عمولات وسطاء الرهن العقاري في الولايات المتحدة الأمريكية: كيف تعمل وماذا تتوقع

Discover how mortgage brokers earn commissions, the types of fees involved, industry regulations, and how borrowers can optimize costs when securing a home loan.

في هذه الصفحة

يعد تأمين الرهن العقاري قرارا ماليا مهما يتطلب غالبا خبرة وسيط الرهن العقاري. يعمل هؤلاء المحترفون كوسطاء بين المقترضين والمقرضين ، مما يساعد الأفراد في العثور على أنسب خيارات القروض.

بينما يقدم وسطاء الرهن العقاري خدمات قيمة ، من الأهمية بمكان أن يفهم المقترضون كيفية تعويض هؤلاء المهنيين. في الولايات المتحدة الأمريكية ، تلعب عمولات وسيط الرهن العقاري دورا محوريا في عملية قرض المنزل.

من هم وسطاء الرهن العقاري؟

A mortgage broker is a financial professional who acts as an intermediary between individuals or businesses seeking a mortgage loan and the lenders who provide the funds for the loan.

Mortgage brokers help borrowers navigate the complex process of securing a mortgage by connecting them with lenders that offer suitable loan products based on their financial situation and needs.

فهم عمولات وسيط الرهن العقاري

عمولات وسيط الرهن العقاري هي رسوم تدفع للوسطاء مقابل خدماتهم في تسهيل عملية طلب الرهن العقاري والموافقة. في الولايات المتحدة الأمريكية ، تأتي هذه العمولات عادة في شكلين: الرسوم المقدمة والرسوم المستمرة.

1. الرسوم المقدمة

- رسوم الإنشاء: هذه رسوم مقدمة شائعة يتقاضاها وسطاء الرهن العقاري. عادة ما تكون نسبة مئوية من مبلغ القرض ويمكن أن تتراوح من 0.5٪ إلى 1.5٪. تعوض رسوم الإنشاء الوسيط عن معالجة طلب القرض وتقييم الجدارة الائتمانية للمقترض والتنسيق مع المقرض.

- Loan discount points: Borrowers may also encounter loan discount points, which are upfront fees paid to reduce the interest rate on the mortgage. Each point typically costs 1% of the loan amount and can result in a lower interest rate, potentially saving money over the life of the loan.

2. الرسوم الجارية

- Yield Spread Premium (YSP): While less common today, YSP is a commission paid by lenders to brokers for securing a loan with a higher interest rate than the borrower qualifies for. This practice has been subject to scrutiny, and regulations have been implemented to ensure that brokers act in the best interests of the borrower.

- عمولات المسار: في بعض الحالات ، قد يتلقى وسطاء الرهن العقاري عمولات مستمرة ، تعرف باسم عمولات المسار ، طوال مدة القرض. تستند هذه العمولات إلى الرصيد المستحق للرهن العقاري وتحفز الوسطاء على الحفاظ على علاقة طويلة الأمد مع المقترض.

في السنوات الأخيرة ، هدفت التغييرات التنظيمية إلى زيادة الشفافية في صناعة الرهن العقاري وحماية المستهلكين. على سبيل المثال، يتطلب قانون دود-فرانك لإصلاح وال ستريت وحماية المستهلك من سماسرة الرهن العقاري الكشف عن تعويضاتهم للمقترضين. يتضمن ذلك تفصيل رسوم الإنشاء ونقاط الخصم وأي رسوم أخرى مرتبطة بالقرض.

كم يكسب وسطاء الرهن العقاري؟

The annual earnings of a mortgage broker can vary depending on their location and the volume of business they conduct. Typically, their compensation is a percentage of the mortgage amount, making regions with high home prices more lucrative as borrowers in such areas often require larger loans.

Established and proactive mortgage brokers who engage in numerous transactions tend to earn more compared to those who are new to the field or work part-time.

توفر العديد من المنصات والموارد عبر الإنترنت مجموعة من متوسط الأرباح لوسطاء الرهن العقاري بأجر اعتبارا من أبريل 2023:

- According to Indeed, national average base salary for mortgage brokers is $98,162 per year, with some receiving additional commissions. In specific areas like the San Francisco Bay area, the average salary was notably higher at $141,240, although based on a small sample size of just three brokers.

- PayScale reports an average salary of $64,630 for mortgage brokers based on 57 reports, with commissions ranging from $12,000 to $178,000. Those with less than one year of experience had an average total compensation of $47,000, while those with over 20 years of experience averaged $69,000. These figures are derived from relatively small sample sizes.

