8 étapes pour calculer la commission de vente avec la structure de la commission, les formules et les exemples

Vous est-il déjà arrivé de soumettre des revenus incorrects pour vos commissions de vente et de subir une perte ? Ou bien vous avez vu quelqu'un le faire et vous craignez de le faire à votre tour ? Dans ce cas, consultez cette formule simple de calcul du pourcentage de la commission de vente et soumettez toujours des chiffres corrects.

Sur cette page

Une étude indique que les entreprises risquent de perdre jusqu'à30 % deleurs opportunités de vente au profit de leurs concurrents. Elle souligne l'importance de l'évaluation du processus de vente et des paramètres. Grâce à des outils appropriés, une entreprise peut augmenter de 20 % la réalisation de ses quotas de vente et mettre en place un processus de vente rationalisé et précis.

Un tel événement a été démontré par l'un des principaux fabricants de machines à commande numérique. l'un des principaux fabricants de CNC qui a facilement modifié la trajectoire de ses ventes et s'est rapidement développé. Avec une équipe nombreuse répartie sur plus de 32 sites de vente et de service dans le monde, cette entreprise a dû relever le défi de l'automatisation des commissions.

Leurs principaux objectifs étaient de permettre à leurs représentants commerciaux d'accéder facilement aux données relatives à leurs primes, de réduire considérablement le temps passé à calculer les commissions et d'éliminer la charge de travail manuelle précédemment gérée par le directeur des ventes.

