Nesta página

The #NewNormal is forcing companies to re-balance their sheets, looking for ways to cut fixed costs without compromising productivity.

What’s the best approach? #WFH has played its part, reducing infrastructure and real estate expenses. But there’s another game-changer: the incentive-based pay system.

Blending an incentive-based pay component into the compensation structure offers a smarter, leaner way forward. It doesn’t just ease financial pressure during downturns—it also strengthens business continuity and fuels long-term efficiency. The real kicker? An incentive-based pay system doesn’t just work in tough times—it’s a sustainable model even when the going is good.

The essence of performance-based pay is nothing new. It’s the same logic that makes disposable pens and paper plates practical—they serve their purpose, then move on.

As a structured business practice, PRP (Performance-Related-Pay) was officially introduced in the UK in the 1980s. Since then, the incentive-based pay model has become a staple in industries like insurance, delivery, financial services, factories, and food & beverage.

The network marketing (MLM) model is a prime example—it thrives on the principle that earnings should match effort. This is why the incentive-based pay system has always resonated with business leaders across industries and generations.

Organizations like IKEA, Coke, and Pepsi have successfully integrated performance-driven pay structures, continuously refining them to stay ahead of the curve.

The takeaway? An incentive-based pay system isn’t just about reducing costs—it’s about rethinking compensation to drive efficiency, motivation, and long-term business sustainability.

Understanding incentive-based pay systems

Salaries, as we know them, are getting a reality check. The old model of fixed pay—where costs remain static regardless of revenue or performance—is starting to look rigid, expensive, and, frankly, outdated. Enter incentive-based pay—a system designed to make compensation as dynamic as the business itself.

At its core, incentive-based pay is simple: instead of a one-size-fits-all paycheck, employees earn based on performance. The better they do, the more they make. This elasticity helps businesses control costs while keeping employees engaged, motivated, and driven by results.

What does incentive-based pay look like?

No two companies do it the same way. But the guiding principle remains the same—performance dictates pay. Here are some of the most common structures:

- Commission-based pay: A percentage of revenue or sales earned, making it the go-to model for sales-driven industries.

- Performance bonuses: Rewards for hitting (or exceeding) targets. The better the output, the bigger the payout.

- Profit sharing: Employees get a slice of company profits, aligning their interests with business success.

- Stock options & equity compensation: A long-term play, where employees earn company shares, creating a direct link between their performance and the company’s growth.

- In-kind incentives: Think beyond cash—trips, perks, and experiential rewards often hold just as much appeal.

Why businesses are making the switch

In a VUCA (Volatile, Uncertain, Complex, Ambiguous) environment, businesses are waking up to the cost-control advantage of variable pay. Unlike fixed salaries, which keep payroll rigid even in downturns, incentive-based models flex with performance, allowing companies to stay lean, agile, and financially resilient.

This isn’t a fad or a trend—it’s the new normal. The companies that crack the incentive-pay formula will not just cut costs but create high-performance teams that thrive on results.

Base pay vs. incentive pays: Striking the right balance

For years, base pay has been the foundation of employee compensation—a fixed salary, predictable, and consistent.

But predictability comes at a cost. No matter how well (or poorly) a business performs, salaries remain the same, creating financial strain during downturns and limiting flexibility.

On the other hand, incentive pay brings elasticity into the equation. Instead of treating payroll as a fixed cost, companies tie compensation to results, ensuring that employees earn based on performance while businesses maintain financial control.

Why businesses are blending both models

Going all-in on either model comes with risks. While a 100% incentive-based structure may create uncertainty for employees, relying solely on fixed salaries bloats costs and reduces motivation.

Most businesses today are finding a middle ground—a mix of base pay and incentive pay that offers financial stability while keeping employees driven. The right ratio depends on industry, job roles, and business goals, but companies that get it right unlock higher efficiency, better cost control, and a high-performance workforce.

Business case for incentive-based pay to reduce fixed costs and improve efficiency

Variable pay schemes can vary – from incentives to bonuses to profit sharing to ESOPS to in-kind to a host of innovative ideas. The common thread knitting them is the conviction that rewards must be a close function of performance.

