Como desenvolver um plano de incentivos anual que funcione: Uma abordagem estratégica

Um plano de incentivos anual bem estruturado é mais do que um simples bónus - é uma ferramenta estratégica para impulsionar o desempenho e alinhar os colaboradores com os objectivos empresariais. Saiba como conceber um plano de incentivos anual que estimule o desempenho.

Nesta página

Um estudo efectuado pela Fundação de Investigação de Incentivos descobriu que as organizações com programas de incentivos bem concebidos registam um aumento de 44% na produtividade dos trabalhadores.

A otimização do desempenho das vendas é essencial para a rentabilidade e o crescimento a longo prazo. As empresas descobriram que a implementação de planos de incentivos anuais (AIPs) é uma tática de sucesso. Estes programas destinam-se a motivar os colaboradores, a alinhar o seu trabalho com os objectivos organizacionais e, eventualmente, a melhorar os resultados de vendas.

Este artigo aborda o conceito de planos de incentivos anuais, incluindo os diferentes tipos, as suas vantagens e as estratégias de implementação ideais.

O que é um plano de incentivos anual?

Um plano de incentivos anual (AIP) é um programa de compensação estruturado que recompensa os colaboradores com base no seu desempenho ao longo de um ano. Os principais objectivos são aumentar a produtividade, inspirar os colaboradores a atingir os objectivos e ligar os seus esforços aos objectivos estratégicos da empresa.

Embora a conceção dos planos de incentivos anuais possa variar muito, normalmente incluem determinados objectivos, uma estrutura de pagamento e medidas de desempenho. Os planos de incentivos anuais têm dois componentes principais, que são:

- Indicadores de desempenho: Os padrões pelos quais o desempenho de um empregado é avaliado são conhecidos como métricas de desempenho. Estes podem incluir índices de satisfação do cliente, objectivos de vendas ou outros indicadores-chave de desempenho (KPI) que sejam relevantes para os objectivos da empresa.

Por exemplo, uma empresa de tecnologia pode utilizar métricas como o crescimento das receitas, a aquisição de novos clientes e as taxas de retenção de clientes como métricas de desempenho para a equipa de vendas.

- Estrutura de pagamento: A estrutura de pagamento define a forma como os incentivos aos trabalhadores são atribuídos. Pode tratar-se de opções de compra de acções, bónus em dinheiro ou outros incentivos. Para garantir a motivação e a igualdade, a estrutura deve ser explícita e inequívoca.

Por exemplo, a estrutura de bónus da Google inclui incentivos financeiros e opções de compra de acções para reter talentos. Para manter o talento nos seus quadros, a Google oferece opções de compra de acções para além dos incentivos monetários. A estratégia é altamente personalizada para satisfazer as exigências específicas da sua organização e dos executivos que estão a tentar atrair ou reter, em vez de ser uma fórmula única para todos.

Diferença entre um plano de incentivos anual e um bónus anual

Embora tanto um plano de incentivos anual (AIP) como um bónus anual recompensem os empregados pelo seu desempenho, diferem em termos de estrutura, objetivo e critérios.

Em suma, os AIP são estruturados e orientados para o desempenho, enquanto os bónus anuais são recompensas mais gerais e discricionárias.

Tipos de planos de incentivos anuais

Os Planos de Incentivos Anuais (AIPs) são programas de compensação estruturados, concebidos para recompensar os colaboradores por atingirem objectivos empresariais específicos. Estes incentivos não só impulsionam o desempenho, como também alinham os esforços individuais e de equipa com os objectivos estratégicos da empresa. Eis uma análise mais detalhada dos diferentes tipos de AIPs e do seu funcionamento:

1. Plano de incentivos baseado nas receitas

Este plano associa diretamente os incentivos à geração de receitas. Os colaboradores, em particular os que desempenham funções de vendas e desenvolvimento de negócios, recebem bónus com base no cumprimento ou superação dos objectivos de receitas. O objetivo é encorajar o crescimento e assegurar que as equipas trabalham consistentemente para aumentar os ganhos da empresa.