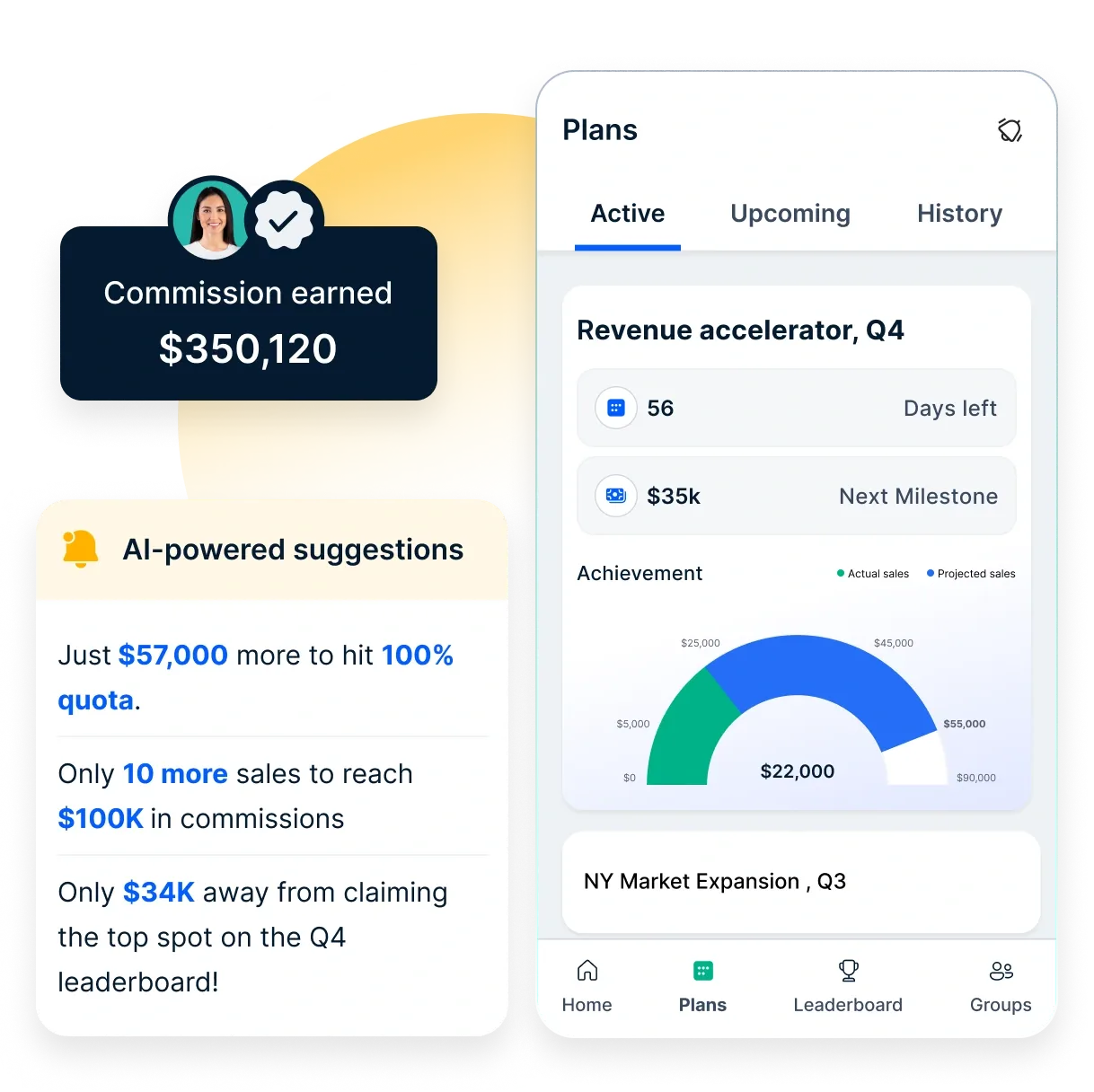

Ils ont intégréCompassun logiciel de gestion des commissions de vente. Compass offre des fonctionnalités telles que des flux de travail de programme, des moteurs de règles automatisés, des processus d'approbation, des tableaux de bord et une application mobile pour le suivi des performances en temps réel. L'organisation a obtenu une visibilité en temps réel sur le calcul des primes.

Il a également garanti l'exactitude des paiements, supprimé la dépendance de l'équipe de gestion des ventes à l'égard du traitement manuel du processus de commission, et s'est appuyé sur le calcul des commissions de vente pour automatiser la procédure de bout en bout.

En conséquence, la réalisation des quotas a augmenté de 20 % en moins de 90 jours, la participation au programme a augmenté de 22 % et l'adoption de la plateforme a atteint 73 %.

Une rémunération équitable étant essentielle pour motiver les vendeurs, un calculateur de commissions de vente devient un outil important. C'est pourquoi ce blog explore les aspects importants des calculateurs de commissions de vente afin de vous aider à comprendre leur utilité.

Qu'est-ce qu'un calculateur de commissions de vente ?

Un calculateur de commissions de vente est un outil qui permet de calculer la somme d'argent qu'un vendeur gagne en fonction de ses performances de vente. Il s'agit généralement d'entrer le montant des ventes et le taux de commission, et le calculateur fournit la commission gagnée. Un calculateur de commissions de vente peut aider une organisation à maintenir.. :

- Précision. Un calculateur de commissions SaaS garantit le calcul correct des commissions afin d'éviter les erreurs manuelles.

- Efficacité, car il permet de gagner du temps en automatisant les calculs. Il permet ainsi aux vendeurs de se concentrer sur la vente.

- Transparence, car un tel outil fournit des informations claires et immédiates sur les revenus potentiels.

Passons en revue une étude statistique sur les techniques de vente pour comprendre comment un tel outil, ajouté à la pile technologique, peut influencer les résultats de l'entreprise.

- Selon une étude deMcKinsey80 % des directeurs commerciaux estiment qu'il est essentiel de disposer d'une technologie de vente efficace pour atteindre les objectifs de chiffre d'affaires.

- La même étude révèle que 80 % des chefs de vente estiment que les compétences analytiques et quantitatives sont parmi les plus importantes.

- Une autre étude de McKinsey a révélé que les acteurs B2B qui emploient des équipes de vente omnicanales, des technologies de vente avancées, l'automatisation et l'analyse de données enregistrent10%de part de marché.

