Os 3 principais planos de compensação para gestores de conta: Estratégias para promover a retenção e o crescimento das receitas

O plano de remuneração do gestor de conta descreve a forma como os seus esforços se traduzem em recompensas financeiras e motiva-o a atingir objectivos específicos.

Nesta página

Os planos de remuneração dos gestores de conta são concebidos para se alinharem com o seu papel único na promoção da retenção e crescimento dos clientes. Ao contrário das funções de vendas, que se centram na aquisição de novos clientes, os gestores de conta (AM) e os gestores de sucesso do cliente (CSM) concentram-se em cultivar as relações existentes, garantindo satisfação do clientee na descoberta de oportunidades de upselling e cross-selling.

Este enfoque na retenção é fundamental, especialmente tendo em conta que reter clientes é muito mais rentável do que adquirir novos clientes. A investigação mostra que custa cinco vezes mais atrair um novo cliente do que reter um já existente. Além disso, melhorar as taxas de retenção de clientes em apenas 5% pode aumentar os lucros em 25% ou mais.

Dada a importância estratégica da retenção de clientes para um crescimento sustentado, os planos de remuneração dos gestores de conta devem refletir as suas contribuições fundamentais. Isto inclui incentivos ligados a métricas de sucesso do cliente, esforços de upselling e satisfação geral para garantir a fidelidade e a rentabilidade do cliente a longo prazo.

Um plano de remuneração eficaz para gestores de conta é a pedra angular da motivação dos gestores de conta, da retenção dos clientes existentes e do crescimento das receitas.

Porque é que os salários fixos não funcionam para os gestores de conta?

As funções de gestão de contas, como os gestores de contas e os executivos de contas, fazem frequentemente a ponte entre a retenção de clientes e a aquisição de novos negócios. Embora o salário base médio dos gestores de conta nos EUA seja de $70.000 por ano, os ganhos no objetivo (OTE) podem exceder $100.000.

Para atingir o equilíbrio certo, um plano de remuneração abrangente combina salários fixos com remuneração variável, incorporando bónus de crescimento, uma estrutura de comissões e incentivos ligados à retenção de receitas líquidas ou quotas de vendas.

A plano de compensação bem estruturado não só reduz a rotatividade dos clientes, como também permite que toda a equipa de vendas se concentre nas contas existentes, em ciclos de vendas mais curtos e em serviços adicionais aos clientes, o que acaba por impulsionar o crescimento global das receitas e garantir a rentabilidade da agência.

Quais são os melhores planos de remuneração dos gestores de conta para promover a retenção?

Embora um salário base competitivo seja importante, os melhores planos de remuneração de gestores de conta para promover a retenção centram-se em bónus que incentivam os comportamentos certos:

Plano 1: Comissão baseada na retenção

Este plano de remuneração é ideal para gestores de conta cuja principal responsabilidade é reter os clientes existentes. Os gestores de conta são recompensados com base na sua capacidade de renovar contratos e reter receitas das contas existentes.

Um gestor de conta tem uma quota de retenção mensal de $35.000 de ARR e ganha uma comissão de 12% por cada negócio que fecha.

- Comissão baseada em retenção com 1 caminho para ganhos

- Quota de receita líquida trimestral: $300,000

Regra de ganhos:

- 0% - 100% = 7,5% de taxa de comissão

- 100% - 150% = 12,5% de taxa de comissão

- 150% = 15% de taxa de comissão

Esta estrutura de compensação motiva os gestores de conta a concentrarem-se na retenção dos clientes existentes, contribuindo para a retenção de receitas líquidas e reduzindo a rotatividade dos clientes.

Plano 2: Bónus de retenção e upsell

Este plano incorpora tanto a retenção como o crescimento da conta, recompensando os gestores de conta pelas renovações e vendas adicionais. Está alinhado com objectivos estratégicos como o aumento do valor do tempo de vida do cliente e o crescimento do negócio.

Um gestor de conta tem uma quota de retenção trimestral de $250.000 de ARR e ganha uma comissão de 9% por cada renovação que gere. Além disso, tem uma quota trimestral de upsell de 80.000 dólares de ARR e ganha uma comissão de 12% por cada negócio de upsell.

Bónus de retenção e upsell com 2 vias de ganhos

1. Quota trimestral de receitas de retenção: $250.000

- 0% - 100% = 9% de bónus

- 100% - 150% = 12% de bónus

- 150% = 15% de bónus

2. Quota trimestral de receitas de upsell: $80.000

- Regra de ganhos: bónus de 12%

Este plano de compensação bem estruturado garante que os gestores de conta são incentivados a reter os clientes existentes e a identificar oportunidades adicionais de serviço ao cliente para impulsionar o crescimento global das receitas.