- Glassdoor indicates an average base salary of $136,620 for mortgage brokers, with a range from $111,000 to $352,000. Additional compensation, including cash bonuses, commissions, tips, and profit-sharing, is estimated at $55,484 per year.

- Lastly, ZipRecruiter reports a national average mortgage broker salary of $129,346, with a range spanning from $11,500 to $297,500.

من المهم ملاحظة أن هذه الأرقام هي متوسطات ويمكن أن تتأثر بعوامل مختلفة ، بما في ذلك الموقع الجغرافي ومستوى الخبرة والظروف المحددة للوسطاء الأفراد.

How mortgage brokers profit from transactions?

Mortgage brokers predominantly earn a commission based on the loan amount, usually ranging from 1% to 2%. This commission can be paid by either the borrower or the lender, and it is typically around 2% of the loan value. Larger loans result in higher commissions for brokers, creating a financial incentive for them to secure larger loan amounts for their clients.

Since a mortgage broker's income is commission-based, it is directly tied to the transaction value. For instance, a broker charging a 2% rate on a $250,000 loan would earn $5,000.

However, factors such as the local real estate market and the broker's experience level can significantly impact their annual earnings. According to ZipRecruiter, the average annual salary for a mortgage broker in different states varies, with factors like demand and experience playing a crucial role.

While mortgage brokers provide valuable services in simplifying the loan process, borrowers should be aware of potential fees. One way to mitigate costs is by obtaining multiple mortgage quotes from different lenders.

According to a 2018 Freddie Mac report, borrowers can save an average of $3,000 over the life of the loan by securing at least five quotes. If a broker's commission exceeds this potential savings, borrowers may consider exploring alternatives with different fee structures.

كيف يتم الدفع لسماسرة الرهن العقاري؟

The payment to mortgage brokers can take various forms, including cash or an addition to the loan balance. If the borrower is responsible for the fee, it is paid at the loan closing.

However, if the lender covers the cost, it may be rolled into the overall loan amount, meaning the borrower still bears the financial burden. As fee structures vary among brokers, borrowers are advised to thoroughly understand the terms before committing to a specific broker.

What affects a mortgage broker's pay?

Mortgage brokers typically earn a base salary along with a commission that varies based on several factors, including loan terms, client agreements, and market conditions.

1. The terms of the loan

On average, mortgage brokers charge a commission of 2% to 2.5% per loan. However, federal regulations prohibit brokers from charging more than 3% of the total loan amount. For example, if a mortgage broker charges 2.25% on a $500,000 loan, they would earn $11,250 in commission.

2. The agreement with the client

Mortgage brokers can work for either borrowers or lenders, and their fees depend on these agreements. Lenders generally pay higher commissions than borrowers. When lenders compensate brokers, they typically pay between 0.5% and 2.75% of the total loan amount. If borrowers pay, brokers charge an origination fee, which is usually less than 3% of the loan amount.

3. The housing market

The local housing market also influences mortgage broker commissions. In highly competitive markets, brokers may lower their commission rates to attract more clients. In contrast, in less competitive markets with fewer options, brokers might charge higher fees.

حساب عمولات وسطاء الرهن العقاري

دعنا نحلل مثالا على كيفية حساب عمولة وسيط الرهن العقاري.

1. Loan amount: $300,000

2. Interest rate: 4%

3. Loan term: 30 years

Where,

- Loan amount: This is the total amount of money borrowed by the borrower.

- Interest rate: The interest rate is the percentage of the loan amount that the borrower pays as interest to the lender over the life of the loan.

- Loan term: The loan term is the number of years over which the loan will be repaid.

Commission structure

Broker's commission rate: 1% of the loan amount

Calculation:

1. Loan amount: $300,000

2. Commission rate: 1%

3. Commission amount: Commission Rate * Loan Amount

Commission amount = 0.01 * $300,000

Commission amount = $3,000

لذلك ، في هذا المثال ، سيحصل وسيط الرهن العقاري على عمولة قدرها 3,000 دولار لتسهيل قرض الرهن العقاري بقيمة 300,000 دولار بمعدل عمولة 1٪.

It's important to note that commission structures can vary, and some brokers may also receive additional bonuses or incentives based on factors like loan volume or client satisfaction.

Additionally, brokers may receive commissions from both the borrower and the lender, or they may charge fees to the borrower in addition to or instead of a commission. Always refer to the specific terms of the agreement between the broker and the lender for accurate calculations.