- La même étude suggère que plus de 30 % des tâches et des processus du cycle de vente peuvent être automatisés dans une certaine mesure. Il s'agit d'activités allant du calcul des commissions de vente, de la planification et de la gestion des prospects à la génération de devis.

- L'étude révèle également que l'automatisation permet d'augmenter le chiffre d'affaires et de réduire le coût du service jusqu'à 20 % chacun, tout en favorisant la satisfaction des clients et des employés.

Si de nombreuses tâches commerciales peuvent être automatisées, tous les efforts ne sont pas aussi fructueux. Les entreprises les plus performantes se concentrent sur l'automatisation de domaines spécifiques tels que la gestion des prospects, la rédaction des contrats, la génération de primes à l'aide d'un calculateur de commissions de vente et la planification des commissions de vente.

Les technologies avancées permettent d'automatiser de nombreuses tâches commerciales chronophages et de libérer les vendeurs pour qu'ils se consacrent à des activités plus utiles. Cela peut se traduire par une augmentation des recettes, une réduction des coûts et une plus grande satisfaction des clients et des employés.

Facteurs essentiels pour le calcul de la commission de vente

Le calcul des commissions de venteest essentiel pour de nombreuses entreprises, en particulier celles qui s'appuient sur une équipe de vente pour générer des revenus. Compte tenu de l'importance du processus, il est nécessaire de comprendre que plusieurs facteurs essentiels doivent être pris en compte pour déterminer le montant de la commission à verser à un vendeur.

Avant de vous expliquercomment calculer la commission de vente, il convient donc de vous familiariser avec les facteurs essentiels qui influencent le calcul de votre commission de vente.

1. Base de la Commission

La base de la commission est le revenu ou le bénéfice sur lequel la commission d'un vendeur est basée. Il peut s'agir du chiffre d'affaires total, de la marge bénéficiaire sur les ventes ou d'une autre mesure reflétant la contribution du vendeur au résultat net de l'entreprise.

2. Taux de commission

Le taux de commission est le pourcentage de la base de commission qu'un vendeur recevra sous forme de commission. Par exemple, si la base de la commission est de 100 000 $ et que le taux de commission est de 10 %, le vendeur recevra une commission de 10 000 $.

3. Période de la Commission

La période de commission est la période sur laquelle la commission est calculée. Il peut s'agir d'une semaine, d'un mois, d'un trimestre ou d'une autre période adaptée à l'entreprise et au cycle de vente.

4. Niveau de la Commission

Un niveau de commission est une structure qui fixe différents taux de commission en fonction des différents niveaux de performance. Par exemple, un représentant commercial peut recevoir un taux de commission de 10 % sur les premiers 50 000 $ de ventes, de 12 % sur les 50 000 $ suivants et de 15 % sur toutes les ventes supérieures à 100 000 $.

Dans ce cas, il est essentiel d'appliquer le niveau de commission approprié pour que le représentant commercial soit rémunéré en fonction de ses performances.

5. Passer outre

Un override est une commission supplémentaire versée à un vendeur qui gère une équipe d'autres vendeurs. L'override est calculé en pourcentage de la commission gagnée par les vendeurs de l'équipe.

6. Fente

Le partage est utilisé lorsque deux vendeurs ou plus travaillent ensemble sur une vente. Dans ce cas, la commission est partagée entre les vendeurs sur la base d'une formule convenue. Par exemple, la commission peut être partagée à 50/50 entre deux vendeurs qui ont travaillé ensemble sur une vente.

Il est important de tenir compte de ces facteurs lors du calcul des commissions de vente, car ils peuvent avoir un impact significatif sur la commission que reçoit un vendeur. En tenant compte de ces facteurs et en créant une structure de commissions équitable et transparente, les entreprises peuvent motiver leur équipe de vente à atteindre leurs objectifs et à stimuler la croissance de leur chiffre d'affaires.

