaires horaires.

Un accord de commission sur les ventes est un document formel essentiel pour les employés travaillant en tant qu'agents ou représentants commerciaux. Il décrit les conditions relatives à la rémunération à la commission perçue par les représentants commerciaux. Ces accords sont généralement intégrés dans le contrat de travail global et peuvent couvrir les points suivants

- Les deux parties impliquées dans le contrat. Leurs coordonnées et autres éléments d'identification.

- Le montant du pourcentage qu'ils recevront après avoir conclu chaque vente.

- Quotas mensuels ou hebdomadaires qu'un représentant commercial doit atteindre en termes de volume de ventes.

- Le salaire horaire que le vendeur pourrait percevoir.

Quels sont les différents types d'accords de commission ?

Les accords de commission se présentent sous différentes formes, chacune étant adaptée aux différents accords de vente :

- Accords de commissionnement des employés : Ils s'appliquent aux salariés qui reçoivent des commissions en plus de leur salaire de base. Un accord de commission sur les ventes bien défini garantit la transparence des revenus et permet aux équipes de vente de rester motivées pour atteindre leurs objectifs.

- Accords de commissions pour entrepreneurs indépendants : Conçu pour les entrepreneurs dont le revenu dépend uniquement des commissions. Un modèle d'accord de commission structuré permet d'établir des conditions claires, en veillant à ce que les deux parties comprennent la structure de paiement et les attentes.

- Accords de commissions ponctuelles ou récurrentes : Un accord de commission unique s'applique lorsque les commissions sont payées par vente, tandis qu'un modèle d'accord de commission sur les ventes récurrentes est idéal pour les entreprises qui offrent des incitations permanentes pour les ventes répétées ou les modèles basés sur l'abonnement.

Le montant de lastructure des commissions de venteest généralement déterminé par voie de négociation avant qu'un poste de vendeur ne soit pourvu. Ces conditions sont ensuite formalisées dans un accord de commission de vente. Le montant de la commission spécifiée et l'accord lui-même peuvent généralement être ajustés au fur et à mesure que le salarié acquiert de l'expérience dans le domaine de la vente. Par conséquent, les aspects suivants peuvent avoir un impact sur les termes de l'accord :

- Normes industrielles.

- Les dossiers de vente du représentant commercial.

- Le volume des ventes du représentant pendant toute la durée de son emploi.

- Les facteurs géographiques, tels que le coût de la vie dans un État ou une ville en particulier.

Maintenant que nous avons discuté des éléments qui influencent votre commission de vente, passons en revue les détails de base de l'accord.

Les bases d'un accord de commission sur les ventes

Les bases de l'accord de vente et de commission qu'il faut connaître pour comprendre l'accord sont les suivantes :

Parties concernées

- Vendeur/agent : personne chargée de stimuler les ventes et de percevoir des commissions en fonction de ses performances.

- Entreprise/employeur : l'organisation qui engage le vendeur et s'engage à verser des commissions selon les termes convenus.

Structure de la commission et rémunération

- Taux de commission : définit le mode de calcul des revenus, qu'il s'agisse d'un montant fixe, d'un modèle à plusieurs niveaux ou d'un pourcentage du chiffre d'affaires. Un modèle de structure de commissions de vente bien défini permet d'établir des attentes transparentes.

- Conditions de paiement : spécifie le moment où les commissions sont traitées, que ce soit mensuellement, trimestriellement ou à la conclusion de l'affaire. Ces détails doivent être alignés sur le modèle d'accord de commission de vente afin d'éviter toute confusion.

Objectifs de vente et attentes en matière de performance

- Définir des objectifs clairs : fixer des objectifs de vente réalisables qui s'alignent sur les objectifs de l'entreprise et incitent à de bonnes performances.

- Impact des objectifs non atteints : décrit les conséquences potentielles si les objectifs ne sont pas atteints, telles qu'une réduction des taux de commission ou des évaluations supplémentaires des performances.

Durée et conditions de l'accord

- Dates de début et de fin : spécifie la date d'entrée en vigueur de l'accord de commission et sa période de validité.

- Conditions de renouvellement et de résiliation : elles précisent les circonstances dans lesquelles l'accord peut être prolongé ou résilié, afin de garantir la clarté pour les deux parties.

Clauses de confidentialité et de non-concurrence

- Sauvegarde des intérêts de l'entreprise : comprend des clauses visant à protéger les données confidentielles de l'entreprise, les secrets commerciaux et les informations stratégiques.

- Limitation de la collaboration avec les concurrents : il peut s'agir de restrictions empêchant le vendeur de rejoindre un concurrent pendant une période déterminée.

Résolution des conflits et considérations juridiques

- Méthodes de résolution des conflits : précise si la médiation, l'arbitrage ou d'autres méthodes seront utilisées pour résoudre les conflits liés aux commissions.