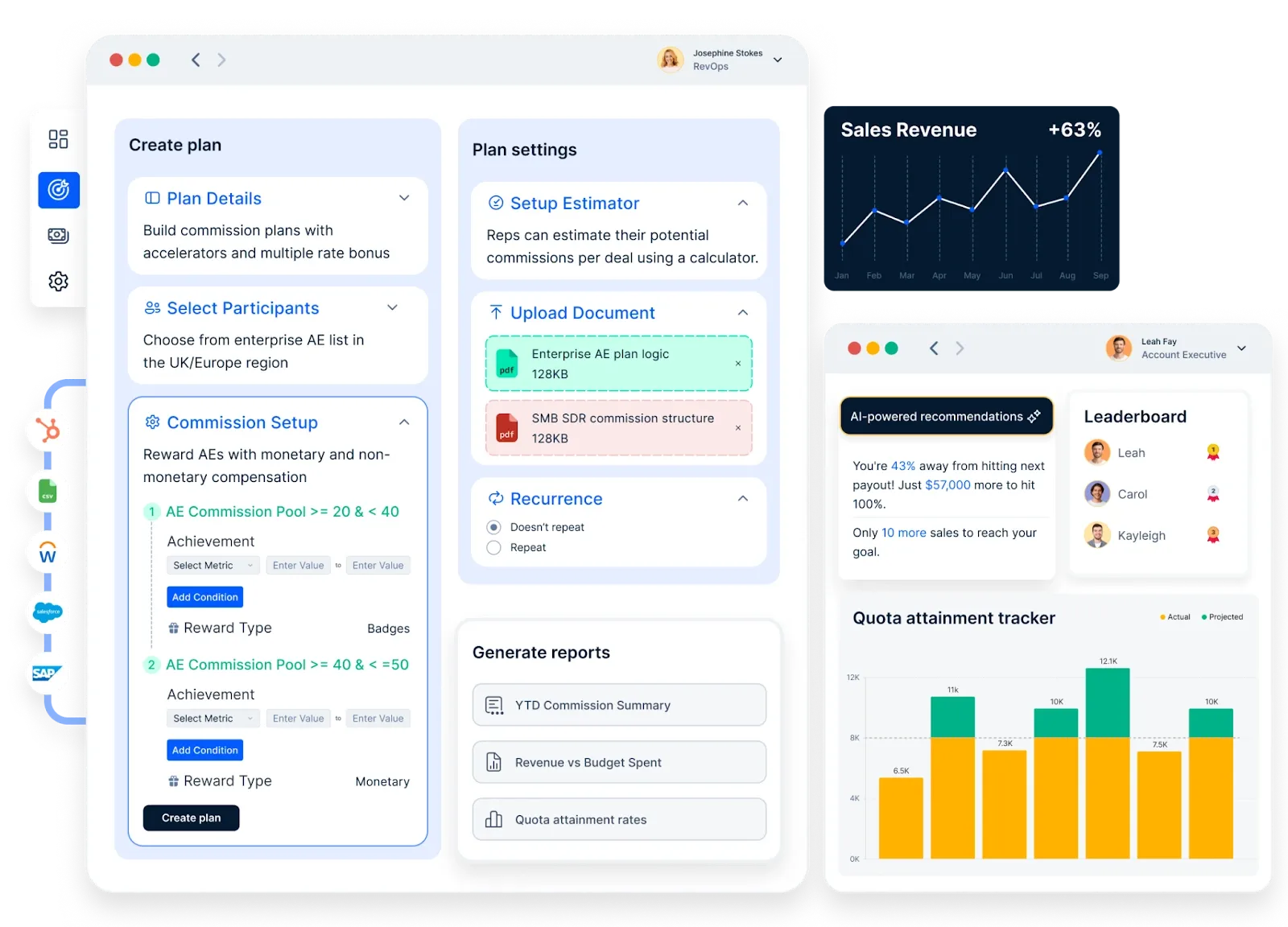

How can Compass simplify Mortgage Broker commission calculation?

Here is how Compass, mortgage commission automation software, that might simplify mortgage broker commission calculations:

- التكامل مع أنظمة الرهن العقاري: يمكن أن يتكامل Compass مع مختلف الأنظمة المتعلقة بالرهن العقاري، مثل برامج إنشاء القروض وأدوات إدارة علاقات العملاء (CRM)، للوصول إلى البيانات ذات الصلة لحساب العمولة.

- هياكل عمولة قابلة للتخصيص: قد تسمح المنصة لوسطاء الرهن العقاري بإعداد وتخصيص هياكل العمولة بناء على اتفاقيات مع مقرضين مختلفين. تضمن هذه المرونة توافق الحسابات مع الشروط المحددة لكل علاقة إقراض.

- أتمتة عمليات الحساب: Compass يمكن أتمتة حساب العمولات، مما يقلل من الحاجة إلى الإدخال اليدوي ويقلل من مخاطر الأخطاء. تضمن الأتمتة إجراء العمليات الحسابية بشكل متسق وفعال.