2. Plano de participação nos lucros

Um modelo de participação nos lucros distribui uma percentagem dos lucros da empresa pelos empregados. Ao contrário dos incentivos baseados nas receitas, este plano recompensa a rendibilidade global e não o desempenho individual das vendas. Promove um sentido de responsabilidade partilhada, motivando os colaboradores a contribuir para a eficiência dos custos e para o sucesso financeiro global.

3. Plano de incentivos baseado em objectivos

As empresas definem frequentemente objectivos não específicos de receitas que impulsionam o crescimento do negócio, como a expansão para novos mercados, a melhoria da retenção de clientes ou o aumento da eficiência da produção. Os colaboradores são recompensados pelo cumprimento destes objectivos pré-determinados, assegurando que as prioridades do negócio, para além das receitas, são abordadas.

4. Plano de incentivos ao desempenho da equipa

Em ambientes onde a colaboração é fundamental, os incentivos baseados na equipa encorajam o desempenho coletivo. Em vez de recompensar os indivíduos, os bónus são distribuídos com base nas realizações do grupo, assegurando que todos os membros da equipa contribuem para os objectivos comuns. Esta estrutura é particularmente útil em indústrias baseadas em projectos e em equipas multifuncionais.

5. Plano individual baseado no desempenho

Este tipo de plano mede e recompensa os colaboradores com base em métricas de desempenho pessoal. Os indicadores chave de desempenho (KPIs), tais como quotas de vendas, resultados de satisfação do cliente ou taxas de conclusão de projectos, determinam os pagamentos de incentivos. Ao centrarem-se nos resultados individuais, as empresas podem promover a responsabilização pessoal e a melhoria contínua.

6. Plano de bónus discricionário

Ao contrário dos programas de incentivos estruturados, um bónus discricionário é atribuído à discrição da empresa. A administração avalia as contribuições gerais, o desempenho da empresa e as realizações excepcionais para determinar os bónus. Uma vez que estes bónus não são fixos, permitem flexibilidade no reconhecimento de um desempenho excecional.

7. Plano de incentivos escalonado

Um sistema escalonado incentiva os colaboradores a excederem os seus objectivos básicos, oferecendo níveis crescentes de recompensas. Os colaboradores que atingem os objectivos mínimos recebem um incentivo de base, enquanto os que ultrapassam as expectativas se qualificam para pagamentos mais elevados. Esta abordagem motiva os colaboradores com melhor desempenho a ultrapassar constantemente os seus limites.

8. Plano do Balanced Scorecard

Um plano de balanced scorecard associa os incentivos a vários indicadores de desempenho e não a uma única métrica. Os colaboradores podem ser avaliados em termos de geração de receitas, satisfação do cliente, eficiência operacional e inovação. Isto assegura uma abordagem completa à avaliação do desempenho, evitando que se dê demasiada importância a uma área específica.

A eficácia de um plano de incentivos anual depende do alinhamento dos incentivos com os objectivos empresariais e as funções dos colaboradores. Algumas empresas implementam uma combinação destes planos para criar um sistema completo que promove a motivação e o sucesso a longo prazo. Uma abordagem estruturada e baseada em dados garante que os incentivos contribuem tanto para o crescimento individual como para o desempenho global da empresa.

Benefícios da implementação de planos de incentivos anuais

Eis as 3 principais vantagens de ter um plano de incentivos anual:

- Aumento da motivação para as vendas: Os planos de incentivos anuais, que oferecem prémios mensuráveis e objectivos específicos e atingíveis, aumentam consideravelmente a motivação dos empregados. Os empregados estão mais inclinados a ir mais além para atingir os objectivos quando estão confiantes de que os seus esforços serão apreciados.

- Alinhamento com os objectivos da empresa: Os AIPs ajudam a coordenar as acções dos trabalhadores com os objectivos estratégicos da organização. Os colaboradores estão mais conscientes de como o seu trabalho afecta a organização como um todo quando os incentivos estão ligados a determinados indicadores de desempenho, o que garante que todos visam os mesmos objectivos.

Retenção e satisfação dos trabalhadores: A satisfação e a retenção dos trabalhadores podem ser aumentadas através da implementação dos planos de ação anuais. A retenção dos empregados a longo prazo reduz a rotatividade e promove uma cultura positiva no local de trabalho, quando os trabalhadores se sentem apreciados e recompensados pelas suas contribuições.