- Juridiction et droit applicable : identifie le cadre juridique dans lequel l'accord de commission de vente sera appliqué. Cela permet de s'assurer que toutes les parties comprennent leurs droits et obligations.

En utilisant un modèle d'accord de commission bien structuré, les entreprises peuvent créer un système équitable et transparent qui profite à la fois à l'entreprise et à sa force de vente.

Il faut connaître ces aspects de l'accord pour résoudre intelligemment un litige. Prenons l'exemple de Wells Fargo.

Depuis 2002, les dirigeants de la banque sont au courant des ouvertures frauduleuses de comptes pour atteindre les objectifs de vente. Malgré ces faits répétés, l'organisme de réglementation compétent n'a pas réagi publiquement ni pris de mesures à l'encontre de Wells Fargo jusqu'en 2017.

Bien que les employés aient créé plus dedeux millions decomptes frauduleux, Wells Fargo n'a pas imposé, dans un premier temps, de récupération, comme le prévoyait son accord sur les commissions de vente. Au lieu de cela, la société a licencié5 300 employéset a payé d'importantes amendes gouvernementales.

Toutefois, en septembre 2016, le PDG de Wells Fargo, John Stumpf, a fait l'objet d'un examen minutieux lors d'une audition de la commission bancaire du Sénat. Peu de temps après, l'entreprise a adopté sa disposition contractuelle de récupération, invoquant une atteinte à sa réputation.

En conséquence, Stumpf et Carrie Tolstedt, responsable de la division Community Bank, ont renoncé à d'importants bonus et primes en actions. Wells Fargo a finalement récupéré plus de 180 millions de dollarsauprès des dirigeants, car leur contrat de commission de vente stipulait que la société pouvait récupérer la rémunération si certaines conditions étaient remplies, telles que des activités frauduleuses, une mauvaise conduite ou des déclarations inexactes importantes.

Wells Fargo s'est appuyée sur les accords de vente et de commission pour lancer la procédure de récupération. Elle a fait valoir que les activités frauduleuses des employés violaient les conditions de leur emploi et compromettaient l'intégrité du processus de vente.

Cela souligne l'importance de créer un accord de commission de vente complet

En raison du scandale de Wells Fargo, nous savons également quels sont les pièges à éviter.

Évitez ces erreurs courantes dans un accord de commission sur les ventes

Un accord de commission sur les ventes bien structuré est la clé d'une équipe de vente motivée. Toutefois, certains écueils peuvent être source de confusion et de litiges.

- Termes imprécis - Un modèle d'accord de commission de vente imprécis peut entraîner des malentendus sur les paiements, les quotas et les calendriers de paiement. Des termes clairs permettent d'éviter les litiges et d'instaurer la confiance.

- Objectifs irréalistes - Un modèle de structure de commissions doit fixer des objectifs réalisables afin de motiver les équipes de vente plutôt que de les décourager.

- Absence de résolution des conflits - Un accord de commission de vente solide doit prévoir des méthodes de résolution des conflits afin d'éviter que les désaccords ne s'aggravent.

- Clauses de non-concurrence restrictives - Un accord de commission trop strict peut faire fuir les meilleurs talents commerciaux. Une approche équilibrée protège l'entreprise tout en maintenant l'engagement des employés.

Un modèle de structure de commissions de vente bien conçu garantit l'équité, la transparence et la réussite à long terme. L'affaire Wells Fargo est une mise en garde contre les pièges potentiels d'accords de vente et de commission mal conçus. Il est donc préférable de se référer à un modèle d'accord de commission de vente bien conçu.

Meilleures pratiques en matière d'accords de commission sur les ventes

L'étude de cas de l'accord de commissionnement des ventes de Wells Fargo et les conséquences qui en ont découlé offrent plusieurs bonnes pratiques pour la conception et la gestion des plans de rémunération des ventes.

- Maintenir la transparence :Indiquez clairement le taux de commission, la méthode de calcul et le calendrier de paiement. Indiquez les objectifs de vente, les quotas et les critères de performance qui déterminent l'éligibilité aux commissions. Incluez également des dispositions relatives aux retours de produits, aux remises, aux rétrocessions et à d'autres facteurs pertinents susceptibles d'avoir une incidence sur les commissions.

- Proposer une structure de rémunération équilibrée :Les plans de rémunération des vendeurs doivent établir un équilibre entre le salaire de base et la rémunération variable. La structure de rémunération agressive de Wells Fargo, qui privilégiait la rémunération variable, a contribué à créer un environnement sous haute pression qui incitait à des comportements contraires à l'éthique. Un équilibre raisonnable peut contribuer à maintenir la motivation sans encourager le désespoir chez les employés, ce qui peut conduire à des comportements répréhensibles.