- تحديثات البيانات في الوقت الفعلي: من خلال الوصول إلى البيانات في الوقت الفعلي، يمكن لموقع Compass توفير حسابات عمولة دقيقة ومحدثة. وهذا أمر بالغ الأهمية في سوق الرهن العقاري الديناميكي حيث يمكن أن تتغير الأسعار والشروط بشكل متكرر.

- إدارة الامتثال: قد تتضمن المنصة ميزات الامتثال لضمان التزام حسابات العمولة بلوائح ومعايير الصناعة. هذا يساعد وسطاء الرهن العقاري على البقاء ملتزمين بالمتطلبات القانونية.

- تقارير شفافة: Compass قد يقدم موقع أدوات إعداد التقارير التي توفر رؤى مفصلة عن أرباح العمولات. وتساعد التقارير الواضحة والشفافة وسطاء الرهن العقاري على فهم كيفية حساب العمولات وتوفير أساس للتواصل مع العملاء والمقرضين.

- الحد من الأخطاء: من خلال الأتمتة وآليات التحقق من الصحة، يمكن أن يساعد Compass في تقليل احتمالية حدوث أخطاء في حسابات العمولة، مما يقلل من مخاطر التناقضات المالية والنزاعات.

- تحسين سير العمل: قد يؤدي Compass إلى تبسيط سير عمل العمولة الإجمالي، بدءًا من إدخال البيانات وحتى توزيع المدفوعات. يمكن لهذا التحسين أن يوفر الوقت لوسطاء الرهن العقاري، مما يسمح لهم بالتركيز على بناء علاقات مع العملاء وتنمية أعمالهم.

- التكامل مع أنظمة المحاسبة: يمكن أن تتكامل المنصة بسلاسة مع أنظمة المحاسبة ، مما يسهل النقل السلس لبيانات العمولات للإدارة المالية وإعداد التقارير.

استنتاج

يتطلب التنقل في عالم عمولات وسطاء الرهن العقاري في الولايات المتحدة الأمريكية فهما واضحا للرسوم المختلفة وكيف تؤثر على التكلفة الإجمالية للرهن العقاري. مع استمرار تطور اللوائح ، يمكن للمقترضين توقع زيادة الشفافية والحماية. عند العمل مع وسيط الرهن العقاري ، يعد التواصل المفتوح حول الرسوم والتعويضات أمرا أساسيا لضمان شراكة ناجحة ومفيدة للطرفين.

الأسئلة الشائعة

1. Do mortgage brokers earn more than loan officers?

Mortgage brokers and loan officers both play pivotal roles in facilitating home loans, but their compensation structures differ. Mortgage brokers typically earn commissions by connecting borrowers with suitable lenders, while loan officers, employed by specific financial institutions, may receive a combination of salary and performance-based bonuses.

According to data from April 2023, mortgage brokers have an average base salary of $58,304, whereas mortgage loan officers have an average base salary of $49,369. However, total earnings for both can vary based on factors like experience, location, and transaction volume.

2. Do mortgage brokers need a license?

Yes, mortgage brokers are required to be licensed to operate legally. In the United States, the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) mandates that mortgage brokers complete pre-licensing education, pass a national exam, and fulfill annual continuing education requirements. Licensing ensures that brokers adhere to industry standards and regulations.

3. How can I ensure a mortgage broker is legitimate?

To verify the legitimacy of a mortgage broker:

- Check licensing: Use the Nationwide Multistate Licensing System (NMLS) Consumer Access portal to confirm the broker's licensing status and review any disciplinary actions.

- Review credentials: Ensure the broker has relevant experience and professional affiliations.

- Seek recommendations: Consult friends, family, or real estate professionals for referrals to reputable brokers.

- Assess transparency: A trustworthy broker will clearly explain fees, loan options, and the lending process.

- Read reviews: Look up online reviews and ratings to gauge the broker's reputation and client satisfaction.

4. How much do mortgage brokers make in commission?

Mortgage brokers typically earn commissions ranging from 0.5% to 2.75% of the total loan amount. For instance, on a $300,000 mortgage, a broker might earn between $1,500 and $8,250. The exact percentage can vary based on the broker's agreement with the lender, the complexity of the loan, and regional market conditions.

5. How much do brokers charge for commission?

The commission charged by mortgage brokers generally falls between 0.5% and 2.75% of the loan amount. This fee is often paid by the lender, the borrower, or a combination of both, depending on the agreement. It's essential for borrowers to discuss and understand the fee structure upfront to avoid any surprises at closing.