Financial benefits of an elastic pay model

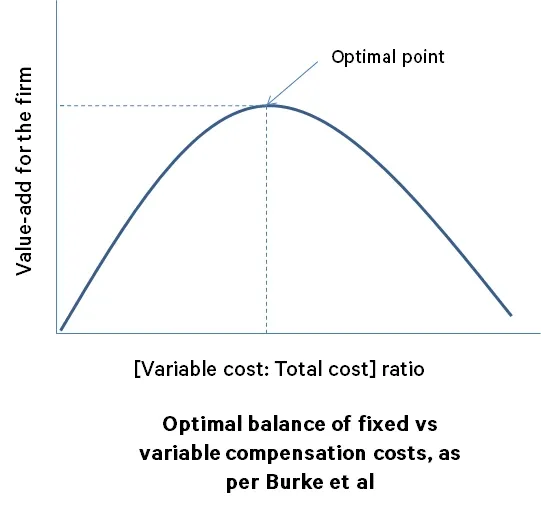

The benefits of an elastic pay scheme – one characterized by a lower fixed and a higher variable package - first came to light in 2004, when the economic framework of Terry and Burke demonstrated that a reduction in operating leverage essentially translates into a percentage gain in profits.

Before them, Rendell and Simmons had, in 1999, shown the world that variable pay – when deeply integrated with the organizational ethos and purpose - reduces profit volatility and enhances the earnings stream for shareholders.

Market trends driving incentive-based pay

As volatility goes south, it drags the company’s Beta Coefficient (i.e. market risk as assigned by market investors) down with it. This reduces the cost of capital (Beta) of the firm. Net result? The economic value of the business goes up.

Stats say that companies across sectors are increasing Variable Pay (specifically, pay aligned with performance) share by as much as 15% to tone down expenses.

In the opinion of Arvind Usretay (Director of Rewards at Willis Towers Watson, a risk management advisory), sectors such as FMCG, e-commerce, pharma, financial services, IT, and fintech will spearhead a ‘near mass exodus’ to a Pay-for-Performance paradigm.

At the heart of it is elasticity

While it is common management wisdom that turning processes ‘stretchable and malleable’ helps teams stay agile and adaptable to change (an essential ingredient in maintaining a competitive edge), few CXOs or founders have looked at compensation through an elastic framework.

Till now, that is.

“The crisis has highlighted the inelasticity in compensation costs, and there will be a move towards making these more variables over the coming years.”

Benefits of elastic pay that’s linked to performance loops and improving efficiency

Here are the key benefits of elastic pay tied to performance loops, ensuring sales reps stay motivated, efficiency improves, and compensation aligns with results.

1. Turn mediocre performers into rockstars

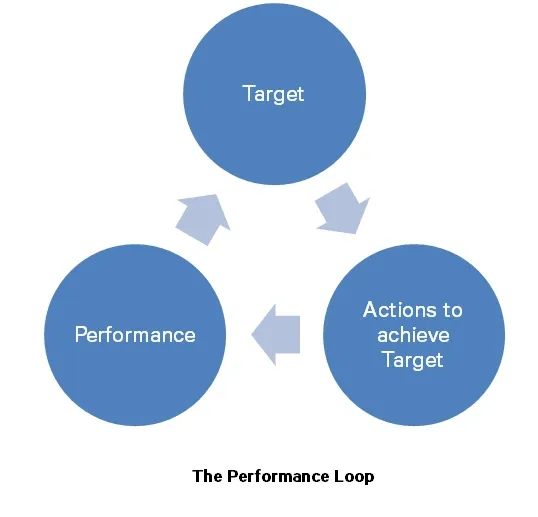

Even with strong strategies, advanced technology, and skilled talent, businesses often operate below their full potential. Introducing a performance loop—where pay is driven by performance and, in turn, motivates further performance—helps unlock untapped efficiency.

Each company must determine its own fixed-to-variable pay ratio, ensuring it aligns with its business model and goals. According to Deloitte, the ideal proportion of fixed to variable pay generally stands at 85:15, with senior leadership roles seeing a shift toward 50-75% fixed pay.

This performance loop eliminates complacency, resets motivation, and enhances workforce efficiency. Companies that successfully implement this model often witness rapid improvements in KPIs, goal achievements, and overall workplace morale.