- Maintenir l'équité et la motivation :Veillez à ce que le plan de commission encourage les comportements qui contribuent aux objectifs généraux de l'entreprise. Fixez des objectifs de vente qui motivent les vendeurs sans être irréalistes ou décourageants. Proposez des programmes de rémunération qui attirent et retiennent les meilleurs vendeurs.

- Une gouvernance et une surveillance solides: Des structures de gouvernance efficaces sont essentielles pour contrôler le respect des normes éthiques. Le fait que Wells Fargo n'ait pas réagi aux activités frauduleuses de ses employés pendant de nombreuses années souligne la nécessité de mettre en place des mécanismes de contrôle solides. Les organisations doivent mettre en œuvre des audits réguliers et définir clairement les responsabilités en matière de pratiques de vente afin d'atténuer les risques liés à un comportement contraire à l'éthique.

- Envisager un audit du plan de commission: Effectuez des examens réguliers afin d'identifier les divergences potentielles ou les domaines susceptibles d'être améliorés. Utilisez également un logiciel de commissionnement. Vous pouvez utiliser des outils spécialisés pour rationaliser les calculs, suivre les performances et améliorer l'efficacité.

Comment rédiger un modèle d'accord de commission sur les ventes avec exemple ?

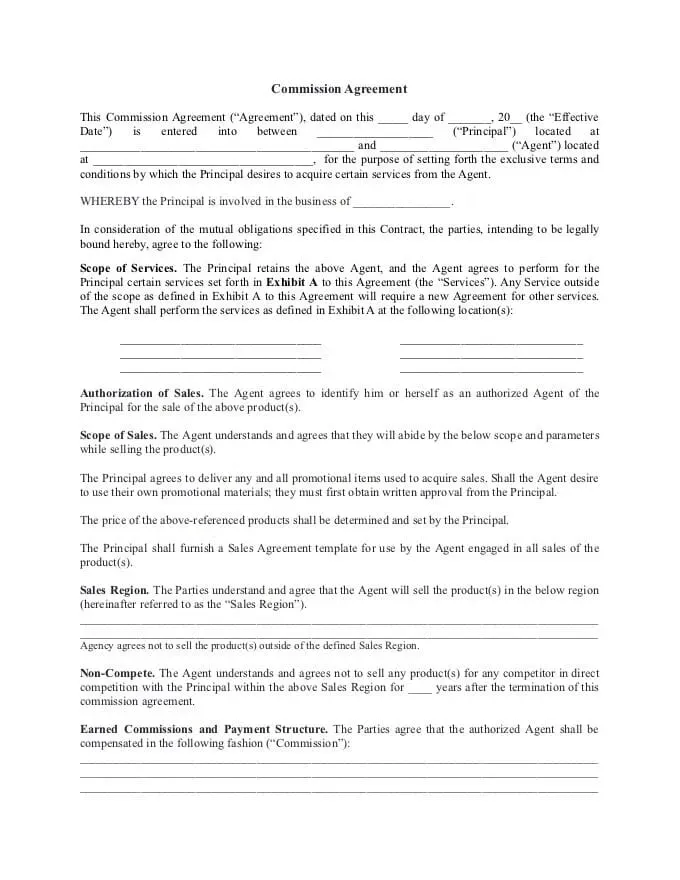

L'accord commence par décrire les détails concernant les deux parties. Il comprendra les informations sur les parties, la date et les détails sur les entreprises de la manière suivante. Tous les accords de commission sur les ventes comportent les éléments suivants :

Utiliser un modèle d'accord de commission de vente

Un modèle d'accord de commission de vente bien structuré constitue un point de départ fiable pour la rédaction d'un contrat clair et applicable. En utilisant un modèle d'accord de commission, vous pouvez vous assurer que tous les détails essentiels - tels que les taux de commission, les modalités de paiement et les responsabilités - sont inclus sans omettre d'éléments cruciaux. Ces modèles peuvent être personnalisés pour s'aligner sur votre modèle spécifique de rémunération des ventes.

Définir le type de travailleur et la structure des commissions

L'approche de la structuration d'un accord de commission sur les ventes dépend du fait que le bénéficiaire est un salarié, un entrepreneur indépendant ou un vendeur rémunéré à la commission. La structure des commissions de vente doit indiquer comment les commissions sont déterminées en fonction du rôle du travailleur. Les structures les plus courantes sont les suivantes

- Salaire de base plus commissions: Les employés reçoivent un salaire garanti ainsi que des revenus supplémentaires basés sur des commissions.

- Commission directe: La rémunération est uniquement basée sur les performances de vente, avec souvent des pourcentages de commission plus élevés.

- Commission sur la marge brute: La commission est calculée après déduction des coûts liés à la vente, ce qui garantit que le vendeur bénéficie de transactions rentables.