Comment calculer la commission de vente en 8 étapes simples ?

Le calcul des commissions de vente comporte plusieurs étapes afin de s'assurer que les représentants commerciaux sont rémunérés de manière équitable pour leur travail. Bien qu'il existe en 2023 des technologies qui vous permettent d'automatiser vos commissions.d'automatiser le calculvous permettent d'automatiser le calcul de vos commissions, il se peut que vous souhaitiez le faire manuellement.

Voici donc une explication détaillée des étapes du calcul de la commission de vente si vous souhaitez procéder à un calcul manuel :

Étape 1 : Déterminer la période de commission

La première étape consiste à déterminer la période de commission, c'est-à-dire la période sur laquelle la commission sera calculée. Il peut s'agir d'une période hebdomadaire, mensuelle, trimestrielle ou annuelle. Choisissez donc la période pour laquelle vous souhaitez obtenir des commissions et arrondissez les ventes que vous avez réalisées au cours de cette période.

Étape 2 : Identifier la base des commissions

Identifiez et gardez à portée de main la base de la commission pour chaque opération de vente pour laquelle vous demandez une commission. Comme le montant de base peut être différent pour chaque vente que vous avez réussi à générer, il est essentiel d'en garder une trace stricte pour faciliter le calcul par la suite.

Étape 3 : Multiplier le taux de commission par la base de commission

Maintenant que la base de la commission est prête, multipliez-la par le taux de commission pour obtenir le montant de base de la commission qui vous est due.

Mais n'oubliez pas qu'il ne s'agit pas de la valeur finale car il peut y avoir des ajouts ou même des déductions sur cette valeur de base de la commission en fonction des termes de votre contrat.

Étape 4 : Envisager différents taux de commission

Modifiez la valeur de vos taux de commission dans les cas où votre taux est différent de votre taux habituel.

Par exemple, si votre taux de commission pour une entreprise ou une transaction est de 10 % et de 12 % pour une autre entreprise/transaction, multipliez la base de commission pour cette entreprise/transaction particulière par le taux de commission respectif pour un calcul précis.

Étape 5 : Appliquer le niveau de commission (le cas échéant)

Outre les différents taux de commission auxquels vous devez être attentif, vous devez également repérer les entreprises/transactions dont les taux sont échelonnés. Étant donné que la plupart des transactions de vente ne sont pas soumises à des taux différenciés, il est facile d'en oublier une, auquel cas vous recevrez une rémunération bien inférieure à celle qui vous est due.

Il est donc préférable de conserver une liste séparée des entreprises offrant des commissions échelonnées, ainsi que les échelons, afin de faciliter le calcul à la fin de la période de commission.

Étape 6 : Calculer la commission de dérogation

Réclamez la commission à laquelle vous avez droit pour les ventes conclues avec succès par les représentants que vous gérez. Multipliez le taux de commission par la commission totale.que les membres de votre équipeet ajoutez la valeur obtenue au calcul de votre commission.

Étape 7 : Déduire les éventuels retours

Notez la valeur de la commission que vous avez reçue jusqu'à la dernière étape et déduisez tout revenu provenant de ventes que le client a annulées ou retournées.

Même si vous avez conclu l'affaire dans un premier temps, de telles transactions sont considérées comme nulles si votre entreprise doit finalement restituer l'argent ou si elle ne l'a pas reçu en premier lieu parce que le client a annulé la vente.

Étape 8 : Partage de la commission (le cas échéant)

Déduisez de la valeur de la commission à laquelle vous êtes parvenu la part de vos collègues représentants si vous avez participé à la conclusion d'une vente avec eux.

En suivant ces étapes, le calcul de la commission finale de toutes vos ventes peut être déterminé comme suit :

A =Base de commission pour la période de commission déterminée x Taux de commission respectifs pour les différentes transactions

B =A + Valeur de la commission selon les différents niveaux

C =B + Part de la commission gagnée par les membres de l'équipe

D =C - Valeur de la commission de vente pour les opérations de vente retournées ou appelées

E =D - Part des ventes des collègues en cas de commissions fractionnées

Pour calculer le pourcentage de commission de vente, prenez la valeur de "E" dans la formule ci-dessus et divisez-la par "100".