Plano 3: Prémio baseado na retenção

Esta abordagem recompensa os gestores de conta por atingirem objectivos específicos de retenção de receitas através de bónus fixos. Este plano oferece segurança financeira, ao mesmo tempo que incentiva a concentração na retenção das relações com os clientes e na redução da sua rotatividade.

Um gestor de conta tem uma quota de retenção mensal de 40.000 ARR e ganha um bónus de 40 dólares por cada percentagem da sua quota atingida.

- Bónus baseado na retenção com 1 caminho para os ganhos

- Quota de receita líquida trimestral: $300,000

Regra dos ganhos:

- 0% - 80% = $90 de bónus por ponto percentual

- 80% - 100% = $110 de bónus por ponto percentual

- 100% - 150% = $130 de bónus por ponto percentual

- 150% = $150 de bónus por ponto percentual

Um plano de remuneração abrangente como este promove a motivação do gestor de conta, alinha-se com os objectivos da empresa e aumenta a retenção de receitas líquidas. A revisão regular dos planos de compensação de vendas garante que estes atingem eficazmente os objectivos da empresa e impulsionam o crescimento das receitas. Tomemos como exemplo esta empresa comercial.

Os gestores de conta naempresa de produtos comerciaisenfrentam desafios na retenção dos clientes actuais e na expansão do número de produtos e serviços vendidos a esses clientes.

A solução foi criar um plano de bónus que recompensasse os Gestores de Conta por excederem os objectivos de renovação de receitas, vendas de novos produtos a clientes existentes, dias de vendas pendentes e implementação do plano de contas chave. Os resultados não são discutidos no documento.

A empresa precisava de aumentar as receitas dos clientes actuais e gerar novos clientes que se enquadrassem no perfil desejado. A empresa também pretendia reter os clientes actuais e expandir o número de produtos/serviços que lhes eram oferecidos.

Era necessário investir tempo em novos mercados e aproveitar as relações actuais com os clientes para gerar negócios com novos clientes. Assim, para responder a estes desafios, a empresa concebeu um plano de compensação de vendas abrangente para gestores de conta.

Também definiu requisitos de participação para manter a transparência e utilizou métricas baseadas no desempenho da unidade e nos tipos de desempenho. Acrescentaram ainda um plano de bónus para a gestão de contas, com bónus específicos associados à renovação mensal das receitas e às vendas de novos produtos.

Definiram métodos para creditar as vendas e partilhar os objectivos entre os membros da equipa. Como resultado da integração do programa de incentivos, incluindo o plano de remuneração dos gestores de conta, a empresa de produtos comerciais notou que A estrutura de bónus proporcionava incentivos financeiros claros aos gestores de conta, o que os encorajava a atingir e a exceder os seus objectivos.

- Os gestores de conta recebiam o bónus máximo de $6.000 depois de atingirem uma taxa de renovação perfeita de 100%.

- Vários gestores de conta recebiam $1.000 depois de venderem vários produtos novos ao mesmo cliente existente.

- Colaboração entre os executivos de vendas e os executivos de contas.

- Aumento da satisfação do cliente e das renovações de contratos.

A que métrica associar os seus planos de compensação AM?

A melhor métrica para o seu plano de compensação AM depende dos objectivos da sua empresa.

Se quiser dar prioridade à retenção de clientes, então deve fazê-lo:

Tente implementar o plano GRR ou Retenção da Receita Bruta. A métrica para este plano centrar-se-á exclusivamente na retenção do fluxo de receitas do conjunto de clientes existente.

Ao associar este tipo de métrica ao plano de compensação do gestor de conta, pode recompensar os gestores de conta com base na forma como mantêm a rotatividade dos clientes sob controlo. Este método garantirá que os gestores de conta recebam o impulso necessário para renovar os contratos existentes.

Suponhamos que a quota trimestral é de $300.000 em GRR. Assim, se atingir 80% ou mais da quota, o gestor de conta ganha um bónus de um montante definido por si. Para referência, a estrutura é de $125 por cada $1.000 em GRR que exceda a quota.