Une fois que vous avez choisi le meilleur modèle de structure de commissions pour votre équipe, veillez à ce que l'accord détaille explicitement comment les commissions sont perçues et dans quelles conditions. La transparence réduit les risques de litiges et clarifie les attentes.

Liste des activités pouvant faire l'objet d'une commission

Un modèle de structure de commissions de vente doit préciser quelles activités donnent droit au versement de commissions. Certains contrats limitent les commissions aux affaires conclues, tandis que d'autres les étendent à la génération de prospects ou aux renouvellements de contrats. Une répartition claire des activités donnant droit à une commission permet d'éviter les malentendus.

Fixer le taux de commission

Après avoir défini l'éligibilité à la commission, déterminez le taux de l'accord de commission applicable. Qu'il s'agisse d'un pourcentage fixe ou d'un système à plusieurs niveaux, l'accord doit décrire la formule exacte utilisée pour calculer les commissions. Un exemple concret peut améliorer la clarté de l'accord.

Décrire les primes et les incitations

De nombreux accords sur les commissions de vente prévoient des incitations supplémentaires en plus des commissions habituelles. Les primes peuvent être basées sur la réalisation d'objectifs de vente, le maintien de comptes clients ou l'obtention de contrats de grande valeur. Si votre entreprise offre de tels avantages, veillez à ce qu'ils soient bien documentés dans l'accord de commission afin de motiver votre équipe de vente.

Traiter les commissions de cessation d'emploi et les commissions postérieures à l'emploi

Précisez ce qu'il advient des commissions en cours si un vendeur quitte l'entreprise. Recevra-t-il encore des paiements pour des ventes antérieures ? Votre accord sur les commissions de vente doit définir les politiques en matière de commissions postérieures à l'emploi afin d'éviter les conflits et de garantir une transition équitable.

Envisager une clause de confidentialité

Si votre processus de vente implique des données sensibles sur les clients ou l'entreprise, incluez une clause de confidentialité dans le modèle d'accord de commission. Cette clause protège les informations exclusives et empêche les anciens vendeurs d'utiliser des informations privilégiées au profit de leurs concurrents.

En utilisant un accord de commission de vente structuré et un modèle de structure de commission de vente, les entreprises peuvent créer des plans de rémunération transparents, équitables et motivants pour leurs équipes de vente.

Conclusion

Les accords de commission sur les ventes sont essentiels pour définir les conditions de rémunération entre une entreprise et ses représentants commerciaux. Ces accords définissent la structure des commissions, les modalités de paiement et la nature de la relation de travail, protégeant ainsi les deux parties contre les malentendus et les problèmes juridiques potentiels.

En outre, des structures de commissions clairement définies peuvent motiver les représentants commerciaux à atteindre leurs objectifs, car ils comprennent comment leurs efforts se traduisent en revenus. Pour rationaliser le processus de commissionnement, faites confiance àCompass. Il s'agit d'une plateforme conçue pour rationaliser la gestion des accords de commissions sur les ventes et les processus connexes. Compass peut :

- Automatiser le calcul des commissions sur la base de critères prédéfinis ;

- Suivre les performances et les commissions en temps réel pour favoriser la transparence du processus de rémunération ;

- être intégré aux systèmes de gestion de la relation client (CRM) existants.

Compass facilite la gestion des données de vente et le calcul des commissions en un seul endroit.Planifiez un appelavec nos experts pour découvrir comment Compass peut être la solution à votre désorientation en matière de calcul et de gestion des commissions dans l'accord.

FAQ

Quel est un exemple de politique de commission sur les ventes ?

Un exemple de politique de commissionnement des ventes pourrait être une structure de commissionnement à plusieurs niveaux dans laquelle les représentants gagneraient 10 % sur les ventes jusqu'à 100 000 $ et 15 % sur tout montant supérieur. Ce système encourage les performances commerciales en récompensant les représentants qui dépassent des seuils de revenus spécifiques.

À quoi ressemble un accord de commission ?

Un accord de commission consiste généralement en un document formel qui précise le taux de commission, les objectifs de vente, la fréquence des paiements et toute autre condition pertinente. Il peut également contenir des dispositions relatives aux litiges et aux responsabilités des deux parties.

Quel est le contrat type de commission de vente ?

Un contrat type de commission de vente décrit les conditions dans lesquelles les représentants commerciaux perçoivent des commissions. Il comprend des détails tels que les taux de commission, les conditions de paiement, les activités qualifiantes pour la commission et les conditions de retenue ou de remboursement des paiements.

Comment rédiger un accord de commission de vente ?

Pour rédiger un accord de commission sur les ventes, il convient d'inclure des sections sur les parties concernées, la structure de la commission (par exemple, pourcentage des ventes, taux progressifs), le calendrier des paiements et les clauses de résiliation. Il est essentiel de définir clairement ce qui constitue une vente et toute condition susceptible d'affecter le paiement des commissions.