2. Stop competition from poaching your best performers

When you optimize your finances with the ‘magic‘ of variable pay, you can avoid laying off your rockstars if business runs into choppy waters. An elastic pay structure not only lets you retain top performers but also gets them to perform ‘miracles’ – yes even when the chips are down - turning your business into a happy aberration.

No wonder companies across sectors like Retail, BFSI, Chemical, FMCG, IT, e-commerce and telecom are hiking their variable component by upto 25 % to attract and retain talent, since their experience suggests that best performers relish the idea of being rewarded for their merit and hard work.

3. Survive on leaner resources, thrive on thinner margins

Variable Pay matrices lighten the yoke of fixed costs on the company’s coffers – often significantly. Indeed, a strategic, reward-first approach to productivity lets teams take a big step towards the ‘Holy Grail’ of businesses in the #NewNormal age: DOING MORE, WITH LESS. By footing only those bills that bring in value, leaders can eliminate unnecessary operations, re-channelize resources better and amp up efficiency across the ranks.

Strategies for implementing an incentive-based pay system

While we are still in the early stages and the codes are changing every day, here are some insights and learnings from the industry that can help us implement and institutionalize an incentive-based pay program during – and after - the crisis phase:

1. Shifting to an Incentive-Based Pay Model: Changing the Mindset

It all starts with a revamp in mindset. A variable-heavy compensation structure delivers its full benefit only when everyone is aligned with the vision and equally kicked about the possibilities.

In other words, workers need to be just as gung-ho as the founder or top leadership. There will be hurdles to handle, naturally. ‘Memories and ‘Inertia’ of the status-quo may linger stubbornly across organizational workflows, and one will have to learn to ignore them.

There will be resistance from a slice of the team and culture that’s comfortably settled in the old way (where ‘fixed’ outweighed ‘variable’) and that’s where the transformation should hammer most.

Workshops and Demos of new technologies and practices being introduced to facilitate change, handholding during micro-moments at work and the occasional inspirational speech by first adopters – can all go to make the crossover a little easier, and a little more seamless.

2. Find your right operating-model fit

Change typically doesn’t come with a Playbook, leaving us to feel and figure out directions and intensities that will work best for us. The WHAT-WHO-WHEN-WHY-WHERE must be clear before one begins on a reward and incentive-driven journey to rein in cost leaks at every step.

Your business must decide on the right <fixed: variable> payout ratio in the account's books.

You must ensure incentives are not ‘one size fit all’ but mapped to ability, motivation and personality. Your processes must be sufficiently flexible – especially during the initiating teething months of the transition - to allow for adjustments and improvisations.

And you must make the extra effort to find the right transformation partner – someone who can iron out hiccups and chart expedient roadmaps with the power of experience and expertise.