Se quiser dar prioridade ao crescimento dos clientes, então deve fazê-lo:

Utilizar o NRR ou Retenção de receitas líquidas. Isto recompensa os gestores de conta por manterem os clientes existentes e aumentarem as receitas através de vendas adicionais e expansões. Associar o NRR ao plano de remuneração dos gestores de conta levaria os gestores de conta a abrirem-se a oportunidades de upselling.

Esta métrica considera a retenção de clientes e as oportunidades de upselling. Com ela, pode reter os clientes existentes e incentivá-los a expandir as suas subscrições de serviços ou a comprar produtos adicionais. Este tipo de métrica tem o potencial de impulsionar o crescimento global das receitas.

A retenção de receitas líquidas considera as receitas dos clientes existentes. Este plano de compensação incentiva a superação dos objectivos. Suponhamos que a quota trimestral é de $300.000. O seu bónus de desempenho é de $125 por cada ponto percentual alcançado acima da quota. Por exemplo, um AM excede a sua quota em 20% e ganha um bónus de $2.500 (125 x 20).

Se pretender equilibrar o crescimento e a retenção, utilize um plano combinado de retenção de receitas brutas e líquidas:

Esta abordagem mista motiva os MA a alcançar o sucesso em ambas as áreas. Existem alguns elementos que também podem ser utilizados para apoiar o desempenho da AM. São eles:

- Cumprimento da quota:Mede a capacidade da AM para assegurar um montante específico de receitas ou vendas num determinado período de tempo.

- Custo de aquisição de clientes (CAC):Um CAC mais baixo indica que a AM está a atrair novos clientes de forma eficiente.

- Valor do tempo de vida do cliente (CLTV):Esta métrica recompensa os AMs pela aquisição de clientes que trazem valor a longo prazo para a empresa.

- Taxa de retenção de clientes:Uma taxa de retenção elevada significa o sucesso da AM em manter os clientes actuais satisfeitos.

Considere uma abordagem equilibrada que combine métricas. Vejamos como esta marca de automóveis de luxo mundialmente aclamada implementou um plano de remuneração bem estruturado para toda a equipa que conduziu ao seu sucesso global, com um aumento de 96,2% na adoção de pagamentos.

Já identificámos as principais métricas para avaliar o desempenho dos gestores de conta.Vamos agora discutir como criar um plano de compensação abrangente para os gestores de conta.

Como criar os melhores planos de remuneração para gestores de conta?

A conceção de um plano de remuneração para gestores de conta bem sucedido é fundamental para atingir os objectivos da sua empresa e manter os gestores de conta motivados. Eis como pode criar um plano de remuneração bem estruturado:

1. Alinhar-se com os objectivos da empresa

A sua estratégia de compensação deve apoiar diretamente os objectivos da sua organização de vendas. Quer o seu foco seja a retenção de clientes, o aumento de receitas ou a aquisição de novos clientes, o seu plano de remuneração de gestor de conta deve incentivar acções que se alinhem com estes objectivos.

2. Dimensão e complexidade da conta

As contas maiores ou mais complexas requerem mais tempo e esforço para serem geridas. Certifique-se de que os gestores de conta que gerem contratos de elevado valor anual ou necessidades complexas dos clientes são mais bem remunerados do que os que gerem contas mais pequenas.

3. Adaptar-se à experiência

Os executivos de contas experientes ou os gestores de contas sénior trazem frequentemente mais valor através de ciclos de vendas mais curtos, retenção de clientes e serviços adicionais aos clientes. Reflicta este facto no seu salário base, remuneração variável ou bónus de crescimento.