Recompensar os profissionais de elevado desempenho com incentivos transparentes

Automatize os pagamentos de comissões e alinhe as recompensas com os objectivos de vendas. Com o Compass, pode motivar a sua equipa e melhorar a eficácia geral das vendas.

Como conceber um plano de incentivos anual eficaz

Um plano de incentivos anual (AIP) deve ser mais do que uma mera recompensa financeira; deve servir como uma ferramenta estratégica para impulsionar o desempenho, reforçar os principais objectivos empresariais e alinhar os esforços dos colaboradores com os objectivos da empresa.

A conceção de um plano eficaz requer uma estruturação cuidadosa para garantir transparência, motivação e resultados sustentáveis. Segue-se uma abordagem metódica para a criação de um plano de ação anual que produza um impacto mensurável.

1. Estabelecer objectivos comerciais claros

Um AIP bem concebido deve ser uma extensão direta da estratégia da empresa. O primeiro passo é definir o que a empresa pretende alcançar durante o período de incentivo. Estes podem ser o crescimento das receitas, a melhoria das margens, a expansão da quota de mercado, a retenção de clientes ou a eficiência operacional.

Principais considerações:

- Os objectivos devem ser específicos, quantificáveis e limitados no tempo (por exemplo, "aumentar as receitas em 15% ano após ano" em vez de "melhorar as vendas").

- Dar prioridade a um equilíbrio entre objectivos financeiros e não financeiros para evitar a tomada de decisões a curto prazo em detrimento da estabilidade a longo prazo.

- Assegurar o alinhamento entre departamentos para que os incentivos não conduzam a comportamentos contraditórios (por exemplo, objectivos de vendas agressivos que comprometam o serviço ao cliente).

2. Definir os indicadores de desempenho que interessam

Os indicadores de desempenho devem ser precisos, mensuráveis e controláveis pelos participantes. A escolha da métrica errada pode levar a comportamentos desalinhados que prejudicam a saúde do negócio a longo prazo.

Considerações sobre a seleção de métricas:

- Métricas baseadas nas receitas: Receita bruta, receita líquida ou percentagem de crescimento da receita.

- Métricas de rentabilidade: EBITDA, margem operacional ou margem de contribuição.

- Métricas de produtividade: Eficiência de vendas, receitas por empregado ou cumprimento de quotas.

- Métricas centradas no cliente: Taxa de retenção, valor do tempo de vida do cliente (CLV) ou pontuação do promotor líquido (NPS).

- Métricas estratégicas: Expansão para novos mercados, redução do custo de aquisição ou KPIs de inovação.

Melhores práticas:

- Utilizar uma abordagem ponderada. Nem todas as métricas devem ter a mesma importância; atribua um peso com base na prioridade (por exemplo, 50% para a rendibilidade, 30% para o crescimento, 20% para a retenção de clientes).

- Assegurar a visibilidade. Os participantes devem poder ver como os seus esforços individuais influenciam as métricas, evitando cálculos de "caixa negra" que minam a confiança.

- Incorporar um limite máximo e um limite mínimo. Defina um limite mínimo abaixo do qual não ocorre qualquer pagamento e um limite máximo para evitar pagamentos excessivos e imprevisíveis.

3. Estruturar o modelo de pagamento para obter o máximo impacto

A estrutura de pagamento deve motivar o desempenho sem introduzir um risco excessivo para as finanças da empresa.

Estruturas comuns:

- Modelo limiar-objetivo-estiramento

- Limiar: O desempenho mínimo aceitável (por exemplo, 80% do objetivo).

- Objetivo: O nível de desempenho esperado.

- Esticado: Um nível ambicioso mas atingível (por exemplo, 120% do objetivo) com um pagamento de prémio.

- Pagamentos escalonados

- Pagamentos graduais baseados em níveis de realização (por exemplo, bónus de 5% para 90% do objetivo, 10% para 100%, 15% para 110%).

- Multiplicadores e aceleradores

- Percentagens de incentivo mais elevadas para o desempenho excessivo, o que promove um esforço excecional.