8 Structures de commissions de vente et comment les calculer à l'aide d'une formule

Les plans de commissionnement des ventes ne sont pas uniformes. La structure idéale dépend des objectifs, du cycle de vente et du modèle de revenu de votre entreprise.

Un plan bien conçu peut stimuler la motivation et les performances tout en garantissant une rémunération équitable. Vous trouverez ci-dessous huit structures de commissions courantes, ainsi que des formules de calcul de la rémunération.

1. Salaire de base + commission

Ce modèle combine un salaire fixe et une commission basée sur les performances de vente, offrant une stabilité financière et des incitations à la croissance. La formule de commission est la suivante :

Exemple : Un représentant commercial perçoit un salaire de base de 45 000 dollars, auquel s'ajoute une commission de 12 %. S'il réalise un chiffre d'affaires de 120 000 dollars, sa rémunération totale sera de 45 000 dollars + (120 000 dollars x 0,12) = 59 400 dollars.

Idéal pour : Les entreprises dont les cycles de vente sont imprévisibles

Avantages : Encourage la régularité des performances tout en réduisant le risque financier pour les représentants.

Inconvénients : coûts fixes plus élevés pour les employeurs ; risque de réduire l'urgence de maximiser les ventes.

2. Commission basée sur les quotas

Ce plan ne récompense les représentants par des commissions que lorsqu'ils dépassent un quota de vente fixé, ce qui en fait une stratégie efficace pour encourager les performances.

Exemple : Un représentant a un salaire de base de 3 500 $ et touche une commission de 18 % sur les ventes dépassant un quota de 12 000 $. S'il réalise un chiffre d'affaires de 15 000 dollars, sa rémunération sera de 3 500 dollars + (3 000 dollars x 0,18) = 4 040 dollars.

Idéal pour : Les équipes de vente expérimentées avec des objectifs agressifs

Avantages : Motive les représentants à dépasser leurs objectifs, ce qui augmente le chiffre d'affaires.

Inconvénients : peut décourager les représentants si les quotas semblent inatteignables.

3. Commission directe

Les représentants gagnent un pourcentage des ventes totales sans salaire de base. Le taux de commission détermine l'ensemble de leurs revenus. Voici la formule de calcul de la commission :

Exemple : Un représentant vend 8 000 $ de produits avec un taux de commission de 15 %. Ses gains seraient de 8 000 $ x 0,15 = 1 200 $.

Idéal pour : Les professionnels de la vente indépendants ou les entreprises ayant des cycles de vente courts

Avantages : Potentiel de gain élevé et corrélation directe entre l'effort et le revenu

Inconvénients : la variabilité des revenus peut créer une instabilité financière

4. Commission résiduelle

Ce modèle récompense les représentants des ventes par des commissions récurrentes provenant de clients à long terme.

Exemple : Un client s'abonne à un service de 1 500 dollars par mois. Le représentant perçoit une commission de 6 %, soit 90 dollars par mois tant que le client reste abonné.

Le meilleur pour : Les entreprises basées sur les SaaS et les abonnements

Avantages : Favorise la fidélisation des clients à long terme

Inconvénients : peut prendre du temps pour générer des revenus substantiels

5. Commission du volume du territoire

Un modèle basé sur l'équipe où la commission est répartie entre les représentants en fonction de leur contribution aux ventes totales du territoire. La formule de commission est la suivante :

Exemple : Le territoire d'un représentant génère 70 000 $ de ventes et les ventes totales de l'équipe atteignent 700 000 $ avec un taux de commission de 9 %. Les revenus du représentant seraient de (70 000 $ / 700 000 $) x 0,09 x 700 000 $ = 6 300 $.