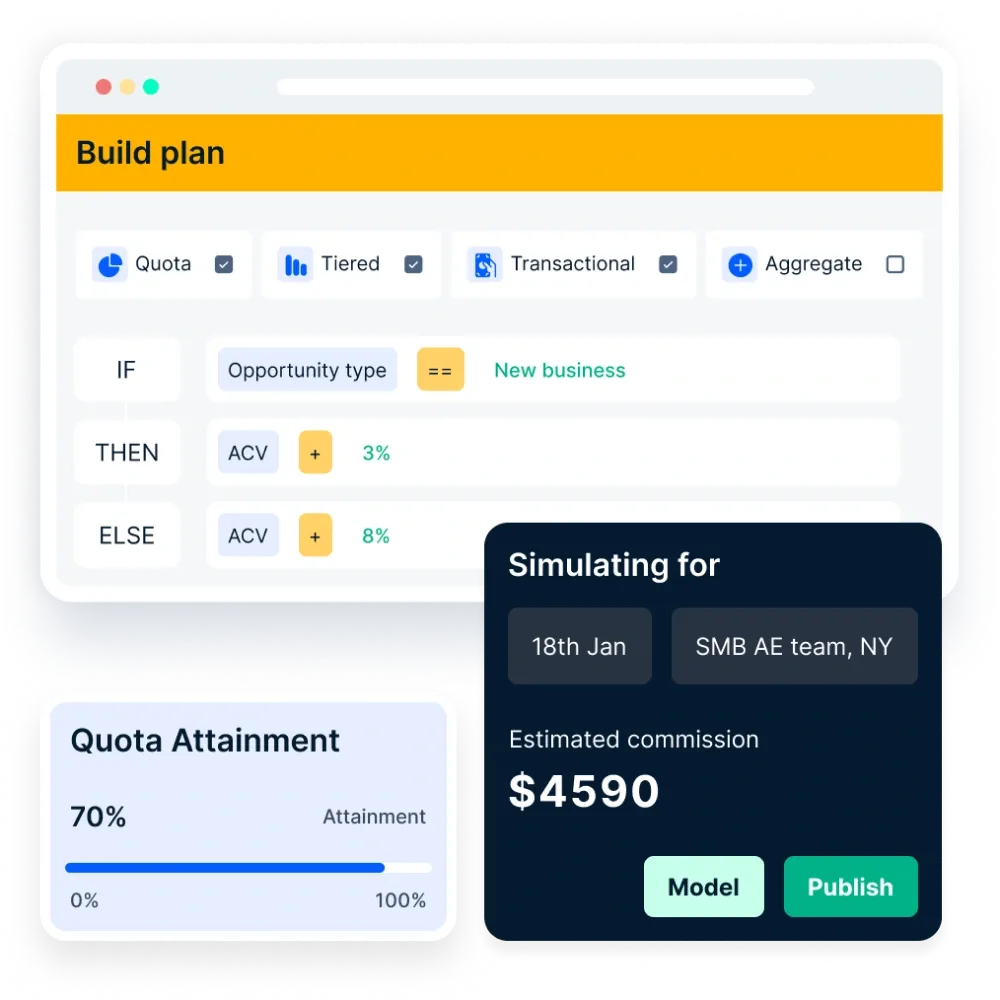

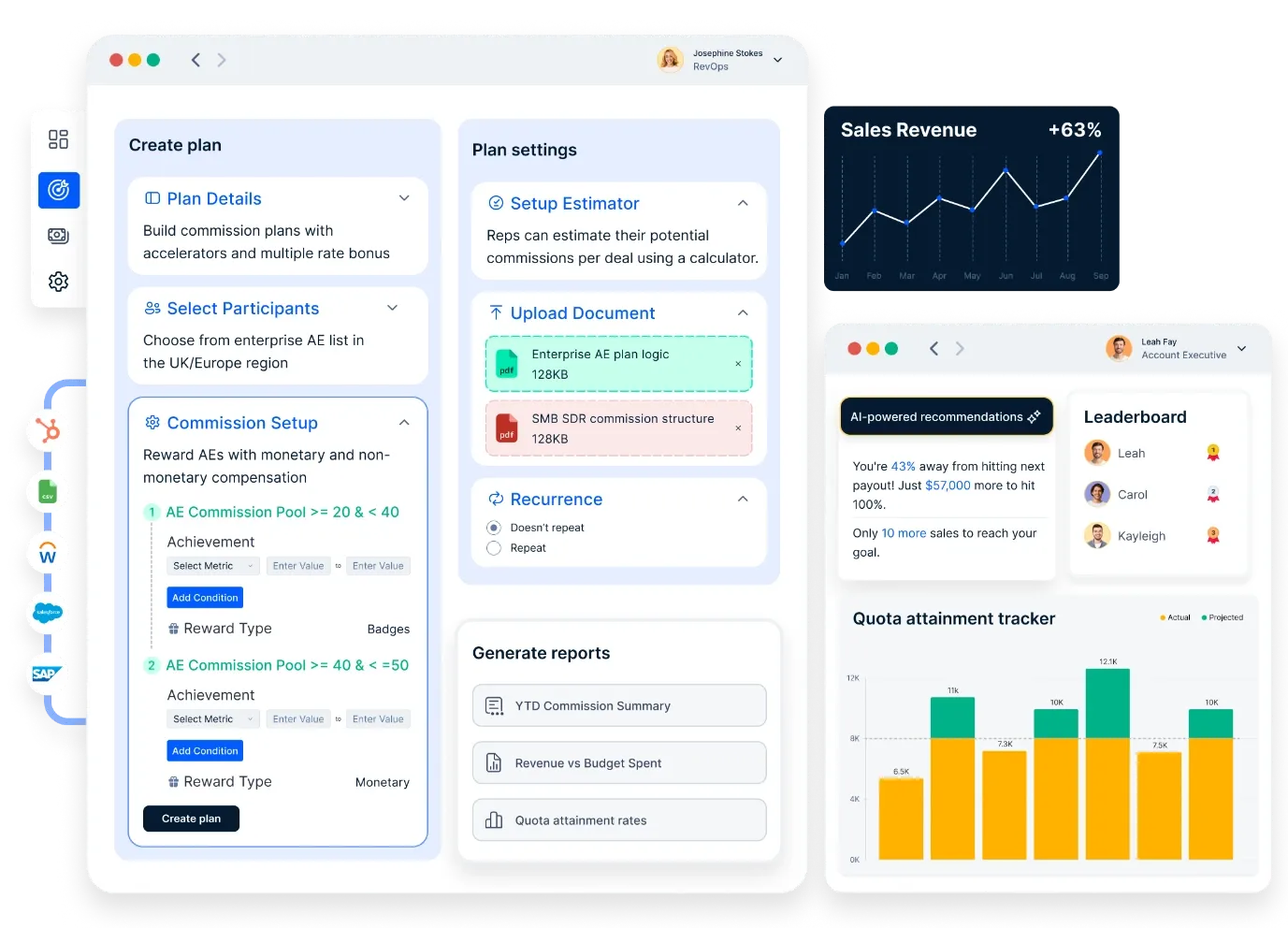

Compass pode melhorar significativamente o plano de compensação AM, permitindo-lhe testar projectos de planos de compensação de incentivos antes de entrarem em vigor. Com a sua poderosa modelação de cenários hipotéticos, pode analisar a forma como as diferentes funções serão afectadas.

Além disso, Compass permite-lhe analisar e clonar planos de compensação bem-sucedidos que levaram anteriormente a um aumento da obtenção de quotas e à máxima rentabilidade. Isto significa que pode replicar facilmente estratégias eficazes.

Pode ajustar os seus planos de incentivos ou de comissões em qualquer altura para se alinhar com as tendências do mercado e objectivos de receitas, assegurando que a sua estratégia de compensação se mantém relevante e eficaz.

4. Planos de indemnização competitivos

Compare os seus programas de compensação com os padrões da indústria. A oferta de salários fixos competitivos, ganhos no alvo e comissões pode ajudar a atrair e reter os melhores talentos na sua equipa de vendas.

5. Comunicação clara

Explique claramente a estrutura de comissões, a quota de renovação e os bónus de crescimento. Um plano de remuneração abrangente e fácil de compreender permitirá aos gestores de conta exceder as expectativas.

6. Sazonalidade e ciclos de vendas