Principais considerações:

- Equilibrar o risco e a recompensa. Evite pagamentos excessivamente generosos que afectem a rentabilidade ou planos demasiado restritivos que desmotivem os empregados.

- Assegurar a competitividade externa. Comparação com as normas do mercado para manter os incentivos atraentes.

- Minimizar consequências indesejadas. Assegurar que as fórmulas de pagamento não incentivam a manipulação do calendário de receitas ou a assunção de riscos excessivos.

4. Alinhar o plano de incentivos com as contribuições específicas da função

Uma abordagem do tipo "tamanho único" dilui a eficácia. Adapte a estrutura de incentivos com base em KPIs específicos da função.

- Funções geradoras de receitas (vendas, desenvolvimento comercial): Crescimento das receitas, taxas de conversão de negócios, velocidade do pipeline.

- Funções operacionais e de apoio: Ganhos de eficiência, redução de custos, melhoria de processos.

- Funções voltadas para o cliente (gestão de contas, sucesso do cliente): Taxas de retenção, índices de satisfação do cliente, eficácia das vendas cruzadas.

- Equipas de produtos e de inovação: Conclusão de etapas, contribuição para as receitas de novos produtos.

Princípio-chave: Manter os incentivos alinhados com o que os empregados podem influenciar diretamente. Por exemplo, um engenheiro de software não deve ser avaliado com base nas receitas da empresa, mas sim nos marcos do projeto e nas métricas de sucesso do produto.

5. Criar um sistema transparente de comunicação e controlo

Mesmo os planos de incentivos mais bem concebidos falham se os empregados não compreenderem o seu funcionamento. A transparência gera motivação e confiança.

Principais etapas de implementação:

- Documentação pormenorizada: Definir claramente a elegibilidade, os indicadores de desempenho, as fórmulas de pagamento e os prazos.

- Actualizações regulares do progresso: Implementar um painel de controlo em tempo real onde os funcionários possam acompanhar os seus progressos.

- Controlos frequentes: Efetuar revisões trimestrais para reforçar o alinhamento e ajustar as expectativas, se necessário.

Evite estas armadilhas:

- Complexidade que reduz o envolvimento. Os trabalhadores não deveriam necessitar de um diploma em finanças para compreenderem os seus incentivos.

- Subjetividade nos pagamentos. Se os trabalhadores se aperceberem de favoritismo ou de ajustamentos discricionários, a motivação diminui.

- Prazos pouco claros. Definir quando e como os pagamentos serão distribuídos (por exemplo, anualmente, trimestralmente com ajustamentos no final do ano).

6. Avaliar e aperfeiçoar regularmente o plano

Os planos de ação anuais não devem permanecer estáticos. Devem evoluir a par da atividade, das condições de mercado e das expectativas dos trabalhadores.

Considerações sobre a revisão anual:

- O plano conduziu aos comportamentos e resultados comerciais desejados?

- Os incentivos pagos eram competitivos em relação aos valores de referência do sector?

- Houve consequências indesejadas, como a assunção de riscos excessivos ou a tomada de decisões a curto prazo?

Os ajustamentos podem incluir:

- Reequilibrar as ponderações das métricas com base nas prioridades da empresa.

- Refinamento dos níveis de pagamento para manter a competitividade.

- Introduzir novos indicadores de desempenho à medida que a estratégia empresarial evolui.