Idéal pour : Les grandes équipes de vente couvrant des territoires géographiques

Avantages : Favorise le travail d'équipe et le développement du marché régional

Inconvénients : peut créer des conflits si les contributions ne sont pas reconnues de manière égale.

6. Commission à paliers

Les représentants gagnent des taux de commission plus élevés à mesure qu'ils atteignent des seuils de vente plus élevés, ce qui les incite à dépasser leurs objectifs initiaux.

Exemple : Un plan offre une commission de 5 % sur les premiers 10 000 $ de ventes, de 10 % sur les ventes entre 10 000 et 20 000 $ et de 15 % sur les ventes supérieures à 20 000 $. Un représentant qui vendrait 25 000 $ gagnerait : (10 000 $ x 0,05) + (10 000 $ x 0,10) + (5 000 $ x 0,15) = 2 250 $.

Idéal pour : Les équipes performantes avec un potentiel de vente évolutif

Avantages : Récompense les meilleurs vendeurs et stimule la motivation permanente

Inconvénients : peut décourager les employés les moins performants si les échelons supérieurs semblent hors de portée.

7. Commission sur la marge brute

Ce plan calcule les commissions sur la base des marges bénéficiaires plutôt que des revenus, ce qui permet d'aligner les incitations sur la rentabilité.

Exemple : Un produit ayant une marge brute de 300 $ et un taux de commission de 12 % rapporte à un représentant 300 $ x 15 x 0,12 = 540 $.

Idéal pour : Les entreprises qui privilégient le profit au volume de revenus

Avantages : Encourage la vente de produits à forte marge

Inconvénients : le calcul est plus complexe que celui d'une commission standard basée sur les revenus.

8. Tirage au sort contre la commission

Ce modèle fournit aux représentants des ventes une avance qui doit être remboursée par des commissions futures.

Exemple : Un représentant reçoit un tirage au sort de 2 500 $. S'il gagne ensuite 4 000 $ de commission, son paiement final est de 4 000 $ - 2 500 $ = 1 500 $.

Ce qui convient le mieux : Les nouvelles embauches dans le domaine de la vente ou les fonctions dont le revenu est fluctuant

Avantages : Offre une sécurité financière aux représentants pendant les périodes de ralentissement des ventes.

Inconvénients : peut entraîner des difficultés financières si les ventes ne répondent pas aux attentes.

Comment Compass peut-il aider à calculer les commissions de vente ?

Compass peut considérablement rationaliser l'automatisation du calcul des ventes en éliminant les processus manuels et en assurant un suivi précis et en temps réel des commissions. Voici comment Compass peut vous aider :

1. Calculs automatisés des commissions

- Compass automatise le calcul des commissions de vente à l'aide de formules prédéfinies pour le calcul des quotas de vente et de règles personnalisables, réduisant ainsi les erreurs humaines et garantissant la transparence.

- Prise en charge de plusieurs structures de commissions, y compris les commissions par paliers, les incitations basées sur les quotas et les commissions résiduelles.

- Il fonctionne également comme un calculateur d'atteinte de quotas, car il présente les étapes et envoie des encouragements en fonction de l'objectif atteint.

2. Suivi en temps réel de la réalisation des quotas

- Les équipes de vente peuvent suivre l'atteinte de leurs quotas et les progrès réalisés en matière d'incentives à l'aide de tableaux de bord en temps réel.

- Les responsables ont une meilleure idée des tendances en matière de performances commerciales et peuvent adapter les stratégies de rémunération en conséquence.

3. Formules de taux de commission personnalisables

- Compass permet aux entreprises de définir différentes formules de taux de commission en fonction des rôles, des objectifs de revenus et des niveaux de performance.

- Ce modèle fonctionne bien pour les modèles de commission SaaS, les ventes de produits à forte marge et les structures basées sur le territoire.