Ter em conta as variações nos ciclos de vendas e nas renovações. Durante os períodos mais lentos, ofereça incentivos para manter a motivação e a eficiência das vendas. Considere a possibilidade de oferecer bónus associados a ciclos de vendas mais curtos ou serviços adicionais aos clientes durante os períodos de menor procura.

7. Revisões e ajustamentos regulares

Avalie regularmente os seus planos de compensação. Factores como a duração do ciclo de vendas, a rotatividade de clientes e as receitas geradas devem orientar as actualizações necessárias para manter o plano eficaz e alinhado com os objectivos da empresa.

Ao considerar estes elementos, pode criar planos de compensação motivadores que incentivam os gestores de conta, impulsionam o crescimento global das receitas e asseguram o alinhamento com os objectivos de receitas da organização.

Melhores práticas do plano de remuneração do gestor de conta

Iremos desenvolver as melhores práticas através da análise de estudos de caso, centrando-nos nos fabricantes alemães de automóveis de luxo e considerando as necessidades das organizações de produtos comerciais.

Da empresa global de produtos comerciais, aprendemos a:

- Alinhar a remuneração dos gestores de conta com o objetivo da empresa. A empresa concebeu o plano de remuneração dos gestores de conta de modo a alinhá-lo com os seus principais objectivos, que incluíam a retenção dos clientes actuais, a expansão das vendas de novos produtos aos clientes existentes e a melhoria dos dias de vendas pendentes. Isto ajudou muito a organização a proporcionar aos gestores de conta a compensação de que necessitavam para se empenharem.