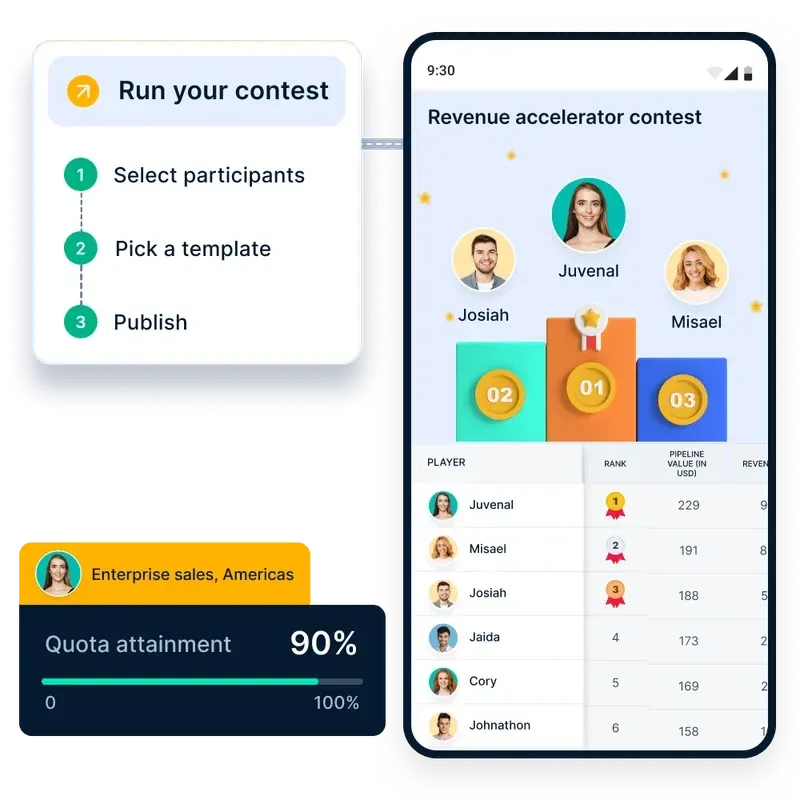

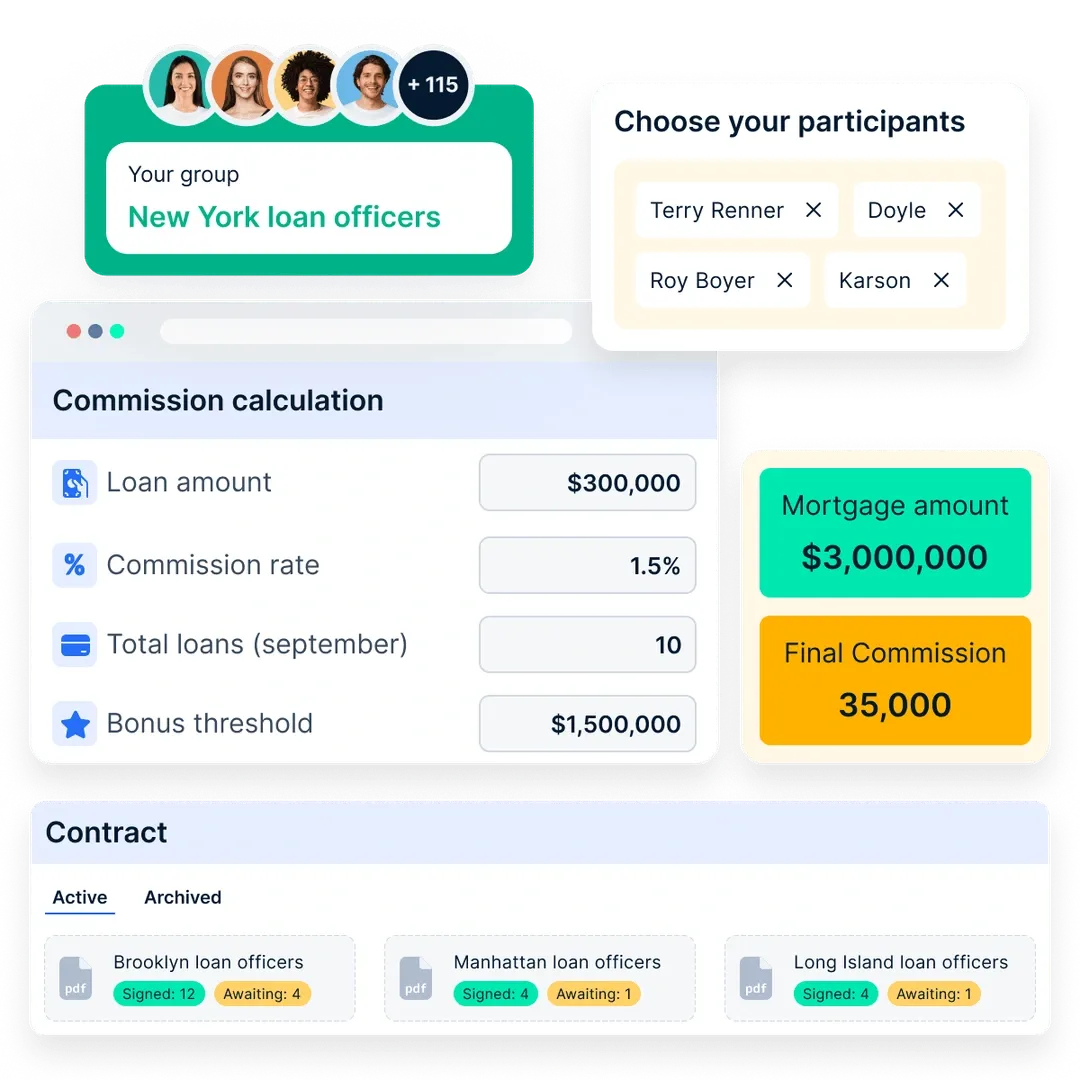

Potencie o seu plano de incentivos anual com o Compass

A gestão de um Plano de Incentivo Anual (AIP) pode tornar-se esmagadora - cálculos errados, objectivos pouco claros e pagamentos atrasados podem levar a equipas desmotivadas. Compass elimina estes desafios automatizando e optimizando o seu AIP, assegurando uma execução perfeita e motivando os colaboradores com informações transparentes e em tempo real.

Como é que Compass transforma os AIP:

- Cálculos de incentivos automatizados: Acabaram-se as folhas de cálculo e os erros manuais. Compass garante pagamentos precisos com base em métricas de desempenho predefinidas.

- Desenho de planos personalizáveis: Alinhe os incentivos com os objectivos da empresa, adaptando as estruturas às diferentes funções e equipas.

- Acompanhamento do desempenho em tempo real: Dê aos empregados visibilidade instantânea do seu progresso, promovendo a motivação e a responsabilização.

- Integrações perfeitas: Sincronize sem esforço com o seu CRM e ferramentas de vendas para obter dados de desempenho precisos e actualizados.

Um AIP bem estruturado pode aumentar o desempenho, reter os melhores talentos e impulsionar o crescimento das receitas - mas apenas se for corretamente executado.

Pronto para eliminar as suposições da gestão de incentivos? Experimente Compass hoje mesmo!

Conclusão