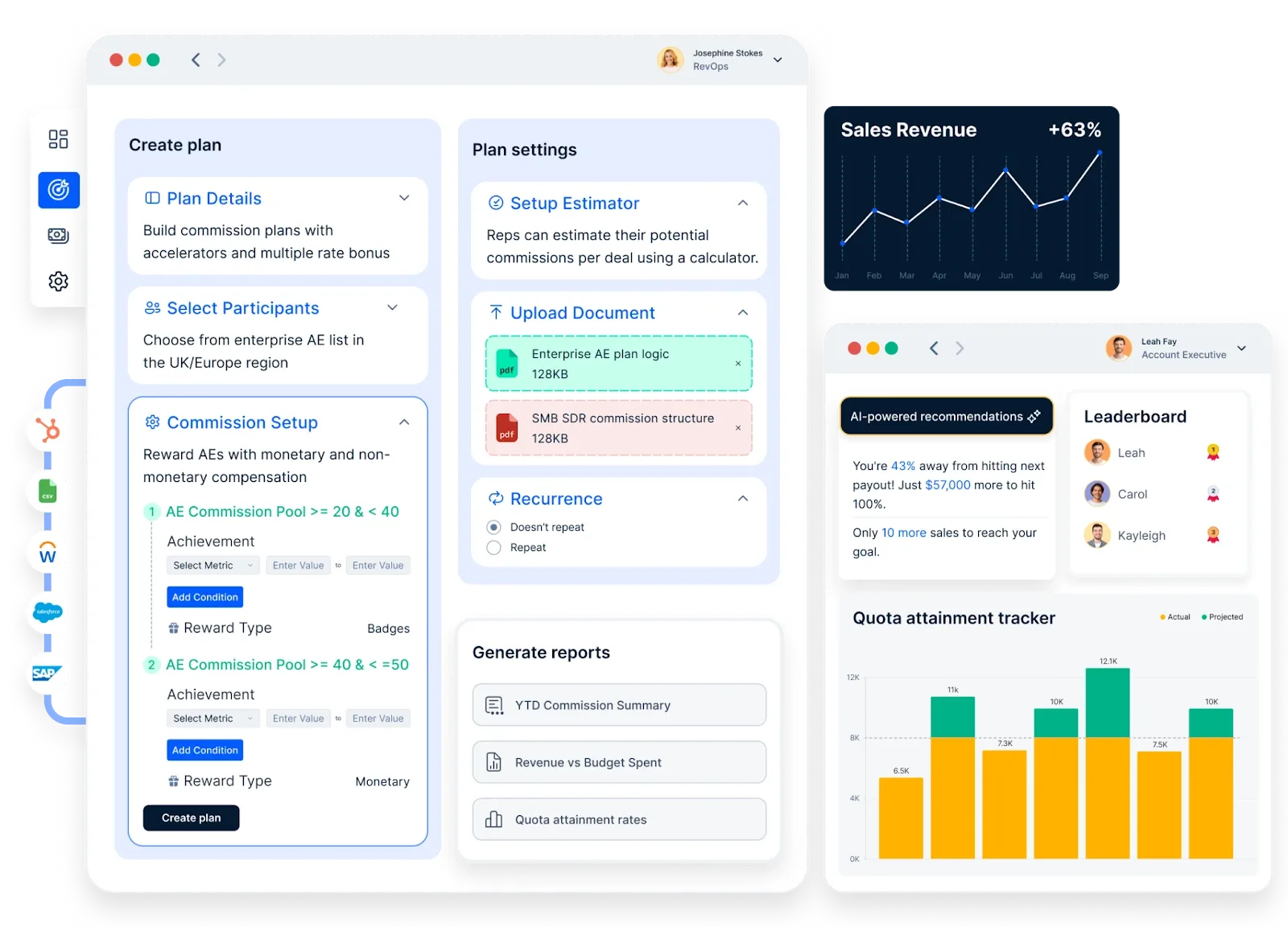

In this connection, a mention of Compass is significant: Intuitive and bespoke, Compass combines the art and science of engaging an in-house as well as extended workforce and towards more incredible performance via incentives and has been helping companies around the world leap into the unknown during the current time of uncertainty.

Compass helps engage your in-house and extended workforce for higher employee performance via incentives.

3. Implement slowly, if you must, but flawlessly

While things may not be flawless straight off the bat, it’s important not to slacken the reins or vision. Do not compromise on the high standards you set for the other aspects of your business.

And while it may take time and patience (be it habits or silos), ensure that your revamped incentive-first performance model is ultimately immersed and integrated into the system seamlessly and involves every worker and stakeholder optimally. If nothing else, consider this a Beta Test and Preparation Period for the long haul.

An elastic and incentive-inspired style of functioning can help businesses reboot quicker and fly off the starting block faster than their peers when the economy finds its balance back. Indeed, future-facing HR leaders expect the current disruptions in payouts and disbursement systems to be long-term (if not permanent).

In her words, “Companies have realised that traditional form of compensation are outdated and variable pay could offer more flexibility… this would continue.”

Common challenges and how to overcome them

Shifting to an incentive-based pay system isn’t just a financial decision—it’s a cultural transformation. While the benefits are clear, execution is where most companies stumble. If not done right, it can rattle employee confidence, create friction, and even derail productivity. Here’s what could go wrong—and how to fix it.

1. Winning over the skeptics

Not everyone will be thrilled about the change. Some employees will cling to the comfort of a fixed salary, fearing income fluctuations. Leadership may hesitate, worried about losing control over payroll dynamics.