- Implementar planos de contas-chave de forma agressiva. Ao associar os bónus dos gestores de conta a estas métricas, o plano incentivou comportamentos que apoiaram a estratégia global da empresa.

- Criar uma estrutura de bónus completa. A empresa de produtos comerciais colocou um plano de bónus estruturado, que incluía requisitos de participação para manter a transparência, métricas baseadas no desempenho da unidade e tipos de desempenho, e bónus específicos ligados à renovação mensal das receitas e às vendas de novos produtos. Além disso, incorporou métodos de crédito de vendas e de partilha de objectivos entre os membros da equipa. A estruturação dos bónus com regras definidas proporcionou incentivos financeiros para os gestores de conta atingirem e ultrapassarem os seus objectivos.

Ao manter as melhores práticas para o plano de remuneração do gestor de conta, irá notar:

- Melhoria da colaboração entre os executivos de vendas e os executivos de contas

- Satisfação do cliente e renovações de contratos, como se verificou através da empresa de produtos comerciais e da marca alemã de automóveis de luxo que registou uma taxa de adoção Compass de 96%.

- A estrutura de bónus motivou eficazmente os gestores de conta a concentrarem-se nas renovações, nas vendas adicionais e nas relações com os clientes, conduzindo a melhores resultados comerciais para a empresa.

Conclusão

Os planos de compensação de vendas devem motivar os gestores de conta a fazer crescer as contas. Para tal, é necessário criar uma estrutura de remuneração que recompense o crescimento das contas e garantir que os planos são claros e pormenorizados.

O caminho para o crescimento começa com os líderes de vendas a compreenderem onde e como os esforços de vendas ficam aquém da identificação e implementação de alterações adequadas ao plano de remuneração do gestor de conta. Isto pode ser feito através da avaliação do desempenho atual das vendas em termos de renovações, vendas cruzadas/acrescidas e novas receitas em relação às projecções e aos objectivos de crescimento. Por conseguinte, implemente um acelerador como o Compass para:

- Automatizar o programa de incentivos. Esta automatização ajuda a eliminar erros e atrasos associados aos processos manuais.

- Obtenha informações sobre o desempenho em tempo real. Obtenha visibilidade das métricas de desempenho e informações sobre comissões.

- Crie um plano de compensação flexível para os seus gestores de conta. Compass pode lidar com estruturas de compensação simples e complexas, tornando-o adaptável a várias necessidades comerciais.

Por último, Compass oferece análises preditivas e conhecimentos poderosos para que as organizações possam planear melhor as suas equipas e tomar decisões informadas relativamente a estratégias de compensação. Portanto, agende uma chamada de demonstração com os nossos especialistas para descobrir como pode elaborar um plano de remuneração de gestor de conta perfeito para os seus AMs.

FAQs

1. Como é que os gestores de conta devem ser remunerados?

Os gestores de conta devem ter uma estrutura de remuneração que equilibre o salário base com incentivos baseados no desempenho. Um salário base competitivo assegura a estabilidade financeira, enquanto os bónus ou comissões associados à retenção de clientes, ao upselling, ao cross-selling e à satisfação do cliente impulsionam o desempenho. Além disso, a oferta de benefícios não monetários, como oportunidades de desenvolvimento de carreira, aumenta a motivação.

2. Qual é o plano de remuneração de um gestor de conta?

O plano de remuneração de um gestor de conta inclui normalmente um salário base e comissões. As comissões estão frequentemente associadas ao cumprimento ou superação dos objectivos de vendas, à aquisição de novos clientes ou ao aumento de vendas dos clientes existentes. Incentivos como bónus por ultrapassar as quotas ou o desempenho da equipa também podem ser incluídos.

3. Como é que os gestores de conta ganham comissões?

As comissões são ganhas se forem atingidos ou ultrapassados os objectivos de receitas, se forem efectuadas vendas adicionais, vendas cruzadas ou se forem retidas contas-chave.

4. Um gestor de conta recebe uma comissão?

Sim, os gestores de conta recebem frequentemente comissões por cumprirem os objectivos de retenção, upselling ou cross-selling.

5. Qual é a estrutura de comissões para os executivos de contas?

Os executivos de contas ganham normalmente uma percentagem das vendas, com taxas mais elevadas para a aquisição de novos clientes, negócios de maior dimensão ou superação de quotas. Alguns planos incluem taxas de comissão escalonadas.