Os planos de incentivos anuais são ferramentas poderosas para maximizar o desempenho das vendas e atingir os objectivos da empresa. As empresas podem estabelecer programas de incentivos que encorajem os empregados, combinem os seus esforços com os objectivos organizacionais e conduzam ao sucesso empresarial, compreendendo os elementos essenciais, as vantagens e as melhores práticas para os conceber e implementar, como mencionado no blogue

FAQs

1. Quais são os principais componentes de um plano de incentivos anual?

As medidas de desempenho, os calendários de pagamento e os incentivos que estão em linha com os objectivos empresariais são os principais elementos de um plano de incentivos anual.

2. Como é que os planos de incentivos anuais aumentam a motivação das vendas?

Os sistemas de incentivos anuais encorajam os empregados a fazer um esforço extra, estabelecendo objectivos claros e oferecendo incentivos tangíveis para os alcançar. Isto aumenta a motivação para as vendas.

3. Que tipos de indicadores de desempenho são normalmente utilizados nos planos de incentivos anuais?

Os objectivos de vendas, os índices de satisfação dos clientes e outros KPI relevantes para os objectivos da organização são exemplos de medidas de desempenho comuns.

4. Como é que as empresas podem garantir a equidade dos seus planos de incentivos anuais?

As empresas podem garantir a equidade estabelecendo uma estrutura de pagamento clara, definindo o processo de avaliação do desempenho e avaliando e modificando regularmente o plano, se necessário.

5. Porque é que a celebração do sucesso é importante nos planos de incentivos anuais?

Recompensar as conquistas aumenta o ânimo, demonstra o valor do programa de incentivos e inspira os empregados a continuarem a procurar a grandeza.