How to fix it:

- Make the transition gradual. Don’t flip the switch overnight.

- Educate employees on how they can earn more under the new model.

- Start with pilot programs in select teams to demonstrate success before a full rollout.

2. Getting the performance metrics right

A pay-for-performance model is only as good as the metrics that drive it. If targets feel unrealistic, subjective, or constantly shifting, employees won’t buy in.

How to fix it:

- Define clear, measurable KPIs that leave no room for confusion.

- Use real-time tracking tools to give employees visibility into their progress.

- Balance short-term targets with long-term performance incentives to avoid tunnel vision.

3. Striking the right balance between fixed and variable pay

Too much variable pays? Employees may feel pressured, stressed, or disengaged. Too little? The model loses its edge, defeating the whole purpose.

How to fix it:

- Find your sweet spot—Deloitte suggests a fixed-to-variable ratio of 85:15, but it can go up to 50-75% variable for CXOs.

- Offer a stability cushion for employees shifting to variable pay for the first time.

- Combine monetary incentives with non-cash perks like career growth opportunities.

4. Preventing the ‘shortcut’ mentality

A pure incentive-driven model can tempt employees to cut corners, chase quick wins, or even game the system. If unchecked, this can damage trust and lead to long-term instability.

How to fix it:

- Link rewards to quality metrics, not just raw numbers.

- Rotate targets periodically to prevent employees from exploiting loopholes.

- Keep a mix of individual and team-based incentives to encourage collaboration over cutthroat competition.

5. Leading the cultural shift

Change is uncomfortable. Some employees will resist the new reality, preferring the familiarity of fixed pay. Others may struggle to adapt, leading to lower morale and engagement.

How to fix it:

- Rewire mindsets through training, open forums, and leadership alignment.

- Use early adopters to showcase success and create a ripple effect.

- Keep feedback loops open—adjust and fine-tune the model based on real-time insights

Less fixed costs, more performance—Compass makes it happen

Moving to an incentive-based pay system isn’t just about tweaking numbers—it’s about precision, automation, and execution. You need a system that calculates, tracks, and pays out seamlessly without turning payroll into a logistical nightmare. This is where Compass comes in.

Think of Compass as the performance-pay enabler. It takes the complexity out of structuring, managing, and optimizing incentive-driven compensation, ensuring that every payout is fair, transparent, and data-backed.

- Tracks performance in real time

No more guesswork. Compass integrates with your existing systems to measure productivity and automate payouts, ensuring every employee earns exactly what they deserve.

- Custom-tailored incentive structures

Whether it’s sales commissions, milestone bonuses, or profit-sharing, Compass lets you design, and tweak pay models that fit your business like a glove.

- Payouts without the payroll chaos

Automates compensation calculations, eliminates manual errors, and ensures smooth, hassle-free disbursements—whether weekly, monthly, or performance-triggered.

- Insights that drive smarter decisions

Real-time analytics help you spot trends, identify top performers, and fine-tune incentive plans for maximum efficiency.

- Scales as you grow

Whether you’re running a lean startup or a large enterprise, Compass adjusts to your workforce needs, ensuring that pay remains elastic, fair, and performance driven.

By plugging into Compass, businesses don’t just reduce fixed costs—they create a high-performance, high-ownership culture where employees are driven, motivated, and rewarded for results. No payroll bloat, no inefficiencies—just leaner costs and stronger execution.

Future-proof your compensation strategy. Schedule a demo with Compass today.

Conclusion: The future is performance-driven

The days of bloated payrolls and rigid salary structures are numbered. Businesses that cling to fixed pay models risk carrying unnecessary financial weight, while those that embrace incentive-based pay gain the advantage of leaner costs, sharper execution, and a performance-first culture.

An elastic, results-driven pay structure isn’t just about reducing fixed costs—it’s about future-proofing your workforce. By shifting compensation from a static expense to a dynamic, scalable model, companies can boost efficiency, retain top talent, and stay financially agile in any market condition.

The question isn’t whether incentive-based pay works—it’s whether your business is ready to make the switch. Those who do will find themselves ahead of the curve, running leaner, faster, and more efficiently than ever before.