4. Intégration transparente avec les outils de vente et de finance

- S'intègre aux plateformes de gestion de la relation client (Salesforce, HubSpot), aux systèmes ERP et aux logiciels de paie, garantissant ainsi un flux de données fluide.

- Réduit les efforts de réconciliation manuelle en extrayant les données de vente en temps réel pour un traitement automatisé des paiements.

Qu'il s'agisse d'une startup ou d'une entreprise, Compass s'adapte à votre équipe et permet d'ajuster facilement les structures de commissions en fonction de l'évolution de l'entreprise. Compass permet de gérer des modèles de rémunération multirégionaux, multidevises et multi-niveaux sans effort. Planifier un appel dès maintenant !

Conclusion

Convertir des prospects en ventes demande des efforts considérables et vous devez vous assurer d'être rémunéré de manière adéquate. Pour ce faire, il faut d'abord soumettre les calculs corrects en tenant compte de tout ce qui doit être ajouté ou déduit.

Grâce à ce guide facile sur le calcul des commissions de vente, vous pouvez désormais vous assurer que tous vos efforts sont reconnus et que vous recevez chaque centime de la commission que vous méritez. Alors, rassemblez toutes vos transactions de vente et calculez votre commission avec cette formule de pourcentage de commission de vente aussi simple que"ABCD" !

FAQs

1. À quelle fréquence les taux de commission sont-ils revus et mis à jour ?

Cela dépend de la politique de l'entreprise. Certaines entreprises révisent les taux de commission chaque année, tandis que d'autres le font plus ou moins fréquemment.

2. La commission est-elle payée sur le prix de vente ou sur la marge bénéficiaire ?

Cela dépend de la politique de l'entreprise. Certaines entreprises paient une commission sur le prix de vente, tandis que d'autres paient une commission sur la marge bénéficiaire.

3. Les commissions sont-elles soumises à des taxes ?

Oui, les commissions sont considérées comme des revenus et sont soumises à l'impôt. L'impôt à payer dépend de la tranche d'imposition de l'individu et d'autres facteurs.

4. Comment calculez-vous la commission de vente ?

La formule de calcul de base est la suivante : commission = (total des ventes x taux de commission). Cependant, le calcul des commissions peut s'avérer délicat car il dépend de la structure des commissions, du secteur d'activité et des conditions spécifiques de l'accord.

Les étapes de base du calcul des commissions comprennent la détermination de la période de commission, le calcul de la base de commission totale réalisée au cours de cette période et la multiplication du taux de commission par la base de commission.

Il est également essentiel de prendre en compte les taux de commission variables et progressifs et d'effectuer tous les calculs et ajustements supplémentaires applicables, tels que les dérogations, les déductions pour les retours et les répartitions de commissions pour les territoires partagés.

5. Qu'est-ce qu'une commission de 3 % sur 100 $ ?

Pour calculer une commission de 3 % sur 100 $, il faut multiplier 100 $ par 3 %3. Le calcul est le suivant : $100 x 0.03 = $33.

6. Quelle est la formule de calcul de la commission sur les bénéfices ?

La formule de la commission sur la marge brute est la suivante : recettes ($) - coûts ($) = marge sur la marge brute ($) x taux de commission (%) = commission totale ($)1. Pour calculer la commission sur la marge brute dans une feuille de calcul, vous pouvez utiliser la formule =(SOMME(A1:A10)-SOMME(B1:B10))*C1, où A1:A10 est la plage de cellules contenant les montants des ventes, B1:B10 est la plage de cellules contenant le coût des marchandises vendues, et C1 est le pourcentage de la commission.

7. Quelle est la structure moyenne des commissions pour les ventes ?

La structure de commission moyenne pour les ventes implique généralement un salaire de base combiné à un pourcentage du chiffre d'affaires généré par les ventes. Les commissions peuvent varier de 5 à 20 %, en fonction du secteur, du produit et des performances individuelles, les commissions les plus élevées étant souvent liées à la réalisation d'objectifs de vente spécifiques. Bas du formulaire